What Is a Daisy Chain in Real Estate?

How a Daisy Chain Works

The principle of wholesaling underpins why and how a real estate daisy chain works. When a seller has an assignable contract with a wholesaler, and that wholesaler then assigns the contract to another wholesaler, who does the same to the next, and so on, a daisy chain happens.

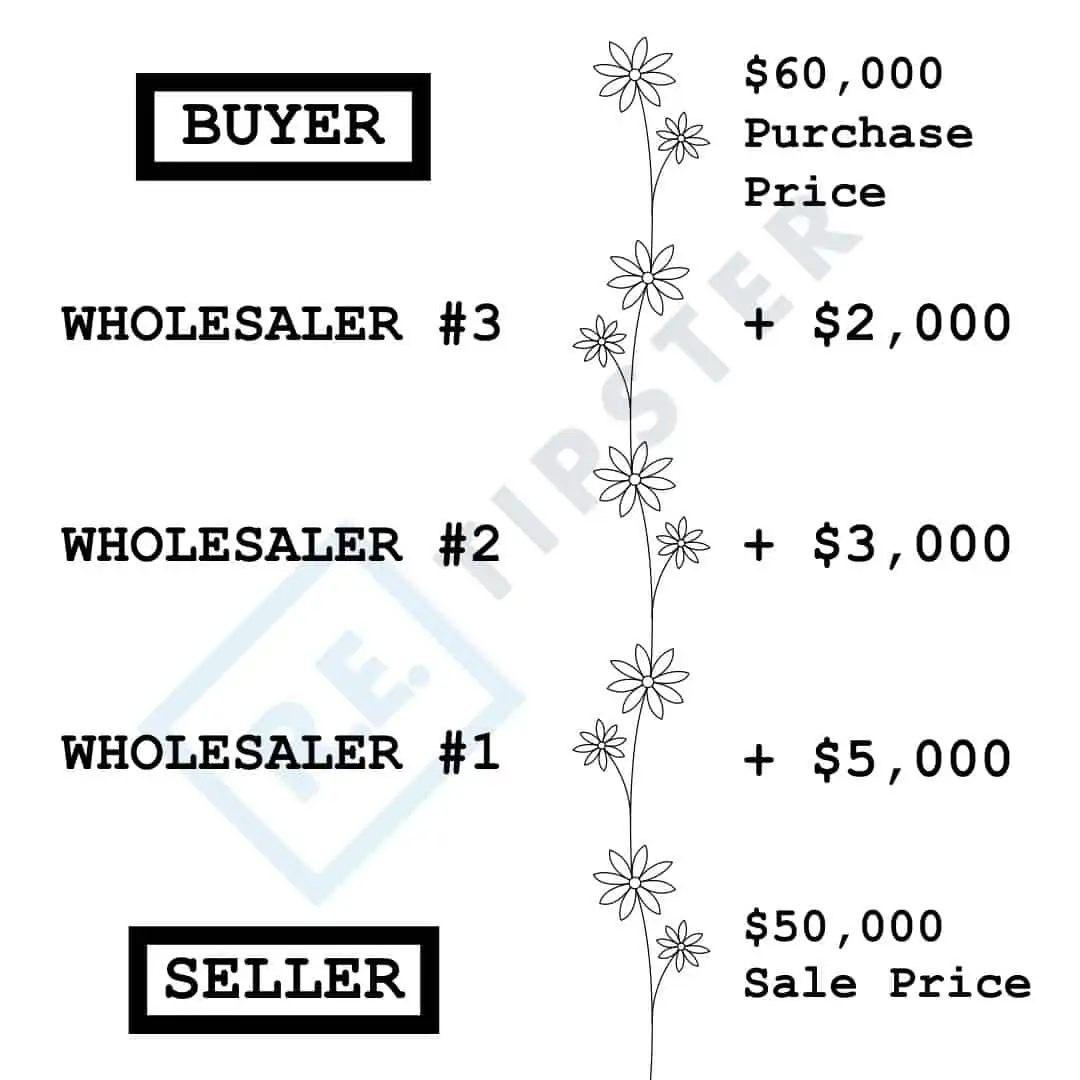

Here is a visual example:

A daisy chain is not always as straightforward as the example above, because in some cases, a wholesaler’s partners, real estate brokers, agents, and others can potentially be involved. These entities might show up in a deal that would otherwise be simple, adding confusion to the chain. For these reasons, many experienced buyers tend to walk away from daisy chains as soon as they pick up on what is happening.

