Real estate has long been considered a sound investment option, as property tends to maintain and even increase its value over time. But is it still a good idea to buy during inflationary periods?

Interestingly, real estate income has consistently outperformed inflation over the past two and a half decades, so property is still a safe asset. Nevertheless, you need to know how to make every penny count when it comes to investing when the economy is experiencing inflation.

Before we go to the how, let's discuss the what—the impact of rising prices and how you can leverage them for investing in real estate during inflation.

Understanding the impact of inflation on real estate

To make informed choices about investing in real estate during inflation, it's essential to understand the market's behavior in such economic conditions.

Inflation's effect on purchasing power

Inflation means an increase in the price of goods and services over time, so each unit of currency buys you less than it did previously. In other words, inflation reduces the purchasing power of the same amount of money over time.

To combat the rate of inflation, a country's central bank (such as the U.S. Federal Reserve or the U.K.'s Bank of England) typically increase interest rates, which affects all kinds of debt, including mortgages. This means fewer buyers have access to financing, which can make it harder to borrow to invest in real estate.

Inflation's effect on development power

In inflationary environments, property construction becomes more expensive. The cost of land, materials, machinery, and wages all increase, which discourages development. When a property does get built, it’s more expensive as the construction costs are passed on to the buyer.

There’s also more demand for existing buildings, so the overall cost of real estate rises, especially in areas with growing populations.

Rental income and inflation

A spike in interest rates means many potential buyers are priced out of purchasing a property. This makes rentals, whether residential or commercial, a great real estate investment.

Be aware that there’s less demand for vacation rentals when people face a higher cost of living. Retirement property also takes a downturn as more people choose to stay in their current homes until the economy recovers.

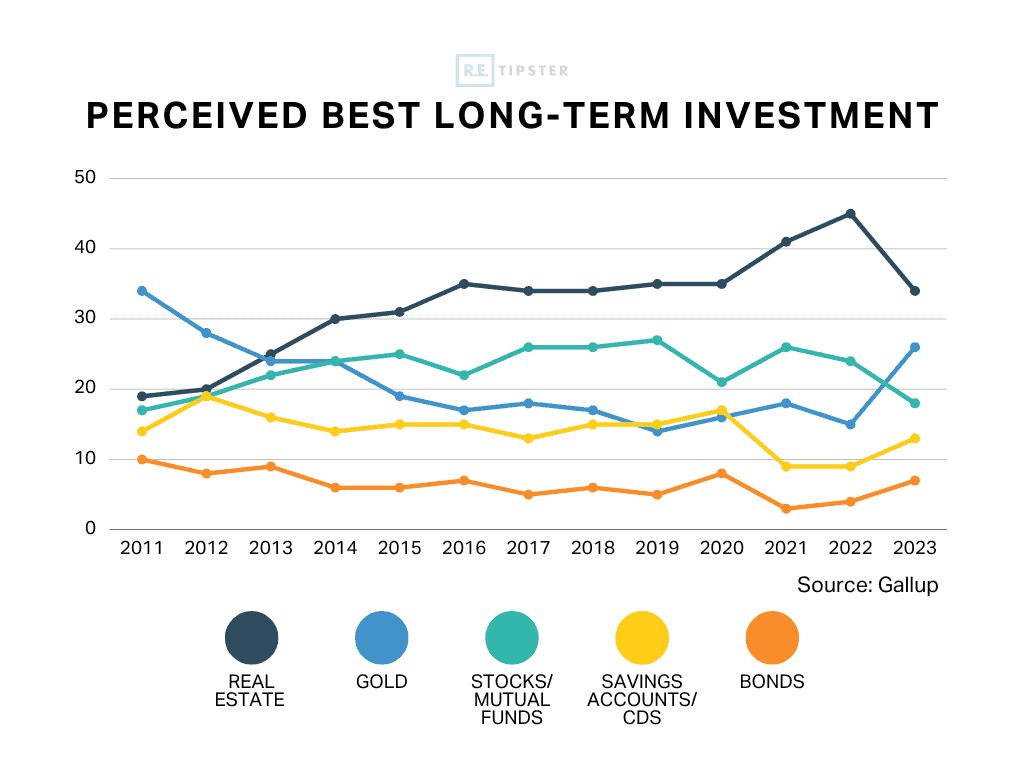

Source: “Real Estate's Lead as Best Investment Shrinks; Gold Rises,” Gallup

Appreciation and inflation

In real estate, the appreciation rate is the increase in the value of a property over time. This is based on market demand—the higher the demand, the more property is worth (especially when there are fewer new developments).

