What Is a NAICS Code?

Shortcuts

- NAICS codes are used to determine which industries businesses should belong to.

- NAICS, the North American Industry Classification System, replaces the Standard Industrial Classification (SIC).

- American, Canadian, and Mexican governments developed NAICS codes to collect, analyze, and uniformly publish statistical data regarding business.

- NAICS codes can also help lenders and insurers identify high-risk businesses.

What Does a NAICS Code Mean?

NAICS stands for the North American Industry Classification System.

The American, Canadian, and Mexican governments have jointly developed it to collect, analyze, and publish business data uniformly[1]. This way, major North American countries can easily evaluate and compare statistical data relating to their economies.

NAICS replaced the Standard Industrial Classification (SIC) system as a standard in 1997[2]. Although government entities like the Securities and Exchange Commission still use SIC codes[3], the SIC code system is being phased out.

NAICS Codes are subject to review every five years to re-categorize existing businesses and incorporate emerging industries into the NAICS classification system. Every year ending in 2 or 7, the Economic Classification Policy Committee of the White House’s Office of Management and Budget solicits proposals from the public, studies all suggestions, and consults its Canadian and Mexican counterparts to finalize the recommended changes to the NAICS manual.

Elements of a NAICS Code

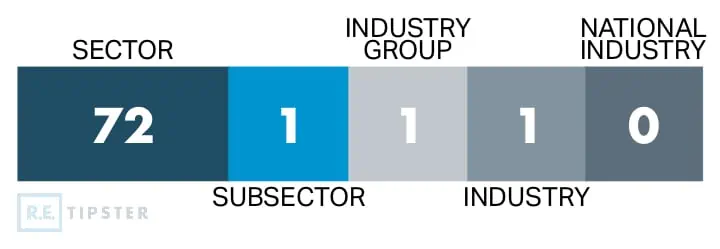

A NAICS Code could be up to six digits. The more digits there are, the more detailed the business classification is.

Here is a breakdown of the digits in a NAICS Code.

The first two digits pertain to the economic sector: construction, finance and insurance, real estate and rental and leasing, and accommodation and food services.

The third digit refers to the sub-sector, while the fourth specifies the industry group. For instance, lessors of real estate and offices of real estate agents and brokers are under the real estate and rental and leasing sector.

The fifth digit represents the NAICS industry. It rounds up the coding system that the U.S., Canada, and Mexico have agreed to follow.

The sixth one is optional, so some NAICS Codes only have five digits. It is reserved for the national industry, which is like a subdivision of the NAICS industry. In the United States, six-digit NAICS Codes ending in 0 are no different from those in the five-digit category; sometimes, 0 is omitted altogether.

For example, the NAICS Code for mortgage and non-mortgage loan brokers[4] (businesses that earn a commission or a fee for bringing borrowers and lenders together) is 522310. SoFi, LendingTree, and New York Mortgage are some companies using this code.

NAICS Code Frequently Asked Questions (FAQs)

Here are common questions regarding the NAICS Code.

Does Every Business Have a NAICS Code?

No business gets a NAICS code automatically.

NAICS is a self-assigned system. This can be challenging since some business establishments may fit into different sectors. If not a single one is perfect, the closest option is the safest.

Do Sole Proprietors Have a NAICS Code?

Like other business structures such as partnerships, limited liability companies, corporations, and cooperatives[5], sole proprietorships need NAICS codes that properly reflect their business activity.

Do Small Businesses Need a NAICS Code?

Yes, but only some companies qualify as a small business. So instead of setting an arbitrary limit that does not work for businesses in different fields, the Small Business Administration relies on NAICS codes.

To be designated a small business and explore opportunities in federal contracting[6], one should consult the size standards for NAICS codes set by the SBA[7]. A company can typically measure its business size by average employee count or by average annual revenue.

Can a Company Have Multiple NAICS Codes?

A company can use more than one NAICS code.

In fact, those with multiple revenue drivers assign classification codes based on differentiating their primary and secondary lines of business. Of course, there could only be one primary code, but having secondary ones broadcasts the range of ways a company makes money.

For instance, McDonald’s uses the NAICS codes 722513 and 533110. These codes say it is in the accommodation and food services and real estate rental and leasing sectors, respectively. Interestingly, this fast-food giant describes itself as a lessor of non-financial intangible assets and not a lessor of any real estate.

In a way, McDonald’s is a real estate company[8]—it owns and leases physical stores to its franchisees, earning it billions in annual revenue.

Can a Company Change its NAICS Code?

