What Is Annual Percentage Rate (APR)?

REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

Understanding How APR Works

Anyone dealing with credit will likely come across APRs. The APR incorporates the bank, credit union, or finance company charges, on top of fees and miscellaneous costs regarding installment loans.

The resulting rate helps the borrower determine how much the loan will be charged annually. On the other hand, APR on credit cards is simply the rate one would pay when the monthly balance was not paid in full, leaving out any charges, such as a card’s annual fee[1].

Most credit products, such as mortgages and auto loans, only have one APR per borrower, but other types of debt can have multiple APRs. Some credit card offers, for instance, may list several APRs—a purchase APR in the card’s terms and conditions, a cash advance APR, or a balance transfer APR.

The Truth in Lending Act requires lenders to disclose their loan terms and APRs upon a borrower’s successful loan application[2].

Fixed and Variable APRs

APRs are typically categorized as either fixed or variable. Borrowers need to determine which one they are getting, as it will affect their monthly payments.

- Fixed APRs — These are based on a fixed percentage rate set by the lender. Borrowers with fixed APRs pay the same amount of interest on their loan every month. As such, fluctuations caused by external factors are not possible with fixed APRs, making them more predictable when budgeting[3]. Common examples of loans with fixed APRs include mortgages and personal loans.

- Variable APRs — Meanwhile, variable APRs are tied to an index interest rate, which means they can fluctuate month to month. The most common index for variable rate APRs is the prime rate published in the Wall Street Journal and set by the Federal Reserve[4]. Most credit cards function on variable APRs, with fluctuating rates based on the movements of the prime rate.

