What Is a Graduated Payment Mortgage (GPM)?

REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

How Does a Graduated Payment Mortgage Loan Work?

A graduated payment mortgage, or GPM, begins with low initial monthly payments due to low interest. Generally, a GPM is more affordable than a conventional home loan[1] at the outset but becomes more expensive as the loan matures.

This amortization schedule structure is attractive for low-income borrowers. Low interest drives down monthly payments, making a GPM more manageable for aspiring homeowners with promising careers.

However, the lender charges less interest early on in exchange for steadily charging a higher rate each year for a predetermined period. After the last year of annual payment graduation, the monthly installment stops rising and stays the same for the remainder of the mortgage loan.

The borrower will continue paying the installments at a higher interest rate until the home loan matures in 15 or 30 years. Alternatively, they can attempt to refinance and get a better deal, depending on market conditions and borrower qualifications[2].

Who Should Consider Graduated Payment Mortgages?

A GPM is a viable option for a borrower with relatively low income but who expects to make more money in the near future. This loan program is also worth considering for people who believe they’ll get a better price on a property now instead of later, despite having to pay more in interest in the long run.

As long as the borrower’s expected income growth exceeds the monthly payment increases, the loan can still be manageable even after its installments have risen. Low initial payments have broad appeal, making it important that borrowers consider the total cost over the life of the loan. Many graduated payment mortgages come with prepayment clauses, ensuring the recipient continues making monthly payments for a fixed number of years.

Graduated Payment Mortgages and the Risk of Negative Amortization

By definition, negative amortization is when a loan amount increases each payment period even if the borrower makes the minimum monthly payments. A graduated payment mortgage may create the risk of negative amortization, although not in all cases.

To clarify this point, it helps to understand how amortization works.

How Fully Amortizing Loans Work

In a fully amortized loan, the monthly payment consists of principal and interest. As long as the borrower makes the required payments on time, the principal balance shrinks after every payment and the loan gets fully paid on schedule[3].

In an interest-only loan, the borrower can pay just the interest for a certain period. Since nothing goes toward the principal, the actual loan amount does not change in the meantime[4].

In a graduated payment mortgage, the total payment increases each year during the graduation period. When the minimum required amount is less than the increased payment due to graduation, this can create a negative amortization loan (assuming the borrower only pays the minimum amount). In short, when the payment does not fully cover the interest portion of the scheduled installment, the result is negative amortization[5]. As a result, the unpaid interest is deferred and added to the principal balance, increasing the loan amount.

Fortunately, the increased mortgage payments do not rise indefinitely. Most GPMs cease graduation after five or 10 years. Therefore, a negatively amortizing graduated loan eventually becomes a fully amortized loan.

Nevertheless, a period of negative amortization makes a GPM more expensive for the borrower. Not only does it guarantee that the scheduled installments will be higher in the future, but it also keeps the size of the loan amount more or less the same for many years. If the borrower cannot bring a mortgage’s principal balance down, the result may be an upside-down mortgage[6].

What Are the Disadvantages of a Graduated Payment Mortgage?

GPMs have a number of drawbacks, including the following.

High Total Cost

Compared to conventional mortgages, GPMs are more expensive overall. In exchange for the convenience and ease of loose lending requirements, the borrower has to pay more interest over the course of the loan. A graduated payment borrower has to deal with substantial mortgage insurance premiums as well[7].

