What is Compound Interest?

REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

Compound Interest Explained

Albert Einstein called compound interest the eighth wonder of the world; Warren Buffett credits it as the driver of his massive wealth accumulation. If you’re a real estate investor, it’s important to know how compound interest works for you and against you.

Justin Pritchard offers another helpful explanation of how to understand compound interest,

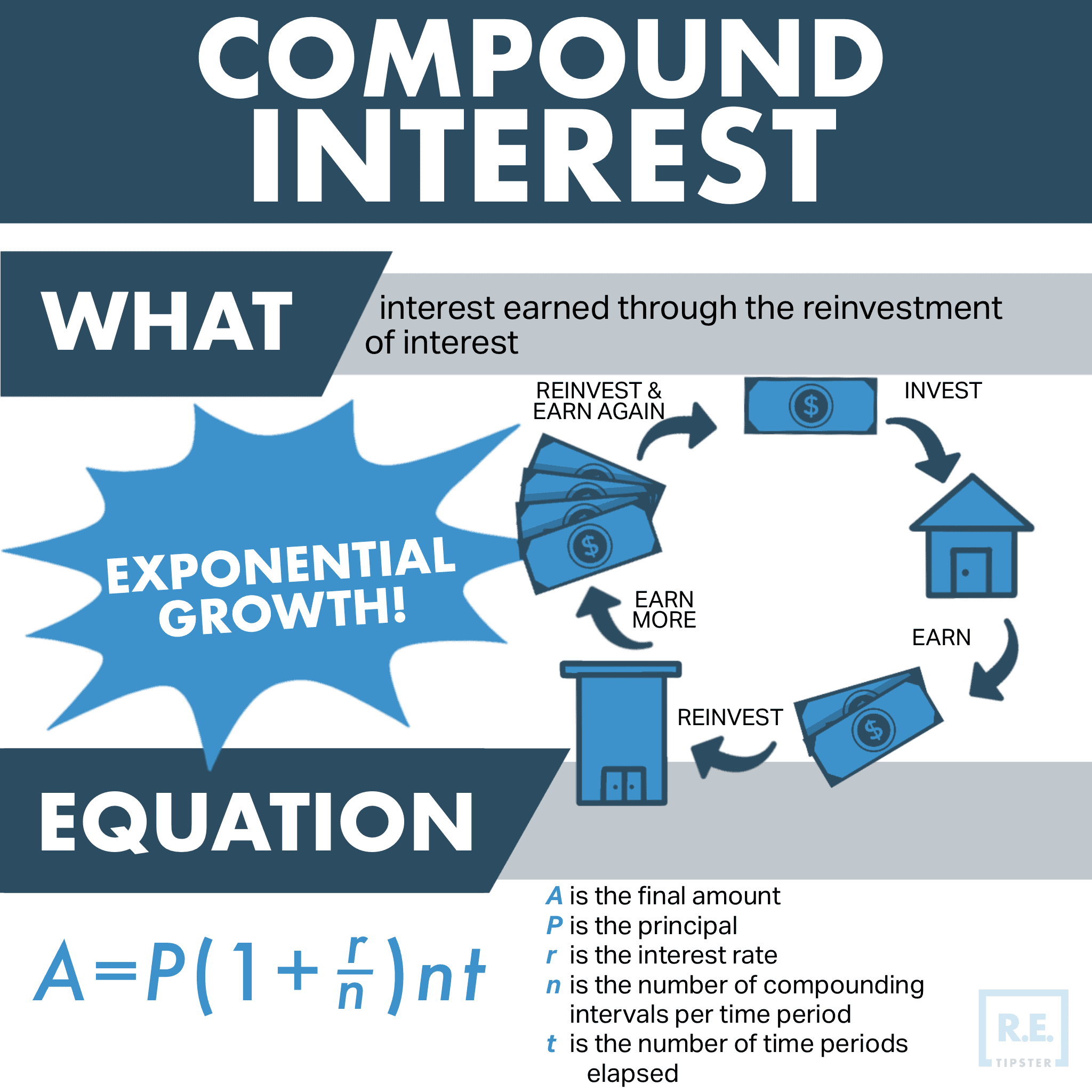

Compounding is a process of growing. If you’re familiar with the “snowball effect,” you already know how something can build upon itself. Compound interest is interest earned on money that was previously earned as interest. This cycle leads to increasing interest and account balances at an increasing rate, sometimes known as exponential growth.

