There’s no shortage of bad actors in the world, ready and waiting to part you with your money. And nowhere is that more evident than in the world of real estate.

In fact, real estate offers the perfect breeding ground for scams, given the high dollar values involved.

As you navigate real estate transactions as a buyer, seller, investor, or renter, watch for the following real estate scams.

1. Foreign Buyer Scam

A variation on a classic check scam, a foreign or long-distance buyer offers to buy your property, often in cash. They can’t meet with you in person because they live far away, but they put down a deposit to buy your home.

You receive a check—often an official-looking cashier’s check—for more than the agreed-upon amount. The buyer apologizes and instructs you to deposit it and send them a partial refund for the overage. You do so, only to then have their check bounced.

How to Protect Yourself

First, work with reputable local real estate agents or attorneys. But even if you’d rather sell FSBO, watch out for sketchy buyers who refuse to meet in person or send a licensed representative, such as their Realtor, to see the property and oversee the transaction.

Bill Gassett of Maximum Real Estate Exposure, a thirty-seven-year real estate veteran, suggests never doing business with someone you’ve never met in person and especially a stranger from a foreign country. “With a purchase as significant as buying real estate, a buyer (or their credentialed representative) should have no issues meeting face-to-face. If they balk at that suggestion, red flags should go up immediately,” he advises.

Most of all, never send a stranger money for a “refund.” Even if the check appears to clear, the sender can sometimes claw back the money later.

2. Fake Realtor Scam

In a fake real estate agent scam, the scammer contacts you claiming to be your Realtor or someone from their office. They use your Realtor’s email address (or one that looks similar to it), or they call you, claiming to be the Realtor's assistant or associate.

Once they’ve established these fake bona fides, they give you the wrong bank account information for transferring an earnest money deposit (EMD). You wire the money, only to discover that your actual agent or title company never received it.

How to Protect Yourself

When you take down payment account information, do it by phone or in person with your real estate agent. If you must take it by email, take it as part of an existing email thread that you know is with your actual Realtor.

3. Fake Escrow Scam

This one works similarly to the fake real estate agent scam, but with the scammer pretending to contact you from the title company or settlement attorney.

They may even go so far as to have a website and phone answering service that look or sound similar to the real title agent’s website or phone system. The phone number or address might be off by a single digit.

The person claiming to work for the title company gives you fake wire instructions for sending in your escrow or settlement funds. You then show up for the real settlement, only for the true settlement agent to ask where your funds are.

How to Protect Yourself

Contact the title company based on the phone number listed in your original loan documents to confirm the funding instructions.

If you receive an email or other communication informing you that the funding instructions have changed, double check it with your existing contact at the title company.

4. Fake Competing Offers

While not criminal fraud like the scams outlined above, lying Realtors still pose a problem.

When you express interest in a property, unscrupulous listing agents sometimes tell you all about how much interest they’ve received in the property, how multiple offers are coming in hot, how the property may not be available “after tomorrow when the buyer compares offers,” and so on.

It’s sometimes true. And it’s sometimes a complete fabrication to spur a hasty and higher offer from you.

How to Protect Yourself

Unfortunately, there’s little way to know just how much competing interest there is from other prospective buyers.

All you can do is stick to your guns and don’t let yourself be oversold by a fast-talking agent. Make the same offer regardless of how much buzz the listing agent tries to spin up, and negotiate based on what the property is worth to you.

“Ignore the hype from the listing agent and create leverage in your negotiations with a real estate comps analysis,” recommends Ramonelle Lyerla of Mashvisor. (Side note: check out our full Mashvisor review here.)

5. Bait-and-Switch Listings

You know the old bait-and-switch trick, but it can cost you thousands of dollars in an industry with assets worth hundreds of thousands.

In real estate, it works like this: You find a property listed for sale or rent, at an excellent price. When you reach out to the listing agent, they tell you that the property has already been sold or rented, but they have some outstanding other properties available.

Then they take you on a spirited romp across town, showing you one overpriced mediocrity after another.

