What Are Hard and Soft Credit Inquiries?

REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

Shortcuts

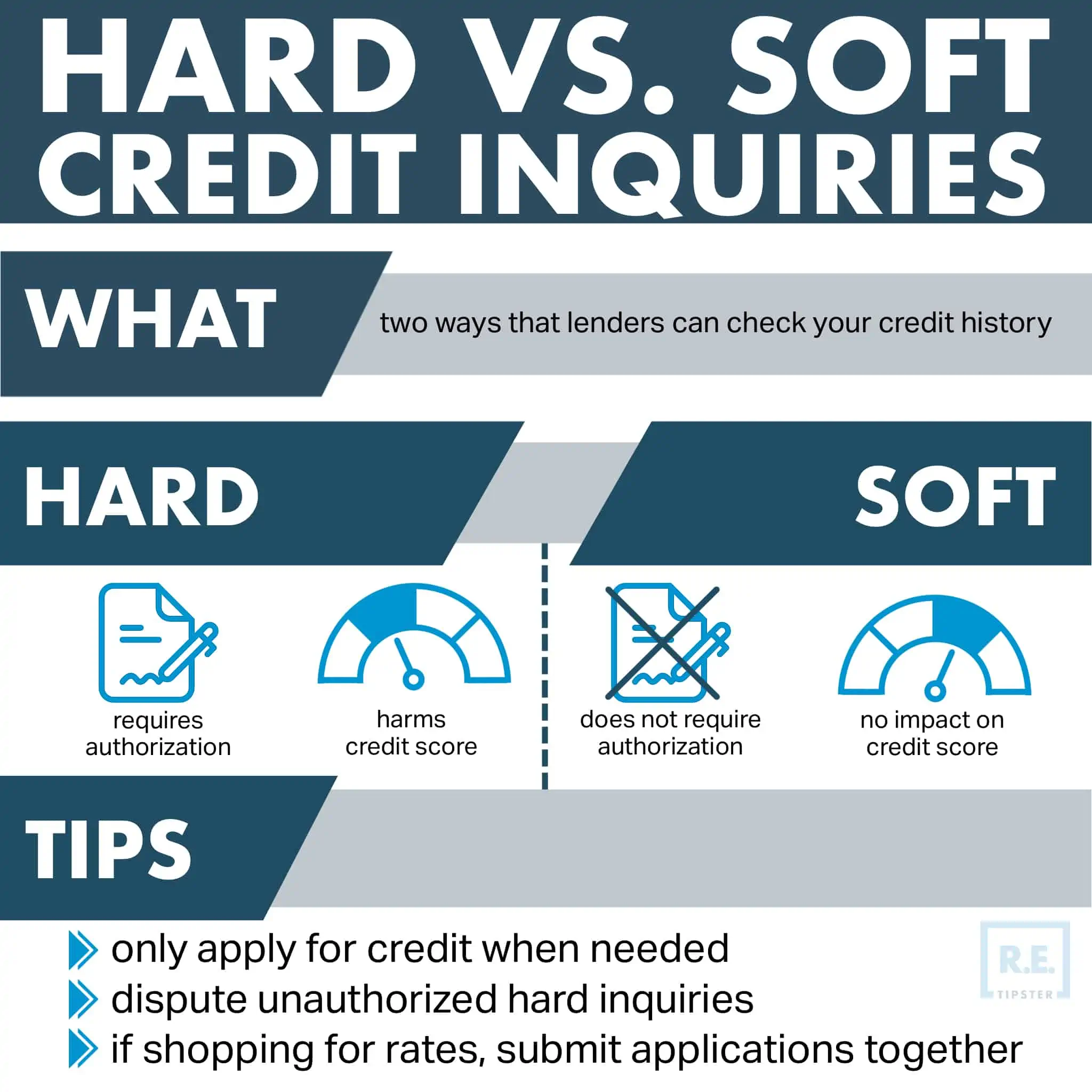

- A credit inquiry or a credit check is a request to access an individual’s credit information.

- It comes in two types: hard credit inquiries (“hard pulls”) and soft credit inquiries (“soft pulls”).

- Hard pulls are initiated when applying for credit and can impact credit scores, while soft inquiries do not.

