What Is an Option?

REtipster does not provide legal advice. The information in this article can be impacted by many unique variables. Always consult with a qualified legal professional before taking action.

How Does a Real Estate Option Work?

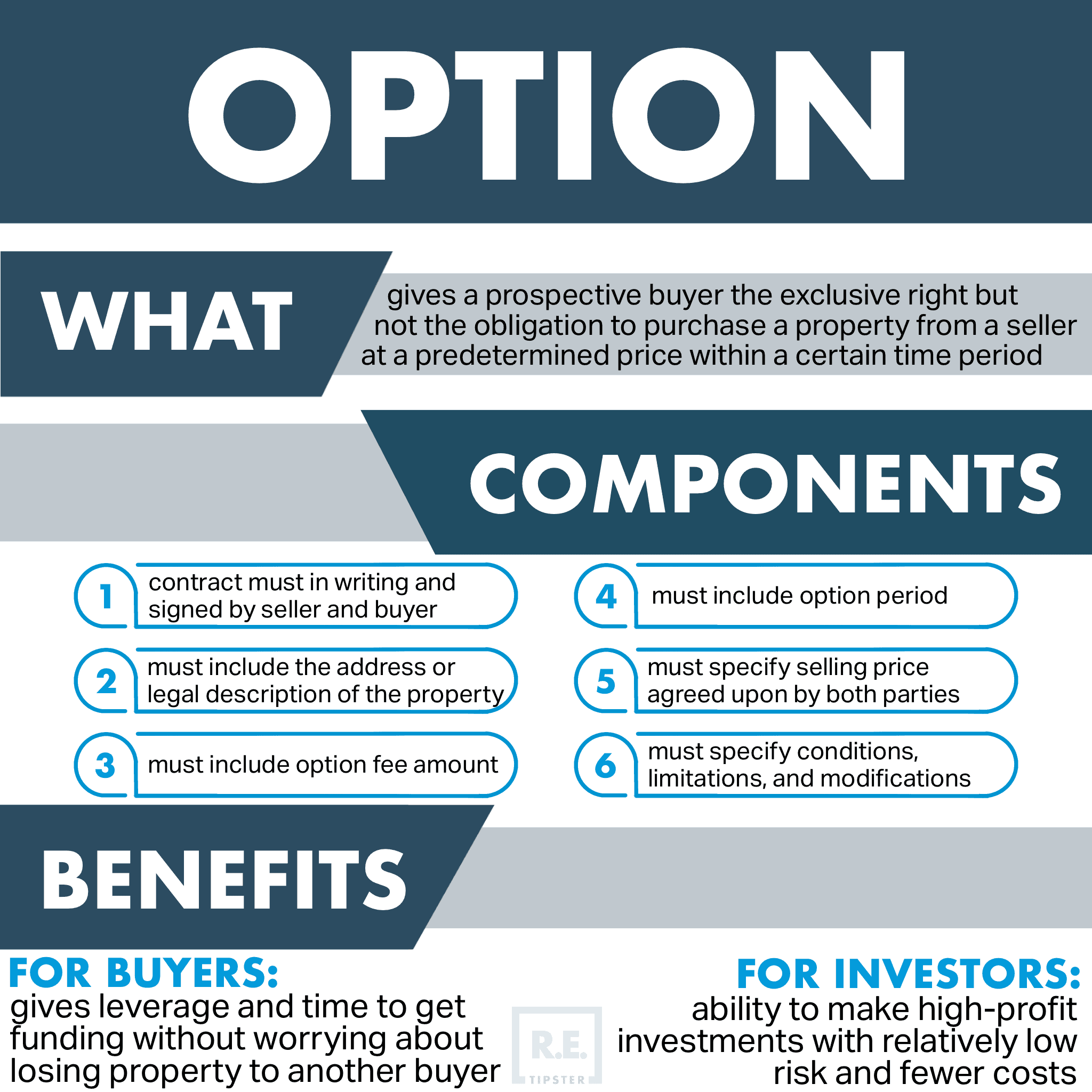

An option gives a prospective buyer (optionee) the right, but not the obligation, to buy a property from the seller (optionor) at a pre-determined price (or, in some cases, a price range) within a specific period of time. In turn, the option limits the seller from selling the property to anyone else during that time[1].