What Is Real Estate Wholesaling?

For a real estate investor, it takes time and a considerable amount of money to find good, profitable opportunities to buy and sell properties.

However, there are other ways to start making money in real estate without actually owning each property outright and one of them is real estate wholesaling.

A real estate wholesaler is in the business of finding under-priced real estate deals (often distressed properties), getting the property under contract, and finding another investor who wants to buy the property at a slightly higher price.

Once a wholesaler has the property under contract, one way to make money from the deal is by signing a purchase agreement with the seller and then assigning that contract to another investor with a tacked-on “assignment fee[1].” In this scenario, the wholesaler does not actually buy the property themselves, but they find another interested party with the cash available to buy it outright, while simultaneously paying the wholesaler their assignment fee.

The wholesaler makes a profit when a buyer purchases the property at the contract price plus this assignment fee; and the original contract price goes to the seller, while the assignment fee goes to the wholesaler.

Real estate wholesalers do not need to take a course or pass an exam, and in most markets, they do not need to have a real estate license (however, there are some states that do require a license in order to work as a wholesaler in this manner). Even in markets where a license isn’t required to be a wholesaler, earning a license can be beneficial, as it gives wholesalers access to the Multiple Listing Service, or the MLS[2].

While the ultimate goal of a wholesaler is to sell each discounted property to a buyer who will pay cash directly, in some cases, a wholesaler only will need to work with another interested party, who may simply assign the contract again to another wholesaler. This is the situation that creates a daisy chain.

Why Do Wholesalers Daisy-Chain Properties?

Wholesaling, co-wholesaling, brokering, direct-selling, flipping, and other real estate investments have one goal: to make a profit.

When a wholesaler decides to daisy-chain a property (or even a group of properties), their sole intention is also to make money. However, the complicated nature of a daisy chain can create a lot more pitfalls.

If a potential buyer spots a property for sale that involves more than one wholesaler, that buyer may try to contact the party with the lowest asking price to close the deal. If that party proceeds with closing the sale and fails to inform the rest of the chain (which isn’t uncommon), other interested buyers may continue trying to purchase a property that has already been sold.

Dealing With a Daisy Chain

While daisy chain properties are often more complex than buying directly from the property owners, it is possible to make money off a daisy chain by doing it ethically, such as starting with the appropriate party and doing proper due diligence to verify each party involved in the daisy chain[3].

An investor can do this by setting up a meeting or a conference call with the wholesaler from whom they have heard about the deal, along with the owner of record. The investor can ask relevant questions to verify what each party’s role is in the daisy chain (and if a daisy chain exists at all).

If the parties do not wish to answer questions, an investor’s safest course of action may be to simply walk away from the deal.

A daisy chain may lead to a good payday for the wholesaler(s) involved with the deal, but without the proper communication and research to verify the numbers of the deal and the parties involved, it could just as well lead to a failed transaction and a damaged reputation for the parties involved.

Takeaways

A real estate daisy chain occurs when a wholesaler signs a purchase agreement with a property seller and then assigns the contract to another wholesaler, who then does the same to another, and so on. All of these parties will tack on an additional assignment fee over the seller’s original asking price, so if the property is sold, the wholesalers in the daisy chain will keep their share of the difference.

There can be many parties making up one daisy chain, which often causes confusion and fragmented lines of communication. While it is possible for all parties to make a profit in a daisy chain, its risks can easily outweigh its benefits.

Sources

- Martinez, A. (2019.) < Real Estate Skills. Retrieved from <https://www.realestateskills.com/blog/wholesale

- Merrill, T. (n.d.) <. FortuneBuilders. Retrieved from <https://www.fortunebuilders.com/how-to-get-started-in-wholesaling/

- Wilmot, J. (n.d.) Why “Co-Wholesaling” Can Get You Stuck (& What I Do Instead). Awesome REI. Retrieved from https://awesomerei.com/cowholesaling-houses/