What Is a Non-Fungible Token (NFT)?

REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

How Do NFTs Work?

A non-fungible token is a unique, irreplaceable, non-interchangeable digital asset on a blockchain[1].

In general, an NFT is a digital file encoded with a signature (a certificate) that sets it apart from other replicas. For example, many copies of a Picasso painting can exist but only one is the original; NFTs are alike, only digital. This code, called its metadata, describes its unique properties and guarantees the authenticity and uniqueness of each NFT[2].

NFTs rely on blockchain technology[3] like their cryptocurrency cousins. However, NFTs differ from cryptocurrencies because they are non-fungible, which means they cannot be traded in equivalence like bitcoin.

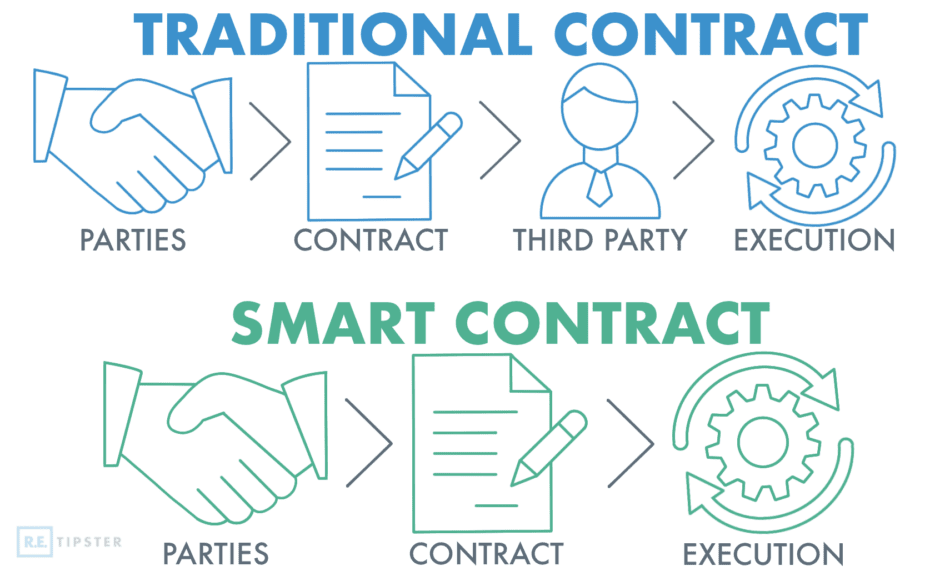

NFTs can work on any blockchain. Initially, most NFTs were created and sold through the Ethereum blockchain since only Ethereum supported the creation of smart contracts. Smart contracts are self-executing programs that automatically run when certain conditions are met[4], such as an agreement between a buyer and a seller. With smart contracts, NFTs can be traded securely and efficiently.

Practically any asset, digital or otherwise, can become an NFT. Tokenization or minting is how an object becomes represented in an NFT[5].

What Are NFTs Used For?

Anyone can make countless copies of these assets, whether a JPG image, a post on social media, an eBook, an audio file, a tweet, or a meme. However, ownership only belongs to one person or group, and an NFT is a certificate that proves this ownership.

In this sense, NFTs have revolutionized the digital and crypto world. Artists, big brands, celebrities, actors, and influencers have begun to use NFTs to retain rights to and monetize their creations[6].

Here are just some of the areas in which it is possible to use NFTs[7]:

- Real estate. Whether to certify ownership of virtual or physical real estate, the smart contracts built into NFTs can make transactions faster and safer.

- NFT art. Any digital artist can create a work, be it a 3D model, an image, or a song, and sell the ownership through an NFT.

- Collectibles. Being unique and unrepeatable, NFTs are ideal as collectibles. In fact, NFTs are essentially equivalent to virtual collectibles.

- Gaming. Any object that can be acquired in a video game can be converted into an NFT, especially rare or difficult to obtain objects.

- Sports. Copyrighted sports media can be represented in the form of NFTs, such as highlight reels[8].

What Are the Advantages of NFTs?

NFTs offer some advantages, such as:

- Economic opportunity. Due to their wide variety of applications, these tokens find a place in almost any industry, creating new opportunities for both creators and merchants.

- Scarcity. NFT creators can only make a limited number of unique tokens, thus naturally creating scarcity and rarity.

- Standardization. NFTs and smart contracts allow the creation of standards, such as ownership, transfer, and access control for any digital asset.

A smart contract is resolved automatically, without the need for a third party to verify it. The blockchain itself acts as a verification method because of its security.

- Tradability. Each token can be freely traded on the market. Thanks to blockchain, users can make an NFT exchange or trade their NFTs in different ways directly without a broker.

- Flexibility. NFTs are generally just pieces of software, and depending on the blockchain, can be programmed to perform complex mechanics and actions.

Making Money With NFTs

NFTs have specific exchange platforms, often huge marketplaces featuring collectibles, game items, and all kinds of virtual objects. These platforms function as trading houses where items are traded through smart contracts. Some even have their own NFT coin[9].

