What Is Real Estate Crowdfunding?

REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

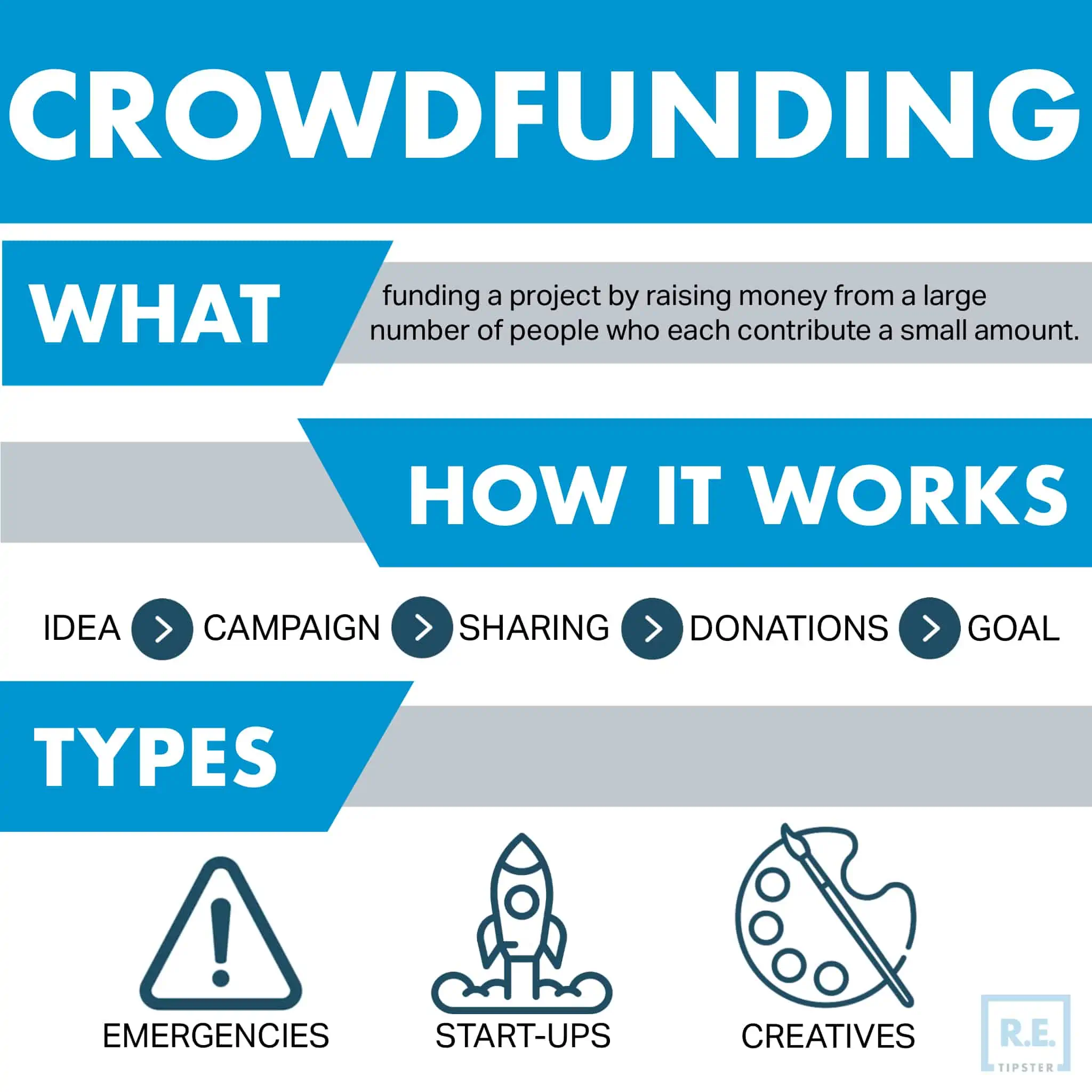

How Does Real Estate Crowdfunding Work?

Real estate crowdfunding platforms offer an investing method where groups of people pool their resources to finance a project, property, or other investment[1]. It leverages social networks (among other means) to connect interested parties with each other for the common goal of raising funds.

The concept is that a group of people (hence the name “crowdfunding”) may be willing and able to invest in a venture and raise capital that individual investors could not manage. People interested in investing in the real estate market often don’t have the means to do so with just their personal capital. With the help of crowdsourced funding, the minimum investment becomes much more accessible.

