REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

Every real estate investor I know has one common goal.

To be financially free.

But what does “financial freedom” mean anyway?

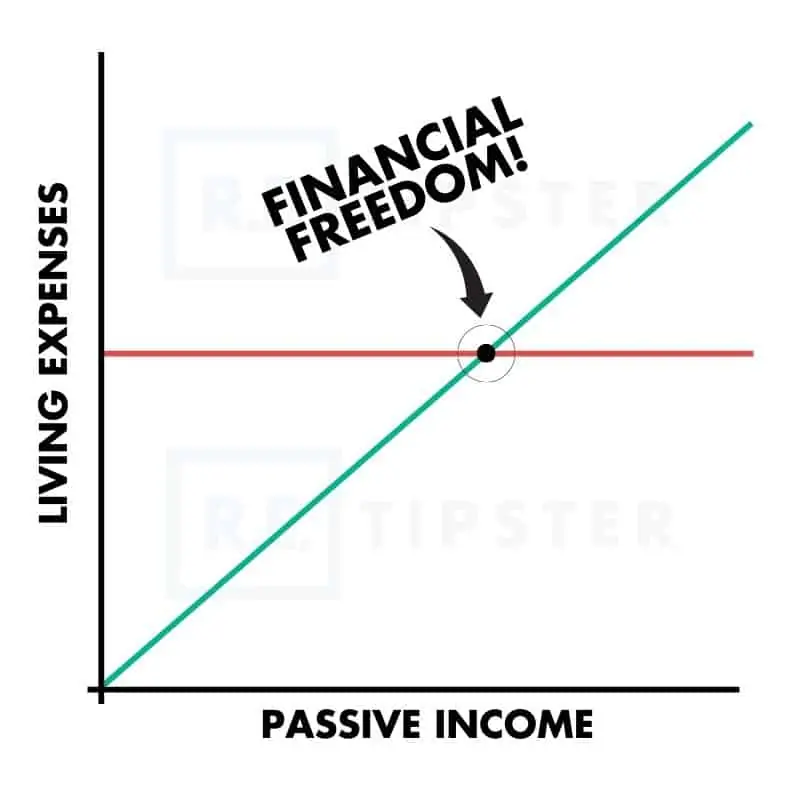

The concept is pretty simple. When you're earning enough income from sources other than your day job (preferably, from “passive income”) to cover all your monthly living expenses, you've officially crossed into the realm of financial independence.

RELATED: The Fast (And Slow) Roadmap for Real Estate Investors

As the chart above implies, there are essentially two issues that need to be dealt with in order to become financially free:

- Understanding what your monthly living expenses are.

- Learning where and how to generate a passive income (and then taking action).

In order to deal with issue #1, you'll need a simple financial freedom calculator to help you determine whether you're ready to fire your boss and enjoy your life to the fullest.

Originally inspired by Tim Ferriss' monthly expense calculator, the Freedom Calculator is designed to give you some clarity about what your monthly income goal should be.

Another side benefit of this calculator is that it should cause you to start looking critically at your monthly expenses. If you take some time to evaluate what the numbers are telling you, you'll probably start to notice some ongoing costs that can be reduced or eliminated entirely.

When you clearly identify what your financial constraints are (both big and small), the real magic happens when you start to recognize which ones shouldn't exist in the first place.

The Power of Cutting Costs

I've met a lot of people who feel stuck in a job they hate – and the only reason they continue to slave away at their job is that it pays enough money to cover the lifestyle they've chosen, and the monthly expenses they think they can't live without.

However, a lot of the expenses we think we need to pay for are completely unnecessary.

The first time I went through this formula years ago, I found all kinds of ways to reduce and eliminate various line items from my budget.

- I got different insurance policies the provide a better value at a lower cost.

- I paid off my student loan and eliminated the monthly payment.

- I got rid of cable TV (one of the easiest things I ever did).

- I opted for a cheaper phone plan and stopped upgrading my phone each year.

- I stopped eating out all the time.

Of course, living cheaper generally means fewer luxuries and cheap thrills in life. But keep in mind, the goal isn't to live without these things forever… the goal is to reach financial independence ASAP.

If you eliminated a few unnecessary costs from your monthly budget, you could retire YEARS earlier than if you continued paying for things you don't need, and might not even be using.

I loved this example from Mr. Money Mustache's blog post about The Shockingly Simple Math Behind Early Retirement,

“Simply cutting cable TV and a few lattes would instantly boost their savings to 15%, allowing them to retire 8 years earlier!! Are cable TV and Starbucks worth having two income earners each work an extra eight years for???“

There are always ways to live with more frugality, and if that's what it takes to live life on your own terms and NOT be a slave to a working life you hate, isn't it worth it?

If you're in desperate need of freedom NOW, there are probably plenty of opportunities to reduce your monthly expenses so you can fire your boss sooner rather than later.

I hope this calculator shows you what it showed me, that financial independence and early retirement are a lot more achievable than most people think.

RELATED: The Surprisingly Simple Math to Retiring On Real Estate