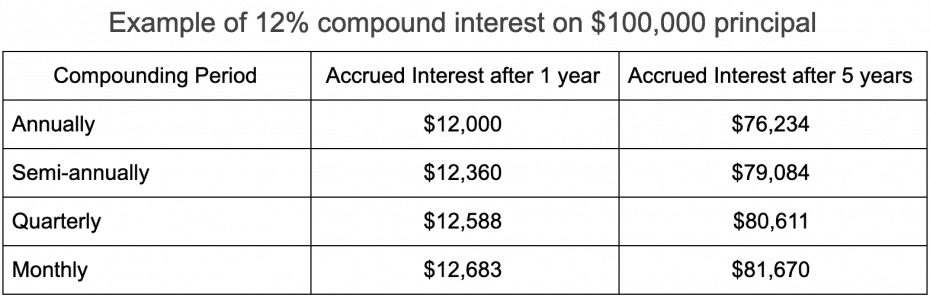

The compounding interval is a force multiplier for compound interest. The more compounding periods, the higher the accrued interest. For example, 12% interest compounded annually will be less than if the interest is compounded semi-annually, quarterly, or monthly.

How to Calculate Compound Interest

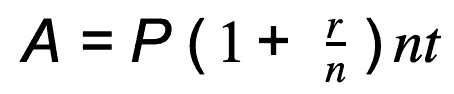

The formula for calculating compound interest is

Where:

- A is the final amount

- P is the principal

- r is the interest rate

- n is the number of compounding intervals per time period

- t is the number of time periods elapsed

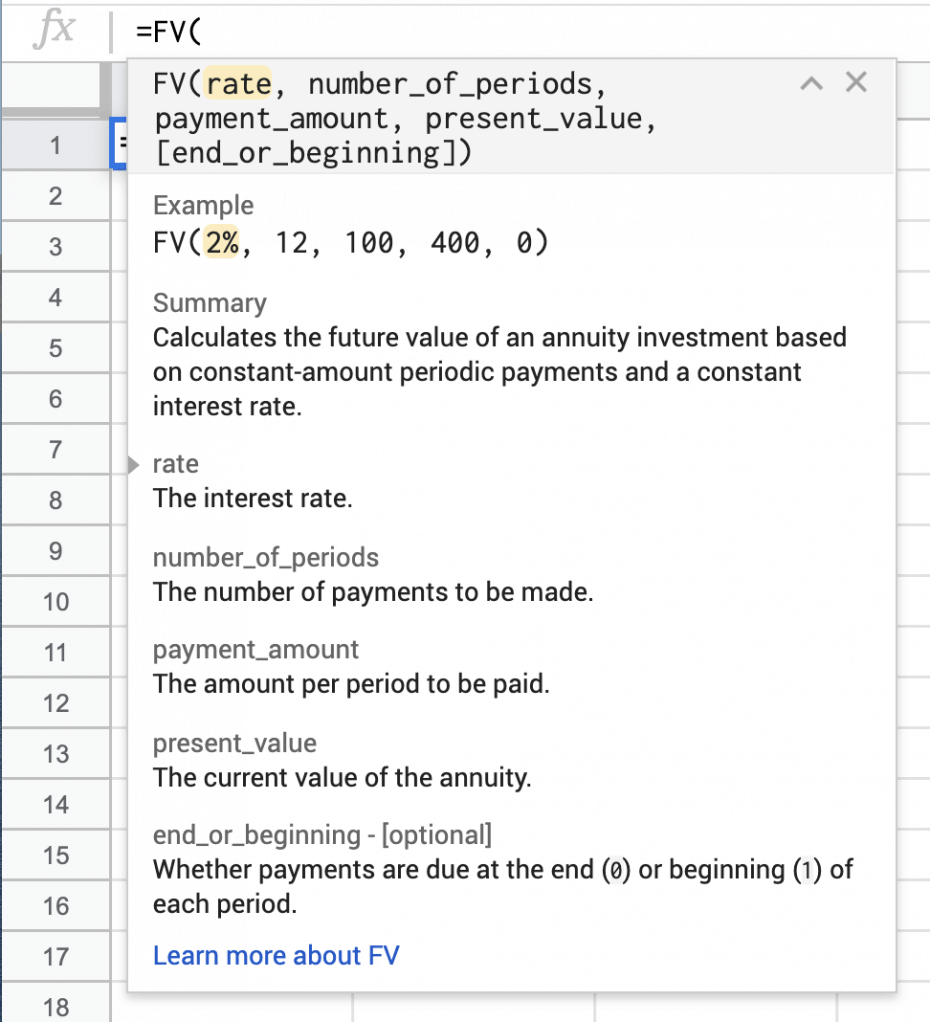

You can save yourself the aggravation of running the calculations yourself by using the “future value” function on Excel or Google Sheets. Open a new sheet and type =FV( in any cell, which brings up a cheat sheet showing you how to enter your variables:

Alternatively, you can bookmark these online compound interest calculators:

The Rule of 72

When dealing with interest that compounds annually, the Rule of 72 can be used to estimate when the investment will double. The formula is simple; simply divide the number 72 by the interest rate to arrive at the number of years it will take for the principal to double.

So, if an investment earns 8%, it will double in roughly 9 years (72 / 8 = 9).

Compound Interest in Real Estate Investing

The most obvious example of compound interest in real estate investing involves mortgages. If an investor is borrowing money to finance an investment property, they are paying compound interest to their lender.

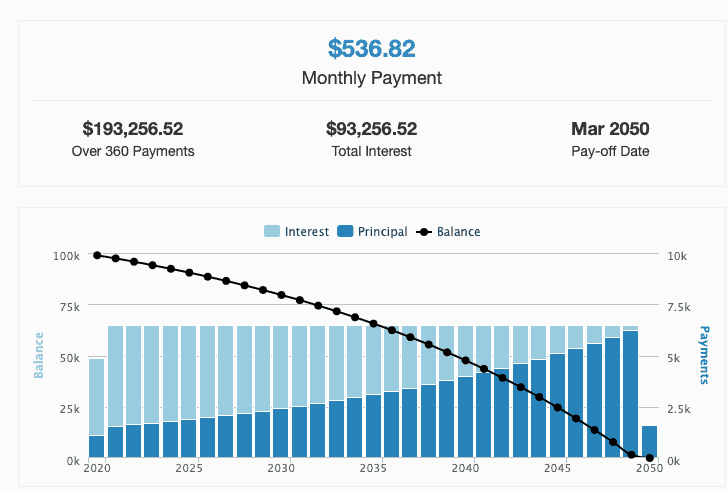

The chart blog is an example that shows the true cost of compound interest of a $100,000 mortgage with a 30-year amortization:

Chart courtesy of CalculateStuff.com

The borrower will pay the lender over $93,000 in compound interest on top of the $100,000, 30-year mortgage at 5%. Some investors get into the real estate business by simply buying existing mortgage notes from the loan originator and pocketing those interest payments for themselves.

Property owners may sell their properties with seller financing for different reasons. They may be unable to find a buyer with the cash or credit to qualify for a conventional mortgage, for example, or they may wish to time capital gains taxes by financing the sale themselves.

RELATED: Why Seller Financing Makes Sense

At some point, these owners may tire of collecting payments or they may need to cash out for personal, financial, or medical reasons. Other investors can buy these notes and assume the lender’s position to collect the monthly cash flow.