How to Protect Yourself

One option is hiring your own buyer’s agent or renter representative. They can find good deals for you and negotiate on your behalf.

Even if you don’t take that route, insist on the listing agent sending you all listings in advance before you waste time traipsing all over the city.

6. Bait-and-Switch Movers

Sadly, the moving industry isn’t known for its scruples. In fact, it’s so rife with bad actors that two of the biggest names in the industry, United Van Lines and Mayflower, launched a service called MoveRescue to help residents avoid problems.

Many movers agree to one price verbally, then once they start loading your belongings, insist on a higher price. “Hmm, this furniture is a lot heavier than we thought. I’m afraid it’s going to cost more than we originally discussed.”

In extreme cases, they hold your belongings hostage. Or they insinuate that your items are fragile, and they’re not responsible for any damage if they unload it back into your home after you “wasted their time.”

How to Protect Yourself

Bribe your friends and family members with pizza and beer to help you move?

If you’d rather hire a moving company, get a referral from someone you trust. Get several quotes, and insist on all of them in writing. If a mover seems reluctant to commit to a written contract, skip them and find someone else. You can also check movers’ profiles on the Better Business Bureau website, which has over 20,000 moving companies listed.

7. Fake Landlord Scam

Renters, especially those moving long-distance, sometimes have to rent a home sight-unseen. That leaves them vulnerable to scammers pretending to own or manage a property, but in fact have no affiliation with it.

The fraudster lists a property for rent at an appealing price—often too good to be true—and then when you contact them, they impress upon you how much interest they’ve received about this property (see the “fake competing offers” scam above). They then offer to hold the property for you if you put down a security deposit, first month’s rent, and/or holding deposit.

All sight-unseen.

You transfer them the money, and they disappear. When you get desperate enough to look up the actual owner or property management company, they don’t know what you’re talking about.

How to Protect Yourself

First, always either see the property yourself or send a representative to see it. It’s harder (but not impossible) for scammers to gain access to the property to show it to you.

Second, verify the ownership of the property and the property manager’s role. That’s easier in the case of large apartment buildings, where you can look up the manager online and contact them independently. You can always hire a Realtor as well to represent you and have them verify the owner or property manager.

Finally, make sure you report these and any other real estate fraud to the police. “Many people hesitate to report being scammed for fear of embarrassment or simply wanting the whole ordeal to go away,” explains Sallie McBrien of Your At Home Team. “But not reporting the incident to authorities only enables the bad actors to continue scamming innocent people. If you are scammed out of money during a real estate transaction, please contact your financial institution and the proper authorities to handle the situation.”

