What Is an Owner's Policy?

Shortcuts

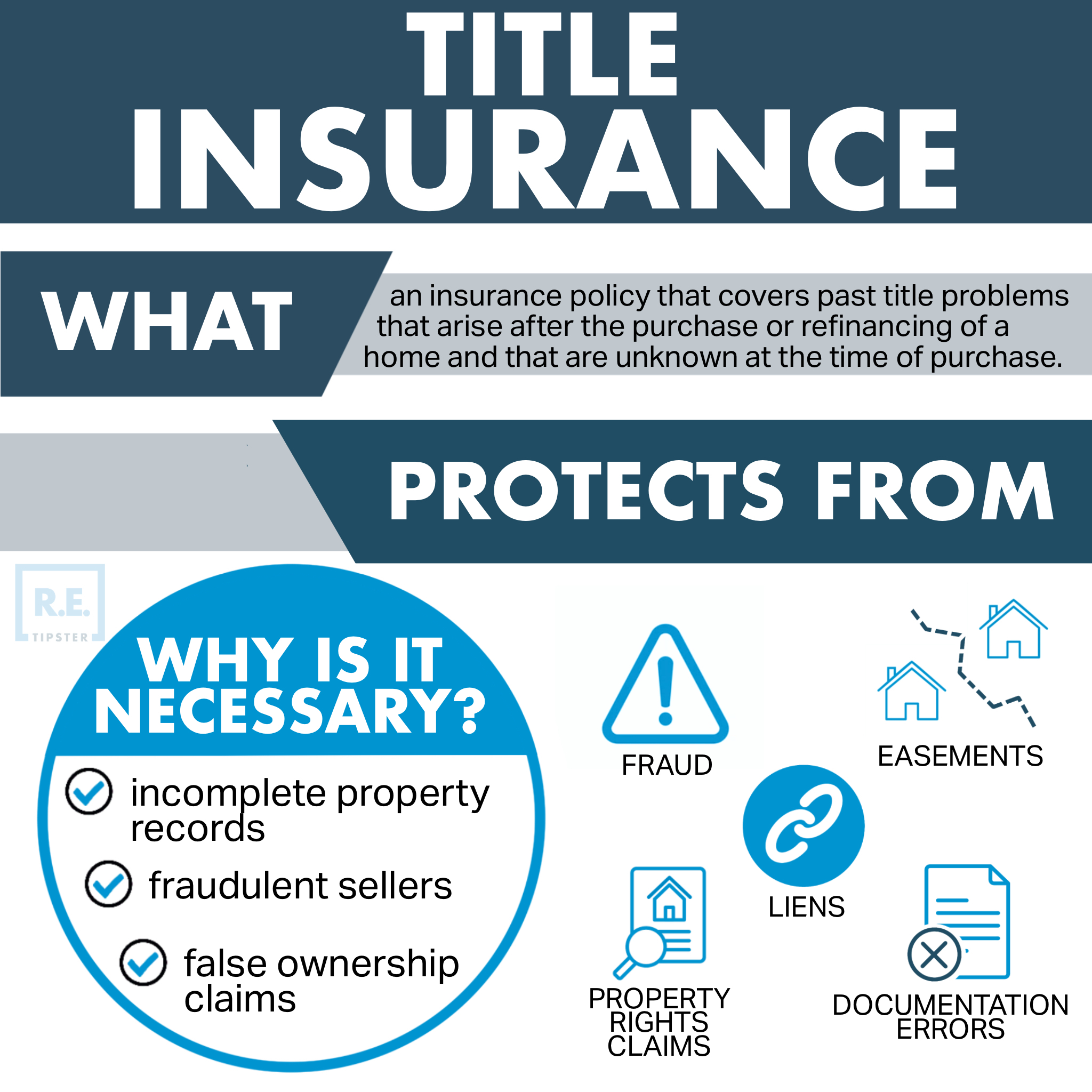

- An owner’s policy is a type of title insurance that provides coverage against title defects or issues concerning property ownership, in contrast to a lender’s policy, which protects the lender’s investment.

- Title defects can arise from clerical errors, unknown liens, illegal deeds, and undisclosed heirs.

- The cost of an owner’s policy is typically based on the property’s value and location and is a one-time fee paid during closing.

- While not mandatory, an owner’s policy is a recommended safeguard against potential title disputes and related financial burdens.

Understanding Owner's Policy

An owner’s policy, also known as an owner’s title insurance policy, provides coverage to property owners in case of title defects or issues that may arise with the property’s ownership. This policy is typically purchased during the closing process of a real estate transaction. It safeguards against potential financial loss or legal complications arising from unforeseen title issues[1].

