What Is Financial Freedom?

REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

Shortcuts

- Financial freedom is an ideal situation where someone has the money and resources to make decisions, pursue passions, and live their desired lifestyle without being constrained by money.

- It’s the end goal of financial independence, or the ability to meet basic needs without actively working for them.

- Financial freedom is the net effect of sound financial decisions, such as diversifying income streams, saving, budgeting, and eliminating debt.

- Financial freedom is less quantifiable than financial independence, but anyone can be financially free as long as they put in the effort and discipline.

Understanding Financial Freedom

Financial freedom isn’t just about getting rich or making a certain amount of money. It’s about taking charge of one’s finances, getting rid of debt, and making a long-term plan for money that fits their passions, dreams, and lifestyle. Being financially free means not only can you pay for your needs (e.g., food and shelter) without a regular, 9-to-5 job but save for the future, build a legacy for your children, and enjoy life.

True financial freedom represents a balance between financial stability and personal fulfillment, where money becomes a tool rather than a constraint.

Components of Financial Freedom

- Autonomy: This is about the capacity to make life-altering decisions, like changing careers or relocating to a new city[1], without fear of employment (or lack thereof) holding you back.

- Pursuing passions: Financial freedom allows individuals to delve deeper into their hobbies, perhaps even turning passions like art or writing into full-time pursuits without the pressure of earning something from it.

- Value-driven choices: Imagine supporting a cause, not because it pays well but because it aligns with your beliefs. Financial freedom facilitates such choices, ensuring decisions come from the heart, not financial necessity.

Financial Freedom vs. Financial Independence

Although many people use the terms “financial freedom” and “financial independence” interchangeably, they have slightly distinct connotations.

Financial freedom is the end goal of financial independence. It gives you more options in managing your money and living your life. It provides more opportunities for managing your finances and entails making decisions based on your ideals and interests without worrying about where the next paycheck comes from.

Meanwhile, financial independence is merely a milestone in the journey toward financial freedom[2]. Being financially independent means you have the security to pay for your necessities without actively working for them. This may happen due to idle income or a combination of factors.

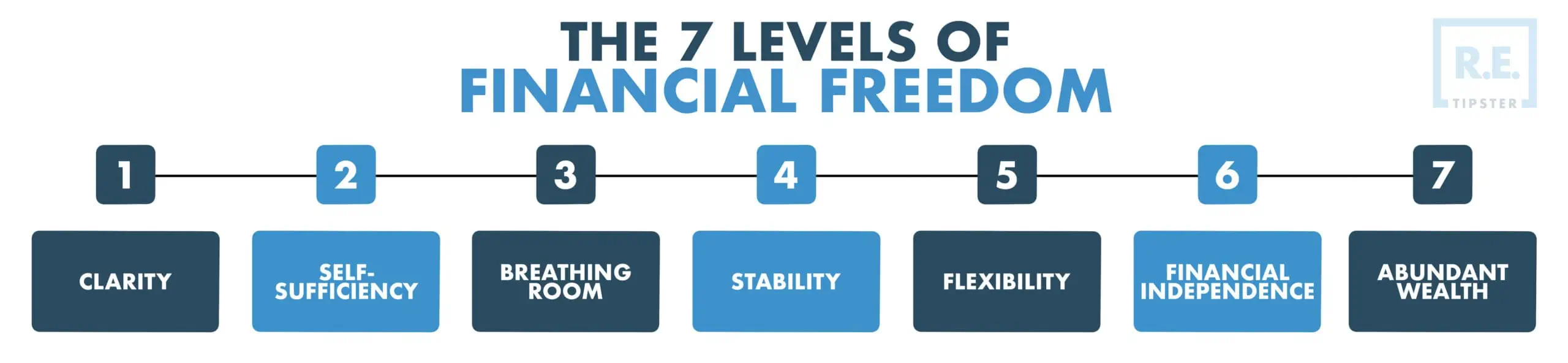

Grant Sabatier, the author of “Financial Freedom” and a supporter of the FIRE (financial independence, retire early) movement, also talks about the seven stages of financial freedom. At level 6, you have financial independence. At level 7, you have “abundant wealth,” equivalent to true financial freedom.

