Personal Financial Statement Definition

REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

What is a Personal Financial Statement?

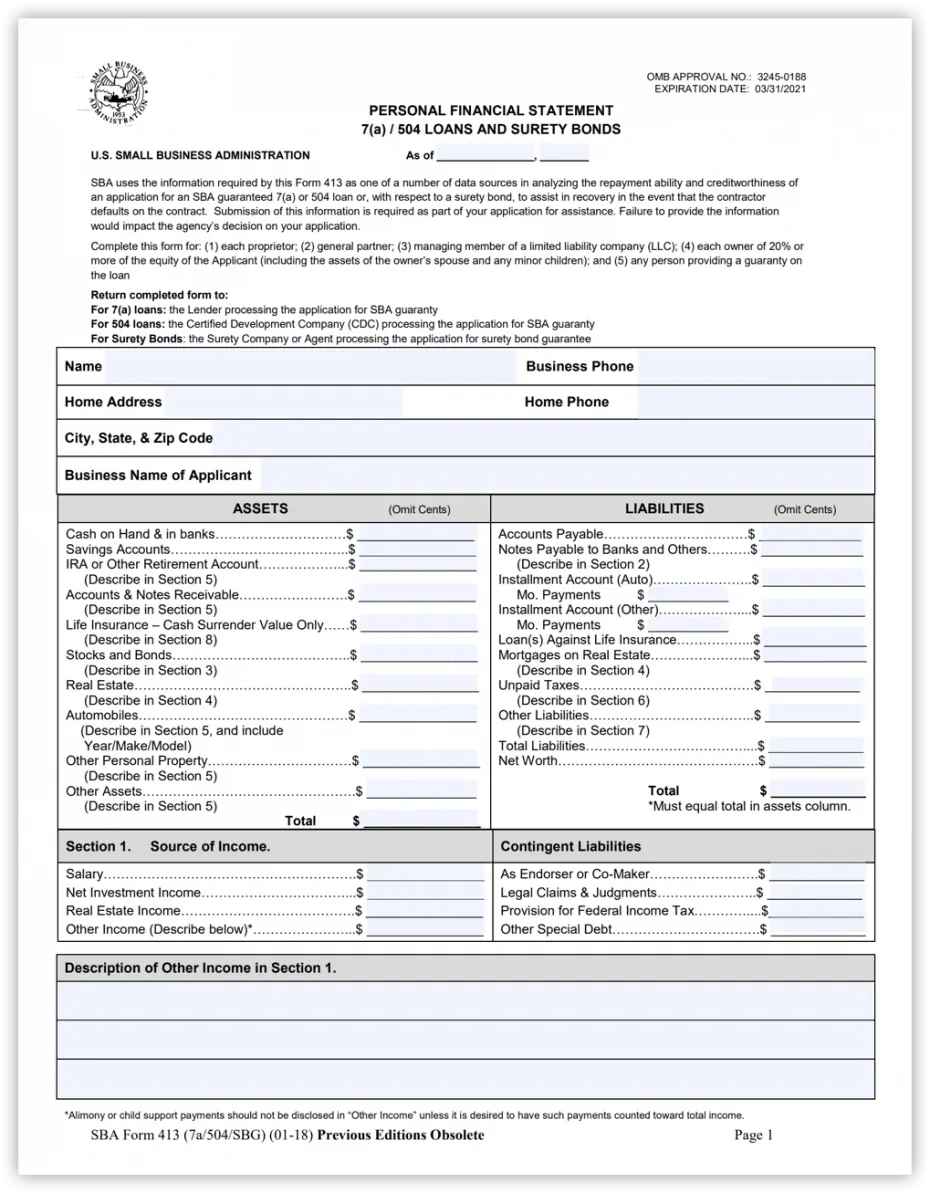

A personal financial statement (PFS) is a document that credit applicants must prepare and submit to prospective lenders, investors, partners, and other entities. The personal financial statement provides a snapshot of an individual’s financial position and net worth at a particular point; it is also useful to track progress toward wealth goals.

