What Is an SBA 7(a) Loan?

REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

How the SBA 7(a) Loan Works

The 7(a) loan program is SBA’s main business loan program[1].

With the SBA 7(a) program, SBA doesn’t lend directly to businesses. Instead, a borrower must apply with one of SBA’s partner banks and lenders nationwide, who will provide the funds. These bank proceeds are then guaranteed by SBA through the 7(a) loan program.

The amount of 7(a) guarantee depends on the loan size and other factors. SBA typically guarantees up to 75% of loans over $150,000 and 85% of loans up to $150,000.

One of the primary objectives behind the SBA 7(a) loan program is to create jobs. One way this objective is accomplished is by encouraging banks to finance projects that may not otherwise fit their risk appetite. SBA can encourage banks to lend on these types of projects through the 7(a) guarantee because the lender will have significantly less risk exposure when SBA stands behind them for a large portion of the project.

SBA’s Primary Objectives

This agency was formed in 1953 “to aid, counsel, assist, and protect the interests of small business concerns[2].”

It is important to understand that SBA loans do not come directly from the Small Business Administration. As opposed to small- and medium-sized enterprises (SMEs) receiving SBA loans from the government, the agency guarantees part of the loans that approved SBA lenders[3] provide to borrowers[4]. This guarantee typically covers about 85% of the loan for amounts less than $150,000 and 75% for amounts more than $150,000, capping out at $3.75 million[5].

Because the federal government itself backs the SBA loan, lenders are more willing to approve small business owners who would not qualify for a small business loan otherwise. In exchange, borrowers get easier access to capital that they can use for various purposes. The SBA also limits the rates and terms offered by the lender, which keeps borrowing costs relatively low.

Of the loans that the Small Business Administration guarantees, the SBA 7(a) is the most popular among small business owners[6].

SBA 7(a) Loan vs. SBA 504 Loan

The SBA partially guarantees both loans, but they differ in purpose. Generally, an SBA 7(a) loan is used for working capital or business expansion, while an SBA 504 loan is usually meant to finance the purchase or improvement of fixed assets, such as commercial property or equipment.

In addition, 504 loans must create or retain jobs or other public policy goals, as outlined by the SBA loan agreement.

Here is a quick reference regarding the difference between SBA 7(a) and SBA 504 loans.

| SBA 7(a) | SBA 504 | |

| Max loan size | $5 million | $5 million, $5.5 million for small manufacturers or specific energy projects |

| Interest rate | Prime rate + 2.25% to 4.75% for variable interest; prime rate + 5% to 8% for fixed interest | 4% to 7% fixed |

| Terms | 10 years, 25 years for real estate | 10, 20, 25 years |

| Minimum down payment | 10% | 10% |

| Used for | Working capital (improvements, purchasing supplies, expanding business, consolidating debt) | Purchasing fixed assets, construction |

BY THE NUMBERS: The U.S. is home to approximately 30 million SMEs, accounting for almost two-thirds of new jobs the private sector has created.