The 7 Stages of Financial Freedom, according to Grant Sabatier

Why Is Financial Freedom Important?

Financial freedom holds immense importance in our lives, impacting various aspects of our well-being. Here are some key reasons why financial freedom matters:

Peace of Mind and Reduced Stress

Financial freedom brings peace of mind and reduces stress levels. Some studies have suggested that financially independent people experience less pain than those who do[4].

With a solid financial foundation, you can navigate unexpected expenses, emergencies, and uncertainties without constant worry. It provides a sense of security and stability, allowing you to focus on other areas of your life, such as personal growth, relationships, and overall well-being.

Pursuing Your Dreams and Passions

One of the most significant advantages of financial freedom is the ability to pursue your dreams and passions. Whether it’s starting your own business, traveling the world, or dedicating time to a cause you’re passionate about, financial freedom provides the resources and freedom to make those aspirations a reality. It allows you to live a life aligned with your values and brings fulfillment and happiness.

Independence and Autonomy

Financial freedom grants you independence and autonomy over your life choices. You are not tied to a job or career solely to earn a paycheck. Instead, you are free to choose work that aligns with your interests and values or even take a break and explore new opportunities without fearing financial setbacks. It empowers you to make decisions based on what truly matters to you rather than being driven solely by financial obligations.

Building Generational Wealth

Achieving financial freedom is not just about benefiting yourself but also future generations. By attaining financial stability, you can create a legacy of wealth and financial literacy within your family[5]. This enables you to provide better opportunities and financial security for your loved ones, setting them on a path toward their own financial freedom.

Strategies to Attain Financial Freedom

Attaining financial freedom requires a combination of disciplined financial habits, strategic planning, and long-term vision. Here are some key strategies to help you on your journey toward financial freedom:

Set Clear Financial Goals

Defining your financial goals is the first step towards achieving financial freedom. Determine what financial freedom means to you personally and set specific, measurable, achievable, relevant, and time-bound (SMART) goals[6]. These goals include paying off debt, building an emergency fund, investing for retirement, or saving for a particular milestone.

RELATED: Could You Quit Your Job Today? Use This Financial Freedom Calculator To Find Out!

Create a Budget and Track Expenses

Developing a budget is crucial for managing your finances effectively. Track your income and expenses, categorize them, and identify areas where you can cut back or save more. A budget provides a clear picture of your financial health and helps you make informed decisions to align your spending with your goals.

In general, any budget plan follows these six steps[7]:

- Track your net income.

- Monitor spending.

- Set realistic goals.

- Make a financial plan.

- Adjust budget as necessary to meet goals.

- Review your budget plan regularly and adapt.

Eliminate Debt

Debt can be a significant obstacle on the path to financial freedom. Prioritize paying off high-interest debts, such as credit card debt[8] or personal loans, as quickly as possible.

There are various ways to eliminate “bad” debt; the most well-known are the debt snowball method (paying off small loans first) and the debt avalanche method (paying off high-interest or big loans first)[9]. Both can accelerate your freedom from debt.

