What are Current Assets?

REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

Difference Between Current Assets and Long-Term Assets

Current assets are usable, expendable, or saleable only in the short term, typically within 12 months or within the normal operating cycle, whichever is less. On a company’s balance sheet, current assets are typically presented at the top, according to their order of liquidity[1]. They are essential to cover the ongoing, day-to-day expenses of a business.

On the other hand, long-term (noncurrent) assets represent fixed assets, which can benefit the company for many years. Examples of long-term assets include land, buildings, vehicles, equipment, patents, copyrights, and long-term investments. Like current assets, long-term assets, and their corresponding purchase prices also appear on the balance sheet.

The Importance of Current Assets

A business continues its everyday operations thanks in part to current assets. The company can use these assets to pay for the costs of daily business operations. Their corresponding value in dollars appears on the balance sheet.

Current assets can be converted into cash within a particular business operating cycle. A business can report the qualifying assets that can be converted at the fair price over the next business operating cycle or a single-year period on the balance sheet[2].

For example, a company can include assets, such as fast-moving consumer goods, that are easy to sell over the following year. By contrast, heavy equipment and land are comparatively difficult to liquidate. A company can thus exclude them from its current assets.

The ratio between current assets and current liabilities is important to creditors because it shows the business’s short-term liquidity[3]. A business is in good standing if its current assets exceed its current liabilities, which means it can meet its obligations within the existing business operating cycle.

Financial Ratios to Analyze Current Assets

The assessment related to liquid assets can include the use of several ratios, such as quick ratio, current ratio, and cash ratio. This use of different financial ratios is due to various business operation attributes, payment cycles, and accounting methods.

Several financial ratios and needed to properly analyze current assets. The measures below can help assess the business’s capability to cover ongoing expenses and pay for liabilities and outstanding debts.

RELATED: How to Pay Off Credit Card Debt Fast

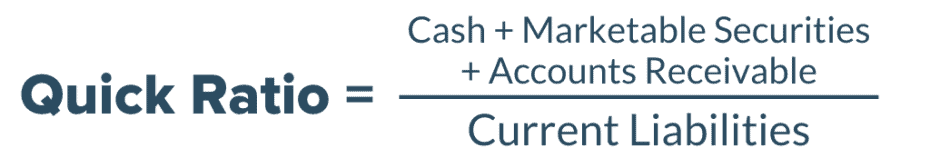

Quick Ratio

The quick ratio analyzes the company’s ability to fulfill its very short-term financial obligations (typically 90 days) using its most liquid assets. Of all a company’s current assets, it only takes accounts receivable, marketable securities, cash, and cash equivalents and divides them against the company’s present liabilities.

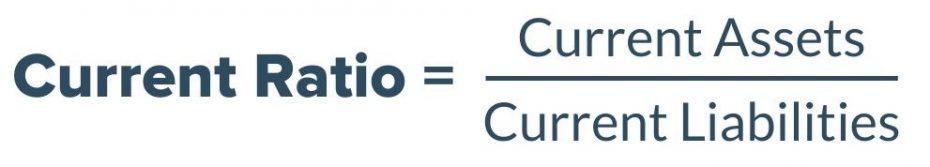

Current Ratio

The quick ratio analyzes the company’s ability to fulfill its short-term financial obligations using its most liquid assets. It takes all of the company’s current assets and divides them by all of the company’s current liabilities. receivable, marketable securities, cash, and cash equivalents against the company’s present liabilities.

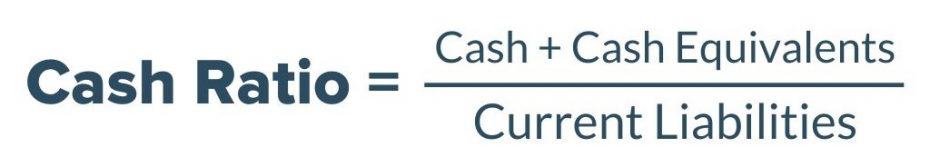

Cash Ratio

The cash ratio analyzes the company’s ability to pay off all of its short-term liabilities immediately. The cash ratio formula takes into account the cash and cash equivalents and divides them by the company’s current liabilities.

A business owner or financial analyst can use these ratios to draw certain conclusions about the financial health of a company and make decisions about how to utilize its current assets within the operating period.

Takeaway

Current assets refer to the assets of a company that are expected to be used, consumed, sold, or expended through regular business operations within a company’s operating cycle (typically one year). They are crucial to keep a business running smoothly and cover its expenses and financial obligations.

Current assets can be used in conjunction with other numbers on the balance sheet to measure the financial position of a company and make important business decisions.

Sources

- Loughran, M. (n.d.). Current and Noncurrent Assets on the Balance Sheet. Dummies.com. Retrieved from https://www.dummies.com/business/accounting/current-and-noncurrent-assets-on-the-balance-sheet/

- Entrepreneur. (n.d.). Balance Sheet. Retrieved from https://www.entrepreneur.com/encyclopedia/balance-sheet

- Lumen Learning. (n.d.). Working Capital. Retrieved from https://courses.lumenlearning.com/boundless-finance/chapter/working-capital/