What Is Equitable Interest?

REtipster does not provide legal advice. The information in this article can be impacted by many unique variables. Always consult with a qualified legal professional before taking action.

Shortcuts: Equitable Interest

- Equitable interest is a legal concept that grants a person certain rights and privileges over a property, even if they do not hold the legal title.

- This right includes the ability to use, occupy, and eventually take full ownership of the asset.

- A property buyer typically gains equitable interest when they sign a purchase and sale agreement or purchase contract to buy that property.

- Partner-held equity, seller-financed real estate deals, and marital investments are typical examples of equitable interests.

- Equitable interest can be transferred to another, as in the case of real estate wholesaling.

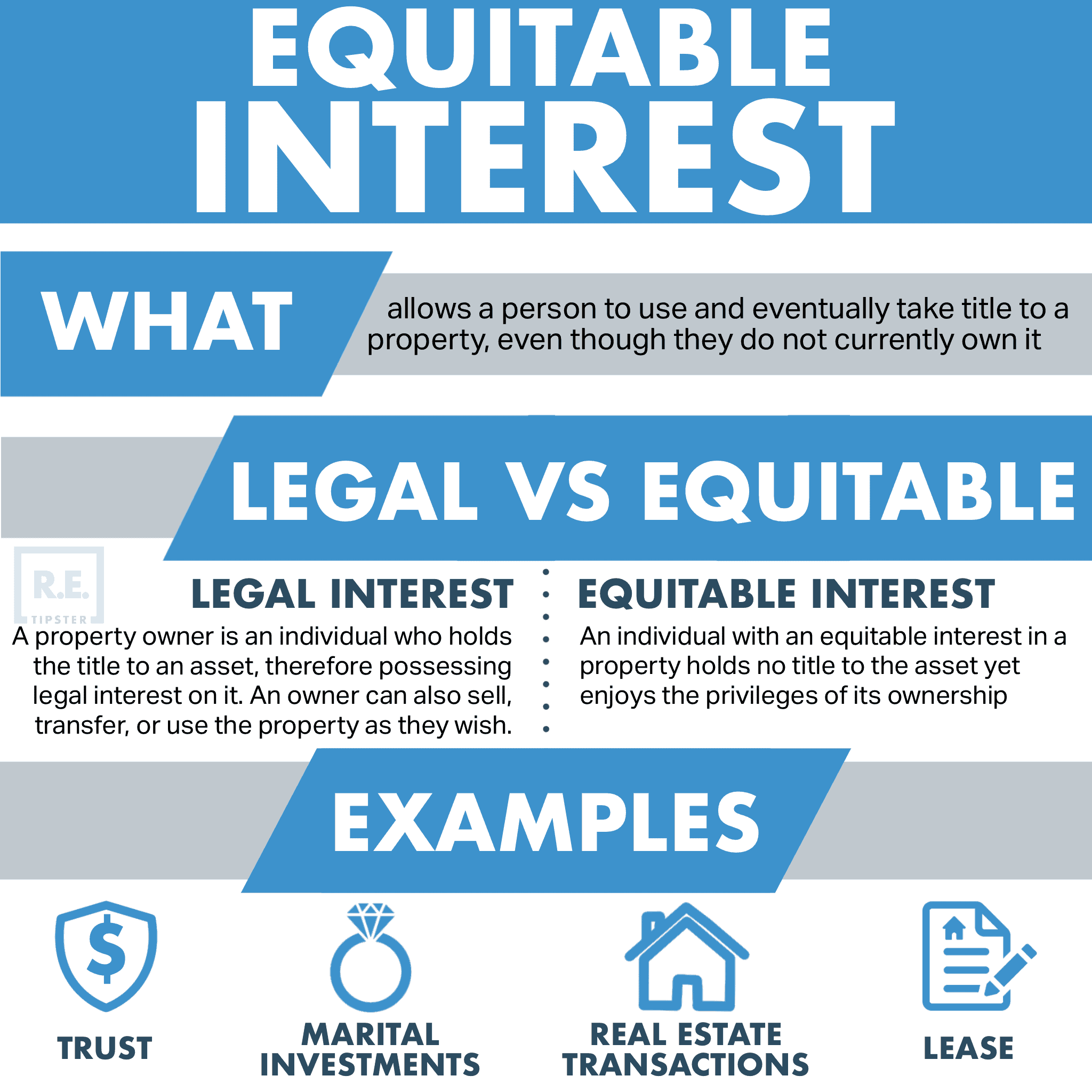

Legal Interest vs. Equitable Interest

Legal interest refers to the actual ownership and title of a property. The legal property owner holds the legal title and has the full rights and responsibilities of owning the asset.

