REtipster features products and services we find useful. If you buy something through the links below, we may receive a referral fee, which helps support our work. Learn more.

One of the most important best practices for any new business owner is keeping personal and company finances separate.

Not only does it help you stay organized, but mixing the two can cause all sorts of legal and tax issues down the road.

When I started my first business and began sorting out my banking situation, I tried opening a business account with the same bank where I had my personal accounts, and I quickly realized that, despite what they all say, most banks and credit unions aren't great for small businesses.

It felt like a BIG ordeal whenever I wanted to do something slightly outside the norm (like open a new account to manage my cash flow). And all the extra fees they charged were ridiculous!

Some banks and credit unions may be fine for personal use, but that doesn't mean they're set up to best serve the unique needs of a small business owner.

The Search for Business Banking Begins

I needed to find a better banking solution tailored to my needs. But it seemed like every bank had some drawback, whether it was high minimum balances, fees for everything, or just not having the tools I needed to manage my finances properly.

You might be tricked into thinking you have to compromise, but that's why you need to know about Relay.

What Is Relay?

That may sound like a mouthful, but it’s essentially a service where you manage your money and decide where it will sit. It allows you to manage your business’s cash flow and clearly understand your earnings, spending, and savings.

If you’ve seen my review of Mercury, Relay is a similar concept.

While Relay is not a bank, your money is FDIC-insured through its banking partner, Thread Bank. Like Mercury, Relay is completely designed for startups and has no physical branches.

And here’s the kicker—it's fee-free for most intents and purposes!

Some random things come with minimal fees (like domestic and international wires), but even then, it's very cheap (we're talking $5-$10). Otherwise, any transaction you make with Relay is free, there are no minimum balance requirements, and their website and mobile app are a joy to use!

Getting Started With Relay

Everyone appreciates simplicity and ease, and Relay does this by making account creation as easy and as straightforward as possible. You can do everything completely online, whether on a computer or phone. Relay has an intuitive mobile app that allows you to do everything you need without switching to another app.

But unlike other banks that make the signup process feel like you're renewing your driver's license at the DMV on a busy Monday, Relay has turned this into an easy, seamless, interactive experience with questions and little prompts. You can sign up in less than 10 minutes, and I was shocked at how it almost felt fun.

Setting up your business profile and linking to an existing, outside bank account is also incredibly smooth. Relay integrates seamlessly with popular accounting software from the get-go, such as QuickBooks or Xero. The ability to easily tie everything together in one place will be a huge relief for you and your accountant.

Plus, this integration is also optimized for accountants and bookkeepers since Relay has a few features that make it easier for these professionals to use the platform. If you want to get paid (or pay someone using Relay), it also integrates with leading payment processors like PayPal, Stripe, Gusto, and others.

Check out this video where I recorded myself setting up my account with Relay, and you'll see how easy it is!

The process might differ slightly if you’re not a U.S. citizen or resident, but it's not difficult. You just need your employer identification number (EIN) and LLC registration.

Compare this to traditional banks, which require a social security number and a physical visit, and you’ll wonder why most banks aren’t doing it this way.

RELATED: How to Start Your LLC (It’s Easier Than You Think!)

Features That Won Me Over

As I started using and exploring Relay more, I discovered many features that blew me away.

