What is a Series LLC?

REtipster does not provide legal advice. The information in this article can be impacted by many unique variables. Always consult with a qualified legal professional before taking action.

What is a Series LLC?

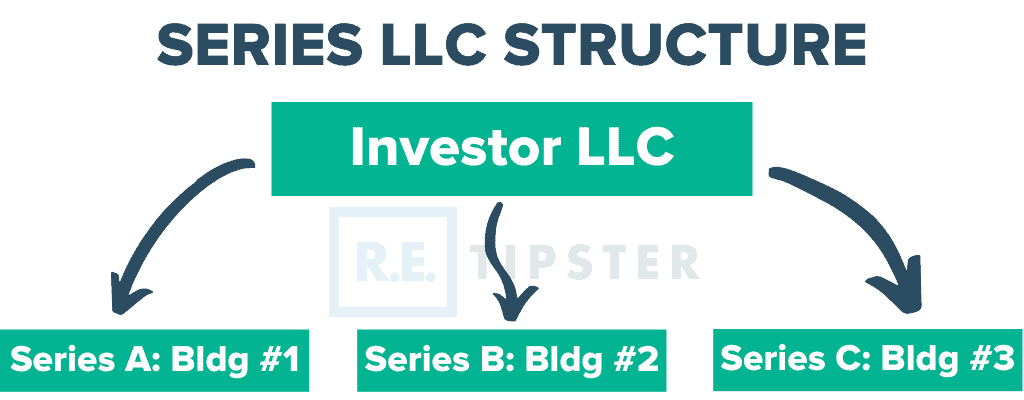

A Series LLC allows investors to form an umbrella organization over multiple properties to separate assets. In other words, an investor or business owner can utilize an SLLC to isolate the debt and risk associated with each asset held within the entity.

When investors form a Series LLC, each asset in the series is treated as if a separate company owns it: They have separate business names, bank accounts, and financial records, even a different registered agent[2].

From an asset protection perspective, a Series LLC keeps risky assets from adversely affecting the entire portfolio. If a lawsuit arises concerning a particular property, this structure protects the assets on the other series.

Setting up each property as a separate entity in a Series LLC has several advantages for the investor:

- It lowers administrative costs. Regardless of the number of series, the umbrella organization pays just one corporate filing fee.

- It streamlines tax preparation. In a properly structured Series LLC, all entities can be reported on a single tax return.

- It limits liability. The risk for each asset or series is isolated to that particular asset. If someone sues over a fall, only the assets in the associated series are at risk.

What Is the Difference Between a Series LLC and a Holding Company?

Both structures are useful for separating assets, but in a holding company, each asset forms a separate LLC. The holding company LLC is the parent company for each property LLC, as represented by the graphic below:

In a Series LLC, there is a single LLC with multiple limited liability interests, each with its own separate business interest or investment objective. Here is a more visual explanation:

The holding company structure requires the creation of multiple LLCs, while the Series LLC structure requires forming only one.

Depending on where the Series LLC is formed, it may be called a parent LLC, a holding LLC, a base LLC, or a master LLC, and the subsidiary entities may be called divisions, cells, or containers.

Are There Disadvantages With a Real Estate Series LLC?

The main disadvantage of this legal structure is that it is not universally available. Not all states recognize a Series LLC.

The following is a list of states and territories where an SLLC is recognized:

- Alabama

- Delaware (The Limited Liability Company Act)[3]

- District of Columbia

- Illinois

- Indiana

- Iowa

- Kansas

- Missouri

- Montana (Montana Limited Liability Act)

- Nevada

- North Dakota

- Oklahoma

- Puerto Rico

- Tennessee

- Texas

- Utah

- Wisconsin

- Wyoming

How to Form a Series LLC

REtipster features products and services we find useful. If you buy something through the links below, we may receive a referral fee, which helps support our work. Learn more.

Forming one is similar to that of a traditional LLC[4] (assuming the company is based in a state that recognizes an SLLC). The company needs to file paperwork with the state that reflects the authorization to establish a subsidiary series beneath the parent LLC.

If the name of the Series LLC is different from the names of the members, an additional form called a doing-business-as (DBA) might need to be accomplished.

The master LLC and each of the subsidiary series will need its own employer identification number from the IRS and its own bank account. A registered agent in each state where the Series LLC operates should also be appointed.

Operating agreements are also necessary for the master LLC and each series entity to establish the roles and responsibilities for each. The state’s Office of the Secretary of State can provide specifics on how the paperwork is handled in their jurisdiction.

The legal structure of the investment entity is an important decision; it affects tax liability, legal liability, financial risk, and ongoing administrative expenses. Therefore, assuming the state in question recognizes a Series LLC, it may be a good option for real estate investment.

RELATED: How to Start Your Own Corporation or LLC (It’s Easier Than You Think!)

Takeaways

A series LLC operates in a similar fashion as a holding company; it is an umbrella organization that allows a business to own multiple separate assets and limit the liability of each. However, unlike a traditional holding company, a series LLC requires the formation of a single LLC instead of separate LLCs for each individual asset.

The main drawback of the SLLC for real estate investors is that the structure is not recognized in every state. In those states, another structure, like a traditional LLC, is necessary to separate personal and business assets.

Sources

- Series LLC. Wikipedia. Retrieved from https://en.wikipedia.org/wiki/Series_LLC

- Sember, B. (n.d.) What Is the Difference Between a Series LLC and a Restricted LLC? Legal Zoom. Retrieved from https://info.legalzoom.com/article/what-difference-between-series-llc-and-restricted-llc

- Nolo. (n.d.) What Is A Series LLC? Retrieved from https://www.nolo.com/legal-encyclopedia/what-is-series-llc.html

- How to Start an LLC. (2019.) What Is A Series LLC? Retrieved from https://howtostartanllc.com/what-is-a-series-llc