What Is Chapter 13 Bankruptcy?

REtipster does not provide legal advice. The information in this article can be impacted by many unique variables. Always consult with a qualified legal professional before taking action.

What Happens In A Chapter 13 Bankruptcy?

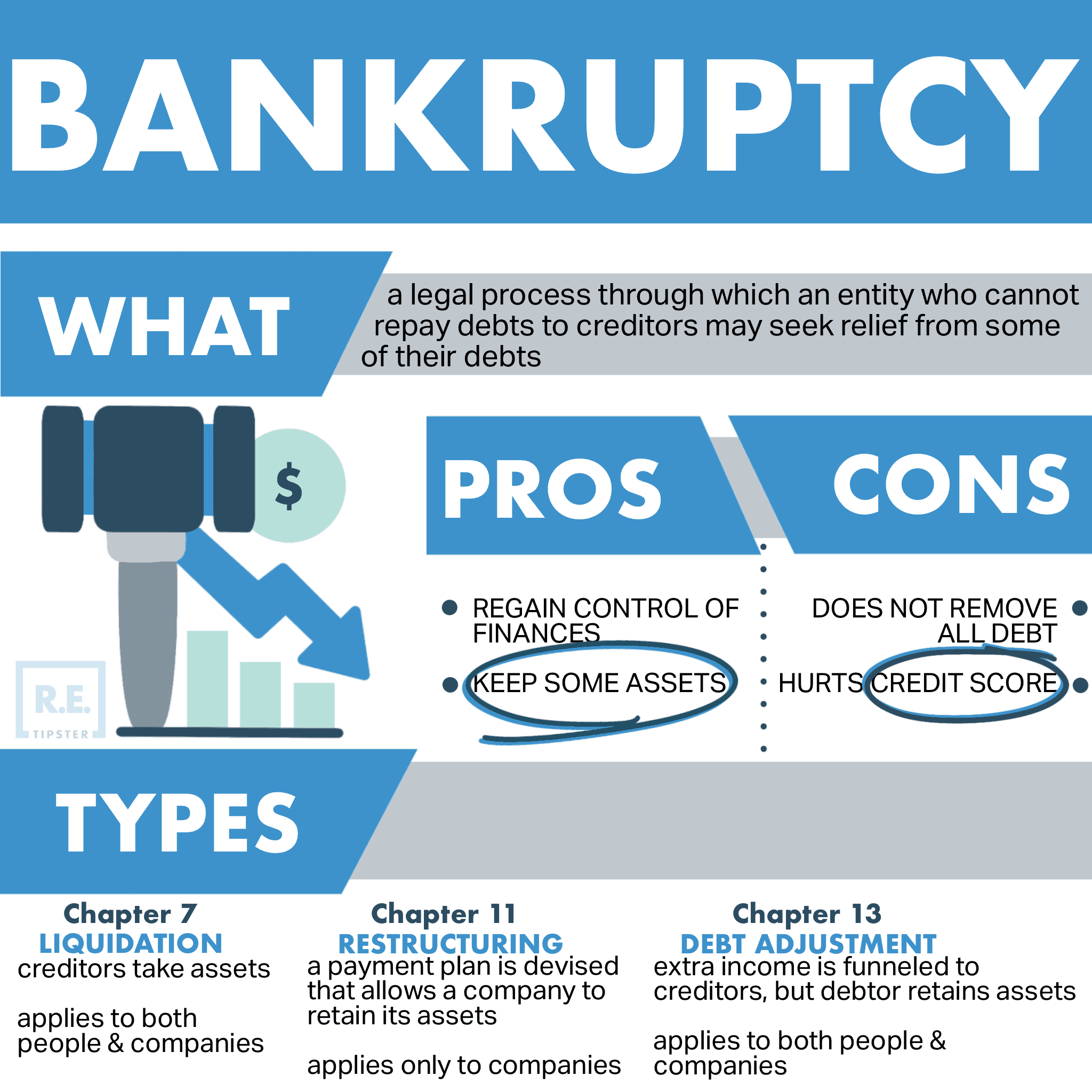

With Chapter 13 bankruptcy (often referred to as “wage earner’s bankruptcy”), the idea is to restructure the borrower’s debts to make them more affordable, rather than sell off all assets and wipe their debts clean.

As in Chapter 7, borrowers will need to disclose all their assets, income, and liabilities to the trustee. The trustee and creditors then sit down and reorganize the debts in a way that the borrower can repay them.

This usually includes a payment plan to get the borrower caught up on back payments. It could mean extending the loan term, to reduce monthly payments.

Borrowers can’t declare a Chapter 13 bankruptcy if their unsecured debts exceed $419,275, or their secured debt exceeds $1,257,850. They are also required to have all their tax returns filed and their taxes paid to date.

In Chapter 13 bankruptcy, borrowers usually keep both their assets and their debts in place, they simply adjust the payment schedule. They can’t file it again for at least two years, and it stays on their credit report for seven years.

Chapter 13 Bankruptcy Explained

A Chapter 13 bankruptcy proceeding involves the adjustment of debts of an individual with regular income[1].

Under Chapter 13, the defaulting borrower will propose a repayment plan to make installments to creditors over three to five years[2].

Chapter 13 bankruptcy is referred to as a reorganization bankruptcy. The debtor’s assets are not sold when they file for bankruptcy protection, and they may be able to keep their property if they can successfully complete a court-mandated repayment plan[3].

Reviewed by Mark H. Zietlow, Innovative Law Group

References

- ^ Ruth, George E. Commercial Lending. 5th ed., Washington, D.C., American Bankers Association, 2004, pp. 306.

- ^ “Chapter 13 – Bankruptcy Basics.” United States Courts, United States Courts, www.uscourts.gov/services-forms/bankruptcy/bankruptcy-basics/chapter-13-bankruptcy-basics. Accessed 19 May 2020.

- ^ Fried, Carla. “Bankruptcy: Chapter 7 vs. Chapter 13.” Experian, Experian, 28 Mar. 2018, www.experian.com/blogs/ask-experian/bankruptcy-chapter-7-vs-chapter-13/. Accessed 19 May 2020.