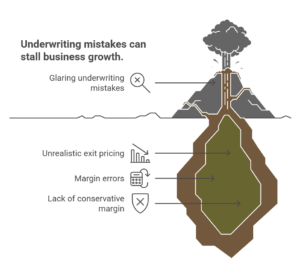

What I'm thinking about: The same glaring underwriting mistakes, week after week, that could stall your business for months (or worse).

Recently, I reviewed land deals from a variety of operators, some running 7+ figure businesses, and 80% of the deals were off by as much as 100% on their exit pricing estimate.

Not 10-15% margin errors. We're talking about operators underwriting properties at market value purchase prices, expecting completely unrealistic exits.

For context, we won't entertain funding (or recommending your own equity purchase) unless there's roughly 2X gross conservative margin (those deals are still out there, trust me, we’ve built a substantial operation ONLY funding those).

Most properties sent over would need their anticipated purchase price cut in half (or more) to even get in the neighborhood of what might work.

The $180-Acre Reality Check: When Exit Pricing Goes Wrong

Here's a glaring example from a Land Daily Diligence session:

- ~180-acre play north of Dallas, expecting to subdivide into 60-75 child parcels of ~2 acres each.

- Road installation required.

- Suggested exit pricing of ~$100K per acre was sent to me based on comps.

My analysis:

- Most parcels in the area are no smaller than ~20 acres.

- Maybe 1-2 recent sold comps in the 2ac range over the past 3 months, with superior characteristics.

- Sold comps in the 10-20-acre range (which seemed a more viable pathway) were moving at ~$20K PPA.

- Smorgasbord of active listings (a sea of green pins on Redfin) with similar/superior characteristics, many on the market for 300+ days.

- Like many sunbelt markets, north of DFW is in a major pricing downtrend right now, especially for residential lots, adding further pressure.

- The subject property had some nice features, but with all of the above, I could not justify offering the seller more than ~$10K per acre, less than ~80% of what they were looking for.

Pretty much every point above was a punch to the gut for the potential of the subdivide. Alarm bells were going off immediately.

And I keep having to ask myself, “How is this level of risk not registering with other land investors?”

Look, I get it. Many of you are running undermanned operations managing lead gen, various marketing channels, comping, biz ops, and dispo… While we are a Category of One business specializing in land deal underwriting all day, every day.

We don’t expect you to be as good as us in that regard, just like it’s unrealistic to expect me to be as good at talking with sellers as your team may be.

The point I’m getting across is that there still seems to be a MASSIVE gap across much of the industry with properly pricing properties. Even with all the education we, and others, have put out, there’s still a LONG way to go, a problem that couldn’t excite me more since we have been working on a solution for a while; see below…

(And for those of you, saying, “Chris, we are locked in on comping properties, no issues here,” mad props to you; keep going and maintain your key advantage. For anyone routinely reading this blog post though, even the best falter, and the skill needs honing continuously.)

This is a topic I will return to often and probably could write about every week given the knowledge gap.

Current Market Conditions Every Land Investor Must Know

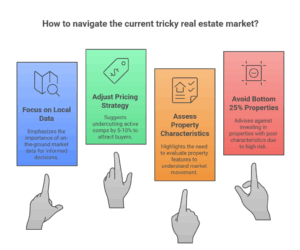

Bottom-up market conditions over everything. We have tendrils and broker relationships, plus active inventory, across much of the US. Local, on-the-ground market data is your best friend.

On average, we’re seeing even more trepidation/slowness than at the start of Q2 2025, when the trade war fears kicked off. At best, conditions are the same.

BE CAREFUL out there, folks! This is the trickiest overall market we have seen in 5+ years.

Standard sell-through rates are useless right now. Typically, they consider the past 12 months, but we've had extreme volatility — a big bull market at the end of 2024/early 2025, then major difficulty in most markets after Q2 2025 started.

The Characteristic Blind Spots Costing You Deals

Track sold comps that went pending after April 1, 2025, specifically. Any comps outside of that range should be viewed with extreme skepticism.

You are probably not undercutting active comps enough. Unless you have disgustingly superior characteristics (which most investors overestimate), you need to undercut ALL active market pricing by at least 5-10% (more if you introduce 3 or more child parcels).

Be smart, of course: get a general baseline of active comp characteristics. You don’t necessarily need to undercut landlocked listings, for instance.

Assess characteristics religiously. The only recent sold comps might have newly placed mobile homes, installed utilities, or proximity to town centers – advantages explaining why they moved in a difficult market.

For target properties that are in the bottom 25% of characteristics, we won’t touch them, regardless of pricing. The risk and potential brain damage just ain’t worth it right now.

The Systematic Solution: Why Even Experts Need Process

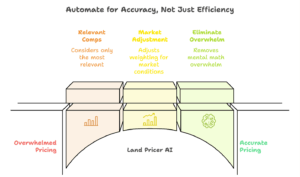

Even as experts, my team gets overwhelmed pricing properties when there are 20-50+ viable comps to consider. I catch myself rushing through $500K+ decisions for efficiency's sake.

This is why we created Land Pricer AI. It considers only the most relevant comps, adjusts weighting for current market conditions, and eliminates mental math overwhelm while accounting for property characteristics.

Remember: Amateurs automate for efficiency. Professionals automate for accuracy.

That 180ac north Dallas deal made my eyes glaze over, and I'm supposed to be one of the best in the industry. Accurate software is the only viable route forward.

We're building the most reliable pricing tool on the market because our own business depends on it:

Know the Real Value Before You Flip

Originally published on https://seriousland.capital/newsletter/ on

This really hits home. I’ve definitely been guilty of overestimating exit pricing before. It’s easy to get caught up in optimism when a deal looks promising, but reality checks like this are crucial. I’ve started leaning more on local broker insight and being extra cautious with comps lately.

Have you found any specific method that helps avoid getting blinded by “perfect on paper” deals?