RELATED: 129: Want to Shred Your Debt 10X Faster? Adam Carroll Explains How

Save, Invest, and Diversify

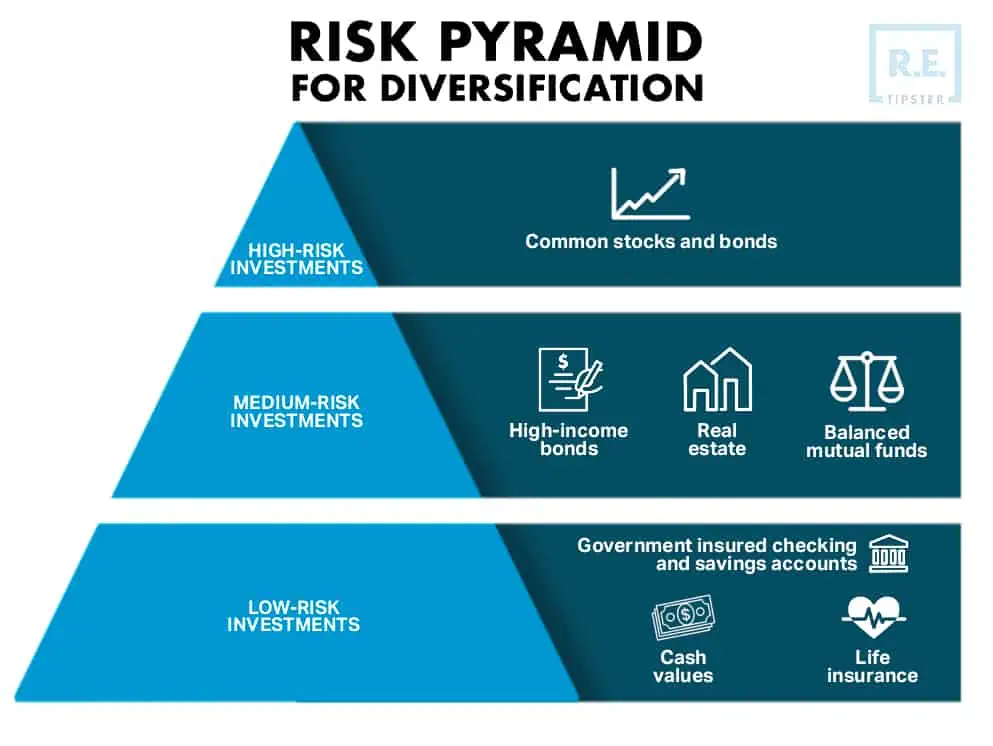

Saving and investing are essential components of building wealth and achieving financial freedom. Establish an emergency fund to cover unexpected expenses, and then focus on long-term investments such as retirement accounts or other investment vehicles that align with your risk tolerance and goals.

One example is real estate, which allows people to build wealth due to its combination of capital appreciation and cash flow from rental income. But keep in mind that even though real estate is a good investment, it has its own problems, such as problems with liquidity[10] and property management.

However, relying solely on a single source of income can be limiting and may even slow down your path to financial security. Diversifying your income can provide stability and additional financial resources to accelerate your journey toward financial freedom.

Consider seeking professional advice from financial planners or advisors to make informed investment decisions.

Continuously Educate Yourself

Financial literacy[11] is a key component of financial freedom. Take the time to educate yourself about personal finance, investing, and money management. Read books, attend seminars, listen to podcasts, or enroll in courses that enhance your financial knowledge. The more you understand managing your finances, the better equipped you are to make smart financial decisions.

Practice Mindful Spending and Avoid Lifestyle Inflation

Mindful spending involves being intentional with your money and making conscious decisions about where and how you spend it. Avoid falling into the “lifestyle inflation” trap, where your expenses increase as your income rises. Instead, focus on living below your means, prioritizing saving and investing, and making choices that align with your long-term financial goals.

The Japanese principle of kakeibo (literally “household ledger”)[12] is a good way to practice mindful spending by writing income and expenses down on a piece of paper. Not only does writing something down help you retain information much more effectively[13], but this principle also allows you to reflect on your monthly expenses and make an action plan for the next.

Frequently Asked Questions: Financial Freedom

How does one measure financial freedom?

Financial freedom is more qualitative than quantitative. While it can be linked to specific monetary goals, its true measure lies in one’s ability to make decisions independent of financial constraints. This might mean different thresholds for different individuals based on their aspirations and lifestyle choices.

However, a certain level of financial independence is required to get to a level of financial freedom. There are many guidelines to calculate the exact amount, but the widely cited principle is the 4% Rule[14].

Is financial freedom a realistic goal for the average person?