The PFS and the schedule of real estate owned (SREO) are two essential documents for real estate investors who want to grow and scale their business. They are typically part of a business plan presentation, supporting a business loan application.

What Goes on a Personal Financial Statement?

Typically, a personal financial statement shows two columns. The numbers on the left are the assets and the numbers on the right are the liabilities. The net worth is listed at the bottom of the right column to balance out the liabilities.

Assets

The assets column details checking, savings, brokerage, and retirement account balances. It should list any real estate owned with values taken from a recent appraisal. If the individual or couple has an equity interest in a business, that information is also listed on the PFS. Some personal financial statement formats also include income, which should match the amount reported on the most recent tax return.

Liabilities

Liabilities include mortgage balances, personal loans, and credit card debt, unpaid personal income, and property taxes. Contingent liabilities, such as loans guaranteed by the individual or couple, should also be listed. If there are other liabilities (such as a legal judgment) that would show up on a public records search, they should also appear on the personal financial statement.

Some people list expenses, expressed as yearly totals, in the personal financial statement, especially if the document is used to support a credit application. Most, however, choose to list income and expenses separately on an income statement.

Not Typically Included

Personal property such as furniture and other household goods are usually not included in the personal financial statement unless they have significant value backed up by an appraisal. Antiques, art, and fine jewelry are examples of personal property that might appear on a personal financial statement.

Sample Personal Financial Statement

There are many different templates available online, but they all follow a very similar format and ask for the same general information. Here is one common example from the U.S. Small Business Administration, required from all prospective borrowers who apply for an SBA loan.

To download an editable version of this form, visit the SBA website.

Tips on Preparing a Personal Financial Statement

With all the different types of assets and liabilities that can be listed on a PFS, here are some best practices to keep in mind when filling out this form.

- Account balances—checking, savings, brokerage—change frequently, so it is not essential to update the PFS each month unless there has been a significant change from the figures on the most current personal financial statement. In most cases, it is acceptable to update the PFS once a quarter, although some people update their financial documents monthly.

- Be sure all liabilities appearing on a credit report are accounted for in the personal financial statement.

- Tax liability[2] should include any unpaid taxes from previous years as well as any payroll taxes for which the individual or couple is personally responsible.

- It is advisable to have supporting documentation for any figure reported on the personal financial statement. Lenders may request this information as part of a loan application.

- For significant assets that can fluctuate in value (real estate, automobiles, etc) or have a subjective value (value of a brand name or other collectibles), it is a good idea to get appraisals to verify and substantiate the value of these assets listed on the PFS.

Most lenders and accountants will be able to identify when the value of an asset needs to be verified by an appraisal.

Where to Download a Personal Financial Statement Template

Individuals can download a personal financial statement template from various sources on the internet. Some apps even create finished documents after the individual enters their values.

Below is a list of blank forms and templates:

- Rocket Lawyer

- FormSwift

- LawDepot

- Corporate Finance Institute

- Small Business Administration

- Score.org

These sites create a personal financial statement based on variables you enter:

Takeaways

The personal financial statement is a detailed statement of assets, liabilities, and other financial details. Along with the statement of real estate owned, the personal financial statement is a key document for lenders in making credit decisions. Individuals can have a PFS prepared by their accountant[3] or download a template online to prepare independently.

Sources

- Corporate Finance Institute. (n.d.) What is a Personal Financial Statement? Retrieved from https://corporatefinanceinstitute.com/resources/knowledge/other/personal-financial-statement/

- Bird, B. (2020.) What Is a Tax Liability? The Balance. Retrieved from https://www.thebalance.com/what-are-tax-liabilities-4159519

- Milazzo, T. (2020.) Why a Personal Financial Statement Matters for a Non-recourse loan. StackSource Blog. Retrieved from https://blog.stacksource.com/why-a-personal-financial-statement-matters-for-a-non-recourse-loan-3e746fa6d44