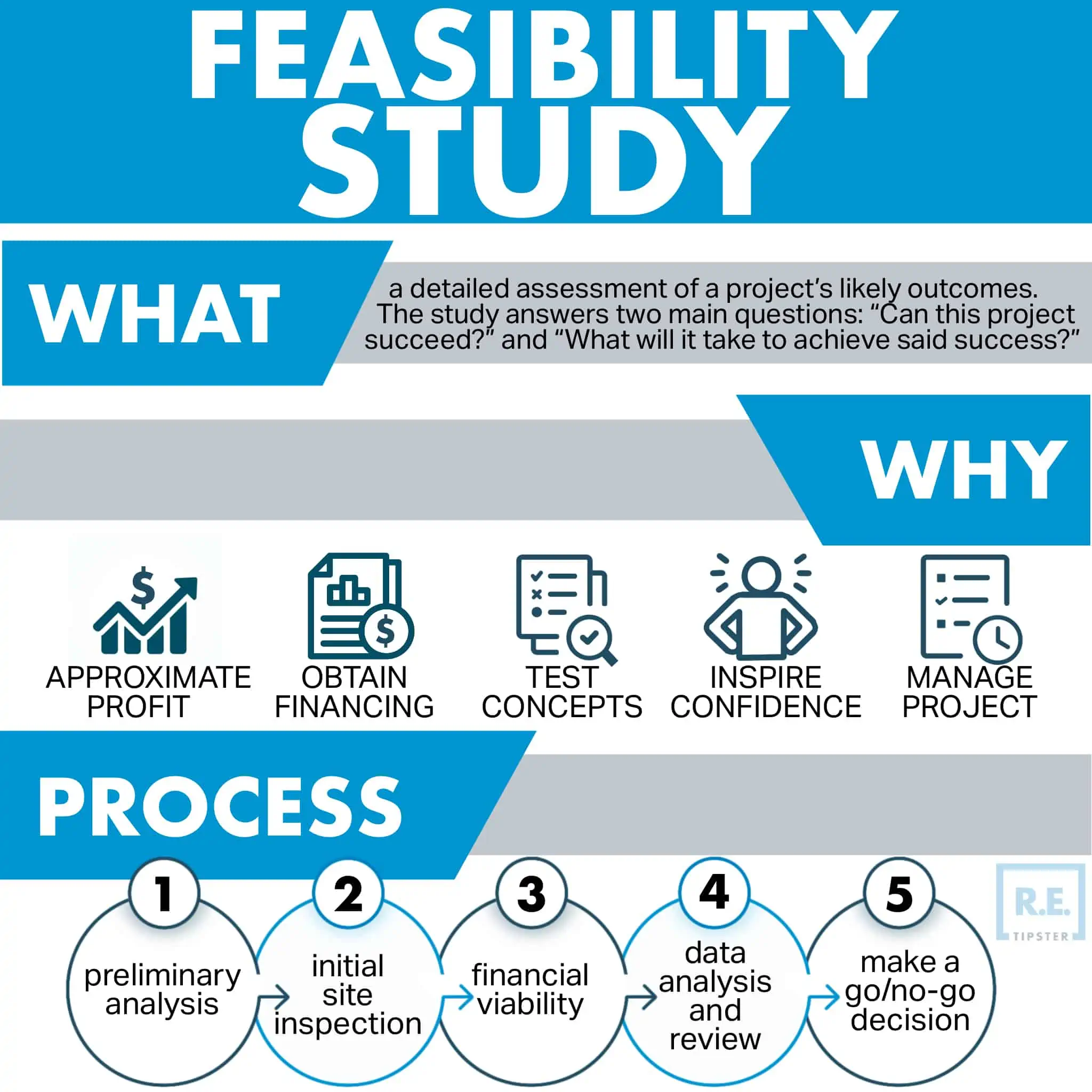

What Is a Feasibility Study?

Understanding Feasibility Studies In Real Estate

The cost of typical real estate projects, particularly in construction and development, is the primary reason most investors will not commit to them without some reasonable assurance that the project will succeed. A feasibility study gauges this “worth” by analyzing various factors, including technical, time, economic, legal, and operational considerations.

At the end of the study, the project’s stakeholders should have enough relevant information to determine if proceeding is practical. They can also help investors recognize the make-or-break issues that may affect the likelihood of success.

A feasibility study also outlines the essential aspects of the project. Failing to recognize any necessary element can result in bad forecasting[1], leading to poor decision-making.

Why Conduct a Feasibility Study?

A well-conducted feasibility study can provide the following benefits:

- Approximate profit — The data from the study can help stakeholders (i.e., investors, contractors, or developers) gauge potential profit to avoid wasting time, money, and effort on unrewarding ventures.

- Obtain financing — A real estate feasibility study provides insight into how much financing is required and for how long. It also identifies potential issues that may impact the project’s success. In many cases, lenders will require a feasibility study prior to approval as a way of verifying the assumptions of the loan applicant.

- Test concepts — Developers can determine the most practical course for reaching set goals using data from a feasibility study. It takes them through different tests to see if a particular concept is realistic and effective and what it will take to actualize it.

- Inspire confidence — A real estate feasibility study helps increase overall confidence in the viability of a project. Developers can have more room for estimates and conceptualizations while bankers and investors are assured of their financial returns.

- Manage the project — A feasibility study can result in useful data regarding project schedules, resources, operational capacity, economic conditions, technical expertise requirements, and other critical considerations in project management. Overall, a real estate feasibility study helps stakeholders make informed decisions.

Feasibility Study Costs

On average, feasibility studies can take anywhere from 30 to 90 days[2] based on the scope and technical aspects. A study may even take longer if it involves working with several external consultants and experts.