Although higher mortgage rates can slow down housing markets, property prices are still expected to increase over time. Appreciation is one reason why real estate assets can be a hedge against inflation.

RELATED: Got $100K to Invest in Real Estate? Do These 9 Things

8 strategies for real estate investment during inflation

With all that said, how exactly can you capitalize on inflation as a real estate investor?

Try these eight ways:

1. Focus on cash-flowing properties

It’s a good idea to focus on properties that will generate a high cash flow. Rentals give you a steady stream of income and perform well during inflation. Consider multi-family homes as well as commercial real estate.

You have the option to increase your cash flow by setting higher rental prices. These properties also tend to maintain their value over time. To do this successfully, it’s important to keep an eye on your cash flow using accountancy tools and software.

Generally, these tools will ensure you have control over your investment budget, but you can also take it one step further and look into specialized software. More specialized tools, such as property accounting software, are designed with real estate in mind. They're also location-specific, which can help you with applicable property taxes, whether you're in the U.S., U.K., or elsewhere.

2. Consider fixed-rate financing

Inflation can go up or down in the future, so it makes sense to lock in a fixed interest rate for the money you borrow. This rate will apply for the entire agreed term, no matter how much the Fed hikes interest rates.

You’ll benefit from property appreciation while your borrowing expenses remain the same. The initial price may be higher than for a floating rate because the lender is taking more risk. Nonetheless, you’ll find it much easier to forecast your expenses.

3. Diversify your real estate portfolio

In an uncertain economic climate, the last thing you want to do is put all your (real estate) eggs in one basket. If you only invest in one type of property, and there’s then a downturn in that market, you’ll lose out. It’s better to choose a mix of different sectors and assets to spread your risk—a practice known as diversification.

For example, you can build a portfolio consisting of both residential and commercial properties, as well as a couple of vacation rentals. Buying property in different locations is also a clever way to hedge your bets.

This is especially true if you have the ability to buy in different countries that may not be suffering the same rates of inflation and may have more favorable market circumstances. However, do your due diligence by researching their tax and legislation requirements thoroughly.

4. Invest in real assets (and development opportunities)

Before you part with any money, make sure the property will be a worthwhile investment. For instance, you can look for properties with great potential and renovate them before selling them for a profit, known as a “fix-and-flip.” If you're short on the funds or have no idea where to start with this, read our guide on how to flip properties with little to no money.

Alternatively, you can seek development opportunities by buying a suitable plot of land, adding value, or holding on to it until there’s a better climate for house building. Developing or remodeling a house can be a great opportunity or side-project if you have any DIY or construction background, as you’ll likely generate a larger profit and have greater control over the project.

That said, be aware that developing a property will likely involve investing much time and attention. So it can be worth investing in tools, like construction industry accounting software, to help you to monitor your finances and take care of important details, such as tax compliance requirements in your property's location, whether it's in Los Angeles or London.

5. Plan for property appreciation

If you invest right now, you’ll see the maximum benefit from rising housing prices before the market starts to cool. You can also consider adding value by renovating your properties and charging more in rent or resale.

Inflation makes your property worth more and gives you passive equity, but if interest rates do fall, a cash-out refinance may be a good idea.

6. Factor inflation into rental rates

If you’ve paid a higher price to purchase a new property, you can offset it by charging more in rent. If you’ve owned rentals for a while, you can increase the rent in line with inflation to cover your own cost of living. Just be careful to set a fair price for the market.

You should make sure you invest in a type of real estate that’s in high demand in your chosen area to make it easier to find tenants.

Free to use image sourced from freepik.com

7. Consider shorter lease terms

If you go for a short-term lease, you can reprice your rent more quickly. Short-term rentals or STRs are often vacation properties, but they don’t have to be—people may need somewhere to stay during home renovations or in the gap between selling and buying a home.

The advantage is that you typically get paid upfront at the time of reservation, and your expenses are tax-deductible. You can always convert an STR into a long-term rental later if you want to.

RELATED: 6 Steps to Turn Your Airbnb Side Hustle Into a Thriving Full-Time Business

8. Monitor economic indicators

Finally, it’s important to keep a close eye on the state of the economy that you intend to invest in, both before you invest and in the future. Forecasting is not an exact science, but staying aware of emerging trends, market differences, and opportunities is still a good idea. Keep an eye on slowing growth in certain sectors, and look for signs of an economic downturn.

Final Thoughts

Provided you understand the impact of inflation on buying power, construction, rental income, and appreciation, real estate can be an excellent investment as prices rise. Property tends to retain its value and generate a steady income, and it’s less affected by economic instability than other investments like stocks.

Follow the tips above, and you can make smart investments in real estate during inflationary periods.