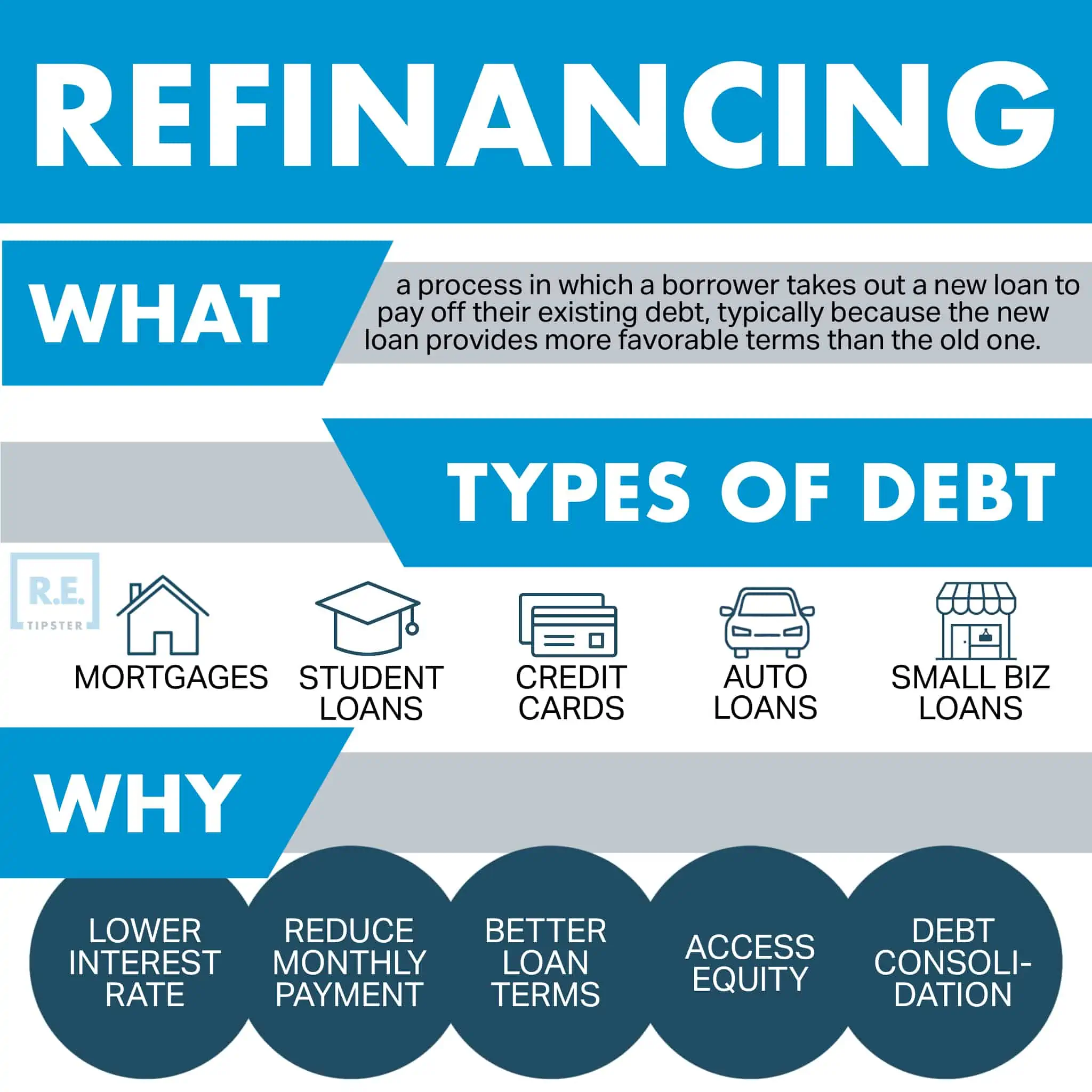

8. Predatory Refinance Lenders

I spent the first five years of my career working for a mortgage lender, and there’s a reason why they love refinancing borrowers so much. Several reasons, in fact.

To begin with, they get to charge you a whole new set of lender fees. These include loan points, but also “junk fees”—flat fees that they literally make up to charge as much as they think they can get away with. “Processing fee,” “underwriting fee,” “document preparation fee,” “wire transfer fee,” and “document recordation fee” are just a few examples.

The other incentive is more subtle. At the beginning of your loan, most of your monthly payment goes toward lender interest. As time goes by, the proportion of each monthly payment that goes toward interest slims down, and more of each payment starts going toward your principal balance. This process is known as amortization.

It means that lenders effectively earn higher interest in the early years of your loan. That, in turn, means that they want to perpetually keep you in those early years by refinancing you as soon as you have enough equity to do so.

In the worst cases, predatory lenders push older borrowers—particularly those with impaired memories or cognition—to refinance as often as every year.

How to Protect Yourself

Older borrowers should discuss major financial decisions with a trusted child, friend, or financial advisor. That includes refinancing their home or investment properties.

But all property owners should understand mortgage lenders’ incentives. Don’t just look at whether a lender can offer you a lower monthly payment or a juicy cash-out refi—calculate the remaining life-of-loan interest on your existing mortgage and compare it to the total cost (including fees and interest) of the proposed loan.

While your loan payoff date might seem infinitely far away and extending it with a refinance might feel like trading one far future data for another, that’s a cognitive illusion. Don’t put yourself into a cycle of endless debt.

9. Timeshares

My stepmother got sucked into a timeshare program from a major hotel chain. Now she and my father own not one but two timeshare packages.

That they almost never use.