In general, crowdfunding is a fundraising method that allows investors to buy and sell securities, much like in an initial public offering (IPO). However, any platform that enables the transaction of securities in the marketplace must be registered and regulated with the Securities and Exchange Commission (SEC) unless they meet the criteria for exemption.

These exemptions in the U.S. market are Regulation Crowdfunding, Regulation A+, and Regulation D[2].

There are many forms of real estate crowdfunding. One of the most well-known ways investors participate in crowdfunding is through a real estate investment trust (REIT).

Real Estate Crowdfunding vs. REITs

One way to consider this distinction is that crowdfunding is a method, while REIT is a platform.

Real estate crowdfunding investors raise funds to buy, develop, or operate properties[3]. Meanwhile, real estate investment trusts are platforms where investors “buy” a share of the REIT’s portfolio of income-producing properties, such as hotels, shopping malls, or office buildings. While still technically a real estate investment, the real estate investment trust offers a more hands-off approach.

When real estate investors buy a share of the REIT, they earn money as dividends from the total rental income this collection of properties produces. When a property in a REIT’s portfolio is sold, the proceeds are distributed among the shareholders as well.

REITs offer these shares on a stock exchange, and investors buy through a brokerage, just like mutual funds or stocks of individual companies[4]. REIT companies own various commercial real estate properties like hotels, shopping malls, or residential rental properties.

In any case, crowdfunding portals and REITs may focus on certain segments of the property market or particular market locations. Interested parties may choose a platform either for accredited or non-accredited investors.

In a nutshell, all REITs are real estate crowdfunding platforms, but not all crowdfunding options are REITs.

BY THE NUMBERS: A study shows that real estate crowdfunding generates an 11% annual return on average.

Source: Plain Finances

Exemptions on Crowdfunding

In the U.S. securities market, there are three exemptions to crowdfunding: Regulation Crowdfunding (CF), Regulation A+, and Regulation D.

These exemptions allow a startup or any company to essentially bypass the regulatory requirements of the SEC to register their securities.

Regulation CF

A Regulation CF (or Reg CF) is an exemption where a company can raise up to $5 million per year by soliciting funds from crowdfunding investors.

A crowdfunding endeavor with this exemption is open to the general public 18 years old and above, whether they are an accredited investor or not. Accredited investors may invest an unlimited amount of money depending on their net worth, while non-accredited ones are limited to $2,200 a year[5].

Reg CF requires an independent CPA to audit the company’s books for either the last two years or since the company’s formation.

Regulation A+

A company may invoke the Regulation A+ exemption to raise up to $75 million annually.

Regulation A+ exemption (also known as Reg A) is broken down into two tiers:

- Tier 1: the company can solicit up to $20 million in a crowdfunding round per year.

- Tier 2: the company can solicit up to $75 million in a crowdfunding round per year.

As with Reg CF, an independent CPA must audit the company’s financials for two years in addition to hiring a securities attorney to file Form 1-A to the SEC[6].

Due to the large amount of money involved in Reg A, some investors call it a “mini-IPO.” REITs and other commercial real estate projects also make up a significant portion of the reported Reg A issuers[7].

Regulation D

Crowdfunding platforms that require raising an unlimited amount of money, usually on a continuous basis, may cite the Regulation D (Reg D) exemption.

Reg D offers two types of exemptions: 506(b) and 506(c)[8].

- 506(b) allows raising unlimited funds from an unlimited number of investors, of which up to 35 may be non-accredited. General solicitation is not allowed.

- 506(c) allows raising unlimited funds from an unlimited number of accredited investors only. Advertising and solicitation are allowed.

Reg D is considered a “safe harbor” for many startups and companies, particularly in real estate. Over 25% of Reg D issuers are real estate businesses[7].

Crowdfunding used to be open to accredited investors only, but the Obama administration’s passing of the Jumpstart Our Business Startups (JOBS) Act in 2012 opened crowdfunding to regular Americans[9].

Pros and Cons of Real Estate Crowdfunding

Just like any form of property investment, real estate crowdfunding has its upsides and downsides. Before committing to a crowdfunded real estate project, investors should examine the following advantages and disadvantages of the method itself and the platform where they wish to park their money.