Source: USTR

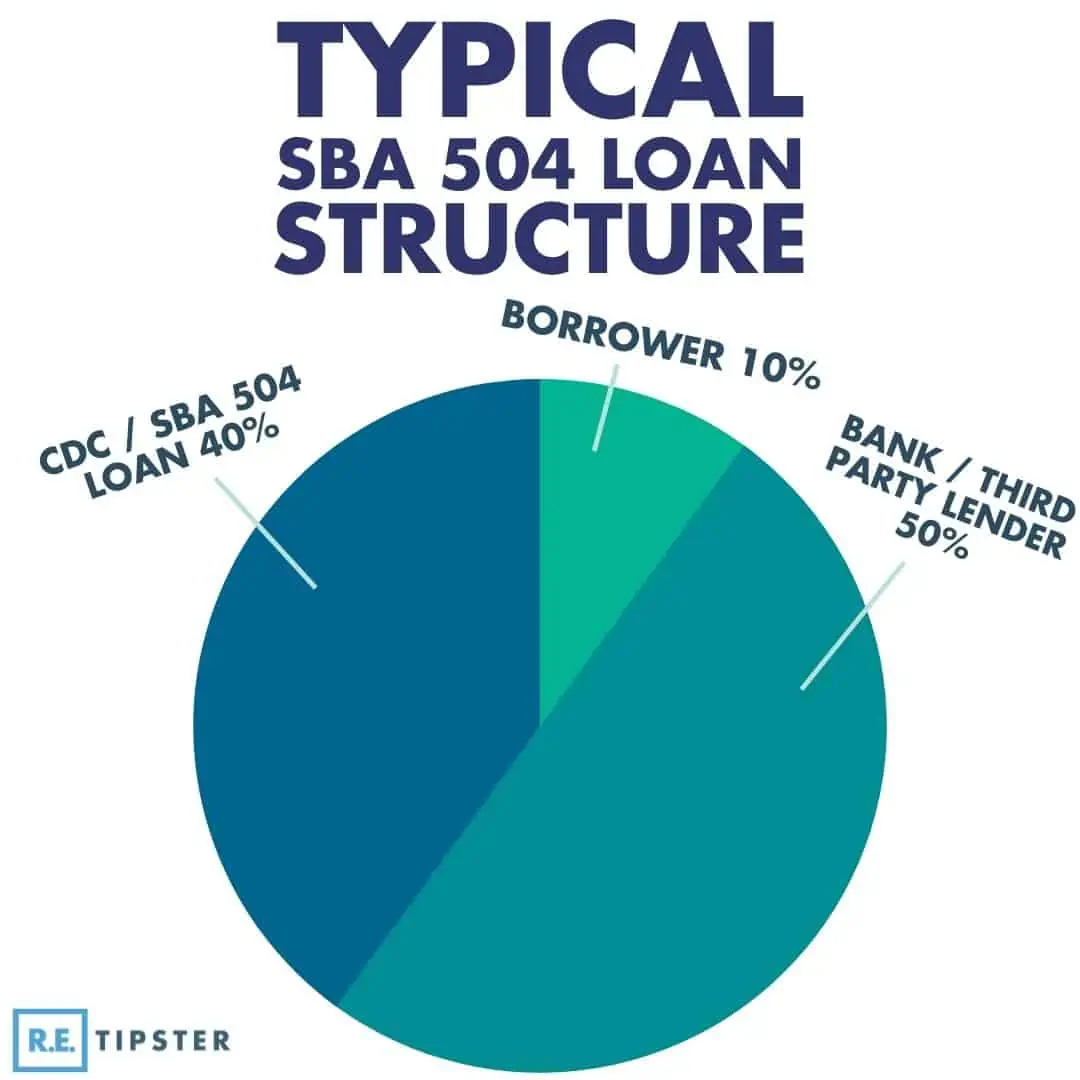

A typical SBA 504 loan is also structured differently, as shown by the infographic below.

Types of SBA 7(a) Loans

The SBA promotes 7(a) loans as its primary assistance program for small businesses, classifying them into several types. These business financing options have varying terms and conditions, such as maximum loanable amounts and SBA loan maximum guarantee percentages. The primary SBA loan options are detailed below[7].

- Standard SBA 7(a) Loan. $5 million maximum loan; 85% maximum guarantee for loans up to $150,000 and 75% for loans greater than $150,000.

- SBA 7(a) Small Loan. $350,000 maximum loan; 85% maximum guarantee for loans up to $150,000 and 75% for loans greater than $150,000.

- SBAExpress. Best for quick turnarounds, which guarantees loan issuance 36 hours after the application approval. $500,000 maximum loan, 50% maximum guarantee.

- Export Express. An even faster version of SBAExpress (24 hours instead of 36) for small businesses in the export industry. $500,000 maximum loan and 90% maximum guarantee for loans of $350,000 or less and 75% for loans more than $350,000.

- Export Working Capital. An SBA loan provided to businesses generating export sales. $5 million maximum loan; 90% maximum guarantee.

- International Trade. The SBA 7(a) option for long-term financing for businesses expanding to grow export sales or modernizing to meet foreign competition. $5 million maximum loan and 90% maximum guarantee.

SBA 7(a) Loan Rates and Fees

The SBA also regulates the rates SBA lenders can offer, which lowers borrowing costs overall for small business owners.

Typically, SBA 7(a) lenders use any of these three ways to set the interest rate:

- Daily prime rate plus a lender spread. The borrower can negotiate the lender spread, but the SBA also limits the maximum lender spread depending on the loan amount and its maturity. The SBA sets the maximum lender spread from 2.25% to 4.75% in variable interest and 5% to 8% on fixed rates[8].

- London Interbank Offered Rate (LIBOR), plus 3% as the lender’s fee.

- The SBA’s optional “peg” rate. This rate is a weighted average based on maturities similar to the average SBA loan.

While SBA loans offer comparatively good interest rates, SBA Express loans generally have higher rates than the other SBA loan programs.

In addition to standard interest payments, SBA 7(a) loans also charge the borrower guarantee fees and annual service fees. The first protects the SBA in case the borrower defaults, while the second compensates the lender for the administrative costs of underwriting and managing the loan.