The term of an Option will typically last from 6 months to 24 months, but it can be longer or shorter, depending on what Optionor and Optionee negotiate.

When an Option Agreement is executed by both parties, the prospective buyer pays an option fee or “consideration” to the prospective seller, which is typically a flat amount or a small percentage of the sale price, to enter into the Option contract[3]. The Option fee is non-refundable.

After the Option has been executed by both parties, the buyer simply has the right to purchase the property at their discretion, for the price and within the time period specified. If the prospective buyer (Optionee) decides to exercise their purchase, the seller (Optionor) must abide by the terms of the Option Agreement and follow through with closing the sale. If the Optionee decides not to exercise their right to buy, the Optionor can keep the option fee[4].

If the terms and conditions of the contract allow it, the prospective buyer (Optionee) may even have the right to sell the option to another party[5] by assigning the option.

An Option can go by various names, such as,

- Option to Buy

- Option to Purchase

- Option Agreement

- Option Contract

In cases where there is a landlord and tenant relationship, variations are known as a lease option or rent-to-own agreement, which give a tenant the right but not the obligation to purchase the property they are renting.

RELATED: Options Explained: How to Unlock Access to Any Deal, Anywhere

What Are the Components of Real Estate Options?

An option is a legally binding contract. But to be valid and enforceable, an option contract must have the following components[6]:

- The option contract must be in writing.

- Ideally, the contract is signed by both the seller and the buyer.

- The contract must include the address or legal description of the property, including lot and block numbers, city and state, and other information about the location.

- The contract must include the option fee amount.

- The contract must include the option period.

- The contract must specify the selling price of the property agreed upon by both parties.

- The contract must also specify any conditions, limitations, or modifications of the option during the term of the contract.

Real Estate Option Examples

When a prospective buyer has specific and important questions about a property that they haven’t been able to answer yet, Options can be a great way to buy more time so they can get those questions answered.

For example, when a real estate investor considers buying a parcel of vacant land, they could face many uncertainties depending on their plans for the property.

Some common questions might be,

- “Will I be able to find a buyer who will pay a higher price for this property in the future?”

- “Is this property even worth the price I think it is?”

- “Will the local officials approve my request for a zoning change?”

- “Can I get the approvals I need to subdivide?”

- “Will the property pass all the inspections needed to build?”

- “Does this property have any hidden problems that will require more time to investigate?”

An Option is an effective way to take a property off the market for a limited time.

Ideally, the Optionee will be able to get answers to their questions during this period and solidify their decision to buy the property or walk away from the deal.

Example 1: The Developer

Suppose a big developer wants to buy several adjoining parcels from different landowners to combine them to build a mall.

Since they will have to negotiate with several different owners, it wouldn’t be wise to commit to buying all the parcels before they know everyone will sell at a reasonable price.

The only practical way to pursue multiple properties like this is to sign an Option with each property owner. Once the developer has control over every property, they can exercise all the Options at once, close on each purchase and proceed with the next stages of development.

In this kind of all-or-nothing scenario, if one property owner says “no” and kills the whole deal, the developer wouldn’t be locked into buying all the other parcels for a project that isn’t feasible anymore.

Example 2: The Wholesaler

Suppose a real estate wholesaler finds a good property, but the most they can offer is 50% of the property’s market value, while the seller wants 70%.

It’s still a good deal at 70% of market value, but it’s more than the wholesaler is willing to pay.

An Option can bridge the gap between the wholesaler’s uncertainty and the seller’s needs because it buys the wholesaler time to find another buyer to step in and close (similar to how an assignment works). If the wholesaler can’t find another buyer, they can walk away from the deal without sinking their limited resources into a deal that wouldn’t be profitable.

