REtipster features products and services we find useful. If you buy something through the links below, we may receive a referral fee, which helps support our work. Learn more.

Every adult 18 and over should have a last will and testament, better known as a will.

If you want it to work as intended after you shuffle off this mortal coil, you need to understand the components of a will.

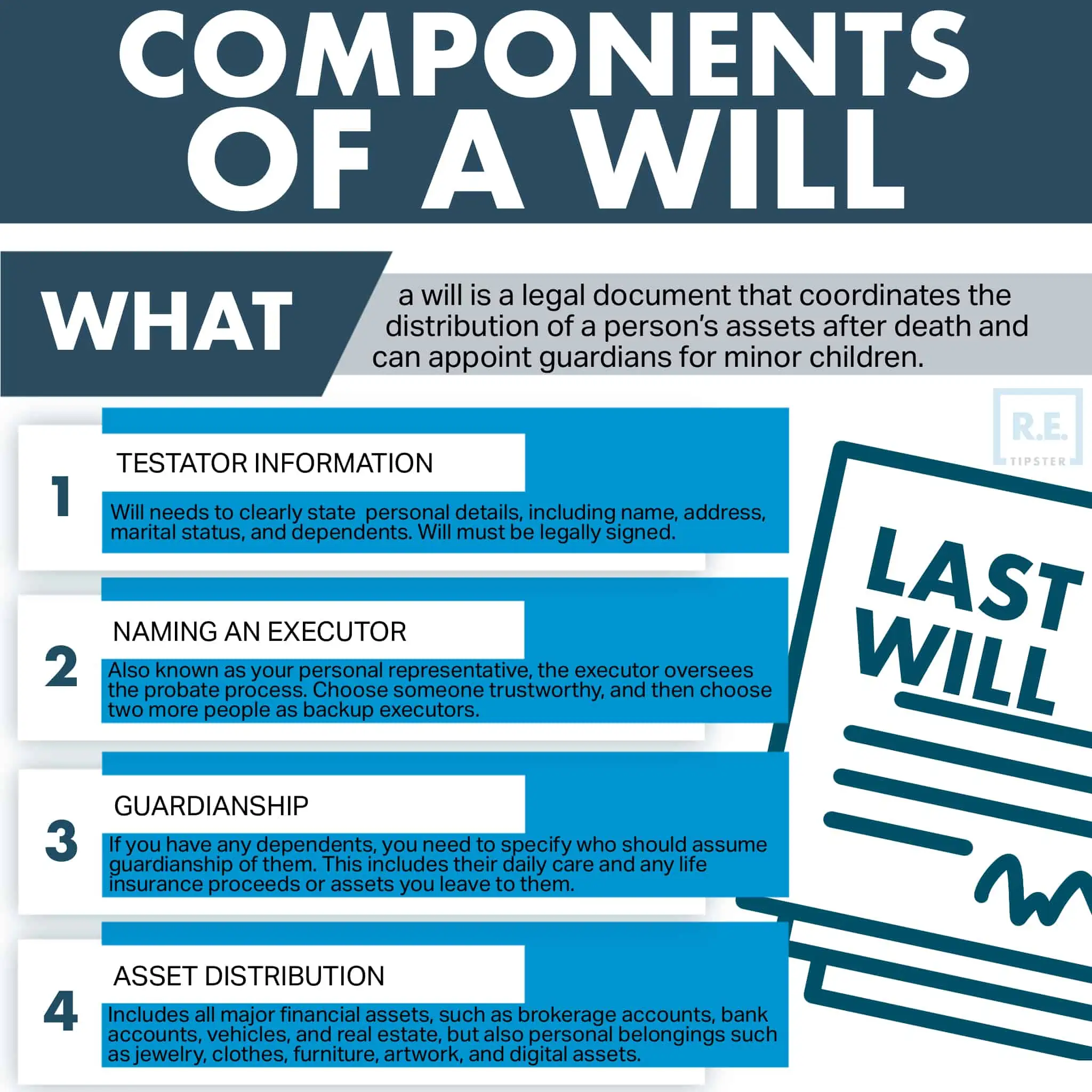

So what are the four major components of a will?

Keep the following in mind as you draft your last will to keep it enforceable.

1. Testator Information and Execution

You are the testator: the person outlining your estate and your wishes. Your will needs to clearly state your personal details, including your name, address, marital status, and dependents.

