What Is a Mortgage-Backed Security?

REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

How Do Mortgage-Backed Securities Work?

When a borrower wants to buy a house, they go to a lender (such as a bank) to apply for a mortgage loan. At this point, lenders can do two things with the mortgage loan. One is to keep the loan in their portfolio and earn money from repayment of the principal and interest on that loan. Another is to sell that mortgage loan to another lender or institution and use the proceeds from this sale to originate another loan.

Institutions that buy these mortgages then bundle several mortgages together based on specific characteristics, such as maturity or interest rate, then sell a portion of the loan payments to investors in the secondary market. The issuer of an MBS guarantees the payment of the interest and the principal to the investor.

While many establishments can buy mortgage loans, the two most common are the government-sponsored enterprises (GSEs) and the Government National Mortgage Association (GNMA, or Ginnie Mae). The Federal National Mortgage Association (FNMA or Fannie Mae) and the Federal Home Loan Mortgage Corporation (FHLMC or Freddie Mac) are two examples of a GSE. A securities firm might also collateralize a new MBS.

Mortgage-backed securities share similarities with other instruments, including stocks, bonds, and mutual funds. An MBS has a value linked to the underlying asset, which means its own security depends on the security of the pool of mortgages backing it. Should a borrower default on a mortgage bundled in an MBS, it would affect the quality of that security.

What Are the Differences Between Ginnie Mae, Fannie Mae, and Freddie Mac?

Ginnie Mae is a corporation wholly owned by the U.S. government, while Fannie Mae and Freddie Mac, both GSEs, are federally chartered, privately owned corporations. All three issue mortgage-backed securities, with slight differences.[1]

Fannie Mae typically buys mortgages from bigger banks and lenders, while Freddie Mac does the same for smaller ones, like rural banks. One similar thing between the two is that they buy conventional loans, which are not insured by the government.

By contrast, Ginnie Mae only deals with government-insured mortgages. An MBS issued by Ginnie Mae is backed by the “full faith and credit” of the government of the United States. Therefore, even if a borrower defaults on a government-insured mortgage that Ginnie Mae has sold to an investor as an MBS, the government still guarantees payment to the investor.

Some have argued that the distinction is outdated, as the federal government rescued Fannie Mae and Freddie Mac anyway during the 2008 financial crisis. As such, the government partly guaranteed payment to Fannie Mae and Freddie Mac investors.[2]

A private firm can also issue an MBS. This is called a “private label” MBS. The credit rating and creditworthiness of an issuing homebuilder, financial institution, or a subsidiary of an investment bank are likely to be lower than those of a GSE or Ginnie Mae.

What Are the Types of Mortgage-Backed Securities?

The simplest type of MBS is the pass-through MBS. Repayments made on the loan are “passed through” to the investors thanks to its structure as a trust. However, it does come with a maturity date; 5, 15, and 30 years are typical, although the actual maturity can be shorter than stated.

The second type is the collateralized mortgage obligation (CMO). Unlike typical pass-through MBSs, a CMO is a slice, or tranche, of mortgage loans categorized by risk. The investor commonly receives the interest and principal cash flow from a pool of like-featured assets. Each tranche operates with its own rules (such as maturities and principal vs. interest payments). The riskier the tranche, the higher its interest rates and vice versa, so investors typically prefer riskier tranches.

RELATED: Learn How to Calculate PITI (Principal, Interest, Taxes, and Insurance) for Your Home Loan

What Are the Benefits of Mortgage-Backed Securities?

Mortgage-backed securities are attractive to many investors because they offer some benefits:

- Monthly cash flow. While the payment may vary from month to month because it is made up of the interest and the principal, investors still receive their payments every month. Whatever amount is left of the principal in the underlying mortgage pool dictates how much interest is paid.

- Higher yields. Thanks to the risky nature of an MBS cash flow as well as its lower liquidity when compared to Treasuries of comparable maturities, mortgage-backed securities have historically yielded higher returns.

- Geographic diversification. Weaknesses in the housing industry in one part of the country may be offset by the strengths of the other mortgages in the mortgage pool.

- Higher credit quality. Many investors consider MBSs to have better credit quality than corporate bonds and other bond types. This is because of the underlying pool of mortgages that collateralize them. MBSs issued by Ginnie Mae have the same implied rating as U.S. Treasuries, and they also enjoy the backing of the U.S. government. Fannie Mae and Freddie Mac may not have the same backing, but they are still highly rated.

What Are the Risks of Mortgage-Backed Securities?

As an investment solution, a mortgage-backed security does come with its share of risks.

- Interest rate. It is possible that investors are exposed to a greater interest rate risk with MBSs than with other bonds. Bond prices in the secondary market generally go up when interest rates go down and vice versa. The secondary market price of an MBS, however, can experience a lower rise than other bonds as interest rates decline due to prepayment and extension risks.

- Prepayment. A homeowner can refinance a mortgage, thereby paying it in full, or make monthly payments higher than what the mortgage requires. This is why the projected maturity of some mortgages is shorter. This shortens the average life of the bond as its principal declines quickly. In effect, the cash flow goes down, and the quoted yield is merely an estimate[3].

