What is a Bridge Loan?

REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

What is a Bridge Loan in Real Estate?

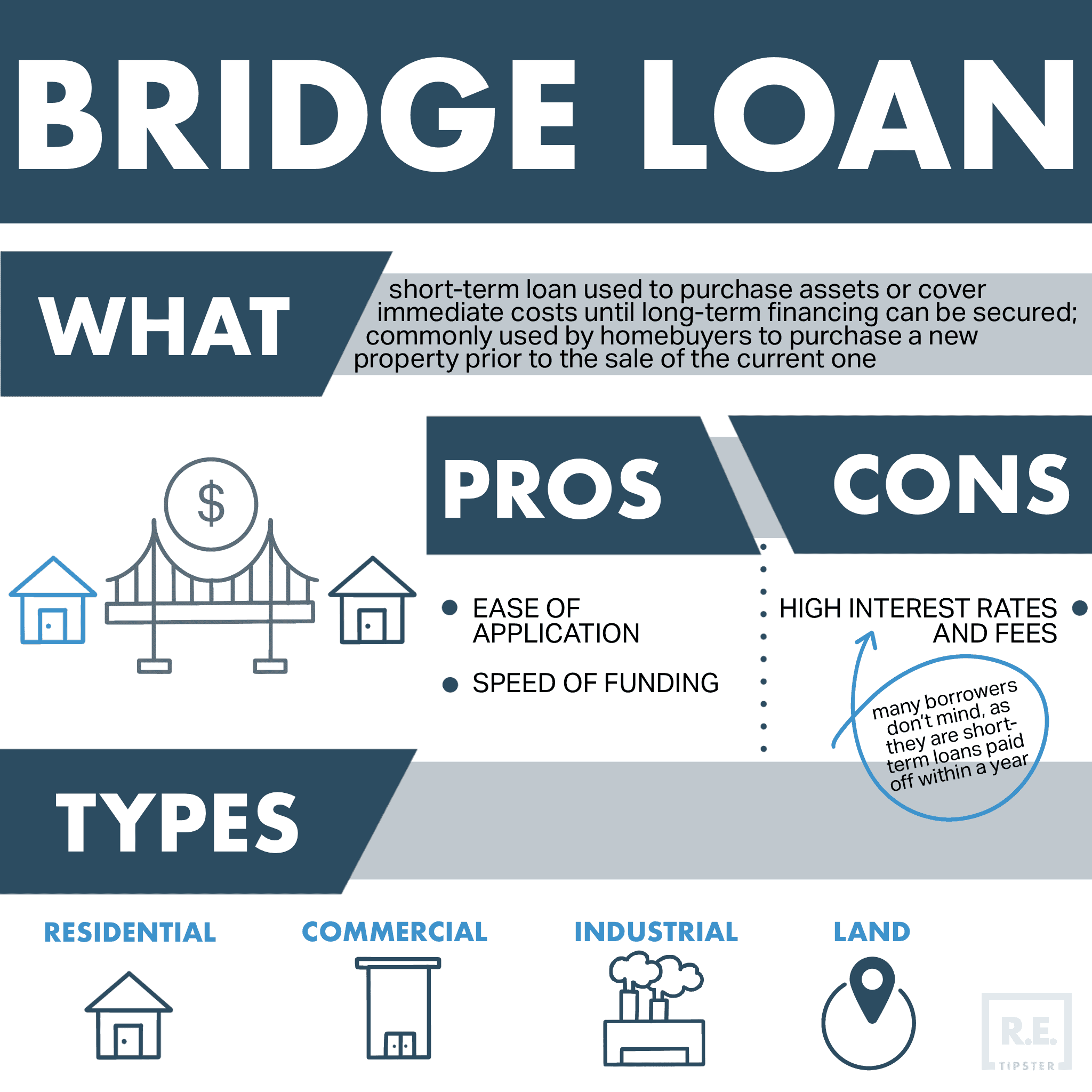

In the broadest definition, the term bridge loan is commonly referred to as:

A short-term loan providing temporary financing until permanent financing can be obtained.

Bridge loans allow for very quick financing and are secured by real estate.

More specifically, a bridge loan (also known as a swing loan or gap financing) refers to a situation where a property owner is able to borrow against the equity in their current property in order to finance the purchase of a new property. Once the new property is purchased, the first property is sold and the bridge loan is repaid. The loan on the current property is providing a financing “bridge” for the acquisition of the new property.

A bridge loan can also be used in reverse order. A short-term bridge loan can be secured by the new property and then repaid by the proceeds from the subsequent sale of the current property.

A bridge loan can be used by both homeowners who wish to move and real estate investors who want to acquire a new investment property prior to the sale of an existing property.

