What Is Free Cash Flow (FCF)?

REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

Free Cash Flow Explained

Free cash flow (FCF) refers to the working capital, or free cash, leftover in a company’s cash accounts after paying its bills, including interest and taxes. It is called “free” because the money has no immediate obligations and can be spent at the organization’s discretion at the end of the financial year.

The organization can spend this free cash on just about anything, such as new acquisitions, expansions, investments into new ventures, or even dividends to the shareholders.

Generally, the higher the FCF, the more spending power the company has to fund its obligations outside of operating expenses.

The FCF figure provides valuable insight into a company’s financial health and profitability since it removes all non-cash transactions from the income statement. As a result, some investors prefer to use this metric over earnings per share[1] when evaluating a company they want to invest in.

Types of Free Cash Flow

There are two primary types of free cash flow:

Free Cash Flow to the Firm (FCFF)

The FCFF (also known as unlevered free cash flow) measures an organization’s ability to generate cash from its core operations. When calculating FCFF, every line item tallied must reflect only the recurring sale of products or services provided by the company. In short, the everyday operations the company relies on for generating cash. Proceeds that do not come from core operations, such as a one-time asset sale, are left out of the calculation.

The FCFF accounts for all operating expenses (including those related to reinvestments) while excluding outflow to creditors and lenders (such as interest payments).

Free Cash Flow to Equity (FCFE)

Also known as levered free cash flow, the FCFE refers to the cash flow available to the company’s equity shareholders[2]. When a company decides to pay out dividends to its equity shareholders, this is usually where the money comes from.

Alternatively, the company can use the money to finance stock buybacks after accounting for its expenses, including debt payments and reinvestments.

How to Calculate Free Cash Flow

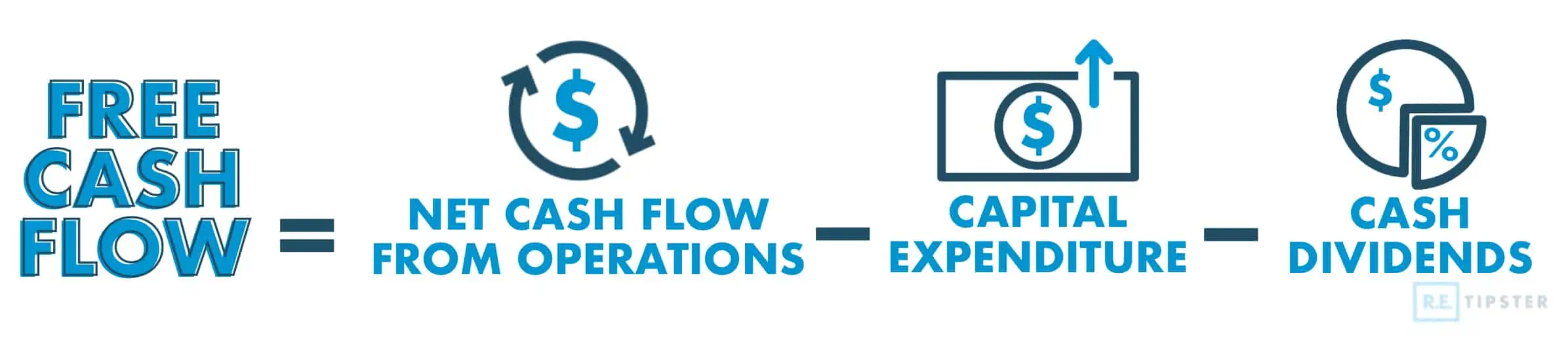

The most common free cash flow formula is:

Here is a quick breakdown of each of these elements.

Net Cash Flow From Operations

This is the amount of income produced by a company from its normal operating activities. It includes any operating expenses incurred in generating revenue, such as the cost of materials and sales-related expenditures.

The net cash flow from operations can usually be found in the topline section of the company’s statement of cash flows.

Capital Expenditure

These are a company’s property, plant, or equipment (PPE) investing activities. Capital expenditures are not cost of sales, but they directly support the sustainability of day-to-day operations.

Cash Dividends

These are cash payments made to shareholders as part of the company’s current earnings or accumulated profits.

