What Is Non-Recourse Financing?

REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

Characteristics of Non-Recourse Financing

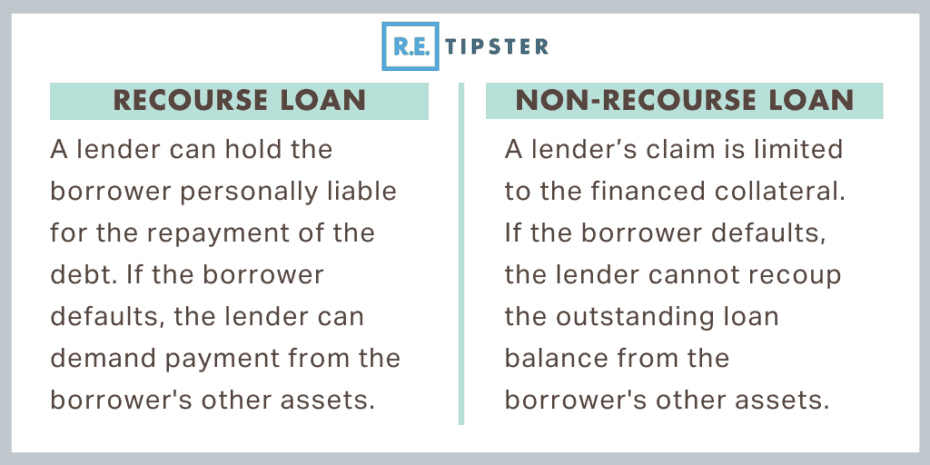

A non-recourse loan is the direct opposite of recourse financing. In the latter, the lender can access all of the borrower’s assets for payment in case of loan default.

Non-recourse financing is, therefore, riskier for lenders. For this reason, lenders place a higher premium on non-recourse loans, such as higher interest rates and more restrictive qualifications[1].

Non-recourse financing offers many benefits to borrowers, such as:

- Less personal risk to the borrowers. The business and personal finances are treated separately in non-recourse financing. Personal assets are excluded from the lenders’ payment claim if the borrower defaults on the non-recourse loan[2].

- Faster and simpler underwriting. Non-recourse financing’s underwriting covers only the asset being used as the collateral. This does not eliminate the loan underwriter’s investigation into the borrower’s personal financial strength and creditworthiness, but because non-recourse financing doesn’t rely on these other assets, there may be a narrower scope of what the underwriter needs to evaluate.

- Renegotiation leverage. The leverage in the renegotiation of non-recourse financing can tilt to the borrowers’ favor if the loan goes sour. The lender may be more accommodating in renegotiating with borrowers inclined to forfeit their loan collateral without risk to their other personal assets[3].

- More borrowing potential for real estate investors. Because a non-recourse loan does not require a personal guarantee, it puts less weight on the borrower’s personal credit or debt-to-income ratio. This advantage is attractive for investors looking to expand or diversify their investment portfolio[4].

- Ideal for partnerships. When one partner takes out a recourse loan, it may impact the other partners, especially one with more stake or assets. However, for a non-recourse loan, only the collateral is at risk, not the assets of the other partners.

Potential Disadvantages of Non-Recourse Financing

Generally, borrowers prefer non-recourse financing, but lenders prefer recourse loans. While it is tempting for borrowers to hold out for a non-recourse loan offer, traditional lending institutions usually do not extend this loan to regular borrowers unless they hold a very high credit score or spotless credit history.

In addition, a non-recourse loan’s higher risk of default means it is subject to more fees, especially higher interest. Some mortgages financed by non-recourse loans, for instance, have a higher down payment. For some borrowers, this puts them at a disadvantage as their only choice is to find better terms on interest rates and lower down payments through government-sponsored entities (GSEs) like Fannie Mae or Freddie Mac[5].

Finally, while non-recourse loans do not count toward the borrower’s personal credit, defaulting on a non-recourse loan will still damage the borrower’s credit score.

