What Is a Buy Box?

What Exactly Is a Buy Box?

If you’ve been around real estate investors for any length of time, you’ve probably heard someone mention their “buy box.” It’s a very useful concept once you understand it.

Think of it like a filter or checklist. The buy box helps investors (and the people they work with) understand what a “good deal” looks like. It’s often used when talking to agents, brokers, wholesalers, and other deal finders. Instead of saying, “Let me know if you find something good,” an investor with a buy box says, “Here’s exactly what I’m looking for.”

It keeps everyone on the same page and helps avoid wasting time on deals that don’t fit.

What’s Usually Included in a Buy Box?

Every investor’s buy box is a little different, but most will include some combo of the following:

1. Location

- State, county, or city

- Even specific zip codes or school districts

- Rural vs suburban vs urban

2. Property Type

- Single-family homes

- Multi-family (duplexes, triplexes, quads)

- Commercial retail or office buildings

- Self-storage facilities

- Vacant land (infill, rural, buildable lots)

3. Price Range

- “I’m looking for deals under $150K”

- “between $25K and $75K per acre”

4. Lot or Building Size

- Minimum lot size or square footage

- Max size, if there’s a limit to what they’ll take on

5. Zoning & Use

- Must be zoned residential, commercial, industrial, etc.

- Whether unzoned or mixed-use is acceptable

6. Development or Value-Add Potential

- Is the investor looking to develop raw land?

- Tear-downs? Cosmetic fixer-uppers?

- Properties with potential for adding value

7. Target Returns or Strategy

- Minimum ROI, cap rate, or margin

- Flip, buy-and-hold, rent, wholesale, subdivide, etc.

8. Terms or Deal Structure

- All cash?

- Seller financing preferred?

- Will they assign contracts?

Who Uses a Buy Box?

A buy box isn’t just helpful for the investor. It’s also essential for anyone bringing deals to them.

- Investors: To stay laser-focused and avoid analysis paralysis.

- Realtors & Brokers: So they can send the right deals.

- Wholesalers: To match their leads to serious buyers.

- Acquisitions Managers: To stay consistent when evaluating properties.

In short, it creates a common language. Everyone knows what qualifies as a real lead. It saves time, cuts confusion, and helps the right opportunities rise to the top. Whether you’re building your own portfolio or working with others, having a buy box makes the whole process smoother and more productive.

How to Build Your Own Buy Box

If you don’t already have one, you probably should!

You can start with what you know:

- What market(s) do you want to buy in?

- What’s your ideal price range?

- What property types make sense for your business model?

- Are you more interested in quick flips or long-term holds?

Over time, you’ll determine what works best and refine your criteria. It doesn’t have to be perfect initially; it just has to be specific enough to act as a filter.

Pro tip: Write it down and share it with your team, broker, or anyone who sends you leads.