- Multiple hard inquiries within a short period can raise concerns about creditworthiness and lower credit scores.

- Soft inquiries are non-invasive and typically occur during background checks or credit monitoring.

- Understanding the distinction between hard and soft credit inquiries is crucial for maintaining a healthy credit profile.

What Are Credit Inquiries For?

When individuals apply for credit, lenders often initiate credit inquiries to gather information about their financial history and evaluate the associated risks.

Credit inquiries play a vital role in finance as well as raising capital for investing as they help lenders assess an individual’s creditworthiness and determine their ability to repay loans.

Two primary types of credit inquiries exist: hard credit inquiries (“hard pull”) and soft credit inquiries (“soft pull”). Understanding these differences is crucial to maintain a healthy credit profile.

What Is a Hard Credit Inquiry?

A hard credit inquiry or a hard pull happens when a lender or creditor reviews an individual’s credit report as part of the application process for new credit. It is typically initiated when individuals apply for a mortgage, auto loan, credit card, lines of credit, and similar financial products[1].

A hard inquiry aims to assess the individual’s creditworthiness, debt management, and overall financial responsibility. When a hard inquiry is made, it becomes a record on the individual’s credit report.

Impact on Credit Score

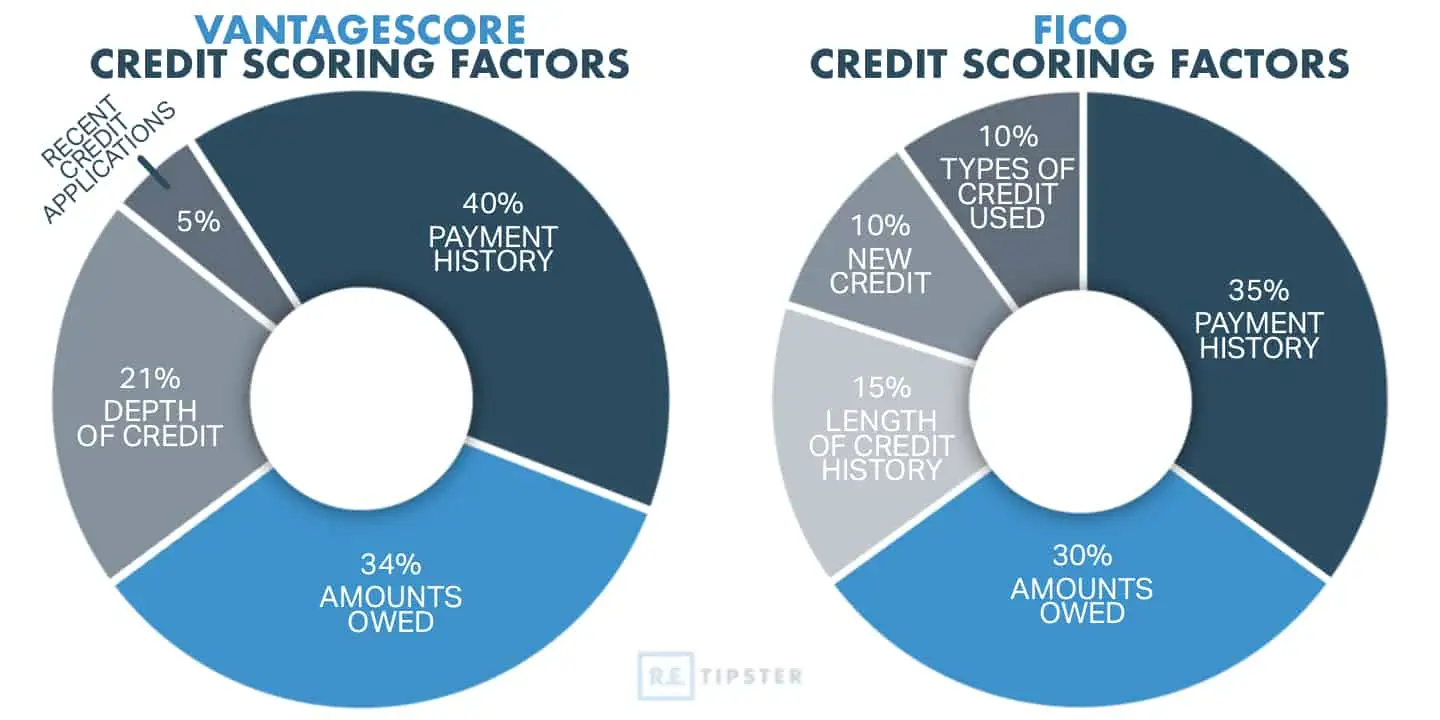

Each hard pull typically deducts a few points from your credit score; in FICO®, the score deduction is about five points per hard inquiry[2].