Since property title represents a person’s legal right to the property, an owner’s policy is important because it protects against title defects. These defects (“clouds on title”) may keep an owner from exercising this right, leading to ownership disputes with another party.

An owner’s policy remains in effect for as long as the insured party or their heirs have an interest in the property[2]. This longevity differentiates it from a lender’s policy, which lasts until the mortgage is fully repaid.

Owner’s Policy vs. Lender’s Policy

While both policies deal with title insurance, they serve different beneficiaries. An owner’s policy is tailored to protect the property owner. In contrast, a lender’s policy is designed to shield the lender’s investment in the property against potential title defects.

For those purchasing a property via a mortgage, it’s typical for lending institutions to mandate a lender’s policy. However, the decision to secure an owner’s policy rests with the buyer, although it’s highly recommended, given the protection it affords.

In addition, an owner’s policy is different from homeowner’s insurance. An owner’s policy insures against defects in the title, while homeowner’s insurance covers potential damage to the property or liability claims[3] resulting from injuries on the property.

Extended Owner’s Policy

An extended owner’s policy goes beyond the standard coverage, offering a more comprehensive shield against potential title defects. These policies include “off-record” defects, such as mechanic’s liens or estate tax[4], easements, encumbrances, and other subdivision or CC&R violations.

Who Pays for an Owner's Policy?

In a real estate transaction, the party responsible for paying for the Owner’s Policy of title insurance can vary based on regional customs, local practices, or terms negotiated in the purchase agreement. Here’s a general breakdown:

- Regional or Local Customs: In some areas, it’s customary for the seller to pay for the Owner’s Policy, while in others, it’s the buyer’s responsibility. This can even vary within states; for example, in one county, it might be customary for the seller to pay, while in a neighboring county, the buyer might typically pay.

- Negotiated in the Contract: Even if there’s a local custom, the buyer and seller can negotiate who pays for the Owner’s Policy as part of their purchase agreement. Everything in a real estate contract is negotiable, so either party could agree to pay for it as part of their negotiations.

- Lender’s Policy vs. Owner’s Policy: It’s also worth noting the difference between the Owner’s Policy and the Lender’s Policy of title insurance. The Lender’s Policy protects the lender’s interest in the property, and its cost is almost always the responsibility of the buyer/borrower. On the other hand, the Owner’s Policy protects the buyer’s interest in the property.

To determine who typically pays for the Owner’s Policy in your region or for your particular transaction, it’s best to consult a local real estate agent, title company, or attorney. They can provide guidance based on local practices and any specific nuances of your transaction.

Why Do Title Defects Happen?

Title defects can emerge from several circumstances. While seemingly minor, clerical errors can lead to significant complications in public records, giving rise to disputes. Similarly, unknown liens arising from previous owners’ unpaid debts can encumber a title.

Another source of title defects is illegal deeds. If a deed to the property was made by someone not legally authorized to do so (e.g., a minor, an illegal immigrant, or someone lawfully considered of unsound mind)[5], such deeds could be challenged, causing potential hitches for future owners.

Moreover, missing heirs can be a considerable source of concern. There are instances where previously unknown or unacknowledged heirs come forward after a property’s sale. They may then claim that they still possess rights to the property, leading to lengthy and often expensive legal battles.

These title issues can have severe consequences for property owners. For instance, if a previously undisclosed lien is discovered after purchasing a property[6], the new owner may be held responsible for the outstanding debt. Similarly, if someone else claims property ownership, it can lead to costly legal battles and potential property loss.

In many cases, it’s rare for a title company to miss these defects, but some do fall through the cracks, which is where an owner’s policy is useful. Title companies often issue a preliminary title report detailing their findings on a property’s history.

Do You Need an Owner's Policy?

Whether you need an owner’s policy or not may hinge on several factors. One reason is that the likelihood of title defects increases for properties with a long or convoluted transaction history[7], so an owner’s policy may be invaluable when buying these properties.

Additionally, in areas known for frequent land disputes or intricate zoning laws, title insurance acts as a safeguard against potential conflicts. The cost of an owner’s policy becomes a mere fraction of significant real estate investments when weighed against the possible losses stemming from title disputes.

If you decide to purchase an owner’s policy, here are a few things you should know:

Cost and Purchase Process

The cost of an owner’s policy is typically determined based on the property’s value and location (due to state-specific regulations and fees). Expect to pay between $500 to $3,500[8] for each property in the transaction. Rates may also differ among title insurance companies, so shopping around can be advantageous.

In any case, it’s a one-time fee usually settled during the property’s closing, which means no annual premiums.