Compounding in Rental Properties

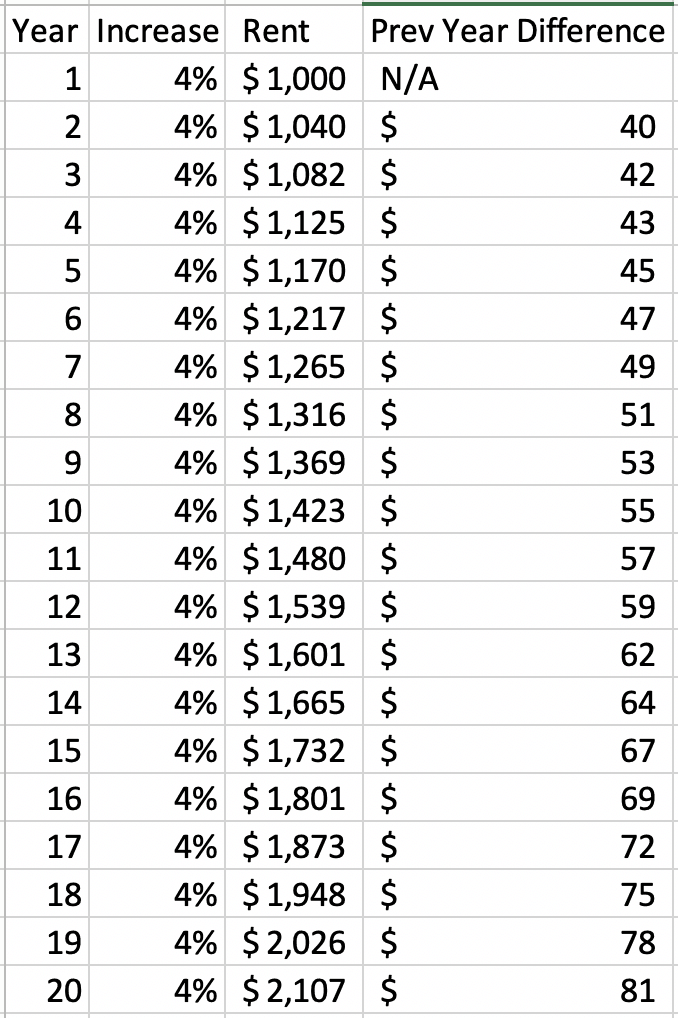

The principle of compounding can also be applied to rental income. A lease agreement with a built-in 4% rent increase each year is another example of compounding.

If the rent in year one is $1,000 per month, it would be $1,040 in year two. In year three, the 4% increase applies to both the initial $1,000 a month rent and to the extra $40 from the prior year’s increase. Year three rent would be $1,082, with the extra $2 reflecting the power of compounding.

With the compounding 4% increase from the previous year’s rent (not the original rent amount), the annual increase of each subsequent year gets larger and larger.

Understanding Compound Annual Growth Rate (CAGR)

Compound annual growth rate is a staple in financial calculations. It represents the rate of return for a particular time period. For example, if your real estate portfolio grows in value from $400,000 to $650,000 over five years, your CAGR would be 10.2%.

CAGR has a few real-world applications that apply to all types of investing. It can be used to estimate the future value of investments, develop monthly savings targets to achieve a short- or long-term goal, or demonstrate the effect of time on principal.

Example 1: Using a 10% CAGR, the value of a $500,000 portfolio today would be approximately $805,250 in five years, assuming no additional deposits.

Example 2: If your savings goal is to have $100,000 in five years and you assume a 10% CAGR, you would have to save about $1,290 per month.

Are You Paying Compound Interest?

The Truth in Lending Act (TILA) requires lenders to disclose whether or not their borrower is paying simple interest or compound interest.

A borrower can also determine this by comparing their loan’s interest rate to its annual percentage rate (APR). The APR takes all the finance charges and fees and converts it to a simple interest rate.

If the APR is significantly higher than the loan’s stated interest rate, the borrower is either paying compound interest or the lender is charging a lot of extra fees in addition to interest.