What Is a Mortgage Loan Originator (MLO)?

REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

What Does a Mortgage Loan Originator Do?

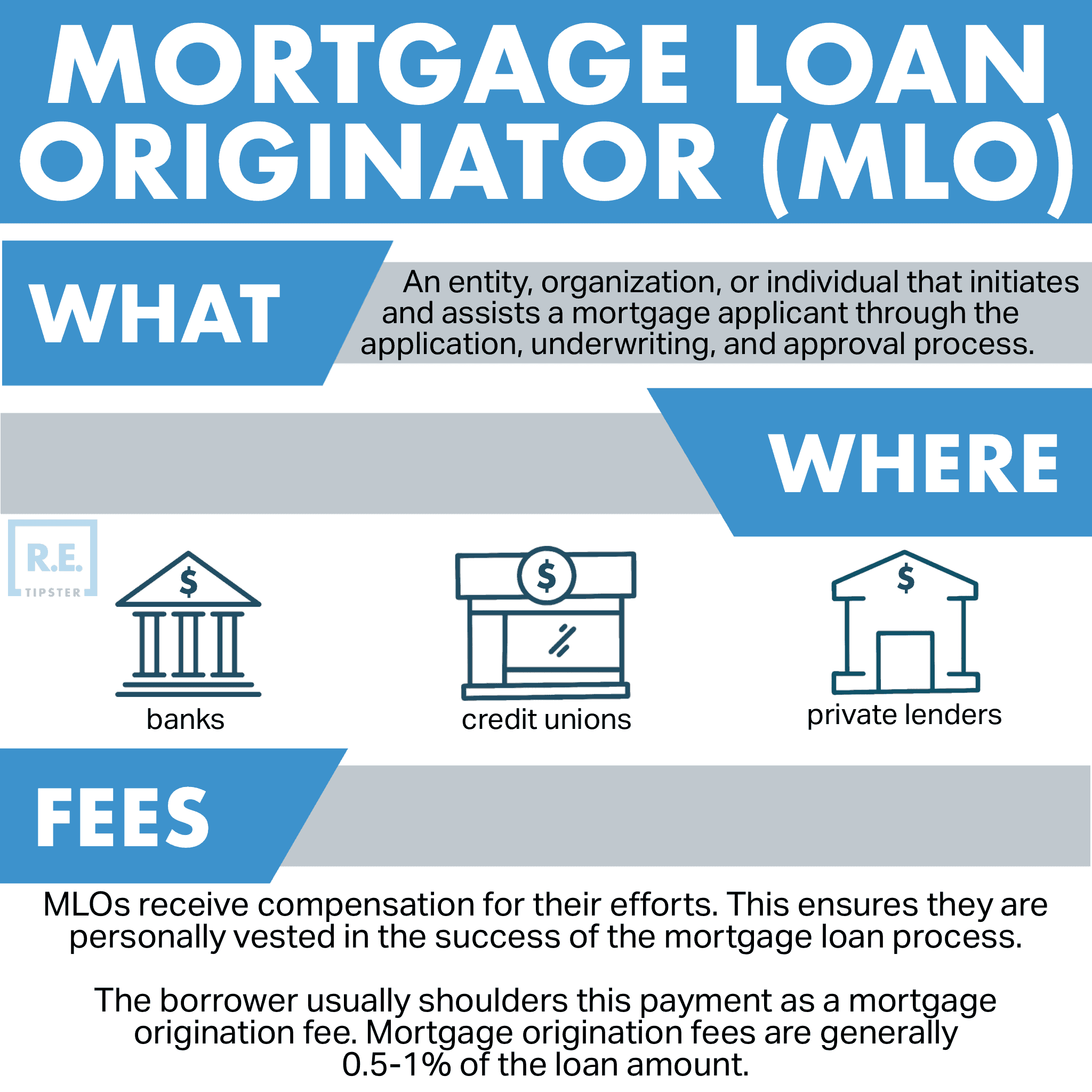

The role of a mortgage loan originator is to initiate the process that starts the loan application[1]. This process, called “loan origination,” refers to qualifying and verifying the borrower’s creditworthiness, background, and financial standing to see if they meet the requirements for the loan. In real estate, this loan is typically a mortgage.