Non-Recourse Loans in Real Estate

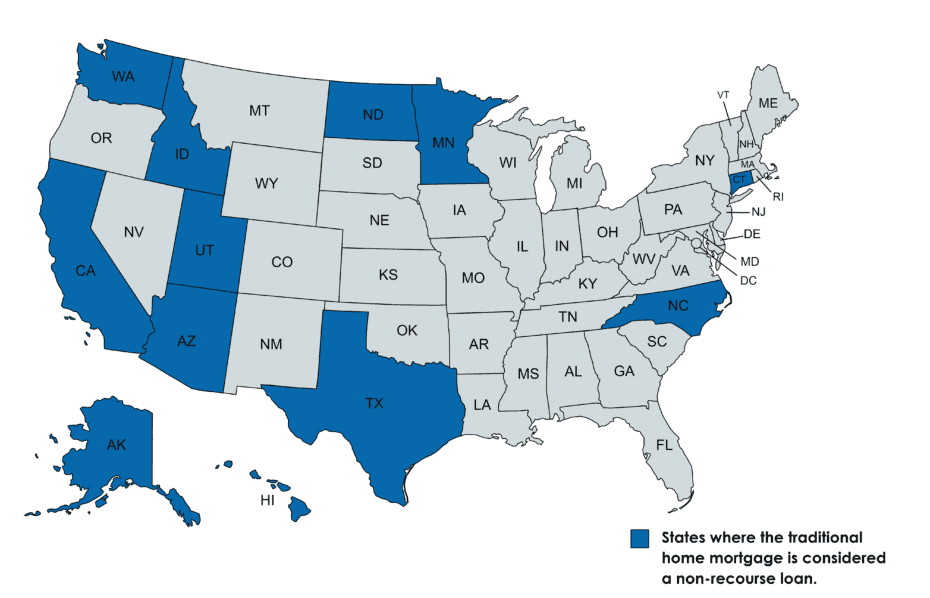

There are 12 states where the traditional home mortgage is considered a non-recourse loan, where only the home itself serves as collateral. If the borrower defaults, the lender is only allowed to foreclose on the property and sell it to recoup their loss. If the sale proceeds are not enough to cover the loan balance, the lender will have no choice but to face a loss[6]—but not all states in the U.S. permit this.

There are 12 non-recourse states[7]:

- Alaska

- Arizona

- California

- Connecticut

- Hawaii

- Idaho

- Minnesota

- North Carolina

- North Dakota

- Texas

- Utah

- Washington

In these states, mortgage lenders who foreclose borrowers’ properties must accept whatever amount they get from the foreclosure sale.

For the other 38, some forms of recourse in mortgages are allowed. Still, many recourse states limit the collection on a deficiency judgment. How much is limited and the manner of the limitation will depend on the recourse state.

Non-Recourse Financing of Multifamily Housing

The government knows that multifamily housing, such as apartments, are often the first homes of a new family. Because these properties are important to U.S. housing inventory[8], GSEs like Fannie Mae and Freddie Mac are tasked to offer the lowest barrier to entry for new homeowners.

GSEs, specialty lenders, and multifamily housing developers regard non-recourse financing as attracting borrowers and potential homeowners.

A lender underwriting a non-recourse loan to a multifamily home developer generally considers the property’s cash flow. The lender may foreclose on the property and sell it to repay the outstanding loan balance if it is insufficient.

Non-Recourse Financing of Commercial Properties

Some types of non-recourse loans are available for commercial real estate investors. However, these are limited to certain asset classes or commercial property (such as rentals and apartment buildings). Banks and other traditional lenders often do not extend these types of loans. Still, investors may find non-traditional lenders (such as insurance companies, angel investors, or other private individuals) are more open to these transactions[9].

Non-recourse commercial mortgage loans are also generally only available to huge commercial investments. In general, big lenders look at loans ranging from $2 million to $10 million[10], which generally means the borrower is confident that they can repay the loan.

Additionally, non-traditional lenders screen commercial real estate borrowers through several aspects. These factors describe the risk level of the loan[11]:

- The property’s location.

