What Is Forced Equity?

Shortcuts

- Forced equity is increasing the value of property by improving it, which proportionately increases the owner’s equity.

- Equity, or the percentage of ownership, grows either actively or passively.

- Forcing equity is an active way of growing equity.

- Forced appreciation and forced equity are similar concepts, but the former applies to rental properties and the latter to an owner’s main dwelling.

How Can One Force Equity?

An owner can force equity by improving the property, thus increasing its value. This is common in real estate investing, most often seen when people buy, fix, and flip an investment property.

To figure out why increased property values lead to increased equity, it pays to understand equity first.

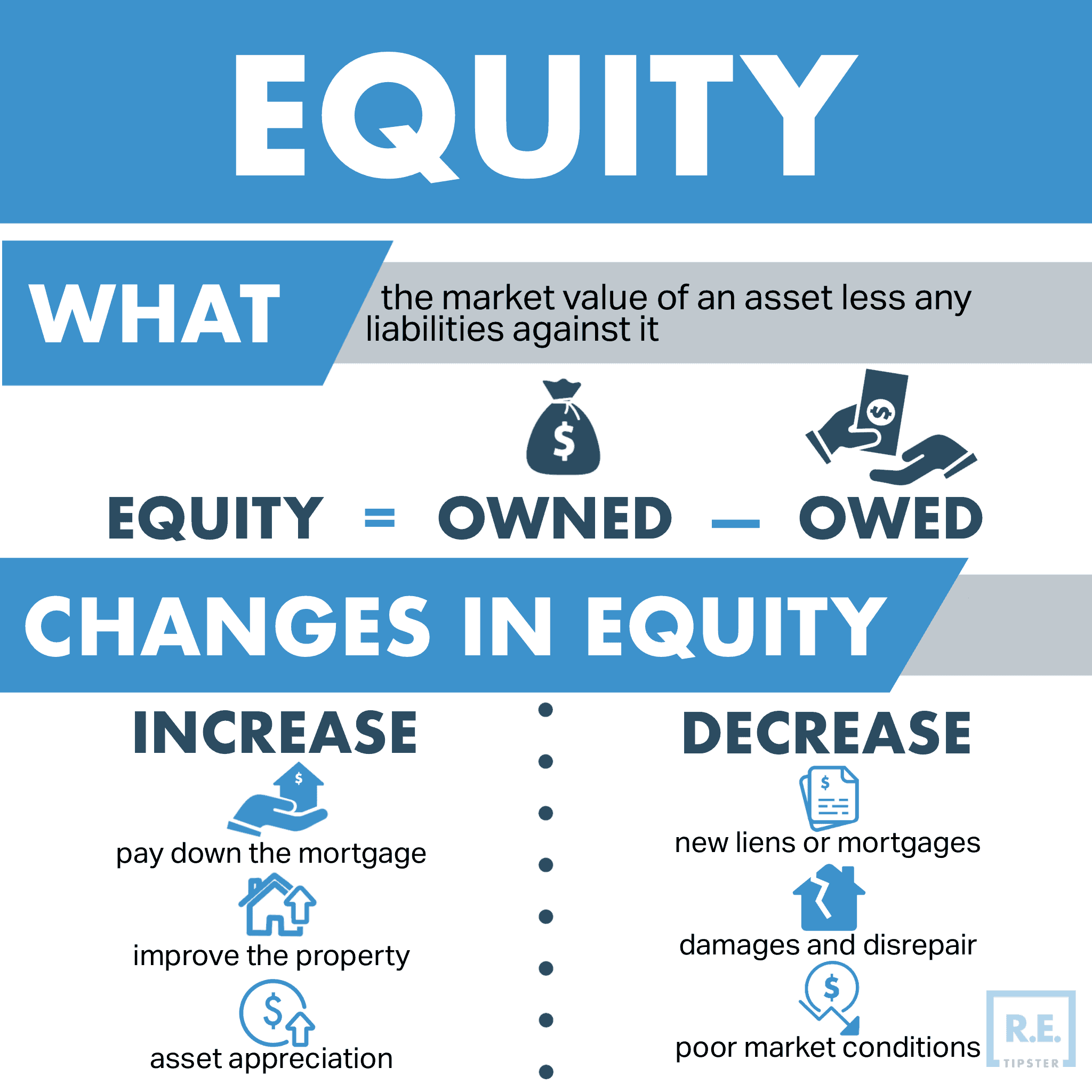

In real estate, equity is the proportion of ownership of property. It can be calculated by the difference between the property’s current market price and the principal still owed on it.

For example, if a person owns a $250,000 house and has a mortgage debt of $150,000, the initial equity is $100,000.

When the owner of this property improves it and drives its value up to $400,000, they are said to have forced equity of up to $150,000 on top of the original $100,000.

Therefore, their total equity after improvements is $250,000.

Typically, equity grows as long as the property owner does not miss a payment. However, external factors like market appreciation may affect its growth or become negative even if the mortgage payments have been made on time and in full[1].

