What Is a Title Binder?

Shortcuts

- A title binder or interim binder acts as a placeholder policy until an actual title policy can be issued in a real estate transaction.

- Title binders last for 30 days up to a maximum of two years, and can typically be converted to a full policy when issued by the same title company.

- Many investors, particularly flippers, use a title binder instead of a full policy because they generally cost a fraction of the actual insurance and they will flip the house anyway.

- Owners who frequently relocate also use a title binder to cut costs.

- Many lenders accept title binders as proof of insurance instead of waiting for the full policy to be issued.

How Does a Title Binder Work?

Also known as an interim binder, a title binder is an insurance policy that covers the transitional period in a real estate transaction where the buyer’s and seller’s insurance policies do not overlap in coverage. A title binder acts as a placeholder until an actual policy can be issued[1].

A title binder works like title insurance but with a standard term of 30 days up to a maximum of two years (although it can be extended for another two years for an extra fee). It covers things like acts of God, physical damage, and theft[2].

Note that a title binder is not insurance per se, but it represents a commitment from the title insurance company to issue a policy. Title binders are not legally required but are commonly used in many real estate transactions.

Use in Real Estate Investing

Real estate investors, particularly flippers, use a title binder to cut costs on title policies[3]. Because title binders generally cost only 10% of the full policy, they buy a title binder when they know they will flip the home instead of acquiring a full title insurance policy that may cost hundreds of dollars more. An interim binder can also help property flippers sidestep several title fees that are usually assessed to insure the same property.

For this reason, title binders are also useful for people who frequently relocate[4]. The caveat is that the buyer must inform the escrow officer[5] about the title binder before closing; otherwise, the buyer must pay the regular title insurance premium.

Most title binders are convertible to a full policy if the same title company issues them. If there is any defect in the title[6] during the interim binder’s term, one can turn it into an actual policy to file a claim.

BY THE NUMBERS: In the United States, title insurance companies charge, on average, $1,000 per policy.

Source: realtor.com®

Frequently Asked Questions: Title Binder

Given the complex nature of title insurance, some buyers have many questions about how a title binder can help them. Here are some of the most common.

Can a Title Binder Be Used as Proof of Insurance?

Lenders can accept title binders as proof of insurance to avoid waiting for the insurance company to generate the actual policy.

The title binder lets the lender know that the borrower’s insurer is willing to issue a policy with sufficient coverage to restore the value of the collateral if and when something happens to it.

How Long Is a Title Binder Good for?

It depends on the jurisdiction. Although most insurance policies get insured in less than three months, the binder can expire without replacement.

If the lender has accepted the binder to approve the home loan application, but the title company fails to issue a policy before the binder’s coverage lapses, the borrower would have to get home insurance from another carrier to be adequately covered.

Is a Title Binder the Same as a Certificate of Insurance?

Title binders and certificates of insurance have similarities, but they are not interchangeable.

Both documents can spell out the details of coverage, covered perils, amount, effective date for insurance coverage, name of the insured party, deductibles, and limits[7].

However, the binder remains valid for just a short period. Since it expires quickly, it cannot replace an insurance policy and ensure coverage over the long term. Plus, the company selling title insurance can issue the binder only when the policy has yet to exist.

Therefore, if the insurer can generate the papers immediately or write a policy with a future effective date for insurance coverage, then the binder becomes redundant.