In addition, multiple hard inquiries within a short period can raise concerns about the individual’s creditworthiness, potentially leading to a lower credit score. Lenders view more than six hard pulls in a short timeframe a sign of increased credit risk[3].

A hard pull is a drop in the bucket of your credit score compared to how you utilize your credit.

That said, the impact of hard inquiries on the credit score is relatively small compared to other factors, such as payment history and credit utilization.

How to Minimize Hard Credit Inquiries

To minimize the number of hard credit inquiries, individuals should be selective and apply for credit only when necessary. Researching and comparing different lenders and loan offers before submitting applications is advisable.

Rate shopping[4], or shopping around for credit within a specific timeframe (typically ranging from 14 to 45 days), allows multiple inquiries to be treated as a single inquiry.

This practice helps protect your credit score from being significantly affected by numerous inquiries related to the same type of credit.

It’s worth mentioning that certain inquiries, such as those made by individuals for their own credit checks or by employers during background checks, are considered soft inquiries[5]. These don’t impact credit scores.

Examples of Hard Credit Inquiries

An example of a hard credit inquiry occurs when a borrower applies for a mortgage. In this case, the lender performs a hard pull to review the applicant’s credit report, assessing their creditworthiness and determining the applicable interest rate and loan terms.

Applying for a home equity line of credit (HELOC) also allows a lender to make a hard pull[6] on your credit profile.

Similarly, when applying for an auto loan or a credit card, the lender will initiate a hard inquiry to evaluate the individual’s creditworthiness and determine the risk of extending credit.

What Is a Soft Credit Inquiry?

A soft credit inquiry, also known as a soft pull or soft inquiry, is a credit inquiry that doesn’t impact an individual’s credit score. It is typically initiated for background checks, pre-approved credit offers, or personal credit checks.

Unlike hard inquiries, soft inquiries aren’t visible to lenders and won’t affect their decision-making when evaluating credit applications.

Impact on Credit Score

Soft credit inquiries have no significant impact on an individual’s credit score.

Since they aren’t associated with credit applications, they’re considered less invasive. Even if multiple soft inquiries occur within a short span, they’re usually harmless regarding one’s credit score.

Soft inquiries provide individuals with information about their credit standing without penalizing them[7] for exploring credit options or monitoring their own creditworthiness.

Examples of Soft Credit Inquiries

An example of a soft credit inquiry happens when you check your credit scores through credit monitoring services. These services often use soft inquiries to retrieve credit information from credit bureaus without affecting your credit score.

Another example of a soft inquiry is when employers conduct background checks during hiring. Employers may perform soft inquiries to verify applicants’ financial history and assess their reliability and trustworthiness.

Note that employers receive a redacted copy of your full credit report for privacy purposes[8]. For example, they won’t be able to see information about your race or ethnicity, but they will see your credit accounts and payment history.

Additionally, individuals may receive pre-approved credit offers from credit card companies and lenders. These offers are often the result of soft inquiries made by the credit issuer to determine whether the individual meets their pre-qualification criteria. Pre-approved offers allow individuals to explore credit options without impacting their credit scores.

Keep in mind that pre-approval does not guarantee final approval or favorable terms. Moreover, a preapproval can become a hard pull on your credit report if you end up applying for the offered loan or line of credit[9].

In any case, experts recommend monitoring your credit scores[10] to detect potential errors or fraudulent activities in your credit. It also lets you know what lenders can see and take proactive steps to address them.

Credit Inquiries FAQs

Here are some frequently asked questions about hard and soft credit inquiries:

Can hard inquiries be removed from a credit report?

Hard inquiries cannot be removed from a credit report if they are legitimate and initiated by a lender or creditor. Additionally, while hard pulls generally stay on your credit report for only two years at most, the far-reaching consequences of a hard inquiry may persist long after that[11].

