What is a Statement of Cash Flows?

REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

What Does a Cash Flow Statement Consist Of?

The statement of cash flows is one of three mandatory financial reports that publicly traded companies must file periodically under Generally Accepted Accounting Principles (GAAP)[1]. It has three parts:

- Cash flow from operations, including the sale of goods or services, labor costs, payments to suppliers, tax payments, and miscellaneous operating expenses.

- Cash flow from investments, including the purchase and sale of securities, real estate, equipment, and other long-term assets.

- Cash flow from debt and equity, including borrowing and repaying loans, stock issues and buybacks, and dividend payments.

Of the three primary financial reports, investors and analysts often favor the statement of cash flows because it shows where an organization’s money comes from and how efficiently it is spent. The cash flow statement is essentially a master check register that reconciles the figures reported on the income statement and balance sheet.

How to Read a Cash Flow Statement

Below is a statement of cash flows for AbbVie Inc.,[2] a biopharmaceutical company. The important things to look for are net income (top line), net cash flow (bottom line), and changes from the previous reporting period.

In the example below, which includes the previous five years, the company has shown positive growth in cash flow from operating activities. The variability in investing and financing cash flows reflect the company’s acquisitions during this period. It is possible to determine what business phase a company is in—startup, rapid growth, profitably mature, decline—by comparing the three sections on the statement of cash flows and the net cash flow every year.

Statement of Cash Flows for Real Estate

Cash flow statements in real estate are useful in analyzing income-producing property. There is a direct correlation between net cash flow and return on investment, so investors pay attention to these metrics in analyzing potential investments.

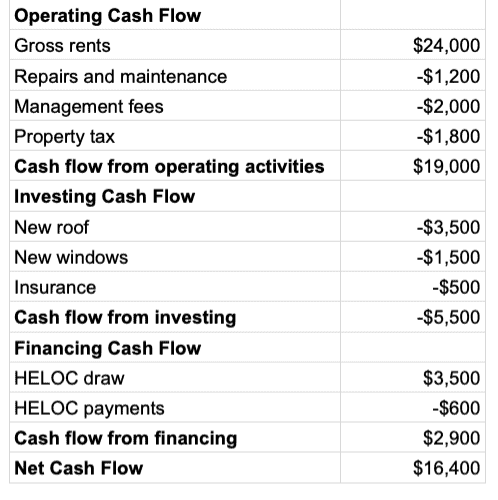

A statement of cash flows for a rental property might look like this:

Categorizing most cash inflows and outflows for rental properties is fairly intuitive. For example:

Operating activities

- Income received from rent and other fees.

- Operating expenses.

- Property tax.

- Repairs.

Investing activities

- Property improvements.

- Expansions.

- Renovations.

Financing activities

- Short-term debt.

- Long-term debt.

- Debt payments.

Depreciation and Statement of Cash Flows

Depreciation—the expensing out of an asset’s cost over its useful lifetime—is a tricky subject in real estate cash flow statements. It is a non-cash expense, but it ultimately affects cash flow by reducing the amount of income taxes paid.

Depreciation is not recorded on the statement of cash flows for an income-producing property. The property itself pays no income tax, which is the only tax affected by depreciation. The property’s tax liability is limited to property tax.

Instead, depreciation is reported in the operating section of the investor’s business statement of cash flows. This is because the individual or the business entity that owns the property pays income tax, so the depreciation and subsequent reduction in tax liability affects the owner’s cash flow, not the building’s.

RELATED: Calculate Depreciation of Your Real Estate Property With Our Depreciation Calculator

Takeaways

The statement of cash flows is one of the three essential financial reports, alongside the income statement and balance sheet. The cash flow statement reconciles the activities reported on the other reports.

Real estate investors pay special attention to cash flow with income-producing properties. Positive cash flow is tied to return on investment[3], so it is important to check the net income, operating cash flow, and net cash flow on a year-over-year basis to verify the investment’s potential.

Sources

- Accounting.com. (2019.) What is GAAP? Retrieved from https://www.accounting.com/resources/gaap/

- MacroTrends. (n.d.) AbbVie Cash Flow Statement 2009-2020. Retrieved from https://www.macrotrends.net/stocks/charts/ABBV/abbvie/cash-flow-statement

- Daibes, V. (2018.) What Is Cash Flow And How Does It Let Real Estate Investors Make Money? Mashvisor. Retrieved from https://www.mashvisor.com/blog/what-is-cash-flow/