The Importance of Free Cash Flow

Calculating free cash flow is an easy way to assess a company’s financial performance. An organization that can generate a high FCF at the end of the accounting period can be deemed financially healthy.

Since cash is king[3], a positive free cash flow may mean that the company still has a lot of spendable cash after deducting its operating expenses and taxes. After all, most operating expenses—salaries, utility bills, equipment purchases, new constructions, and so on—are all paid in cash.

In addition, consistently high FCF figures mean the business benefits from a few things, as follows:

Growth Opportunities

Organizations aiming to scale operations or invest in new ventures can use free cash flow to meet their goals. Moreover, this money is available to the business as operating capital, interest-free.

If a business has no FCF, it will have to raise funds through other sources, such as loans and lines of credit[4], both of which increase the organization’s financial burden through interest payments.

Investor Attractiveness

Consistent free cash flow is a huge beacon for investors. When they see a business with a surplus of cash to spend after taking care of all its bills, it is a sign that it can fund its growth, expand operations, and return value to shareholders.

Couple this with a low-valued share price or any other strong fundamentals, and investors will generally flock to that company.

A Measure of Financial Health

Having a strong FCF can be a solid indicator that the company is financially stable. It is also a key indicator that the organization will remain in business since it has the cash resources to fund non-operation projects.

Planning and Forecasting

Knowing the FCF enables business leaders to plan for future ventures that will improve the business and add to shareholder value. The FCF provides actionable data that can help with forecasting and profitability analyses.

Limitations of Free Cash Flow

- FCF can be subject to manipulation — Companies can boost their FCF for the year by intentionally under-reporting capital expenditure and stretching out their payments, making it look like they still have a lot of cash left. In such instances, the FCF becomes an unreliable metric.

- It is not a one-size-fits-all solution — FCF is just a tool, and it is still up to the investor to make the right forecasts and assumptions about future growth. If their assumption or interpretation is off by just a few percentage points, even a company with solid cash flow statements can end up being a poor investment.

- It does not provide much insight for long-term investing — In the short term, FCF is an invaluable metric that can guide an investor’s decision-making. However, FCF figures provide no insight for long-term investments because far too many variables can impact a company’s financials year-to-year.

Is Negative Free Cash Flow a Bad Thing?

Not necessarily. There are two main reasons a company would report a negative FCF:

1. When the capital expenditures outweigh the cash inflow from operations.

If a company spends more money on acquiring and maintaining its PPEs than the cash it can bring in from its operating activities, there will be a negative FCF. This often applies to businesses in capital-intensive industries, such as energy and auto manufacturing.

2. When operating cash flow is already negative.

If a company reports negative earnings, it cannot be expected to have a positive FCF after adjusting for non-cash expenses.

In any case, a negative free cash flow is not bad in itself. For instance, it can signify that the company has recently made large investments that are expected to pay off in the long run.

What makes a negative FCF bad is if it is consistently poor year-to-year with no sign of recovery. In such instances, it is clear that the company is not likely to remain in business since it regularly lacks sufficient cash to fund its growth and reinvestments.

Takeaways

- Free cash flow (FCF) refers to the cash available to a business after deducting its operating costs and capital expenditures.

- FCF represents the cash that is not otherwise spoken for.

- Therefore, FCF represents cash that the company can use at its discretion, such as non-operation projects, dividend payments, reinvestments, and acquisitions.

- Many investors prefer to use FCF when deciding whether to invest in a company because it removes all non-cash transactions from the income statement.

- Negative FCF is not necessarily a bad thing, especially if the company has recently spent the cash on large investments that can yield healthy returns in the coming years.

Sources

- Fernando, J. (2022). Earnings Per Share (EPS). Investopedia. Retrieved from https://www.investopedia.com/terms/e/eps.asp

- Kennon, J. (2022). What Is Stockholders’ Equity? The Balance. Retrieved from https://www.thebalance.com/shareholders-equity-on-the-balance-sheet-357295

- DiLallo, M. (2022). What Does “Cash Is King” Mean? The Motley Fool. Retrieved from https://www.fool.com/investing/how-to-invest/cash-is-king/

- Bank of America. (n.d.) Understanding Business Lines of Credit. Retrieved from https://www.bankofamerica.com/smallbusiness/business-financing/learn/understanding-business-lines-of-credit/