It should be noted that on a consumer purpose owner-occupied loan, a lender cannot simply do a one-year loan by calling it a bridge loan unless the borrower has laid out a legitimate plan to purchase the new primary residence. Except for the true bridge loan exception, current regulations prohibit a balloon payment on any consumer purpose owner-occupied loan.

Bridge Loan Property Types

Bridge loans can be obtained for any type of property including:

- Residential

- Single-Family or Multi-Family

- Owner-Occupied or Investment Property

- Commercial

- Industrial

- Land

Not all lenders will be able to fund a bridge loan against all property types, but a bridge loan can be secured against any type of real estate. Loan to value ratios for residential property will generally be higher compared to all other property types.

Bridge Loans vs. Traditional Bank Loans

The amount of time needed for applying, obtaining approval, and receiving funding from a private money lender is significantly less for bridge loans compared to bank loans.

Borrowers usually choose bridge loans because of the ease of application and speed of funding they offer. This convenience comes at a cost as they generally have higher interest rates and fees. Many borrowers don’t mind the higher interest rates, as they are only short-term loans that will be paid off within a year.

When Should a Bridge Loan be Used?

Homeowners can obtain a residential bridge loan to purchase a new home when they don’t have the necessary funds on hand for a sufficient down payment or to make a new purchase with all cash. They must have a significant amount of equity in their current home or even own the property free and clear.

Real estate investors are able to utilize the same process for similar situations for their investment properties.

A Residential Bridge Loan Example

To illustrate what this type of financing arrangement has to offer, consider this hypothetical example of what it looks like to move with and without the assistance of bridge financing.

Moving WITHOUT a Bridge Loan:

The homeowner could sell their current home to free up equity in order to make their next home purchase. This would require the homeowner to move out of their home and find temporary housing. Once escrow closed on their current home they would then need to find and purchase a new home and move again.

This scenario is very inconvenient and costly as the homeowner is forced to move twice.

Moving WITH a Bridge Loan:

The homeowner can obtain a bridge loan from a residential bridge loan lender. The loan is secured by either the existing home, the new home, or both the existing and new home. Once the homeowner has purchased the new home, the first home is sold and the proceeds from the sale go towards paying off the bridge loan.

The homeowner only moves a single time once they have purchased the new home.

Bridge Loan Interest Rates and Fees

Bridge loan interest rates can vary greatly based on a wide variety of factors such as property type, loan to value ratio, duration of loan term and in some cases the credit of the borrower. Interest rates usually reflect the amount of perceived risk. In general, bridge loan interest rates from private money lenders are in the range of 8-12%.

Fees for bridge loans are generally in the form of points. Bridge loans are generally in the range of 2-3 points. 1 point represents 1% of the loan amount. Some lenders will add other fees such as document processing or underwriting fees. Ask the bridge loan lender upfront if there are any additional fees or if everything is covered in the points.

Beyond the points, the borrower will also be responsible for all the standard real estate transaction fees such as:

- Escrow

- Title insurance

- Recording fees

- Notary fee

- Wire fee

The escrow and title insurance fees will vary based on the value of the property.

Loan to Value Ratios for Bridge Loans (Residential vs. Commercial)

For residential bridge loans, most bridge loan lenders will lend up to 65% – 75% of the current value of the property. Loan-to-Value (LTV) ratios for commercial bridge loans are lower and generally max out at 60% – 65%.

The reason commercial bridge loans have a lower loan to value is that commercial property is more difficult to value and more difficult to sell. Valuing a residential property is often much easier as there are many more comparable sales to help come to a valuation.

If a borrower needs a quick commercial bridge loan, a lender will feel more comfortable lending a lower and more conservative amount without a time-intensive, detailed appraisal. The higher the loan amount and higher loan to value, the higher the amount of risk for the bridge loan lender.

Pros and Cons of Bridge Loans

As with any type of financing arrangement, there will be times when bridge loans make sense and other times when they do not.

Pros of a Bridge Loan

Quickly access equity in a property without selling it first

This is the main function and benefit of a bridge loan. The existing property is used as collateral in order to purchase a new property. Bridge loans can be funded within days for investment property while owner-occupied bridge loans generally take 2-3 weeks due to current federal regulations.

Preventing the inconvenience and expense of moving twice when purchasing a new home

As mentioned previously, in some cases a homeowner without enough cash to fund a down payment is forced to first sell their current home, move to temporary housing, and then purchase and move into the new home. Obtaining a bridge loan in this scenario allows the homeowner to only move a single time once they have secured their new residence and then sell their existing property.

Proceed without a contingency to sell an existing home

It is common for a homebuyer to submit an offer which includes a contingency that the homebuyer’s existing property must first be sold. Buyers include this contingency because they need the net proceeds from the sale of their current home in order to purchase the new property.

From the seller’s point of view, this can be seen as a weak offer and is less likely to be accepted, especially in a competitive real estate market.