If you sell a property, the new owner must obtain their own owner’s policy[9]. However, having your owner’s policy can make the title process smoother, as any issues covered under your policy would generally not pose risks to the new owner.

Making a Claim on an Owner’s Policy

Making a claim on an owner’s policy is relatively straightforward. If a title defect becomes apparent, the property owner should promptly notify their insurer. They then need to provide evidence of the defect and any related financial losses.

Upon receipt, the insurance company commences an investigation. If the claim is deemed valid, the insurer will either rectify the title defect, reimburse the property owner, or shoulder the responsibility of defending the title in court.

Note that most owner’s policies cover legal defense fees associated with defending your title against claims covered by the policy. However, the specifics might vary based on the policy details; consult your insurer for more information.

Frequently Asked Questions: Owner’s Policy

What doesn’t an owner’s policy cover?

An owner’s policy primarily addresses hidden defects associated with a property’s title. However, it doesn’t provide an all-encompassing shield.

Specifically, it doesn’t cover defects that arise after the policy’s effective date. For instance, if a homeowner takes a second mortgage or fails to pay property taxes after the policy has been issued, any resulting liens wouldn’t be covered.

Additionally, it doesn’t typically cover issues like restrictions on property use due to zoning laws, rent losses, or problems stemming from infringements of building codes[10] unless explicitly stated.

Can I purchase an owner’s policy after closing on a property?

Yes, you can acquire an owner’s policy post-closing[11]. However, think of it as getting car insurance after an accident to understand why it’s better to get it earlier.

Acquiring an owner’s policy after closing exposes the title insurer to risks they weren’t privy to at the outset. Consequently, the process might involve a more in-depth title search, leading to potentially higher costs. Moreover, the policy may also exclude issues arising after the initial closing and before the subsequent policy acquisition.

That said, if no new issues have surfaced and the title remains “clean,” purchasing an owner’s policy post-closing can still provide valuable protection against undiscovered defects from the property’s history.

Is an owner’s policy mandatory?

Strictly speaking, an owner’s policy is not mandatory[12] for real estate transactions.

However, considering potential problems that might exist in a property’s past, such as undisclosed heirs, hidden liens, or recording errors, the protective benefits of an owner’s policy become evident. If there’s a subsequent challenge to your property’s title and you lack this insurance, you’d be shouldering any associated financial burdens yourself.

By contrast, with an owner’s policy in place, the title insurance company is responsible for settling valid claims and any related legal costs. Therefore, while not obligatory, it’s an invaluable safeguard for property buyers.

Sources

- Araj, V. (2023, May 16.) Title Insurance: What You Need To Know. Rocket Mortgage. Retrieved from https://www.rocketmortgage.com/learn/title-insurance

- Title insurance FAQ. (n.d.) Texas Department of Insurance. Retrieved from https://www.tdi.texas.gov/title/titlefaqs.html

- What is homeowners insurance? (n.d.) Insurance Information Institute. Retrieved from https://www.iii.org/article/what-homeowners-insurance

- Title Insurance. (n.d.) California Department of Insurance. Retrieved from https://www.insurance.ca.gov/01-consumers/105-type/95-guides/03-res/Title-Insurance.cfm

- Giusti, A. (2023, July 28.) Common property title issues that can derail your closing. Bankrate. Retrieved from https://www.bankrate.com/real-estate/common-property-title-issues/

- When You Least Expect It… What You Need Know About Unrecorded Real Estate Liens. (2020, August 27.) Deeds.com. Retrieved from https://www.deeds.com/articles/when-you-least-expect-it-what-you-need-know-about-unrecorded-real-estate-liens/

- Pros and Cons of Buying an Older Home. (2016, January 13.) Homes.com. Retrieved from https://www.homes.com/blog/2016/01/pros-cons-buying-older-home/

- Arthur, M. (2016, July 11.) What Is Title Insurance and Do I Need It? Zillow. Retrieved from https://www.zillow.com/learn/what-is-title-insurance/

- Is Title Insurance Transferrable After Buying It? (n.d.) ATG Title. Retrieved from https://atgtitle.com/title-insurance-transferrable-after-buying/

- Title Insurance. (n.d.) North Carolina Department of Insurance. Retrieved from https://www.ncdoi.gov/consumers/homeowners-insurance/title-insurance#WhatisNotCovered-1129

- Fontinelle, A. (2023, June 14.) What Is Title Insurance And Do I Need It? Forbes. Retrieved from https://www.forbes.com/advisor/mortgages/title-insurance/

- Dowd, F. (n.d.) Did you know that owner’s title insurance is optional? ALT Title. Retrieved from https://alttitle.com/owners-title-insurance-is-optional/