However, if you notice unauthorized hard inquiries or errors on your credit report, you can dispute them with the credit reporting agencies to have them investigated and potentially removed.

Do soft inquiries require permission from the individual?

Soft inquiries don’t require explicit permission from the individual[12]. Credit monitoring services, employers during background checks, or lenders for pre-qualification purposes can initiate these credit inquiries.

However, individuals can authorize soft inquiries by granting permission to specific organizations or individuals.

Do hard inquiries affect all types of credit scores equally?

Yes, hard inquiries can impact all types of credit scores, including FICO scores and VantageScore®.

However, the precise impact may vary depending on the scoring model and the individual’s overall credit history. For example, VantageScore puts a hard inquiry under its “less influential” category (compared to other factors like payment history)[13].

Do hard inquiries affect credit scores differently for mortgage applications than credit cards?

Hard inquiries can impact credit scores similarly, regardless of the type of credit being applied for.

However, some credit scoring models may treat multiple inquiries within a short period for the same type of credit, such as a mortgage or an auto loan, as a single inquiry to account for rate shopping. This is not typically the case for credit card applications[14].

Sources

- What Are Inquiries On Your Credit Report? (n.d.) Experian. Retrieved from https://www.experian.com/blogs/ask-experian/credit-education/report-basics/hard-vs-soft-inquiries-on-your-credit-report/

- How long do hard inquiries stay on your credit report? (2022, September 13.) CapitalOne. Retrieved from https://www.capitalone.com/learn-grow/money-management/how-long-do-hard-inquiries-stay-on-credit-report/

- Credit Checks: What are credit inquiries and how do they affect your FICO® Score? (n.d.) myFICO. Retrieved from https://www.myfico.com/credit-education/credit-reports/credit-checks-and-inquiries

- George, D. (2023, February 22.) What Is Rate Shopping, and How to Do It Right. The Motley Fool. Retrieved from https://www.fool.com/the-ascent/personal-finance/what-is-rate-shopping-how-to-do-it-right/

- Why Employers Check Credit — and What They See. (2022, December 2.) NerdWallet. Retrieved from https://www.nerdwallet.com/article/finance/credit-score-employer-checking

- Langone, A., Watt, K. (2023, March 29.) How Does a HELOC Affect Your Credit Score? CNET Money. Retrieved from https://www.cnet.com/personal-finance/home-equity/advice/how-does-a-heloc-affect-your-credit-score/

- How to Perform a Soft Credit Check and See Your Credit Score. (2021, February 3.) Credit.com. Retrieved from https://www.credit.com/blog/request-your-credit-score-it-wont-hurt-credit/

- Push, A., Kirkham, E. (2022, July 29.) Credit Check for Employment: Can Employers See my Score? LendingTree. Retrieved from https://www.lendingtree.com/credit-repair/can-employers-check-your-credit/

- Rafter, D. (2023, March 31.) Does Getting Preapproved Hurt Your Credit? Rocket Mortgage. Retrieved from https://www.rocketmortgage.com/learn/does-getting-preapproved-hurt-your-credit

- Why Should I Check my Credit Reports and Credit Scores? (n.d.) Equifax Knowledge Center. Retrieved from https://www.equifax.com/personal/education/credit/report/why-check-your-credit-reports-and-credit-score/

- Axelton, K. (2020, July 5.) How Long Do Hard Inquiries Stay on Your Credit Report? Experian. Retrieved from https://www.experian.com/blogs/ask-experian/how-long-do-hard-inquiries-stay-on-your-credit-report/

- Thangavelu, P. (2022, September 9. ) Can anyone check my credit without permission? Bankrate. Retrieved from https://www.bankrate.com/personal-finance/credit/check-credit-without-permission/

- DID YOU KNOW: Which inquiries can impact your credit scores? (n.d.) VantageScore. Retrieved from https://www.vantagescore.com/newsletter/did-you-know-which-inquiries-can-impact-your-credit-scores/

- Staples, A. (2023, March 24.) Not all hard inquiries are created equal — you might want to wait before applying for another credit card. CNBC. Retrieved from https://www.cnbc.com/select/difference-between-loan-and-card-hard-inquiries/