In the case of small business loans of less than $350,000, the lender is not obligated to charge any guarantee fees.

SBA 7(a) Loan Borrower Qualifications

Banks and other financial institutions processing SBA 7(a) loans have varying borrower qualifications. The agency requires businesses to[9]:

- Be a for-profit company.

- Be in legal operation.

- Have less than 500 employees.

- Earn less than $7.5 million annual average revenue in the three years before the loan application.

- Post a net income of under $5 million (after taxes and not counting carry-over losses) and a tangible net worth of less than $15 million.

- Show equity in the business.

- Be physically based in the United States and do business in the United States and its territories.

- Have fully exhausted non-SBA loan options or tried but failed to get funds from other financial lenders.

- Prove a sound business purpose for the loan and that the intended funds’ usage is SBA approved.

- Prove no delinquency on any existing debts to the federal government (e.g., taxes, student loans) and prove the small business owner is not on parole or probation.

- Be borrowing for an SBA-eligible industry. Non-profit, speculative, and illegal businesses are excluded.

BY THE NUMBERS: The average loan amount for small businesses is $663,000.

Source: SBA Attorneys

Credit Score Benchmarks

The SBA does not set minimum benchmarks for evaluating borrowers’ personal creditworthiness. Therefore, it is up to the lenders to examine the credit score and credit history of the borrowers before underwriting and issuing the loan.

Generally, SBA-approved lenders will look for a small business owner’s credit score to be 690 or higher.

For pre-approval, the SBA uses the FICO Small Business Scoring Service (SBSS) to evaluate the business’s credit history. The business should score at least 155 on this rating method.

An SBA 7(a) lender can continue processing the application of borrowers who did not meet the SBA’s SBSS benchmark. Other lenders may choose to set minimum SBSS approval scores higher than the SBA’s base number.

Pros and Cons of an SBA 7(a) Loan

Taking an SBA 7(a) loan has certain advantages and drawbacks[10].

The advantages include the following:

- Lower interest than a standard bank’s loan program.

- Access to capital that borrowers with low credit scores would not otherwise have access to.

- Lenient down payment requirements.

Conversely, borrowers may have to contend with the following drawbacks:

- Strict requirements and application procedures.

- Lender discretion on loan terms.

- Tedious SBA prescreening and lender evaluation.

Takeaways

- SBA 7(a) loans are basic loans for small businesses that allow business owners access to working capital. They can use these funds to expand their business, consolidate debt, procure supplies, improve leaseholds, or purchase equipment or fixed assets.

- SBA 7(a) loans are among the small business loans partially guaranteed by the Small Business Administration. Another popular option is an SBA 504 loan.

- The federal backing of these loans, even if partial, allows lenders to assume more risk when approving borrowers, especially for applicants with a subpar credit score or who cannot make a significant down payment.

Sources

- Kenton, W. (2021.) Small Business Administration (SBA). Investopedia. Retrieved from https://www.investopedia.com/terms/s/small-business-administration

- Small Business Administration. (n.d.) Organization. Retrieved from https://www.sba.gov/about-sba/organization

- SBA Complete. (n.d.) Why PLP Status Matters for Lenders. Retrieved from https://sbacomplete.com/knowledge-center/resource/why-plp-status-matters-for-lenders/

- D’ Angelo, M. (2022.) The Small Business Owner’s Guide to Getting an SBA Loan. Business News Daily. Retrieved from https://www.businessnewsdaily.com/15763-sba-loan-guide

- Lowe, K. (2021.) SBA Loan Rates 2022. NerdWallet. Retrieved from https://www.nerdwallet.com/article/small-business/sba-loan-rates

- Prakash, P. (2021.) SBA 7(a) Loans: Types, Requirements, and How to Apply. Fundera. Retrieved from https://www.fundera.com/business-loans/guides/sba-7a-loan

- Small Business Administration. (n.d.) Types of 7(a) loans. Retrieved from https://www.sba.gov/partners/lenders/7a-loan-program/types-7a-loans

- Berry-Johnson, J. (2022.) SBA Loans: What They Are and How to Get One. Value Penguin. Retrieved from https://www.valuepenguin.com/small-business/sba-loans

- SBA7A.LOANS. (n.d.) Do I Qualify for an SBA 7(a) Loan? Retrieved from https://www.sba7a.loans/eligibility-and-qualifications-for-the-sba-7a-loan

- Fora Financial. (2019) Pros and Cons of SBA 7(a) Loans. Retrieved from https://www.forafinancial.com/blog/working-capital/pros-cons-sba-7a-loans/