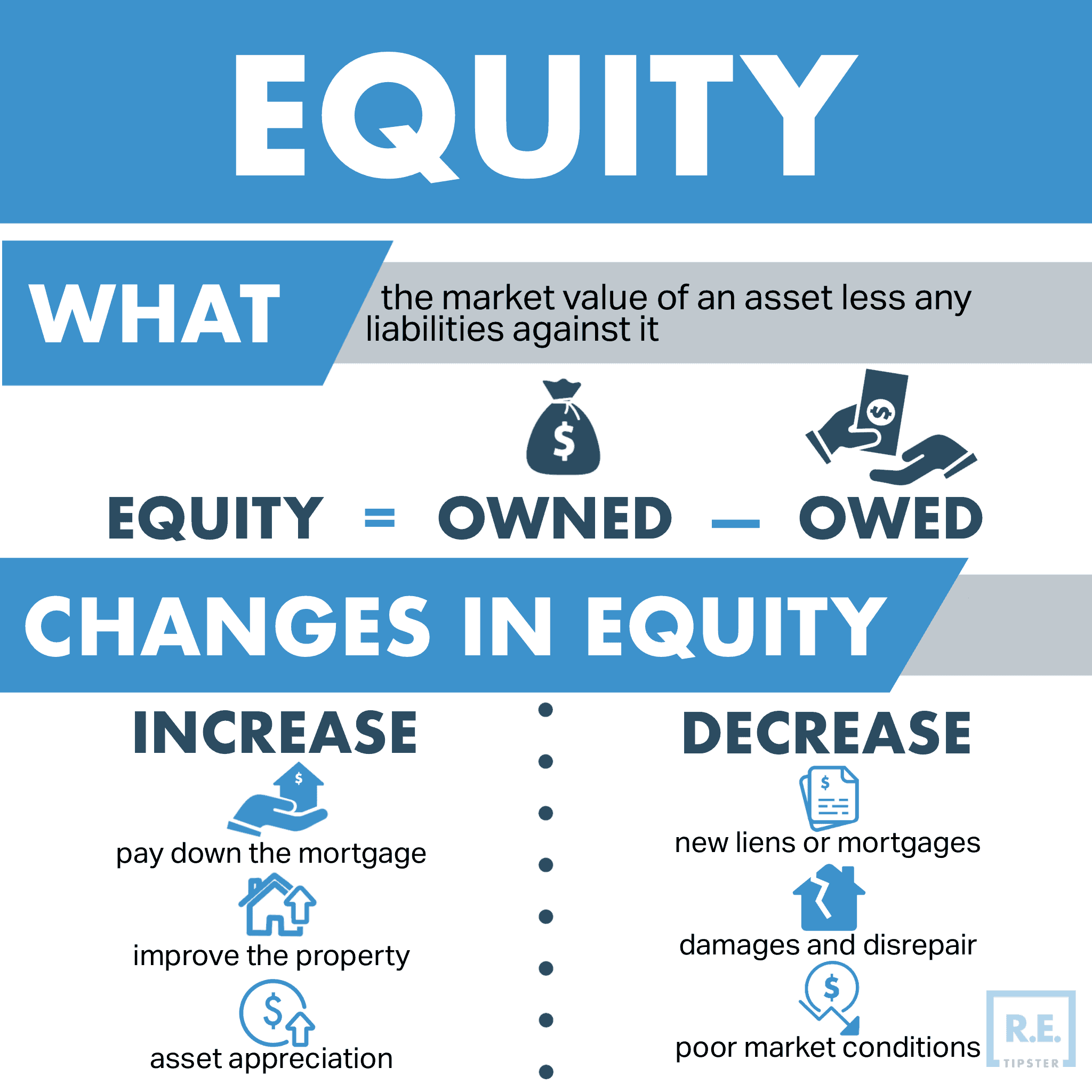

Slow Equity Accumulation

Home equity grows through property appreciation and/or regular mortgage principal reduction. Since this mortgage payment system is not useful for paying down the loan amount quickly[8], the borrower cannot build equity at the rate of other more traditional mortgages.

Possible Prepayment Penalty

Some graduated payment mortgage contracts have a prepayment clause[9], which defines the amount the borrower has to shoulder for paying the loan off ahead of schedule through refinancing or other means[10]. This effectively discourages the borrower from zeroing out the principal balance early, which would negatively affect the lender’s bottom line.

Risk of Future Unaffordability

A GPM is predicated on the borrower’s income rising alongside the loan’s payment graduation. However, betting on something as uncertain as future earnings is extremely risky. Any number of economic factors can disrupt a person’s income, potentially leaving a borrower with an unmanageable home loan.