Equitable interest, on the other hand, allows a person to use, enjoy, and eventually take legal title to a property, even if they do not currently hold the deed. This is a key concept in many real estate transactions and legal arrangements.

The graphic below breaks down the key differences between legal interest and equitable interest.

A property owner is an individual who holds the title to an asset (such as real property) and, therefore, has a legal interest in it. An owner can also sell, transfer, or use the property as they wish[1]. However, ownership also comes with certain responsibilities, such as the property’s care and maintenance.

By contrast, an individual with an equitable interest in a property holds no title to the asset yet enjoys the privileges of its ownership. An example of equitable interest is the beneficiary’s interest in a trust or a silent partner’s interest in a partnership. Meanwhile, in a real estate transaction, the seller holds legal interest; the buyer, equitable interest[2].

Equitable interest can also represent a person’s financial interest in the property. This allows the person to list the property or market it for sale.

How to Obtain (and Prove) Equitable Interest

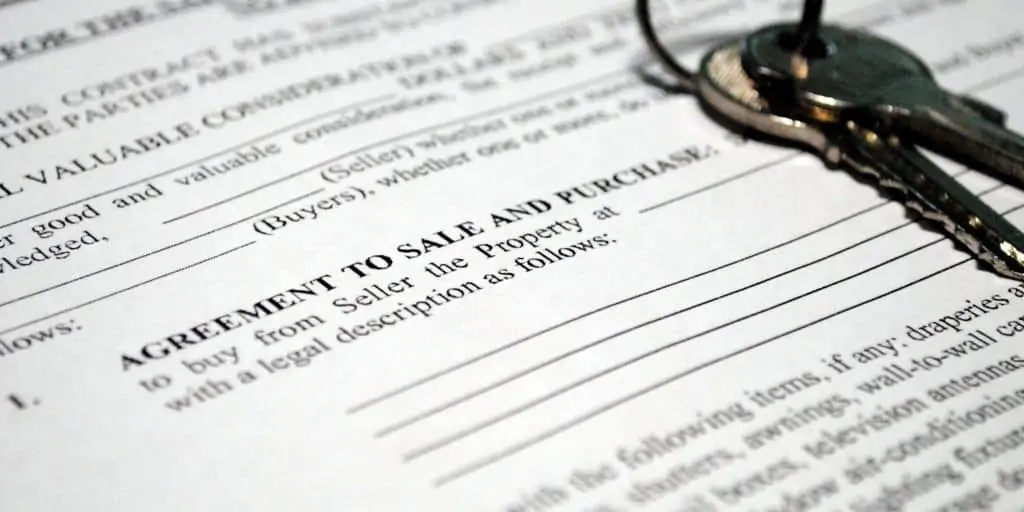

Equitable interest is typically established when a buyer and seller enter into a purchase and sale agreement (or purchase contract) for a property[3]. A buyer obtains an equitable interest—even if the legal title is still in the seller’s name—when they sign the agreement and provide an earnest money deposit.

The purchase contract itself serves as documentation to prove the buyer’s equitable interest. Other paperwork that can demonstrate equitable interest includes:

- Declaration of trust[4]

- Deed of trust

- Mortgage or loan documents

Additionally, making financial contributions toward the purchase price, renovations, or other property-related expenses can help establish and validate a person’s equitable interest[5]. In some cases, sweat equity may go toward equitable interest as well.

Examples of Equitable Interest

Equitable interest may come in the form of purchase and sale contracts, mortgage contracts, option contracts, short sale approval letters, deed contracts, lease option contracts, among others.

Here are some examples of equitable interest.

Trust

The beneficiary of a trust has an equitable interest in the assets held within the trust, even though the legal title belongs to the trustee. While the trustee holds the title to the asset, the beneficiary may claim equitable interest and legal ownership of the trust in certain ways. Such conditions include instances when the trustee misuses the asset or violates the terms of the trust[6].

Lease Option

When tenants enter a lease-option contract, they obtain an equitable interest in the property they are renting, with the option to eventually purchase it[7].

Marital Investments

If a married couple purchases an investment property together, but only one spouse’s name is on the legal title, the non-titled spouse still has an equitable interest in the asset[8].