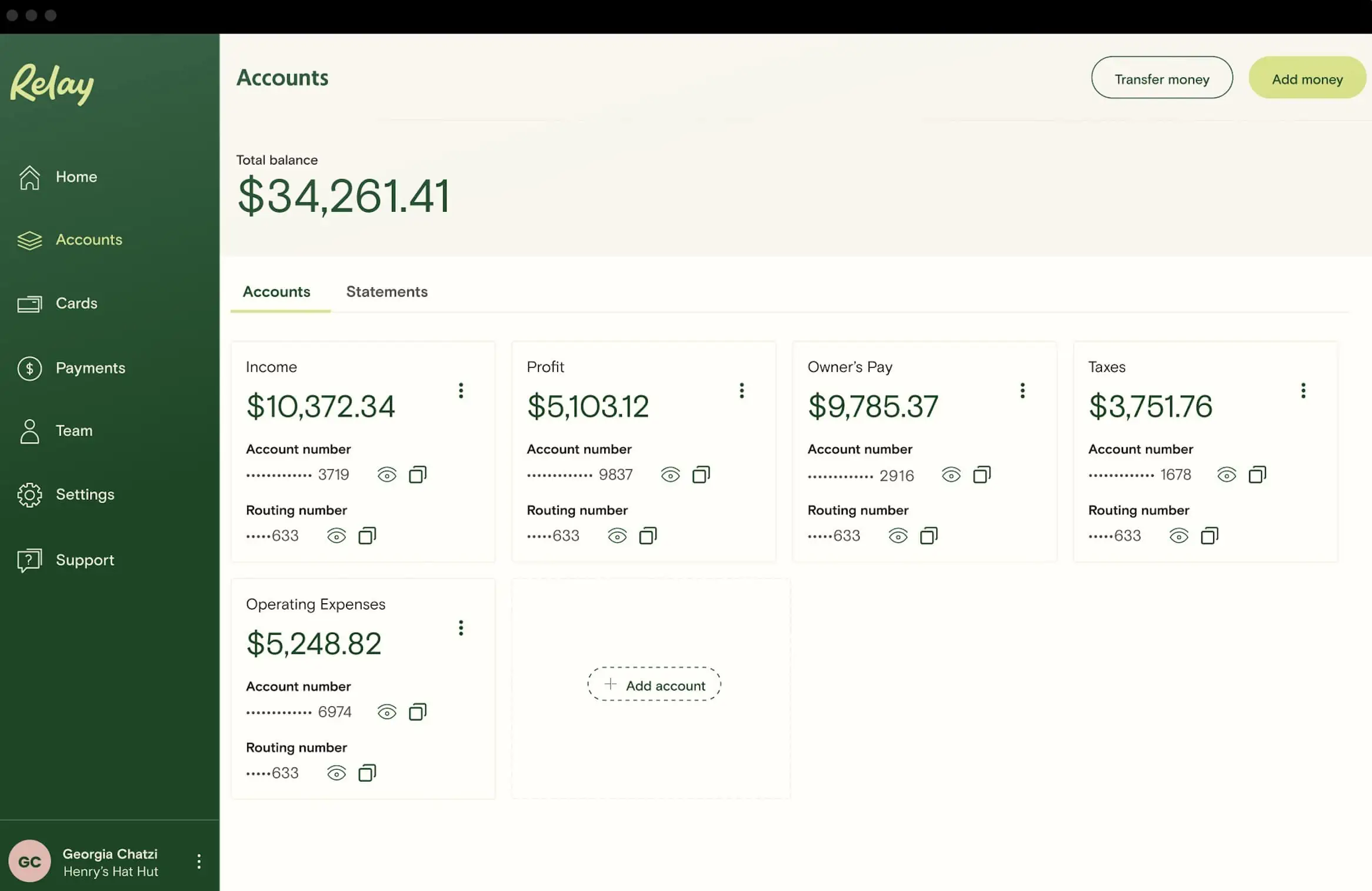

Opening up to 20 checking accounts and two savings accounts with one click was amazing, especially considering how hard I've seen other banks make this process.

And since it’s easy to open a new account in seconds, it can save you a ton of time when you own multiple properties in one LLC, for example.