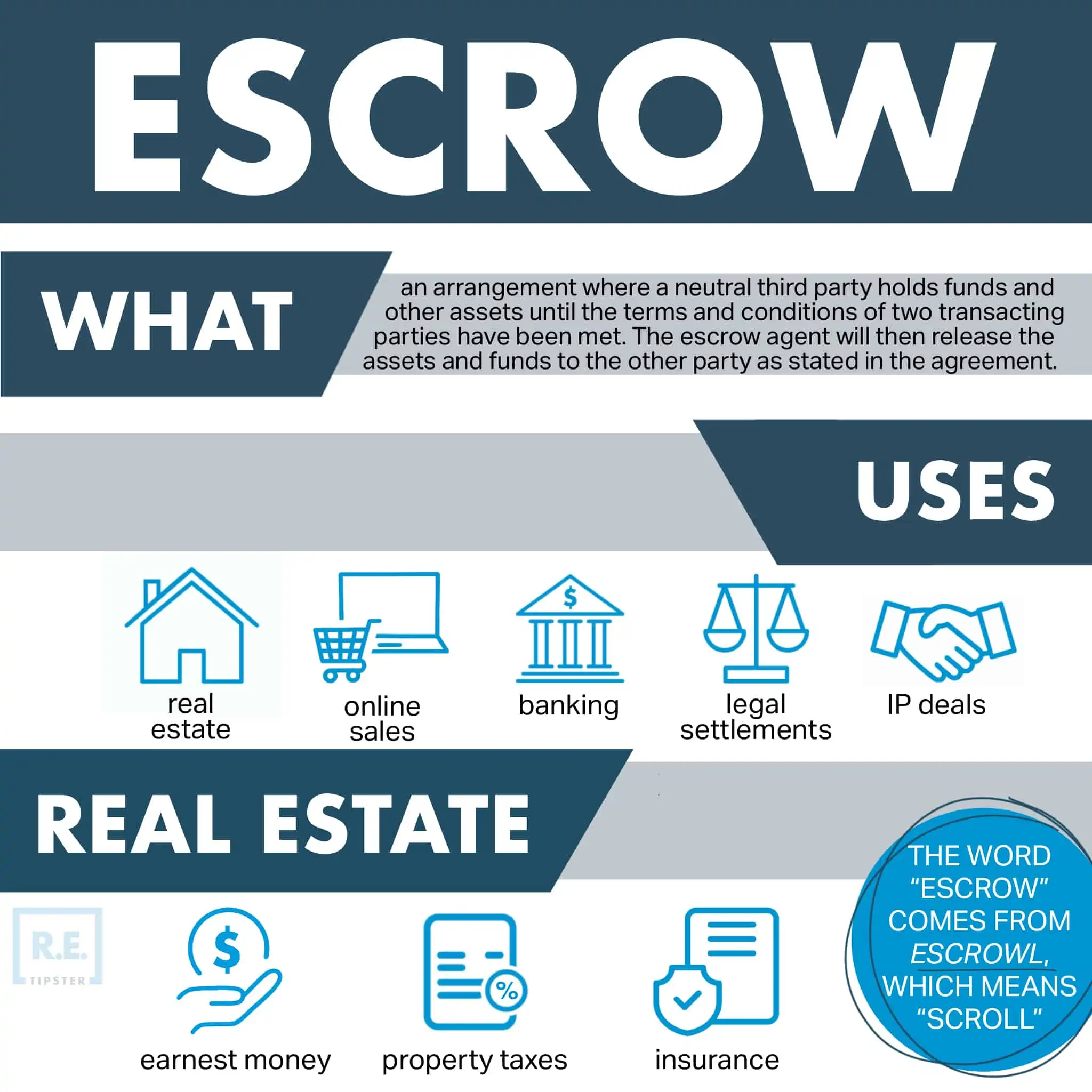

What Is an Escrow Binder?

An escrow binder is the earnest money buyers use to keep sellers from entertaining other parties. It is so-called because once the seller accepts this earnest money, they are contractually bound to delist the property off the market. A real estate agent holds this money in an escrow account (hence the name).

However, if the buyer reneges on this deal by either failing to secure a loan to finance the house or deciding not to proceed with the purchase, the seller gets to keep the funds. The buyer can only recover this earnest money by proving that the seller has acted in bad faith, such as artificially lowering the appraisal[8] or concealing structural defects[9].

BY THE NUMBERS: Earnest money ranges between 1% and 5% of the purchase price.

Source: Forbes Advisor

Sources

- McGinley, K. (2022.) How long does it take to get homeowners insurance? Policygenius. Retrieved from https://www.policygenius.com/homeowners-insurance/how-long-does-it-take-to-get-homeowners-insurance/

- Insurance Information Institute. (n.d.) Homeowners Insurance Basics. Retrieved from https://www.iii.org/article/homeowners-insurance-basics

- Maloney, C., Nasiripour, S., & Tempkin, A. (2021.) House flippers in the U.S. are awash in cash after record year. The Seattle Times. Retrieved from https://www.seattletimes.com/business/real-estate/house-flippers-in-the-u-s-are-awash-in-cash-after-record-year/

- Frost, R. (2020.) Who Is Moving and Why? Seven Questions About Residential Mobility. Harvard Joint Center for Housing Studies. Retrieved from https://www.jchs.harvard.edu/blog/who-is-moving-and-why-seven-questions-about-residential-mobility

- Ceizyk, D. (2021.) What Is An Escrow Officer? LendingTree. Retrieved from https://www.lendingtree.com/home/mortgage/what-is-an-escrow-officer/

- Giusti, A. (2020.) Don’t let common property title issues derail your home closing. Bankrate. Retrieved from https://www.bankrate.com/mortgages/common-property-title-issues/

- Sibor, D. & Schlichter, S. (2022.) What Is Homeowners Insurance, and What Does It Cover? NerdWallet. Retrieved from https://www.nerdwallet.com/article/insurance/understanding-homeowners-insurance

- Zillow. (2021.) The Appraisal Came in Low – Now What? Retrieved from https://www.zillow.com/sellers-guide/appraisal-came-in-low/

- HGTV. (2015.) Common Problems Found During Home Inspections. Retrieved from https://www.hgtv.com/lifestyle/clean-and-organize/common-problems-found-during-home-inspections