- The quality of the borrower (i.e., their background, history, experience in investing, etc.)

- Leverage (or loan-to-value ratio).

- How much cash flow the property generates or is projected to generate.

- The amount of work (i.e., construction) needed to erect the property.

“Bad Boy Carve-Outs”

Non-recourse financing contracts often carry a clause that can change the lending provision to a full recourse loan. Called a “bad boy carve-out,” this clause is invoked to protect the lenders if the borrower behaves poorly.

They can use this clause to make a non-recourse loan a full recourse one if a borrower commits any of the following:

- Declares bankruptcy.

- Commits fraud on financial capability.

- Fails to maintain adequate insurance coverage on the mortgaged property.

- Non-payment of property taxes[12].

Note that bad boy carve-outs exist to protect both the borrower and the lender. However, some lending institutions may use broad, ambiguous terms on their carve-out clauses that defeat the purpose of a non-recourse loan, making it, in essence, a full recourse loan.

Takeaways

Non-recourse financing or non-recourse loans is a lending agreement where the lender cannot pursue the borrower’s assets other than the loan collateral if the latter defaults.

In principle, most borrowers would prefer a non-recourse loan because it is less risky for them, but it is the opposite for lenders. As a result, lenders usually do not extend these types of loans, and even if they do, they come with a high premium (such as high interest rates).

Some commercial real estate lenders have a caveat called the “bad boy carve-out,” however, where a non-recourse loan becomes a full recourse loan if the borrower reneges on certain parts of the loan agreement.

Sources

- Treece, T. (2020.) Recourse Loans Vs. Non-Recourse Loans. Forbes. Retrieved from https://www.forbes.com/advisor/loans/recourse-loans-vs-non-recourse-loans/

- Fuscaldo, D. (2021.) How do Nonrecourse Loans Work? Business.com. Retrieved from https://www.business.com/articles/non-recourse-financing/

- iBorrow. The Advantages of Non-Recourse Loans Over Personal Guarantees. Retrieved from https://www.iborrow.com/blogs/the-advantage-of-non-recourse-loans-over-personal-guarantees/

- Corevest. (2021.) Benefits of Non-Recourse Financing to Real Estate Investors. Retrieved from https://www.corevestfinance.com/benefits-of-non-recourse-financing-for-real-estate-investors/

- Brumer, L. (2021.) Recourse Loan vs. Nonrecourse Loan—What’s the Difference. Millionacres. Retrieved from https://www.millionacres.com/real-estate-financing/mortgages/recourse-loan-vs-nonrecourse-loan-whats-difference/

- Clark, K. (2021.) Recourse Loans vs. Non-Recourse Loans: Knowing the Difference. Investopedia, ed. James, M. Retrieved from https://www.investopedia.com/ask/answers/08/nonrecourse-loan-vs-recourse-loan.asp

- Cheung, J. (2018.) What Is a Recourse State? LegalMatch.Retrieved from https://www.legalmatch.com/law-library/article/what-is-a-recourse-state.html

- Response. (2017.) The Importance of Housing Inventory Statistics. Retrieved from https://response.com/importance-housing-inventory-statistics/

- Graham, G. (2020.) Are Commercial Real Estate Loans Nonrecourse? Crown Point Commercial. Retrieved from https://crownpointcommercial.com/are-commercial-real-estate-loans-nonrecourse/

- Multifamily Loans. (2020.) Non-Recourse Loans on Multifamily Properties and Commercial Real Estate. Retrieved from https://www.multifamily.loans/apartment-finance-blog/2015/5/22/non-recourse-loans

- Reonomy. (2019.) Why Do CRE Investors Use Non Recourse Financing. Retrieved from https://www.reonomy.com/blog/post/non-recourse-financing-in-commercial-real-estate

- Corporate Finance Institute. (n.d.) What Is a Non-Recourse Loan? Retrieved from https://corporatefinanceinstitute.com/resources/knowledge/finance/non-recourse-loan/