- Extension. While some homeowners will make prepayments, others might not. Rising interest rates do not give homeowners an advantage if they refinance their fixed-rate mortgages. This can lower the principal repayment, so when the interest rates rise, MBSs’ declining prices are accentuated.

- Credit and default. Ginnie Mae-backed MBSs generally have a low risk of default, while Fannie Mae and Freddie Mac-issued MBSs have moderate risk. MBSs issued by a financial institution not backed by any of these agencies carry a higher risk of default, especially if they have questionable credit.

- Liquidity. Particularly in a CMO, liquidity can be affected by each tranche’s characteristics, which are often unique from the characteristics of the others in the same pool. Other factors and levels of risk can also affect liquidity, including either the lack of or presence of backing from a GSE.

What Role Did Mortgage-Backed Securities Play in the 2007-2008 Financial Crisis?

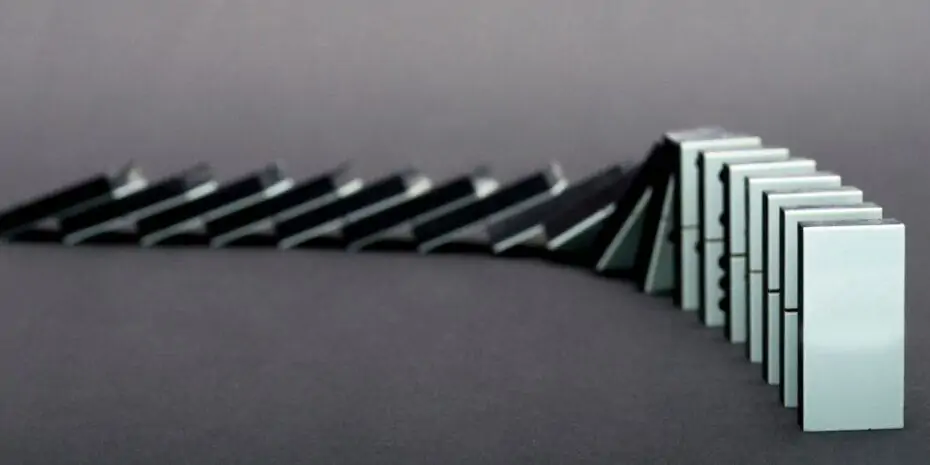

The aggressive creation of subprime mortgages in 2007-2008[4] resulted in the financial crisis that affected the United States, then later to other countries in cascading, domino-like effect. Subprime mortgages steadily grew in number as the government put pressure on lending institutions to finance the mortgages of borrowers considered a higher credit risk. Lending institutions created mortgages that eventually defaulted as borrowers failed to pay.

While the institutions responsible for creating massive amounts of mortgage-backed securities were regulated by the federal government, no laws were in place to directly regulate MBSs themselves. Financial institutions sold mortgages immediately after creating the loans to get their money quickly. This offered no protection for the investors who bought MBSs, which meant they could not get their money when the mortgages defaulted.

Even non-bank institutions were attracted to the increase in popularity of mortgage-backed securities. As the market became saturated with MBSs issued by such institutions, the more traditional and trustworthy lending firms had no choice but to lower their credit standards so they could compete.

Fannie Mae and Freddie Mac issued a steady rise of mortgage-backed securities to support the high demand. The more MBSs were created, the lower their quality fell, and the higher their risk rose. Mortgage borrowers began to default on their payments, which led to a collapse in the market. The U.S. economy was hit hard by losses amounting to trillions of dollars.

Takeaways

A mortgage-backed security (MBS) is a bond collateralized by an asset, in this case, mortgage loans bundled together and issued by Ginnie Mae or, more commonly, GSEs like Fannie Mae and Freddie Mac to investors in the secondary market. When borrowers repay these loans, the cash passes through the MBS to the investors, thus creating monthly income.

Mortgage-backed securities are presumed to have played a significant role in the 2007-2008 financial crisis because subprime mortgage loans defaulted, leading to trillions of dollars in losses. However, with federal backing, MBSs are still popular instruments for investment primarily because investors can enjoy higher yields, monthly payments, and geographic diversification. That said, MBSs do come with some risks, including credit and default and prepayment risks, which can lead to shorter bond life and inconsistent monthly payment amounts.

Sources

- Hernandez, A., Schader, S. (2016, Washington, D.C.) The Differences Between Ginnie Mae and the GSEs and Why It’s Important. Success Stories: 2016 Ginnie Mae Summit. Retrieved from https://www.ginniemae.gov/issuers/issuer_training/Summit%20Documents/gnma_gse_differences.pdf

- Johnson, K. (2019.) Fannie, Freddie government guarantee should be limited: U.S. housing finance chief. Reuters. Retrieved from https://www.reuters.com/article/us-usa-housing-financing-idUSKCN1TE2ZA

- Corporate Finance Institute. (n.d.) What is Prepayment Risk? Retrieved from https://corporatefinanceinstitute.com/resources/knowledge/finance/prepayment-risk/

- Amadeo, K. (2020.) Subprime Mortgages, Their Types, and Impact on the Economy. The Balance. Retrieved from https://www.thebalance.com/what-is-a-subprime-mortgage-3305965