When a loan is completed from start to finish, the loan is “fully originated.”

Banks, credit unions, and private lenders are the most common institutions responsible for funding mortgages. However, regardless of which institution initially funds the loan, most loans are paid off before maturity, either because the borrower refinances, sells their property, or pays off their loan. As a result, mortgage lenders are in a constant, ongoing effort to originate new loans to create new income streams.

To help accomplish that goal, lenders employ an MLO to process and verify loan applications, either in-house or with a third party (third-party MLOs are sometimes called “mortgage brokers;” see below). MLOs are responsible for facilitating the mortgage application process. They also work closely with the lender’s underwriter to determine which terms the borrower qualifies for, if at all.

Note that a mortgage loan originator has no final say in a loan application. Instead, this part is up to the lender’s underwriting department, which evaluates the borrower’s risk profile.

The Secure and Fair Enforcement for Mortgage Licensing (SAFE) Act of 2008[2] mandates MLOs to act in the best interests of borrowers and outlines guidelines for furnishing their services.

Why Are They Called Mortgage Loan Originators?

“Mortgage loan originator” is a broad term[3]. For one, it can describe a company that originates mortgages—the original mortgage lender that works with underwriters and loan processors to facilitate the loan transaction.

It can also describe the individual who provides professional assistance to borrowers through originating a mortgage loan, from application to closing.

In some cases, an MLO may also be referred to as an RMLO, which stands for “Residential Mortgage Loan Originator,” because many mortgage lenders deal with only residential properties.

In any case, an MLO is integral to initiating the mortgage process. However, for clarity’s sake, this article will use the term MLO to refer to the entity or organization that originates loans instead of the individual (unless otherwise stated).

Mortgage Origination Fees

MLOs receive compensation (usually in the form of a commission) for their efforts. This compensation method ensures they are personally vested in the success of the mortgage loan process.

The borrower usually shoulders this payment as mortgage origination fees. On average, mortgage origination fees are generally 0.5% to 1% of the loan amount[4].

Fees calculated under origination charges are usually negotiable. In general, the larger the loan amount, the higher the bargaining power of the borrower.

Mortgage Loan Calculator

Need to generate a loan payment schedule?

With this calculator, you can solve for the term, interest rate, principal, or payment. Enter three (3) of the four known fields, then press the button next to the empty field to calculate!

Once calculated, click “View Amortization Schedule” to see the results!

MLO vs. Related Professions

An MLO is liable to be confused with other professionals or services, especially since its role overlaps with many. Some examples are below.

Mortgage Loan Originator vs. Mortgage Banker

The main difference is that a mortgage loan originator has no authority to approve or deny a loan application, whereas a mortgage banker can make this decision.

Mortgage Loan Originator vs. Mortgage Broker

Both deal with the mortgage application process, but there are key differences between a mortgage loan originator and a mortgage broker.

A mortgage loan originator is usually the corporate entity or institution providing the loan. On the other hand, a mortgage broker is a third party that facilitates the mortgage application.

In addition, loan officers that work for mortgage loan originators can only offer loans from their employers. In contrast, mortgage brokers work with a wide selection of lenders to find the best fit for the borrower.

Lastly, an MLO may be able to offer reduced rates and processing fees since they are the ones originating the loan. Conversely, a mortgage broker may have better access to mortgages with better rates since they work with multiple lenders[5].

What Is the Difference Between a Mortgage Loan Originator and a Loan Officer?

An MLO describes the entity and the individual responsible for kickstarting the loan process. The individual can also be referred to as a loan officer, so in that context, the MLO and the loan officer are the same.

A loan officer’s job is to provide the necessary guidance through the mortgage approval process. This includes helping with the paperwork, taking the necessary documentation, and helping the borrower figure out the loan type that fits their goals.