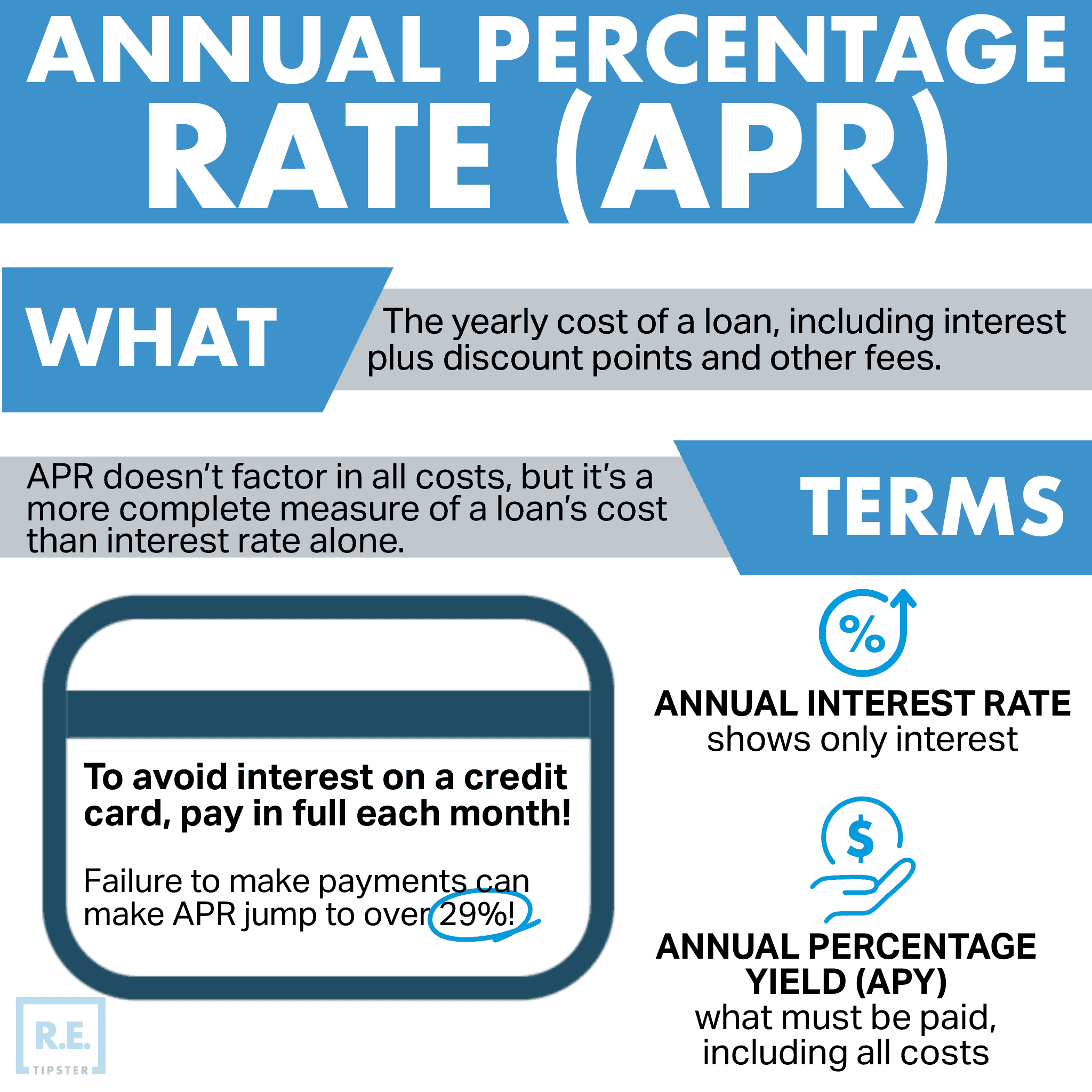

APR vs. Interest Rate vs. APY

It is easy to lump APR, annual percentage yield (APY), and interest rate into the same umbrella, but these three are not exactly the same.

APR and interest rates may work similarly for credit cards because credit card APRs do not have miscellaneous fees. This is not the case for regular loans. The interest rate on these loans is simply the percentage of the principal that a lender charges a borrower for the credit.

The APR, on the other hand, encompasses the interest rate and other additional fees. An example of this is a bank requiring an origination fee to pay for setting up the loan or an auto dealer charging a minimal fee for auto loans handled by the dealership for taking care of the financing.

Meanwhile, APY takes compound interest into account, unlike APR, which includes simple interest yearly[5]. Compounded interest is earned by an individual on interest, while simple interest only accrues on principal balances.

In another sense, APY is also the interest gained on money, such as an investment or savings account. This differs from APR, which is the interest that an individual pays on a loan plus other fees.

Types of Fees Included in APR

The miscellaneous fees a borrower pays depends on what type of loan they are getting. For example, a mortgage for commercial real estate will likely include property survey fees as part of its APR[6]. A credit card, however, will not.

In general, every APR will include some of the following in its full amount:

- Origination fee — This refers to any fees covering the cost of approving and processing a loan application.

- Underwriting fee — It pays for the assessment done to determine if a borrower is eligible for a loan, e.g., examining and verifying financial statements, tax returns, and credit scores.

- Document preparation fee — This one covers the expenses made from organizing the paperwork related to a loan.

- Closing fee — It covers the closing costs of packaging and approving a loan or performing business and real estate valuations.

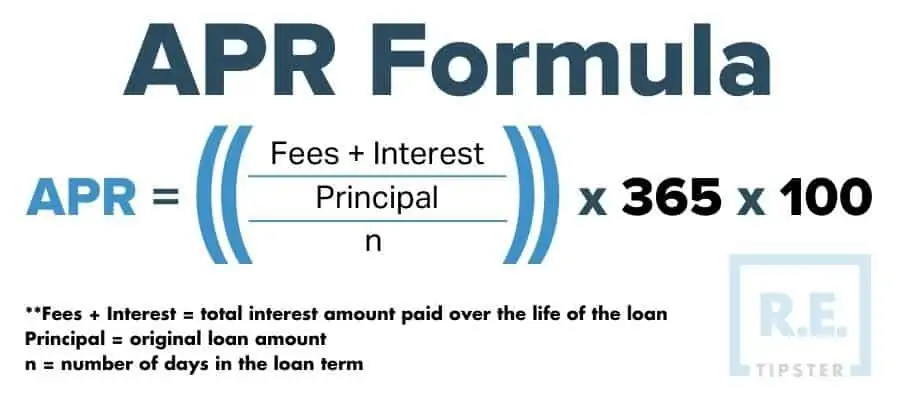

How to Calculate the APR

APR is determined by combining all of the associated costs of the loan and then annualizing them as an annual percentage rate. Banks and other institutions use a formula to calculate how much APR a borrower must pay every year[7].

For example, a borrower takes out a loan of $2,000 with a term of 160 days. Over the term of the loan, $150 must be paid in interest, and a $50 origination fee is required to take out the loan.

Here are the steps to calculate the APR step-by-step:

- Add the origination fee and total interest paid.

$50 + $150 = $200 - Next, take that amount and divide it by the principal or total loan amount.

$200 / $2,000 = 0.1 - And then, divide the number by the loan term.

0.1 / 160 = 0.000625 - Multiply the result by 365.

0.000625 x 365 = 0.228125 - Finally, multiply the product by 100 to get a percentage.