Example 3: The Home Buyer

Let’s say a homebuyer finds a $2 million house, and the seller is willing to let the property go for $1 million.

It’s a great deal, but the homebuyer doesn’t have $1 million cash. They need time to get approved for the financing and do thorough due diligence on the property, and it will take longer than 30 days.

They could ask the seller to sign an Option Agreement for 90-days.

If the seller is willing to do this, it will give the homebuyer the extra time to ensure all the boxes are checked, and they have the funding to close.

What Are the Benefits of an Option to Buyers and Investors?

A real estate option is popular among buyers and investors because of its flexibility.

For Buyers

Option contracts enable buyers to secure land or property at a specific price for a set period. During this time, the seller cannot sell the land or property to anyone else. The buyer may use the time to get funding for the purchase without worrying about losing the land or property to another buyer[7].

Plus, buyers can leverage real estate options in a market where property prices change quickly. If the buyer closes on the property, the seller must sell it at the agreed-upon price even if property values change[8].

For Investors

Real estate options allow investors to make high-profit investments with relatively low risk and fewer costs[9]. For example, an investor finds a plot of land in a desirable location and wants to develop it into housing or a commercial building. The investor enters into a real estate option to get the exclusive right to buy the land.

They can then use the time to find other developers and investors who will buy the land at a much higher price than the option contract. The investor makes a profit by purchasing the land and selling it to the developers for a higher price.

Investors can also buy and sell real estate options, especially when they expect a property to increase in value within months[10]. For instance, an investor gets an option to have exclusive rights to buy a property within one year. Five months into the contract, the value of the property increases. The investor can then sell the option to another investor for a higher price.

Takeaways

- A real estate option is a contract that gives the buyer the right to purchase a property from the seller for a specific price within a limited period. In turn, the seller cannot sell the property to anyone else during the option period.

- The buyer pays an option fee to get exclusive rights to purchase the property and may decide to close on the property or not.

- A real estate option is popular among buyers and investors because of its flexibility.

Sources

- Seth, S. (2021, January 31). How to Arrange and Profit from Real Estate Options. Investopedia. Retrieved from https://www.investopedia.com/articles/active-trading/021015/how-make-money-real-estate-options.asp

- Donofrio, C. (2022, May 4). What Is a Real Estate Option Contract—and Do You Need One to Buy a House? Realtor.com. Retrieved from https://www.realtor.com/advice/buy/basics-of-real-estate-option-contracts/

- Lister, J. (2022, August 16). What Is an Option Fee? SmartCapitalMind. Retrieved from https://www.smartcapitalmind.com/what-is-an-option-fee.htm

- What is an Option to Purchase in Real Estate? (2020, June 18). LawInfo.com. Retrieved from https://www.lawinfo.com/resources/real-estate/options-to-purchase-real-estate.html

- Kyle, D. (2021, March 15). What’s the Difference Between an Option and a Right of First Refusal in Real Estate? The Law Offices of Dana M. Kyle, P.A. Retrieved from https://www.dmkylelaw.com/option-and-a-right-of-first-refusal-in-real-estate/

- Key Terms in Option-to-Purchase Agreements. (n.d.). Nolo. Retrieved from https://www.nolo.com/legal-encyclopedia/key-terms-option-purchase-agreements.html

- Option Contract Real Estate: How They Work. (2021, June 18). ContractsCounsel.com. Retrieved from https://www.contractscounsel.com/b/option-contract-real-estate

- Tincher, L. (2021, November 5). Understanding the Basics of Real Estate Options. Sofi.com. Retrieved from https://www.sofi.com/learn/content/real-estate-options-contracts/

- Smigel, Z. (2022, June 9). Option Contracts in Real Estate. Real Estate License Wizard. Retrieved from https://realestatelicensewizard.com/option-contracts/

- Merrill, T. (n.d.) An Investor’s Guide To Real Estate Contract Flipping. Fortune Builders. Retrieved from https://www.fortunebuilders.com/flipping-real-estate-contracts/