What is the Federal Housing Administration?

REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

What Does the Federal Housing Administration Do?

Many people mistakenly think of the Federal Housing Administration, or FHA, as a lender, but the agency does not actually make loans. FHA functions as an insurance agency, insuring nearly 50 million mortgages since it was created in 1934[2].

The FHA was created as an independent agency near the end of the Great Depression. The Depression nearly destroyed the housing industry; mortgages were limited to 50% of the property value, and terms rarely extended beyond five years. As a result, the United States had become a nation of renters.

Congress authorized the creation of the Federal Housing Administration with a mission to reduce unemployment by putting people to work building homes and increase homeownership by making home loans more accessible. The Department of Housing and Urban Development (HUD) absorbed the FHA in 1965.

Today, the FHA is one of the largest mortgage insurers in the world. The FHA is unique among government agencies in that its operations are entirely funded by the mortgage insurance premiums it collects. FHA loans are attractive to lenders because they assume less risk; if a borrower defaults on an FHA loan, the agency repays the entire remaining balance and makes the lender whole.

How Do FHA Loans Work?

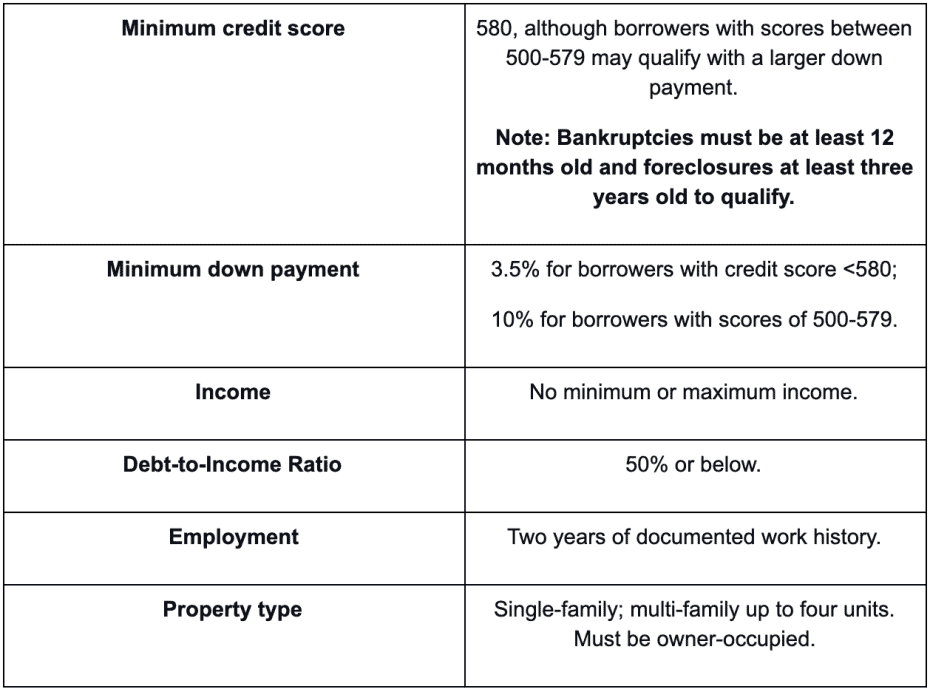

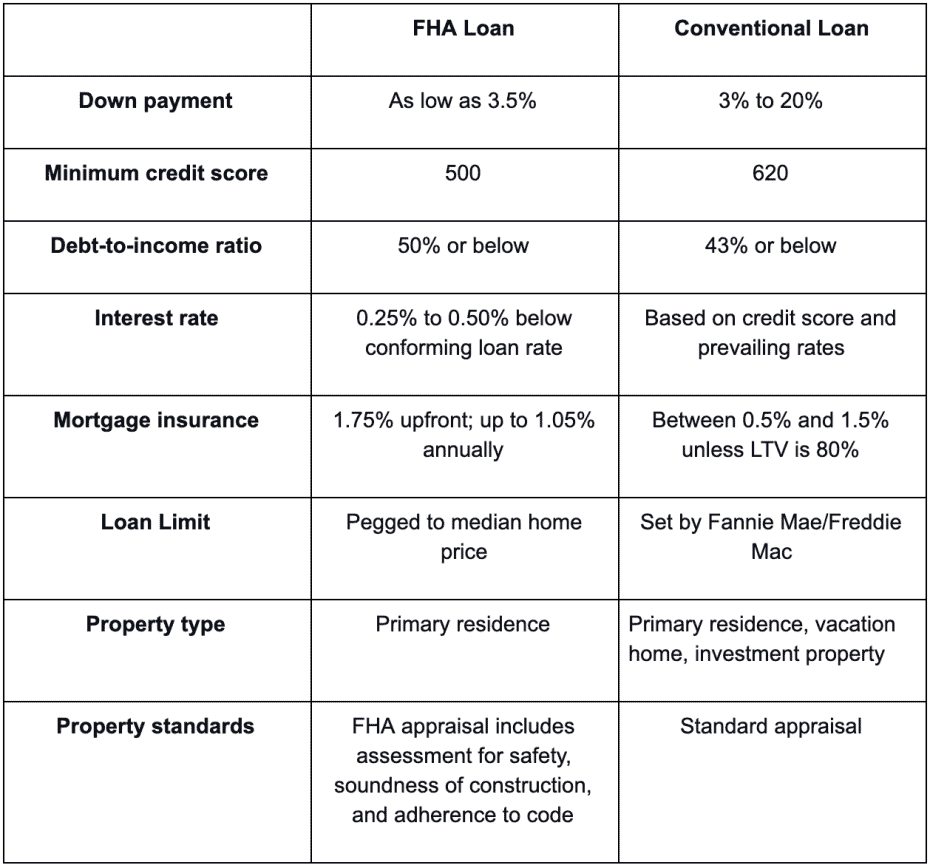

Only lenders approved by the FHA can make FHA loans. Borrowers must meet FHA credit score and down payment requirements to qualify for a loan. Qualified buyers can get into an FHA loan with 3.5% down.

There are no minimum or maximum income requirements, which means any borrower who falls within the debt-to-income limits is eligible. However, there is a cap on loan amounts based on the National Affordable Housing Act[3] as well as on median home prices and the Fannie Mae and Freddie Mac limits.

Borrowers pay an upfront mortgage insurance premium (MIP) based on the loan amount and loan-to-value (LTV) ratio. The upfront MIP is assessed as a percentage of the loan amount and generally rolled into the loan amount and paid off over the life of the loan. The upfront MIP is charged regardless of LTV; this is different from private mortgage insurance (PMI), usually only required if the LTV exceeds 80%.

There is also an annual mortgage insurance premium, which is paid monthly and based on the loan amortization schedule. The annual MIP decreases each year as the loan balance decreases, but if the borrower puts down less than 10% and the term is 20 years or longer, the annual MIP is assessed for the life of the loan.

FHA Loan Eligibility at a Glance

FHA Loan Types

FHA loans are available at both fixed and adjustable interest rates; terms depend on the lender, but typically, 15, 20, 25, and 30-year terms are available. Most borrowers choose a 30-year fixed mortgage, according to the FHA.