REtipster does not provide legal advice. The information in this article can be impacted by many unique variables. Always consult with a qualified legal professional before taking action.

You must also legally execute the will, which means signing it in front of several adult witnesses who are not benefactors in your state. While you don’t need to have your will notarized (unless you live in Louisiana), it certainly doesn’t hurt.

Note that for your will to be legally binding, you must:

- be at least 18 years of age.

- be of sound mind and have testamentary capacity.

- have signed the will voluntarily and without undue influence.

2. The Executor and Their Powers

Someone needs to take the reins and oversee your estate after you kick the proverbial bucket. That someone is the executor of your estate. If you ask an attorney about the four major components of a will, the first words out of their mouth are often “naming an executor.”

Also known as your personal representative, the executor oversees the probate process. With oversight from the course, they're temporarily assigned custody of your assets to distribute them according to your wishes. They also pay off any outstanding debts or taxes, inventory any unlisted assets, and ensure your children or pets transition smoothly to their custodian (more on that shortly).

It’s an important task and one that comes with some discretion. Choose someone you trust implicitly—and then choose two more people as backup executors if your named executor is unable or unwilling to serve.

You should also explicitly state your personal representative’s powers. That removes any ambiguity and shores up their legal rights in the eyes of the probate court.

3. Guardianship of Dependents

If you have any dependents, you need to specify who should assume guardianship of them. This includes their daily care and any life insurance proceeds or assets you leave to them. One individual can assume both roles, or you might have one guardian who assumes the physical custody and care of your dependent and another who is the property guardian (aka custodian, trustee, or property manager.)

Dependents include minor children, of course, but could also mean elderly parents or impaired family members who live with you. You should also declare who should take guardianship of any pets you own.

As with executors, name several backups in case your first entry can’t take over guardianship. Choose people who are both financially stable and who share your parenting values.

4. Disposition of Assets

When most people imagine the four major components of a will, the first concept that comes to mind is how their assets will be distributed.

That includes all your major financial assets, such as your brokerage accounts, bank accounts, vehicles, and real estate, but also personal belongings such as jewelry, clothes, furniture, artwork, and digital assets in today’s world. Think beyond the financially valuable belongings; when my grandparents died, my father and his siblings didn’t argue over the big assets, but they each had a few small, sentimental items they wanted to keep to remember their parents. And in some cases, they all wanted the same items, such as paintings by my grandmother.

Consider your debts as well. Before your executor can distribute any assets, they must pay off your outstanding debts. In some cases, this is easy and intuitive: if you used debt to buy investment properties, your estate can sell the properties to pay off that debt. Aim to leave specific instructions for how to pay off your debts with a minimum of fuss.

If you plan on leaving your worldly possessions to your minor children, consider creating a trust to hold your assets for them until they reach adulthood. You can create rules for the trust that allow some funds to go to their legal guardians to help cover the cost of raising them.

After all, what’s the point of becoming a millionaire real estate investor if you can’t leave something behind for your children?

Note that when you die, the cost basis for your assets resets to its value at the time of your death. That means that if your properties appreciated in value and you die holding them, your heirs pay no capital gains taxes on them. It even holds true if you used 1031 exchanges to defer paying capital gains taxes.

Other Components of a Will and Estate Planning

You can write in other post-mortem requests and wishes as components of a will as well. For example, you can outline your funeral wishes and how your want your remains disposed of. You can also specify if you want your organs donated so others may benefit from them.

If you have a family member you want to be excluded from your will, you can list them as an intentional omission.

Nor does your estate planning end with your last will. As touched on above, you may decide to create a trust to manage your assets. You should create documents expressing your healthcare wishes, such as a living will or advance health directive, stating how you’d want to handle medical treatment if you can no longer make decisions for yourself.

Speak with an estate planning attorney, or at the very least do a little online research on core estate planning documents to decide which you want to create and execute.

Final Thoughts

Once you’ve signed your will and other estate planning documents in front of witnesses, store them in a safe place where your loved ones can find it after you pass away. That could include leaving it with your attorney or in a safe deposit box. You could keep it at home in a fire-proof safe, and possibly keep a copy with your executor.

Regardless of where you keep it, your loved ones must know where it is. If no one can find it after you leave this mortal plane, it does no one any good.

Reviewed by Amy Blacklock and Vicki Cook, founders of WomenWhoMoney.com and authors of Estate Planning 101.