Seller-Financed Real Estate

Equitable interest applies in buyer-seller transactions where the seller finances the buyer’s purchase. The buyer gains equitable interest as they make payments toward the purchase price, even before obtaining the legal title[9]. The seller holds the legal title until the buyer pays the balance in full. Once the buyer completes the payments, they may claim legal ownership.

Can a Person Transfer Equitable Interest?

Equitable interest can sometimes be transferred or assigned to another party. The most common example is real estate wholesaling.

An investor may obtain equitable interest in a property by signing a purchase contract with the seller. Instead of buying the property themselves, they can then assign their equitable interest to an end buyer through a deed of assignment. This allows the investor to profit from the difference between the contract price and the sale price, without taking full ownership.

The video below explains how it works:

However, not all forms of equitable interest can be easily transferred. For example, a trust beneficiary would need to formally sell or gift their equitable interest rather than simply assigning it.

In addition, not all states in the U.S. allow assigning contracts without a valid real estate broker’s license; for a complete list of which states allow wholesaling with or without such a license, consult our guide: Wholesaling Real Estate: Is It Legal In Your State?

FAQs: Equitable Interest

Can equitable interest be foreclosed on?

Yes, in some cases, equitable interest can be foreclosed on, similar to how a mortgage or deed of trust can be foreclosed. If the holder of equitable interest fails to fulfill the terms of the underlying contract, the legal titleholder may be able to foreclose on that equitable interest, in effect stripping away the equitable owner’s right to possess the property.

An example is the Kluge v. Fugazy case in 1988[10].

The process and consequences can vary depending on the specific arrangement, particularly whether the state the property is in is a judicial foreclosure or a non-judicial foreclosure state. Check out our map for the judicial vs. non-judicial foreclosure states in the U.S.

What is the difference between equitable interest and security interest?

A security interest is a lender’s legal claim on a borrower’s property used as collateral, such as a mortgage or lien. This is distinct from equitable interest, which is the buyer’s beneficial right to use and eventually own the property, even if they don’t have the legal title. Security interests protect the lender, while equitable interests protect the buyer.

Does equitable interest have to be recorded?

No, an equitable interest does not have to be recorded to be valid. Courts recognize equitable interests based on fairness and the underlying circumstances, even if they are not formally recorded in public records.

However, not recording an equitable interest can make it vulnerable in certain situations. For example, if someone else purchases the property and records their interest without knowledge of the existing equitable interest, their recorded interest might take priority. Recording provides public notice of the interest, which helps protect it against third parties who might later claim an interest in the same property.

References

- Assets America. (n.d.) What Is Property Interest? Retrieved from https://assetsamerica.com/property-interest/

- Gokce Capital. (n.d.) Equitable Interest: 6 Things (2024) You Ought To Know. Retrieved from https://gokcecapital.com/equitable-interest/

- Legal Information Institute. (n.d.) Sec. 535.6 – Equitable Interests in Real Property. Cornell Law School. Retrieved from https://www.law.cornell.edu/regulations/texas/22-Tex-Admin-Code-535-6

- Corporate Finance Institute. (n.d.) What is a Declaration of Trust? Retrieved from https://corporatefinanceinstitute.com/resources/knowledge/trading-investing/declaration-of-trust/

- Kagan, J. (2020.) Beneficial Interest. Investopedia. Retrieved from https://www.investopedia.com/terms/b/beneficial-interest.asp

- US Legal. (n.d.) Equitable Interest Law and Legal Definition. Retrieved from https://definitions.uslegal.com/e/equitable-interest/

- Rubel, M. (2017.) Lease Option and Equitable Interest. Huffington Post. Retrieved from https://www.huffpost.com/entry/lease-option-and-equitabl_b_11730896

- Braverman, B. How should you title your home?. Bankrate. Retrieved from https://www.bankrate.com/real-estate/how-should-you-title-your-home/

- Ruth, P. (2021.) Wholesaling Real Estate: What It Is, What It Isn’t, and What Needs to be Disclosed. Stock and Leader. Retrieved from https://www.stockandleader.com/uncategorized/wholesaling-real-estate-what-it-is-what-it-isnt-and-what-needs-to-be-disclosed

- Kluge v. Fugazy. (1988.) 145 A.D.2d 537, N.Y. App. Div. 1988. Retrieved from https://casetext.com/case/kluge-v-fugazy-1