If the buyer first obtained a bridge loan against their current home they would have the needed funds for a down payment or the full amount of the offer price in cash and be able to present an offer without the contingency of selling their home.

Bridge loan lenders lend to borrowers who have been denied by banks and credit unions

Bridge loan lenders are primarily concerned with the value of the property and the borrower’s equity in the property as opposed to the creditworthiness and income of the borrower.

A bank will likely deny a borrower’s loan request if the borrower has a low credit score or other issues such as recent foreclosures, bankruptcies, short sales, loan modifications, late mortgage payments or insufficient employment history. Many private money bridge lenders can still provide a loan to borrowers with the previously mentioned issues as long as the borrower has sufficient equity in their property.

Bridge loans can be obtained against properties that are currently on the market

Many conventional lenders will not provide financing for a property that is currently on the market. They are unwilling to go through the process of providing a loan that will be paid off in a short amount of time. Bridge loan lenders are able to provide a bridge loan against a property that is currently for sale.

No ability to pay requirement for bridge loan qualification

With current federal regulations for obtaining loans secured by a personal residence, borrowers are forced to verify their income and submit other financial information so the lender can ensure the borrower’s debt to income ratio remains within an acceptable range. This presents a problem for borrowers who aren’t currently able to provide sufficient proof of income to justify a large loan or loans on two properties at the same time, such as retirees with limited income or self-employed individuals.

Bridge loans provide an exception to these regulations as the predetermined sale of the original property serves as the repayment for the loan. This does not mean that the lender will not pay attention to the borrower’s income and expenses. Lenders do not want to provide a loan where the borrower does not have the ability to make the payments.

Cons of a Bridge Loan

Bridge loans have higher interest rates than conventional loans

Bridge loans from private money lenders have a higher interest rate compared to bank loans which are usually offset by the speed and ease of obtaining the loan. The market interest rate for private money funded loans are higher than conventional loans.

Bridge loans often have higher transaction costs

Bridge loans will often have origination fees in the range of 2-3 points. The borrower will also be responsible for standard transaction fees such as escrow, title insurance, notary and recording fees.

Bridge Loan Amounts

Loan amounts available for bridge loans will vary based on the capital resources of the bridge loan lender. Loan amounts can range from $50,000 on the low end up to $50,000,000 and beyond.

Borrower Requirements for Bridge Loans

Borrower requirements for bridge loans vary from lender to lender. The lender will be primarily focused on the value of the property that will be used as collateral for the loan.

Bridge loan lenders will require a loan application that provides financial information about the borrower (income, assets, other real estate owned, existing debts, etc.) as well as basic information about the property.

For more complicated bridge loans that involve investment properties, lease agreements and other documentation may be required.

Prepayment Penalties for Bridge Loans

A bridge loan may have a prepayment penalty if it is a business purpose loan (use of borrowed funds going towards an investment property). Ask the bridge loan lender upfront if there will be a prepayment penalty. These types of details are often negotiable.

Prepayment penalties on owner-occupied consumer purpose loans are only allowed on certain loans that are classified as Qualified Mortgages and they are not allowed on loans classified as Higher-Priced loans due to current federal regulations.

Finding a Bridge Loan Lender

The majority of bridge loan lenders are usually hard money lenders (private money lenders) as opposed to banks and credit unions. These types of lenders are less known to the majority of people unless they have previously been involved in real estate investing.

RELATED: Hard Money 101: Everything You Need To Know About Getting Started With Hard Money Loans

There are few different ways to find bridge loan lenders in your area:

- Search for “bridge loan lender” + your city or state on your favorite search engine

- Ask a trusted real estate professional for a referral

- Attend a local real estate investor club meeting and network with lenders

If the property being used as collateral for the bridge loan is owner-occupied and the proceeds of the loan are being used to purchase a new owner-occupied property, it will be considered a consumer purpose loan. The lender must have NMLS licensing in order to process and fund a consumer purpose loan.

If the property being used as collateral for the bridge loan is owner-occupied but the proceeds of the loan are being used to purchase an investment property it would be considered a business purpose loan and an NMLS license would not be required.

Other Terms for Bridge Loans

Keep in mind, there are many different terms for bridge loans but they all essentially mean the same thing. Some of the more popular terms include:

- swing loan

- bridging loan

- bridging finance

- interim financing

- bridge mortgage

- gap financing

- caveat loan

Bridge loans are a convenient financing tool that can be used by both homeowners as well as real estate investors.

Jeffrey Hensel is a Broker Associate at North Coast Financial, Inc. a California hard money lender. Mr. Hensel holds a Bachelor’s degree in Real Estate and an MSBA in Entrepreneurship, both from San Diego State University.

North Coast Financial, Inc. is a hard money lender in San Diego, California with over 35 years of experience lending on properties throughout California. For more information on hard money loan programs or to inquire about a loan please contact Jeffrey Hensel at jeff@northcoastfinancialinc.com