Generally, three business models can make the most money in the NFT field:

- Digital content creator.

- NFT project developer.

- NFTs trader or investor (such as a virtual real estate investor).

How Are NFTs Used in Real Estate?

The use of NFT technology in real estate is still growing. However, the smart contract technology and the decentralized security of blockchain have made it possible to digitize contracts, paperwork, and property records, making any due diligence and transfer of ownership seamless and fraud-free.

Furthermore, when a property registry is minted into an NFT, it can contain metadata regarding the property itself, such as location, title, ownership, and so on, directly embedded into the NFT. The NFT, and thus the ownership of the property, can then be sold through specialized secondary markets.

A luxury condo at 436 & 442 E 13th St. in the East Village of Manhattan is the first major asset in NYC that is tokenized to $30 million (source: Forbes.com)

NFTs in real estate may also help reduce the costs involved in traditional real estate transactions. Also, owing to blockchain’s immutable nature, NFT transactions eliminate dubious offers or fraud[10].

In addition, real estate NFTs may also be a significant contributor to the metaverse market, where parcels of virtual land are traded similar to physical real estate, ranging from a few hundred thousand to several million dollars[11].

Investing in NFTs

The general rule of investment still applies to NFT investing: Buy low and sell high. Investing in NFT technology is similar to investing in real estate or pieces of art, but what makes it different is that the market is still young and turbulent.

To invest in NFTs, an investor needs to account for several unique factors in the NFT field. NFTs are assets similar to cryptocurrencies, but they can also be treated as works of art in many cases. Therefore, volatility, inflation, and maturity can all influence the value of an NFT.

On the other hand, just as an investor analyzes a company to determine the price of its shares, it is also possible to do so with the NFT’s developers, industry, the artist’s personal brand, and other fundamental data, especially its community. NFTs have a very vocal community that often gives impetus to its creation. In this sense, a good indicator of the possible success of a project is that it has an active and continuously growing community[12].

Takeaways

- Non-fungible tokens or NFTs are digital assets similar to cryptocurrencies, but cannot be traded in like manner. They are one-of-a-kind and not interchangeable.

- Any object in the physical and digital world can be represented in the form of an NFT. When an object is represented by an NFT, it is said to be tokenized or minted.

- NFTs can represent real estate ownership certificates with various advantages. The power of smart contracts and the security of blockchain can make real estate transactions with 100% security from fraud and may reduce other associated costs with the transaction.

Sources

- IBM. (n.d.) What is blockchain technology? Retrieved from https://www.ibm.com/topics/what-is-blockchain

- Ethereum. (2022.) Non-fungible tokens (NFT). Retrieved from https://ethereum.org/en/nft/

- Nakamoto, S. (2008.) Bitcoin: A Peer-to-Peer Electronic Cash System. Bitcoin.org. Retrieved from https://bitcoin.org/bitcoin.pdf

- Silver, N. (2021.) The History And Future Of NFTs. Retrieved from https://www.forbes.com/sites/nicolesilver/2021/11/02/the-history-and-future-of-nfts/

- Mudgil, S. (2021.) HOW TO MINT AN NFT (PART 2/3 OF NFT TUTORIAL SERIES). Retrieved from https://ethereum.org/en/developers/tutorials/how-to-mint-an-nft/

- Liscomb, M. (2021.) Lindsay Lohan’s Fursona And 12 More Weird And Wild Celebrity NFT Projects From 2021. Retrieved from https://www.buzzfeed.com/meganeliscomb/celebrity-nfts-2021

- Wilser, J. (2021.) 15 NFT Use Cases That Could Go Mainstream. Coindesk. Retrieved from https://www.coindesk.com/business/2021/10/14/15-nft-use-cases-that-could-go-mainstream/

- Young, J. (2021.) People have spent more than $230 million buying and trading digital collectibles of NBA highlights. CNBC. Retrieved from https://www.cnbc.com/2021/02/28/230-million-dollars-spent-on-nba-top-shot.html

- Rosenberg, E. (2021.) Enjin Coin Explained. The Balance. https://www.thebalance.com/enjin-coin-explained-5195487

- Conti, R. (2021.) What You Need To Know About NonFungible Tokens (NFTs). Forbes. Retrieved from https://www.forbes.com/sites/forbesbizcouncil/2021/10/25/nft-in-the-realestate-industry-short-term-trend-or-an-investment-in-the-future/

- Manfredi, L. (2021.) Virtual real estate plot in Decentraland sells for record $2.4M in cryptocurrency. Fox Business. Retrieved from https://www.foxbusiness.com/real-estate/virtual-real-estate-plot-decentraland-sold-record-2-4m-cryptocurrency

- Hyder, S. (2020.) How Social Media Is Helping Cryptocurrency Flourish: A Case Study Forbes. Retrieved from https://www.forbes.com/sites/shamahyder/2020/11/23/how-social-media-is-helping-cryptocurrency-flourish/