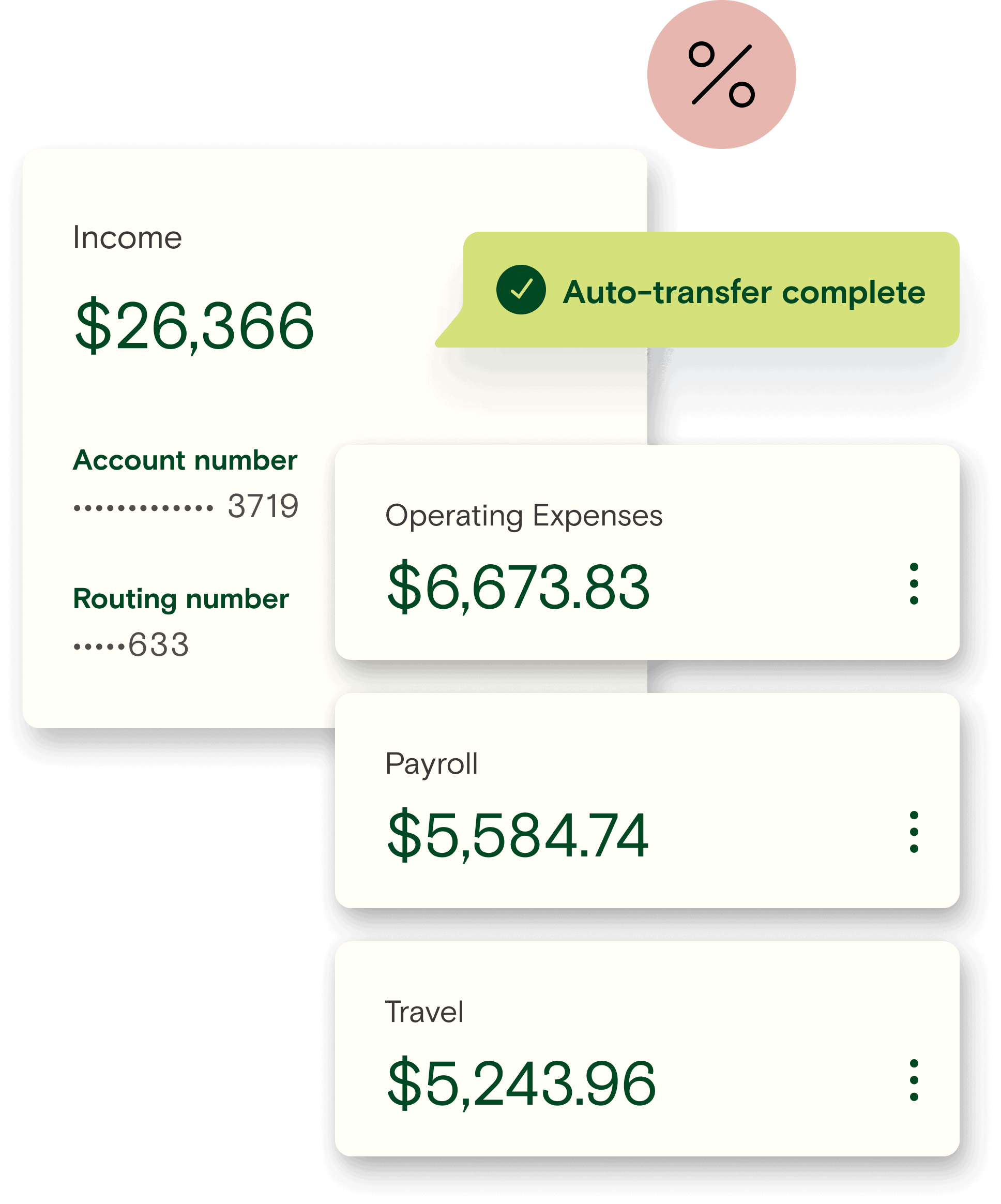

Relay is the actual banking partner of Profit First, and you can see why—it’s made to automate weekly percentage allocations, for instance, as you adjust your earnings and pay yourself first.

On that note, one of the hardest things about implementing Profit First is manually transferring money around to different accounts when each deposit hits your main account each day, week or month. Well, Relay has basically solved that problem with the different automations you can set up to happen whenever you want, and for however much you want transferred around to whichever accounts you want!

If you use Profit First in your business, you will LOVE Relay!

One downside of using most online banks is that it can be harder to work with cash because there isn't a bank branch nearby that you can visit whenever you need to.

While Relay doesn't have any branch locations, it is connected to the Allpoint ATM Network, which means you can withdraw cash from any Allpoint ATM location and even deposit cash into your bank account if you can find an Allpoint Plus ATM location!

You can find your nearest Allpoint ATM here.

Customer Support

Finally, if you ever get stuck on anything, you can talk to someone by phone if you need help (and this alone is a big deal).

Some software companies leave it to chatbots, or at the most; they might give you an email address they'll respond to within 24 hours on business days. But Relay has an actual manned customer service department. They’re in Canada, but interestingly, Relay’s banking partners are all in the U.S.

A Few Growing Pains

Now, Relay isn't without some limitations.

Like most online-only banking platforms, Relay implements transfer limits for new users. This is a security measure rather than a limitation, which should deter bad actors from using the platform to set up illegitimate or illegal businesses. You can always ask for an increase in transfer limits as you use the service properly, but the initial transfer limits may take some time to get used to.

Another potential drawback (depending on what you're looking for) is that if you’re looking for financial products like mortgages or HELOCs, Relay can't help you. I’m not sure if Relay will offer these kinds of banking products in the future, but if you’re looking for something like that, you'll have to shop around for a traditional brick-and-mortar bank or credit union instead.

The Bottom Line

After using Relay, I can confidently say they’re leveling the playing field. Handling finances is now streamlined and easy, and if you're a new business or tech company that rarely has a reason to visit a local bank branch in person, it's hard to think of many reasons not to consider something like Relay.

And I think many people on the internet agree. That said, while general sentiment has been positive, it doesn’t mean Relay has no critics. It remains to be seen how well they can continue to provide excellent service and value to their customers over time. But in my experience, Relay is an incredible service, and its customer support team is incredibly responsive and helpful if you find gaps in what they're offering.

And if you’re wondering, is there a special promotion going on right now with Relay? The good news is that there is! Click through the REtipster affiliate link to open an account. If you deposit at least $100 into your new account, Relay will give you an extra $50 for free.

If you’re going to open an account with Relay anyway, why not get some free money from the deal?

Before you go…

Relay is a solid option, but there are a lot of money management solutions out there. If you're curious about some alternatives worth considering, check out my review on Mercury, which offers a similar set of advantages with a few distinct differences.