0.228125 x 100 = 22.81% (APR)

Common Types of APRs for Credit Cards

Because credit cards are some of the easiest ways to loan money, borrowers must understand the APRs that apply to them. While an individual can have either a fixed or a variable APR, when it comes to credit cards, they can be greeted by several different types, including:

- Purchase APR — This refers to the rate that applies to purchases made with the card. However, if the borrower uses the credit card to purchase something and settles the full balance before it is due, paying interest can be avoided.

- Balance Transfer APR — A balance transfer APR is almost the same as a purchase APR; however, the former often accrues interest immediately. There is no grace period like with purchases. Note that users will be charged with a balance transfer fee—which is not included in the actual APR—when a balance is moved from one card to another.

- Introductory APR — This type enables cardholders to hold a balance without incurring interest for a specific period[8]. For example, an individual gets 0% introductory APR for six months. After that timeframe, the APR will increase, therefore also increasing the cost of using the card. While commonly used with credit cards, an introductory APR can also apply to other forms of credit, such as auto loans.

- Cash Advance APR — A cash advance APR is gained from a cash withdrawal from a user’s line of credit. The rate can be a bit higher to account for risk and is best used when the balance is easily repayable.

- Penalty APR — When a user pays late or misses credit card payments, this will cause a penalty APR, which may apply indefinitely to the account based on their cardholder agreement. This is often much higher than other rates, as balances on the account will be subject to the penalty rate.

What Influences the APR?

For the most part, it is up to the lender what interest rate to apply to a loan, affecting the APR in the process.

However, several factors can also affect what interest rate and APR a borrower gets, such as the credit history and scores. A borrower with outstanding credit scores is likely to get a lower interest rate than someone with poor credit scores for the same loan, assuming all other factors remain the same[9].

It is recommended that borrowers check their credit scores to see where they stand and determine areas that may need improvement. Getting a copy of their credit report is also a great way to check for errors and items that may need to be addressed before taking out the loan.

Furthermore, APRs can also depend on the type of loan a borrower is planning to take out. Credit cards, for instance, usually have higher APRs than most installment loans. Comparing the APR of one product type to another helps increase the chances of getting a reasonable APR.

Takeaways

APR refers to the total cost of borrowing money from a lender covering one year. It is important to note that while APRs, interest rates, and APYs might seem the same, they are different in so many ways. Lenders typically offer loans with fixed or variable APRs, both of which rely on the borrower’s credit scores. When it comes to credit cards, APRs can take the form of other significant costs, such as purchase, introductory, and balance transfer APRs.

In general, the better the credit, the lower the APR. Because of this and other parameters set by the lender, APRs vary depending on the situation. The borrower’s credit history and the type of loan being applied for all play a role in determining how much interest and APR the borrower might get. Lastly, APRs is an excellent way to calculate the actual cost of the loan, as it takes into account all related fees, including origination, underwriting, and closing fees.

Sources

- Pritchard, J. (2021.) What Is an Annual Percentage Rate (APR)? The Balance. Retrieved from https://www.thebalance.com/annual-percentage-rate-apr-315533

- QuickenLoans. (2020.) What Is The Truth In Lending Act? Retrieved from https://www.quickenloans.com/learn/truth-in-lending-act

- Skyler, H. (2021.) Fixed APR vs. Variable APR: Here’s Everything You Need to Know. SuperMoney. Retrieved from https://www.supermoney.com/fixed-apr-vs-variable-apr/

- Irby, L. (2021.) How Credit Cards Use the Wall Street Journal Prime Rate. The Balance. Retrieved from https://www.thebalance.com/prime-rate-960746

- Capital One. (2021.) APR vs. APY: What’s the Difference? Retrieved from https://www.capitalone.com/learn-grow/money-management/apr-vs-apy/

- Lee, J. (2020.) What are APR fees on a mortgage? Bankrate. Retrieved from https://www.bankrate.com/mortgages/apr-fees/

- Indeed. (2021.) How to Calculate APR. Retrieved from https://www.indeed.com/career-advice/career-development/how-to-calculate-apr

- Robben, N. (2020.) Top 7 Things to Know About Annual Percentage Rate (APR). biz2credit. Retrieved from https://www.biz2credit.com/blog/2020/02/26/top-7-things-to-know-about-annual-percentage-rate-apr/

- Martin, T. (2021.) What is Annual Percentage Rate or APR? Uswitch. Retrieved from https://www.uswitch.com/credit-cards/guides/what-is-apr/