An owner can force equity either by “the sweat of their own brow” (in which case it is called sweat equity) or by hiring a contractor to improve the property.

Equity As a Form of Wealth

Equity is a form of wealth because it represents the level of property ownership.

In the example above, the mortgage borrower owns just 40% of the unimproved property, while the remainder belongs to the mortgage lender.

If the owner forces equity and drives the property value to $400,000, their equity balloons to 62.5%. If the borrower fully pays the mortgage, they will have 100% equity (hence 100% ownership).

Equity is also liquid. For example, an owner can use equity as collateral to borrow cash[2], such as in a home equity loan or a home equity line of credit, with the available funds or credit limit depending on the owner’s equity.

Taking out a home equity loan does not require surrendering the keys to the home; the owner can get instant cash, enjoy no spending restrictions, and continue living in the house at the same time.

In addition, equity can be transferred. For instance, the owner can pass a property they have 100% equity on to their heirs[3], who can do with it as they wish. Even if money is owed, it can be sold to pay off the remaining debt using a portion of the proceeds from the sale. The rest can be distributed among the heirs.

Finally, having equity is advantageous if the property needs to be sold. For example, an owner with a distressed mortgage can sell the property at less than its market value to zero out the debt[4].

How to Build Equity

Building equity happens either actively or passively.

Forced equity is a form of building equity actively.

Meanwhile, real estate investors can build equity passively in the ways described below.

Amortized Equity

Amortized equity is a gradual building of equity[5] by paying down regular payments to the principal balance. In this scenario, equity slowly goes up as the mortgage principal is incrementally paid down.

Note that amortized equity does not distinguish who makes the payments. For example, a landlord may use some (or all) of their tenants’ rent to cover the principal payments.

In the case of interest-only loans, the size of the principal remains the same at first, even if the loan itself is amortized. This is because none of the monthly payments go toward the principal during the initial period. As a result, the equity does not grow during the interest-only period.

Phased Equity

Phased equity happens when a real estate investor buys a property in a new development when the purchase price is still low.

In new developments, developers sell properties in staggered “phases,” with each subsequent phase typically being more expensive than the last.

Market Equity

Market equity is one of the truly passive equity builders. The property value grows simply because the neighborhood the building is a part of has become a hotter real estate market.

Found Equity

A buyer can gain found equity by acquiring a property for less than its worth[6]. This usually happens when the seller does not recognize the house’s full value or has to get rid of the property quickly.

Instant Equity

Instant equity is directly gained after a down payment when buying a house. This is why it is sometimes called purchase equity.

Forced Appreciation vs. Forced Equity

Forced appreciation and forced equity are similar concepts, but forced appreciation is increasing the value of rental property, while forced equity pertains to a person building ownership in their own home.

To force appreciation of a rental property, the landlord can typically raise rent (especially when the existing rent is below market).

However, many jurisdictions impose a cap on rent increases, so some landlords force appreciation by remodeling or renovating the property instead. For example, converting the basement, garage, or attic into an additional bedroom may justify rent increases. Alternatively, turning one oversized bedroom into two average-size ones can be an acceptable reason for a significant rent hike.

Other forced appreciation avenues include curb appeal projects. These efforts can make the property seem more desirable to tenants and homebuyers alike.

Finally, fixing every form of structural damage can boost the property’s value in the marketplace, similar to how an investor uses rehabbing[7]. If the owner is not selling it, a newly renovated property can still generate better cash flow than had it been unimproved.

BY THE NUMBERS: Great curb appeal can increase a property’s value by at least 7%.

Source: The Wall Street Journal

Sources

- Colley, A. (2014.) What to Do When Your Home Is Underwater. realtor.com®. Retrieved from https://www.realtor.com/advice/finance/what-to-do-when-youre-underwater/

- Campisi, N. (2022.) Best Ways To Tap Your Home Equity. Forbes Advisor. Retrieved from https://www.forbes.com/advisor/home-equity/best-ways-tap-home-equity/

- Jones, J. (2021.) Inheriting a House? Here’s What to Expect. LendingTree. Retrieved from https://www.lendingtree.com/home/mortgage/options-when-inheriting-house/

- DeNicola, L. (2021.) How Does a Short Sale Affect Credit? Experian. Retrieved from https://www.experian.com/blogs/ask-experian/how-does-a-short-sale-affect-credit/

- Lewis, H. (2019.) What Is Mortgage Amortization? NerdWallet. Retrieved from https://www.nerdwallet.com/article/mortgages/what-is-mortgage-amortization

- Zillow. (2021.) Should You Ever Sell Your House Below Market Value? Retrieved from https://www.zillow.com/sellers-guide/selling-house-below-market-value/

- Lefton, A. (2020.) Here’s How Much House Flippers Actually Make. Bob Vila. Retrieved from https://www.bobvila.com/slideshow/here-s-how-much-house-flippers-actually-make-53102