The FHA insures purchase loans as well as streamlined refinance loans. They also offer a cash-out refi with a maximum LTV of 80%.

Borrowers who want to finance new construction may also use FHA 203k loans. These loans are also open to borrowers who want to finance renovations or the purchase price of a property with a single loan.

Most people are only allowed to have one FHA loan at a time, although there are exceptions:

- A co-borrower on an FHA loan who is going through a divorce may get a second FHA loan for a separate home.

- A co-borrower on an FHA loan who does not occupy the property may qualify for an FHA loan on an owner-occupied property.

- If a borrower is relocating for work and has an FHA loan on their primary residence, they may get a second FHA loan for a primary residence in the new location.

All of the above scenarios need to be properly documented with the loan application. Note that approval for a second FHA loan is not guaranteed.

FHA Loan vs. Conventional Loan

Can FHA Loans Be Used for Investment Property?

FHA loans can be used for multi-family properties with up to four units[4] as long as the owner occupies one unit as their primary residence for at least one year.

Other rules regarding FHA loans for investment property include:

- The units cannot be rented out for 30 days or less; only long-term tenants are allowed.

- Rental income from the property can be used to qualify for the loan in certain circumstances.

- The borrower must comply with lender and state requirements; FHA standards do not override those of the lender or other agencies.

- FHA loans can be used for mixed-use properties as long as the non-residential property does not exceed 49% of the total square footage. The commercial use of the property should not also endanger the health of the residential occupants.

Takeaways

FHA loans are popular with first-time homebuyers, although anyone who meets eligibility guidelines can apply. FHA loans have lower credit requirements, low down payments, and no income limits. They can be used for owner-occupied single-family, multi-family, and mixed-use properties.

Although interest rates tend to be lower, borrowers pay an upfront PMI of 1.75% and an annual MIP of up to 1.05%. Loan limits may also be lower, so borrowers may need a conventional or jumbo loan for more expensive properties.

Sources

- U.S. Department of Housing and Urban Development. (n.d.) The Federal Housing Administration (FHA). Retrieved from https://www.hud.gov/program_offices/housing/fhahistory

- Congressional Research Service. (2019.) FHA-Insured Home Loans: An Overview. Federation of American Scientists. Retrieved from https://fas.org/sgp/crs/misc/RS20530.pdf

- Cranston-Gonzalez National Affordable Housing Act of 1990, S. 566, 101st Cong., (1990). Retrieved from https://www.congress.gov/bill/101st-congress/senate-bill/566

- Wallace, J. (2018.) FHA Loans, Eligible Property Types, And Mixed-Use Properties. FHANewsBlog.com. Retrieved from https://www.fhanewsblog.com/2018/03/fha-loans-eligible-property-types-mixed-use-properties/