Graduated Payment Mortgage vs. Growing Equity Mortgage

A graduated payment mortgage and growing equity mortgage (GEM) are similar, but with certain notable differences.

In terms of similarities, both feature gradual monthly payment increases. They are also FHA loans, as loan programs under Section 245(a) of the Federal Housing Administration.

However, GPMs and GEMs become more expensive as time passes for different reasons.

A GPM’s monthly payments can climb by 2.5%, 5%, or 7.5% a year for the first five years or by 2% or 3% a year for the first 10 years. Meanwhile, a GEM’s scheduled installments can go up by 1%, 2%, 3%, 4%, or 5% a year after the initial year.

A GPM is designed to create additional income for the lender, but a GEM is designed for borrowers to build equity much more quickly[11]. The extra amount added to the GEM’s monthly payments goes toward the principal.

The higher equity the borrower has in the property, the more opportunities for a borrower to acquire better debt. For example, home equity loans, home equity lines of credit, and cash-out mortgage refinance[12] are the three major types of credit a GEM borrower can access.

Plus, if the owner does not borrow against the property at any point during a GEM’s repayment period, they could pay off the home loan in 15 years instead of the usual 30.

Takeaways

- A graduated payment mortgage is a fixed-rate FHA home loan in which monthly payments incrementally rise for the first five or 10 years.

- GPMs are for low-income borrowers who expect to earn more money in the future and want to finance a house now instead of later.

- Graduated payment mortgages have several downsides, including high total cost and a great risk of becoming unaffordable. They can also put the borrower at risk of negative amortization.

Sources

- Consumer Financial Protection Bureau. (2017.) What is a conventional loan? Retrieved from https://www.consumerfinance.gov/ask-cfpb/what-is-a-conventional-loan-en-117/

- Yale, A. (2021.) Here’s What You Need to Know About Refinancing an FHA Loan. Credible. Retrieved from https://www.credible.com/blog/mortgages/refinance-fha-loan/

- Gogol, F. (2020.) Fully Amortized Loan vs. Partially Amortized Loan. Stilt. Retrieved from https://www.stilt.com/blog/2019/12/fully-amortized-loan-vs-partially-amortized-loan/

- Fay, B. (2020.) Interest-Only Mortgages. Debt.org. Retrieved from https://www.debt.org/real-estate/mortgages/interest-only/

- Corporate Finance Institute. (2020.) What is Negative Amortization? Retrieved from https://corporatefinanceinstitute.com/resources/knowledge/credit/negative-amortization/

- Colley, A. (2015.) What Is an Upside-Down Mortgage? realtor.com®. Retrieved from https://www.realtor.com/advice/finance/what-is-upside-down-mortgage/

- The Lenders Network. (2021.) FHA Mortgage Insurance Premium Chart. Retrieved from https://thelendersnetwork.com/fha-pmi-mip-chart/

- Zillow. (2021.) How to Calculate Home Equity. Retrieved from https://www.zillow.com/sellers-guide/what-is-home-equity/

- Rocket Mortgage. (2021.) Prepayment Penalty: What It Is And How To Avoid It. Retrieved from https://www.rocketmortgage.com/learn/prepayment-penalty

- Lake, R. (2021.) 5 Mistakes to Avoid When Paying Off Your Mortgage Early. SmartAsset. Retrieved from https://smartasset.com/mortgage/mistakes-to-avoid-when-paying-off-your-mortgage-early

- Lewis, M. (2017.) 6 Ways to Build Your Home Equity (and Savings) Faster. NerdWallet. Retrieved from https://www.nerdwallet.com/article/mortgages/6-ways-to-build-your-home-equity

- Geffner, M. (2021.) Home equity loan or HELOC vs. cash-out mortgage refinance. Bankrate. Retrieved from https://www.bankrate.com/home-equity/home-equity-loan-heloc-or-cash-out-refi/