Absolutely. Financial freedom isn’t reserved for the elite or extraordinarily lucky. Anyone can navigate toward it with informed financial decisions, consistent savings, and a clear vision. It’s more about discipline, education, and perseverance than starting wealth[15].

Does being financially free mean I never have to work again?

Financial freedom does not necessarily mean never having to work again. It is about choosing to work on your terms and pursuing work that brings you fulfillment. Many individuals who achieve financial freedom continue to work but do so because they enjoy it, not because they are financially dependent on it.

Sources

- Rapacon, S. (2018, July 2.) Moving to a New City? Don’t Forget to Re-Evaluate Your Budget. Money – U.S. News. Retrieved from https://money.usnews.com/money/personal-finance/saving-and-budgeting/articles/2018-07-02/moving-to-a-new-city-dont-forget-to-re-evaluate-your-budget

- Dickerson, A. (n.d.) Financial Freedom vs. Financial Independence: How They’re Different, And How You Can Get There. GoodEgg Investments. Retrieved from https://goodegginvestments.com/blog/financial-freedom-vs-independence/

- Ermey, R. (2022, May 10.) The 7 levels of financial freedom, according to a millionaire — 50% of U.S. workers are at Level 2. CNBC. Retrieved from https://www.cnbc.com/2022/05/10/the-7-levels-of-financial-freedom-according-to-a-millionaire-50percent-of-us-workers-are-at-level-2.html

- Frech, A., Houle, J., Tumin, D. (2021, June 15.) Trajectories of unsecured debt and health at midlife. SSM – Population Health, Volume 15, 100846, ISSN 2352-8273. Retrieved from https://doi.org/10.1016/j.ssmph.2021.100846

- Six financial literacy principles. (n.d.) RBC Wealth Management Group. Retrieved from https://www.rbcwealthmanagement.com/en-ca/insights/6-financial-literacy-principles

- Lazar, A. (2023, January 31.) How to Set S.M.A.R.T. Financial Goals (With Examples). Finmasters. Retrieved from https://finmasters.com/smart-financial-goals/

- Creating a budget. (n.d.) Better Money Habits, Bank of America. Retrieved from https://bettermoneyhabits.bankofamerica.com/en/saving-budgeting/creating-a-budget

- Karp, G. (2023, June 22.) Why Are Credit Card Interest Rates So High? NerdWallet. Retrieved from https://www.nerdwallet.com/article/credit-cards/credit-card-interest-rates-high

- Olliver, G. (2023, April 29.) Is Real Estate a Liquid Investment? LoanBase. Retrieved from https://loanbase.com/learn/properties/is-real-estate-a-liquid-investment/

- Debt Snowball or Debt Avalanche: Which Method Is Right for You? (2023, August 10.) Discover Bank. Retrieved from https://www.discover.com/personal-loans/resources/consolidate-debt/payoff-debt-snowball-vs-avalanche/

- Fernando, J. (2023, March 30.) Financial Literacy: What It Is, and Why It Is So Important. Investopedia. Retrieved from https://www.investopedia.com/terms/f/financial-literacy.asp

- Bergen, A. (2023, September 8.) Kakeibo: The Japanese Budget Method Explained. Money Under 30. Retrieved from https://www.moneyunder30.com/kakeibo-the-japanese-budget-method-explained/

- Bergland, C. (2021, March 19.) 4 Reasons Writing Things Down on Paper Still Reigns Supreme. Psychology Today. Retrieved from https://www.psychologytoday.com/us/blog/the-athletes-way/202103/4-reasons-writing-things-down-paper-still-reigns-supreme

- Williams, R., Kawashima, C. (2023, February 27.) Beyond the 4% Rule: How Much Can You Spend in Retirement? Charles Schwab. Retrieved from https://www.schwab.com/learn/story/beyond-4-rule-how-much-can-you-spend-retirement

- How to achieve financial freedom. (n.d.) Tony Robbins. Retrieved from https://www.tonyrobbins.com/business/achieve-financial-freedom/