Buy Box Examples

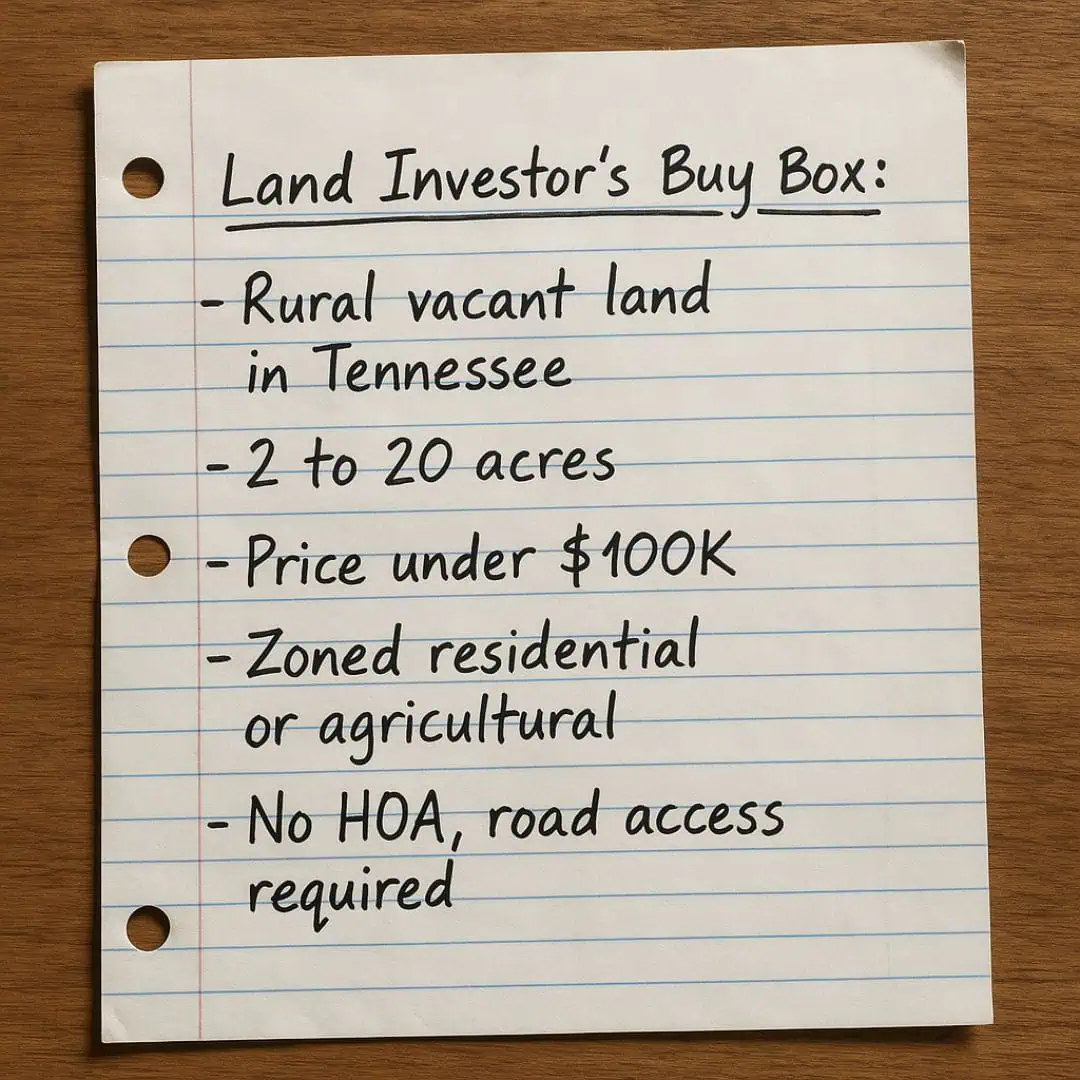

Land Investor Buy Box

- Rural vacant land in Michigan, Wisconsin, or Tennessee

- 2 to 20 acres

- Price under $25K

- Zoned residential or agricultural

- No HOA, road access required

Self-Storage Investor Buy Box

- Stabilized or value-add self-storage facilities

- Within 2-hour drive of Holland, MI

- Purchase price under $1.5M

- Minimum 10,000 rentable sq ft

- On paved road with visible signage

House Wholesaler Buy Box (Flippers)

- Single-family homes in metro Phoenix

- ARV under $350K

- Needs work, but structurally sound

- Seller can close within 30 days

Why Your Buy Box Matters More Than You Think

It’s easy to get distracted in real estate. A buy box helps you say “no” faster and chase the right kinds of deals. It brings clarity, saves time, and builds trust with deal sources who want to help you, but need direction.

Plus, when you’re ready to scale, train a team, or automate your lead funnel, having a well-defined buy box is a must.

Your buy box doesn’t have to be perfect, but it does need to be clear. Think of it as your deal compass. It keeps you heading in the right direction and makes it easier for others to help you get there.

So, what’s in your buy box?

If you’ve never written one down, now’s the time! And if you already have one, don’t be afraid to revisit and tweak it as your goals evolve.

It’s one of the simplest ways to make your investing more efficient—and way more profitable.