What I'm thinking about: The #1 priority in our business for the remainder of the year — our Louisiana subdivide.

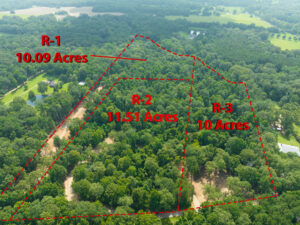

Quick recap for context: 32-acre tract chopped into three child parcels of roughly 10-11 acres each. Months of clearing, driveway installation, and homesite preparation. Turnkey properties where buyers just need to lay foundation and build. Water and electricity at the street.

By the way, the finished contractor work was exceptional — a young guy in his mid-20s working 4AM starts, with a keen eye for detail, taking pride in his craft. Willing to work at cost when some items came over budget. Lucky to work with such quality talent.

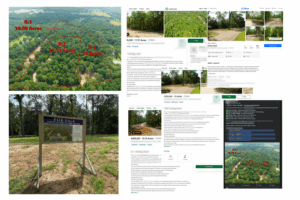

Here's a drone shot of the flag lot driveway, which our broker calls “absolutely spectacular.”

Land Subdivide Marketing: ~$1.2M Case Study

If we get a successful return on this project, it opens the door to millions to tens of millions in external capital flow from investors, probably the largest growth lever we would have to date at our firm.

If we don't… it’s a recoverable situation but could push plans back significantly. The “best laid plans,” though, right?

The local market is relatively slow at the moment, and we have expensive, premium properties listed in a state with downward pricing pressure, on average (FYI: Reminder that RE is hyper-local; I’m generalizing for the sake of article length. Do your own research).

Having the highest quality parcel(s) on the market is the single best advantage you can have in any down cycle. That's certainly the case with our subdivide. Regardless, we can't take anything for granted. A “take-no-prisoners” attitude toward marketing is required with today's level of competition.

So every single day I wake up asking,

“What else can we do to support these properties to sell for solid prices?”

7-Point Marketing Blitz That Targets Every Buyer Channel

- Three-tier pricing strategy. Flag lot (most premium, longest driveway, most development cost) at $450K. Middle parcel at $400K. The least premium lot dropped from $400K to $350K after testing market response—basically a $50K price cut to create urgency and alert the market to the other two properties being listed.

- Physical signage domination. 3×5 foot sign at main entrance with aerial map showing value-add work. Separate smaller signs at each child parcel entrance.

- Directional signs throughout town pointing to property (with QR codes for the listing). The realtor has indicated that most of his land sales come from physical signage. He has lived in the parish his whole life and knows the exact traffic patterns, so we can ensure that we are maximizing visibility with any potential local buyer.

- Digital saturation. MLS listings plus Land.com for all three parcels. Joined every Louisiana land Facebook group, plus national land groups. Multiple posting variations—luxury angle, family-oriented, below-market pricing urgency messaging. AI-generated content variations for A/B testing engagement (and avoiding FB algorithm spam filters). Our land investor partner who brought us the deal has also been leveraging those FB groups for marketing the subdivide so we can get even more visibility. Major money at stake motivates initiative!

- Broker network leveraging. Working with the premier and most well-connected brokerage group in the area. The broker is funneling calls from his other listings to our superior properties. Our realtor quickly lined up a meeting with an out-of-town Texas client looking for a residential lot in the area (and has a local family connection).

- Social media consultant push. Brokerage brought in their social media team for bigger promotional pushes across their accounts.

- Caution tape strategy. Installed at all entrances to protect newly settled driveways while encouraging potential buyers to call the broker instead of self-touring. Creates a controlled showing environment plus accurate lead tracking.

$15K/Acre to $39K/Acre: The Math Behind Our Biggest Bet

The numbers tell the story: We underwrote this at a blended $29K/acre exit to investors. Current pricing averages ~$39K/acre—way above projections. Our all-in cost is roughly $15K/acre, including development. If we hit anywhere near list prices, we're looking at solid 2X+ returns.

Drone aerial shot of all 3 lots with value-add, re-seeded the dirt areas as well to “green up” beautifully soon

Focus on your highest-leverage business problem first. The whole team knows that everything else takes a backseat until this exits successfully.

In the land business, there are only so many factors we can directly control, and exercising patience is crucial. But when the brightest vision of your business's future is within reach, you relentlessly work every possible angle to get there.

=====

Looking for reliable funding on your next development project? Serious Land Capital is actively seeking larger acquisitions ($150K+ purchase price preferred, $50K minimum). Our lessons from complex projects like this Louisiana subdivide mean better systems and fewer surprises for your deals.

P.S. Want the full tactical breakdown of our three-tier pricing strategy and marketing blitz? Episodes 176 and 185 of Get Serious walk through every detail of this make-or-break project. ~10 min daily episodes. No fluff.

Originally published on https://seriousland.capital/newsletter/ on