On the financial side, the cost of a study may be between $5,000 to $10,000 or about 1% to 1.5% of the total cost of the project[2]. The total cost depends on a number of aspects, including the scope of the study and whether it requires hiring external consultants. The more comprehensive the scope, the higher the cost.

Scope of a Real Estate Feasibility Study

What a feasibility study covers will vary depending on its scale and primary goals. However, a typical feasibility study accounts for the following factors:

Economic

This aspect involves a detailed cost-benefit analysis based on current and future economic conditions. In addition to adding to the project’s credibility by identifying its economic benefits, an economic feasibility study also helps boost confidence among potential investors.

Technical

This portion of the feasibility study determines the site’s terrain, topography, soil composition, environmental conditions, zoning restrictions, technical capacity, and other related factors and if they can support the project. It often involves hiring a technical professional, such as an architect or engineer, to conduct necessary tests and furnish the stakeholders with a detailed report on their findings.

Operational

This aspect looks at whether the development team and other relevant stakeholders have the necessary operational infrastructure. It examines the developer’s current staffing, financial resources, supply-chain capacity, technical expertise, debt profile, and so on.

Scheduling

Managing a project means setting goals and milestones[3]. The feasibility study’s scheduling section focuses on estimating how much time is needed to complete a project. It also helps uncover constraints that may alter projected timelines and ascertains measures to protect the bottom line.

Legal

This part of the study considers all legal considerations and requirements relevant to the project. Sometimes, a project may be deemed infeasible because its construction or planned use may contravene local zoning laws or other ordinances. Without a feasibility study, developers and investors may end up wasting their money and time if the project violates public regulations.

The Feasibility Study Process

There is no standard method for conducting a feasibility study since project scopes differ. For example, some studies only require a few simple steps while others may need to be expanded and include more steps and milestones.

In any case, an average real estate feasibility study includes the following steps:

1. Preliminary Analysis

Although the study’s primary objective is to determine whether specific actions will lead to desired results, it should always begin with an internal evaluation of the operation. This means coming up with a project plan and determining whether it is realistically attainable.

Preliminary analysis also involves looking at the developer’s capacity to take on the project. Do they have the means to handle the project? Can keep the project adequately staffed until completion?

One of the most important things in a preliminary analysis is obtaining the title report of the property, known as a title search[4]. This document outlines the legal status of a property and any important information regarding its ownership. If the title report shows issues, the project cannot proceed further unless these issues are addressed first.

2. Initial Site Inspection

This involves studying the basic parameters of the project site. It usually involves a survey to map out the property’s exact boundaries. At the very least, a site inspection should present and evaluate the following:

- Topography.

- Elevation and slope.

- Availability of utilities (access to power, water, gas, phone, etc.).

- Existence of wetlands.

- The zoning classification of the property.

- Legal and physical access.

- Drainage and flooding.

This step may also involve hiring a technical professional to prepare layout options and perform necessary tests, which may include a geotechnical study[5], a Phase I environmental study[6], and even a hazmat study[7].

3. Financial Viability

The third step involves the financial aspect of the project—from expected expenses to projected incomes, and everything in between. Essentially, this part of the study pinpoints the necessary services to project completion and forecasts cost vs. return values.

Critical elements in the financial viability study include acquisition costs, construction costs, professional fees, insurance, taxes, permitting fees, and closing costs.

Some feasibility studies also package market research to get a clearer picture of prevailing market conditions that apply to the project. Some of these considerations are interest rates, demographics, and competition.

4. Data Analysis and Review

The first three steps usually generate volumes of data, so the next step typically involves analyzing them and compiling them as useful information. Data analysis also demands that the data is checked for accuracy, timeliness, and relevance and that the study has overlooked no important factors.

5. Make a Go/No-Go Decision

At this stage, stakeholders should be able to answer one simple question—is this project feasible or not?

All information on the feasibility study is objective and factual, so it is up to the stakeholders if they decide the project is worth the time, investment, and effort to undertake it. The study should also show if the project aligns with the strategic and long-term goals of the organization.

Takeaways

- A real estate feasibility study is a detailed assessment of the viability of a project. It also examines the outcome of various actions and whether they justify the cost and effort it will take to achieve them.

- Real estate feasibility studies are important because they help project developers test concepts, obtain financing, and manage the project better.

- Investors also benefit from feasibility studies because it helps them approximate profits and gain more confidence in the prospective financial returns of the project.

- There are many aspects of real estate feasibility studies, including economic, legal, technical, operational, and scheduling.

Sources

- Corporate Finance Institute. (2022.) Forecasting. Retrieved from https://corporatefinanceinstitute.com/resources/knowledge/finance/forecasting/

- Stockton, B. (2020.) What Is a Feasibility Study for Small Business? Fit Small Business. Retrieved from https://fitsmallbusiness.com/feasibility-study-for-small-business/

- Eade, D. (n.d.) What is a Project Milestone and why are they important? WorkflowMAX. Retrieved from https://www.workflowmax.com/blog/general-project-milestone

- Masterclass. (2022). Title Search on Property: How to Perform a Title Search. Retrieved from https://www.masterclass.com/articles/title-search-on-property

- TrenchlessPedia. (2020.) Geotechnical Investigation. Retrieved from https://www.trenchlesspedia.com/definition/3473/geotechnical-investigation

- Redlin, J., Moore, N. (2018). What is a Phase I Environmental Site Assessment? Partner Engineering and Science Inc. Retrieved from https://www.partneresi.com/resources/blog/what-is-a-phase-i-environmental-site-assessment

- University System of Georgia. (n.d.) Hazardous Material Assessments. REAL ESTATE AND FACILITIES Administration Division. Retrieved from https://www.usg.edu/facilities/resources/hazardous_material_assessments