Any business entity can change a NAICS code after being chosen, but the process can be inconvenient. The owner may have to contact every government agency with the old NAICS code or codes to update it. Various federal government agencies maintain lists of codes and classifications, making updating an existing code with each agency tedious and time-consuming.

Fortunately, it can be done online at no cost.

Which NAICS Codes Are High Risk?

Most business lenders and insurers consider the following sectors highly risky:

- Wholesale trade (42)

- Retail trade (44)

- Transportation and warehousing (48)

- Administrative and support and waste management and remediation services (56)

Businesses with NAICS codes matching those above receive extra scrutiny because they tend to record losses, incur damages, suffer from unpredictable cash flow, have low profit margins, or a combination of those reasons.

Furthermore, some types of businesses fall into the high-risk category because they are cash-intensive, making them at risk for crimes like money laundering. Some of these are:

- Ammunition and weapon sales and manufacturers (332992, 332993, and 332994)

- Auto dealers (441110 and 4411200)

- Automotive parts and accessories retailers (441330)

- Automotive repair shops (811111, 811114, and 811198)

- Aircraft, recreational vehicle, boat, and motorcycle dealers (441210, 441222, and 441227)

- Casinos and other businesses related to gambling (713210 and 713290)

- Check cashing, money order issuance, traveler’s check issuance, money transmission, and payday lending service providers (522390)

- Consumer loan providers (522291)

- Convenience stores (445131 and 457110)

- Currency exchanges, virtual currency trading platforms and brokerages, and crypto mining companies (518210 and 523160)

- Jewelry, precious stone, precious metal, and watch wholesale merchants (423940)

- Liquor stores (445320)

- Parking lots and garages (812930)

- Pawnshops (522299)

- Political organizations (813940 and 813990)

- Restaurants (722511, 722513, 722514, and 722515)

- Tobacco distributors (459991)

- Travel agencies (561510)

- Vending machine operators (445132)

Does NAICS Code Affect Taxes?

NAICS Codes do not directly affect taxes, but information from federal statistical agencies can help governments catch tax evasion cases.

For example, the IRS pays attention to NAICS codes to compare businesses’ tax returns in the same industry[9]. However, state tax agencies may use it only for communication[10].

Companies whose tax forms do not resemble those of similar entities may have a higher chance of getting audited.

Sources

- U.S. Census Bureau. (2022.) North American Industry Classification System. Retrieved from https://www.census.gov/naics

- Management and Budget Office. (2022.) North American Industry Classification System (NAICS) Updates for 2022; Update of Statistical Policy Directive No. 8, Standard Industrial Classification of Establishments; and Elimination of Statistical Policy Directive No. 9, Standard Industrial Classification of Enterprises. Federal Register. Retrieved from https://www.federalregister.gov/documents/2021/07/02/2021-14249/north-american-industry-classification-system-naics-updates-for-2022-update-of-statistical-policy

- U.S. Securities and Exchange Commission. (2021.) Division of Corporation Finance: Standard Industrial Classification (SIC) Code List. Retrieved from https://www.sec.gov/corpfin/division-of-corporation-finance-standard-industrial-classification-sic-code-list

- Consumer Financial Protection Bureau. (2020.) What is the difference between a mortgage broker and a mortgage lender? Retrieved from https://www.consumerfinance.gov/ask-cfpb/what-is-the-difference-between-a-mortgage-broker-and-a-mortgage-lender-en-130/

- Stowers, J. (2022.) How to Choose the Best Legal Structure for Your Business. Business News Daily. Retrieved from https://www.businessnewsdaily.com/8163-choose-legal-business-structure.html

- University of Pittsburgh. (2021.) Basics of Federal Contracting. Retrieved from https://www.osp.pitt.edu/osp-teams/federal-contract-services/basics-federal-contracting

- U.S. Small Business Administration. (2019.) Table of Small Business Size Standards Matched to North American Industry Classification System Codes. Retrieved from https://www.sba.gov/sites/default/files/2019-08/SBA%20Table%20of%20Size%20Standards_Effective%20Aug%2019%2C%202019.pdf

- Purdy, C. (2022.) McDonald’s isn’t just a fast-food chain—it’s a brilliant $30 billion real-estate company. Quartz. Retrieved from https://qz.com/965779/mcdonalds-isnt-really-a-fast-food-chain-its-a-brilliant-30-billion-real-estate-company/

- UpCounsel. (n.d.) What is a Business Activity Code? Retrieved from https://www.upcounsel.com/business-activity-code

- New York State Department of Taxation and Finance. (2019.) North American Industry Classification System (NAICS) Codes. Retrieved from https://www.tax.ny.gov/pubs_and_bulls/tg_bulletins/st/naics.htm