What Is a Rent Roll?

REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

Rent Roll Explained

A property’s rent roll is a key piece of information used in the analysis of an investment property. It plays a critical role for a real estate investor in establishing an offer price and it can also be useful to an appraiser when determining the value of a property using the income approach.

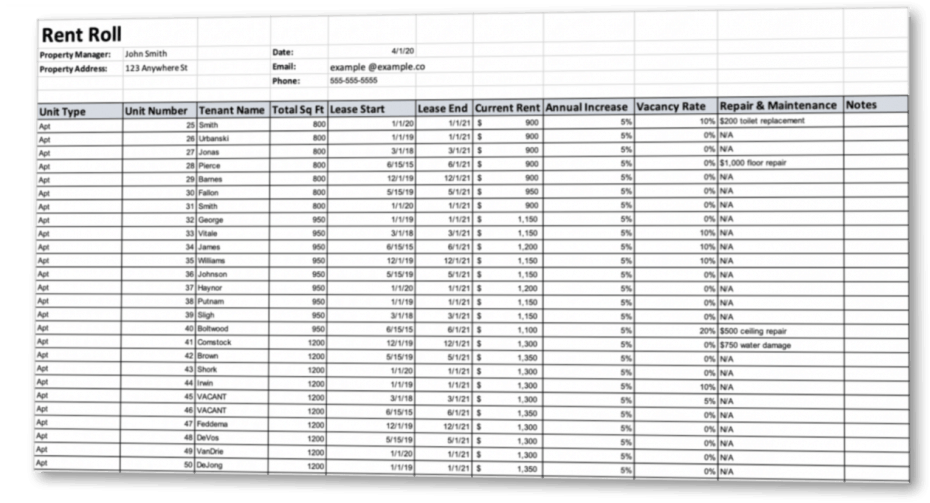

Most often, a rent roll is a document or spreadsheet that lists monthly income from each individual unit in an apartment building or rental portfolio. This includes items like the unit number, unit type, square footage, tenant name, market rent, actual rent, deposit amount, move-in date, lease-start, and lease end dates, and any outstanding balance owed by the tenant.

The purpose of a rent roll is to give investors and lenders an overview of all units within a particular property or portfolio and the corresponding information that indicates how the property is currently performing.

A rent roll keeps track of only gross income. It does not keep track of expenses and mortgage payments. Revenue and expenses are broken down on a separate document called a lease ledger.

A rent roll also needs to be evaluated in conjunction with each property’s vacancy rate (or occupancy rate) in order to determine the property’s gross potential rent.

Benefits of a Rent Roll

Here are all the components a rent roll could have:

- Property address

- Unit/property type

- Bed/Baths

- Square footage

- Lease start date

- Lease end date

- Current rent

- Projected annual rent increase

- Tenant expenses

- Notes on each unit or property

- Gross monthly rent

- Gross yearly rent

- Average monthly rent

- Pre-remodel

- Post-remodel

- Monthly difference

- Remodel cost

- Months until breakeven

A rent roll saves time by removing the need to look over each individual lease or lease ledger.

Since all the information is contained in one document, it is also easy to keep updated. Whenever there is a change to a unit or property (such as a rent increase), the rent roll can be updated, providing an up-to-date financial record of a rental business.

How Accurate is a Rent Roll?

A rent roll is only as accurate as the person compiling the information. It is not the same as an audited financial statement or a tax return.

Unless there is a third-party verifying the accuracy of the numbers, there has to be an element of trust between the recipient of the information and the person who prepared it. Since a rent roll is subject to errors and omissions, the information should be scrutinized and verified for accuracy.

One way to verify the accuracy of a rent roll is to contrast the rent amounts and vacancy rates with market averages. If the rent roll states numbers that are far higher or lower than similar comparables in the area, the validity of the rent roll may be questionable.

Another way to verify the information is to request the seller’s tax return (or Schedule E, if the property is reported in this section of the owner’s tax return). While a tax return is a different set of information than a rent roll, there will be some parallels between the two (because a Schedule E will show the total rents received in the most recent tax year).

Many financial analysts consider a tax return to be a more reliable source of information because this document is submitted directly to the IRS, and as such, it passes through more scrutiny and carries more weight than a simple spreadsheet prepared by the owner or property manager. While it’s still possible for a tax return to report incorrect information (i.e. – if the tax return is revised or if the filer is reporting fraudulent information), it’s usually a helpful tool to cross-check with a rent roll and see if the numbers still make sense.

Using a Rent Roll to Make An Offer

A rent roll can be a useful tool in several ways. Aside from simply understanding the number of units and how much revenue each one is currently generating, this information can also be used by an appraiser to formulate a property valuation based on the income approach.

Likewise, it can also be used by a real estate investor to understand what a property is worth today, and what it could be worth in the future once certain improvements are made to the property, such as:

- Evicting tenants who aren’t paying

- Increasing rent amounts to the market rate

- Adding more units to the property

- Improving units so that rental rates can be increased

- Adding supplemental income to a property (e.g. – coin laundry, vending machines, etc).

In his book The ABC’s of Real Estate Investing, Ken McElroy explains some important points for real estate investors to consider:

“Many property owners will try to sell their property based on future potential income. It is in your best interest to buy it at the actual income. That’s the way I like to buy – based on the way the property is currently running and the amount of money it is currently making.”

Knowing the difference between current performance and potential future performance is an important distinction to make, especially when coming up with an offer price.

Sources

- McElroy, Ken. The ABC’s of Real Estate Investing. 1st ed., Warner Business Books, 2004, p. 100.