If they do find a destination they want to go to, it usually qualifies as a “premium” hotel property and costs double or triple the points. If they want to bring their adult children, they need the upgraded apartment suite option—for triple or quadruple the points.

See where this is going?

I’ve attended a few timeshare presentations myself, and I can tell you firsthand that their salespeople are some of the most persuasive in the world. They have a sexy product and a streamlined, perfected sales pitch honed over many thousands of presentations.

How to Protect Yourself

Don’t attend timeshare presentations, even if they offer you a free vacation.

Hard stop.

10. Hidden Fees from Crowdfunding Platforms

I’ve invested in a lot of real estate crowdfunding platforms, and reviewed even more.

Some are transparent, with clear, simple fee structures. One of my favorites, Groundfloor, doesn’t charge investors any fees. They earn their revenue by charging fees to borrowers (check out our full Groundfloor review for more details).

Other crowdfunding platforms bury their fees in their SEC investment circulars. As a layperson, good luck finding them in these 100+ page legal documents.

One common way to hide fees is by billing expenses to a company that they own and operate. On the more benign side, they might manage the property in-house and charge property management fees, which is fine so long as they disclose that and the fees are in line with the market. But the waters get murkier when they handle all repairs and maintenance in-house, and bill these as expenses without you ever knowing how much they charged for any given repair or how involved the repair actually was. For example, a $900 wall repair could have been a simple patch.

How to Protect Yourself

First, read third-party reviews from expert investors who have actually invested their own money on a platform. For instance, Seth Williams invested money in Fundrise, left it there for five years, and then withdrew it. In his Fundrise review, he breaks down the returns he earned and the other pros and cons of his experience with Fundrise.

Do as much research as you can on each crowdfunding platform, and in particular, their fee structure.

11. High-Dollar Guru Coaching Programs

I’m loath to admit it, but I myself have taken real estate coaching programs for astronomical sums. They all too often disappoint.

In most cases, they start with something cheap, or even “free plus shipping” (which isn’t free, because shipping never costs as much as they charge). Then they take you up an escalation ladder with their $99 program, then their $999 program, then their $9,999 program, and so forth.

How to Protect Yourself

In my experience, paying four- or five figures for an education program is usually a raw deal. At that level, you should really work with a one-on-one or small group coach, where they hold your hand through several deals or otherwise guarantee a specific result.

They may not even charge a fee for this but rather take a percentage of the result they help you achieve. For example, they might partner with you on a real estate deal with 50/50 financial investment, but they get 70% of the profits in exchange for them holding your hand and helping you secure that first deal. There’s nothing wrong with that model—in fact, it ensures their interests align with yours.

12. Not-So-Turnkey Properties

As a real estate investor, you see turnkey properties available for sale all the time. And some of them truly are rent-ready, or have existing tenants paying rent each month.

But some unscrupulous sellers simply cover up the defects and hope that a dumb buyer comes along who fails to do a home inspection or whose home inspector misses lurking problems.

“Often, so-called ‘turnkey properties’ come with hidden defects,” explains Chris Lee, cofounder of Landlord Gurus. “I’ve especially seen problems related to water damage, such as roof or pipe leaks and mold.”

Hidden problems could also include structural defects behind the walls or flaws in the mechanical systems that you just can’t easily detect. In some cases, they could cost tens of thousands to fix.

How to Protect Yourself

“Always get an inspection done,” insists Lee. “Even in a seller’s market, invest the time and money to bring in an inspector, and an experienced and honest one at that.” Ask for a referral from your real estate agent if you don’t know one.

Ask them point-blank: Which structural components could you not see? Do you have any concerns whatsoever?

Trust your nose as well. Do you smell moisture? Mold?

Finally, take all the seller's information with a proverbial grain of salt. If you only have their word on something important—verify it.

Final Thoughts

If something ever looks or feels too good to be true, it probably is. Follow your gut when evaluating offers, listings, or other opportunities in real estate.

Most importantly, get an expert unbiased opinion when verifying something. When something feels even remotely suspicious, call in someone who knows more than you do to double-check it.