They can also help borrowers obtain preapproval to get an idea of how much they can afford. They can make this determination based on the borrower’s financial situation and creditworthiness.

After receiving a complete application and collecting all the relevant documentation, the next step for the MLO is to get it through underwriting. A loan underwriter evaluates the borrower if they qualify for the mortgage. If everything is in order, they will follow up with all the parties to get the application to the closing table.

Overall, a loan officer originates the mortgage loan for the borrower, educates them on the process, and provides professional assistance until the loan is closed, sometimes even after. These are all responsibilities that an MLO (the entity) and the individual (the loan officer) share.

Qualifications of an MLO/Loan Officer

Since a loan officer must first convince the borrower to choose them over other lenders or originators, most loan officers are great salespeople[6]. They are skilled in communicating trust and confidence, an important factor both parties need to ensure a successful transaction.

In addition to federal requirements stated in the SAFE Act, state governments often have licensing procedures for mortgage loan officers, so there might be slight variances in the process.

Generally speaking, there are a few requirements for applicants who want to start a career in mortgage loan origination:

- The candidate must be 18 years old and above.

- The candidate must have completed at least 20 hours of pre-licensure training as part of the prerequisites for obtaining a mortgage loan originator license. The Nationwide

- Multistate Licensing System & Registry (NMLS)[7] regulates and maintains a list of approved providers offering courses that meet this requirement.

- The candidate must have passed the National Mortgage Originator Licensing Exam tests applicants on their knowledge of mortgage law and ethics and any other test required by their state.

- Licensed mortgage loan originators are also called Licensed MLOs or LMLOs.

The NMLS maintains the registry system for LMLOs across the United States. Anyone can search this database to verify the credentials of an MLO and ensure they are in good standing with regulators. Consumers can also file a complaint against an MLO through the NMLS.

Takeaways

- A mortgage loan originator is responsible for originating a mortgage application. “Originating” in this context means vetting the requirements of a borrower and facilitating the loan process.

- MLOs are usually employed by the same lender that will loan the funds, but they may also be a third party.

- MLOs do not have the final say on approving or denying a loan; that is up to the lender’s underwriter.

- MLOs can refer to both the lending institution (such as a bank) or the individual processing the loan, also called the loan officer. In any case, MLOs need to acquire a license for loan origination from the Nationwide Multistate Licensing System & Registry (NMLS) before they can offer their services to the public.

Sources

- Leavitt, L. (2022, January 31.) What Is Loan Origination? The Balance. Retrieved from https://www.thebalance.com/what-is-loan-origination-5207639

- Secure and Fair Enforcement for Mortgage Licensing (SAFE) Act examination procedures. (n.d.) Consumer Financial Protection Bureau. Retrieved from https://www.consumerfinance.gov/compliance/supervision-examinations/secure-and-fair-enforcement-for-mortgage-licensing-safe-act-examination-procedures/

- Crace, M. (2022, February 8.) Mortgage Loan Originators: What Are They And What Do They Do? Quicken Loans. Retrieved from https://www.quickenloans.com/learn/mortgage-loan-originators

- Gobel, R. (2022, August 31.) What Is A Mortgage Origination Fee? Forbes Advisor. Retrieved from https://www.forbes.com/advisor/mortgages/what-is-a-mortgage-origination-fee/

- Webber, M. (2022, May 14.) Loan Officer vs. Mortgage Broker: What’s the Difference? Investopedia. Retrieved from https://www.investopedia.com/loan-officer-vs-mortgage-broker-5214354

- What Is A Mortgage Loan Originator: A Detailed Guide To Understand An MLO’s Job Description. (n.d.) MLO TRAINING ACADEMY. Retrieved from https://mlotrainingacademy.com/what-is-a-mortgage-loan-originator/

- Course Providers. (n.d.) NMLS Resource Center. Retrieved from https://mortgage.nationwidelicensingsystem.org/courseprovider/Pages/Resources.aspx