Advantages

- Relatively smaller outlay. Non-accredited individual investors can start investing in a crowdfunding platform for as low as $500[10].

- Stable dividends. REITs are required to pay out a large portion of their net income in dividends, which provide stable earnings to their investors. Successful crowdfunding platforms typically generate larger income than traditional real estate investments.

Some crowdfunding platforms allow initial investments of as low as $500.

- Diversification. Investment opportunities are widely available on various real estate projects, including residential and commercial real estate investments. Any investment portfolio can benefit from the addition of income-producing real estate.

- Less volatility. Capital raised through real estate crowdfunding sites is less exposed to the ups and downs of the stock market.

- Hands-off investment. Crowdfunding platforms handle property management, freeing their investors from the common concerns of landlords and property managers.

Disadvantages

- Illiquid investment. Investors have to commit 5 to 10 years to real estate crowdfunding platforms before they can liquidate their money in full. If the investor needs to cash out quickly, they should look elsewhere.

- Greater risk. With crowdfunding relatively new, many of its platforms and projects lack a sufficient track record to gauge future success.

- Crowdfunding fees. Crowdfunding platforms may charge management or advisory fees, which can burden investors. Some platforms also require investors to be well-capitalized before they can participate in crowdfunding projects.

Crowdfunding investments are not the most liquid.

- Dividend delays. Investors’ dividend earnings may take some time to materialize. The dividends, for instance, will only be paid when property renovations are completed and tenants come in.

- Tax concessions. Crowdfunding investors may not be able to benefit from tax deductions based on property depreciation. Dividends may be treated as taxable income even if these are reinvested. They may likewise face the prospect of paying state income taxes on property earnings in another state.

Takeaways

- Real estate crowdfunding is a financing method for a group of investors (i.e., a “crowd”) to raise capital or fund property investment, whether through acquisition, development, or operation.

- A common type of real estate crowdfunding are real estate investment trusts, or REITs.

- Crowdfunding is a method to raise funds, while a REIT is a platform.

- Crowdfunding may use one of three exemptions from SEC regulations: Regulation CF, Regulation A+, and Regulation D.

Sources

- Steinberg, S. (2023.) Real Estate Crowdfunding: What It Is And How It Works. Rocket Mortgage. Retrieved from https://www.rocketmortgage.com/learn/real-estate-crowdfunding

- Dalmore. (n.d.) Reg D, A+, Or CF – Which Crowdfunding Approach Is Best For My Business? Retrieved from https://dalmorefg.com/reg-d-a-or-cf-which-crowdfunding-approach-is-best-for-my-business/

- Marquit, M., Schmidt, J. (2022.) How to Invest in Real Estate. Forbes. Retrieved from https://www.forbes.com/advisor/investing/how-to-invest-in-real-estate/

- Davis, C. (2022.) 6 Best Real Estate Crowdfunding Investment Platforms of March 2022. Nerd Wallet. Retrieved from https://www.nerdwallet.com/best/investing/real-estate-crowdfunding-platforms

- Growth Turbine. (2022.) Reg-CF Vs Reg-D Vs Reg A+ Equity Crowdfunding. Retrieved from https://www.growthturbine.com/blogs/reg-cf-vs-reg-d-vs-reg-a-equity-crowdfunding

- Vasiutina, B. (2021.) Reg A vs Reg D vs Reg CF what’s the difference. LenderKit. Retrieved from https://lenderkit.com/blog/reg-a-vs-reg-d-vs-reg-cf/

- Securities and Exchange Commission. (2020.) Report to Congress on Regulation A / Regulation D Performance. Retrieved from https://www.sec.gov/files/report-congress-regulation-a-d.pdf

- Richey May. (2022.) Rule 506(b) vs. Rule 506(c) for New Fund Launches. Retrieved from https://richeymay.com/resource/articles/raising-capital-through-private-placements-rule-506b-vs-rule-506c-for-startups/

- CFA Institute. (n.d.) Crowdfunding and Related Regulations for Smaller Companies. Retrieved from https://www.cfainstitute.org/en/advocacy/issues/crowdfunding-regulations-smaller-companies

- Huffmann, E. (2019.) Real Estate Crowdfunding: How to Invest for Passive Income. Plain Finances. Retrieved from https://www.plainfinances.com/earn/real-estate-crowdfunding/