What Is The Society for Worldwide Interbank Financial Telecommunication (SWIFT)?

REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

How Does the SWIFT System Work?

In order to understand what happens in a SWIFT transaction, it is important to recognize what problems the SWIFT system was designed to solve.

A Brief History of SWIFT

In response to this challenge, 239 banks from 15 countries came together to facilitate a quick and secure communication system for efficient cross-border payments. SWIFT’s official messaging services went live in 1977. SWIFT had 500 financial institutions across 22 countries that initially signed up for it[2].

Now, SWIFT is the trusted resource for international electronic fund transfers, operating in over 200 countries and capable of processing transactions worth $5 trillion per day[3].

How SWIFT Works

In general, one can break down SWIFT into three parts:

- A messaging platform.

- A standardized set of messages.

- A processing system to route and validate these messages.

SWIFT established a new standard for how financial institutions worldwide can interact with one another. By speaking a single language and adhering to one model, users of the SWIFT network, or SWIFTNet Link[4], can communicate transaction information more safely and efficiently.

SWIFT’s standardization of financial messaging data made it easier to understand the data transferred from one financial institution to another, regardless of geographic location and language barriers.

The SWIFT Code Standard

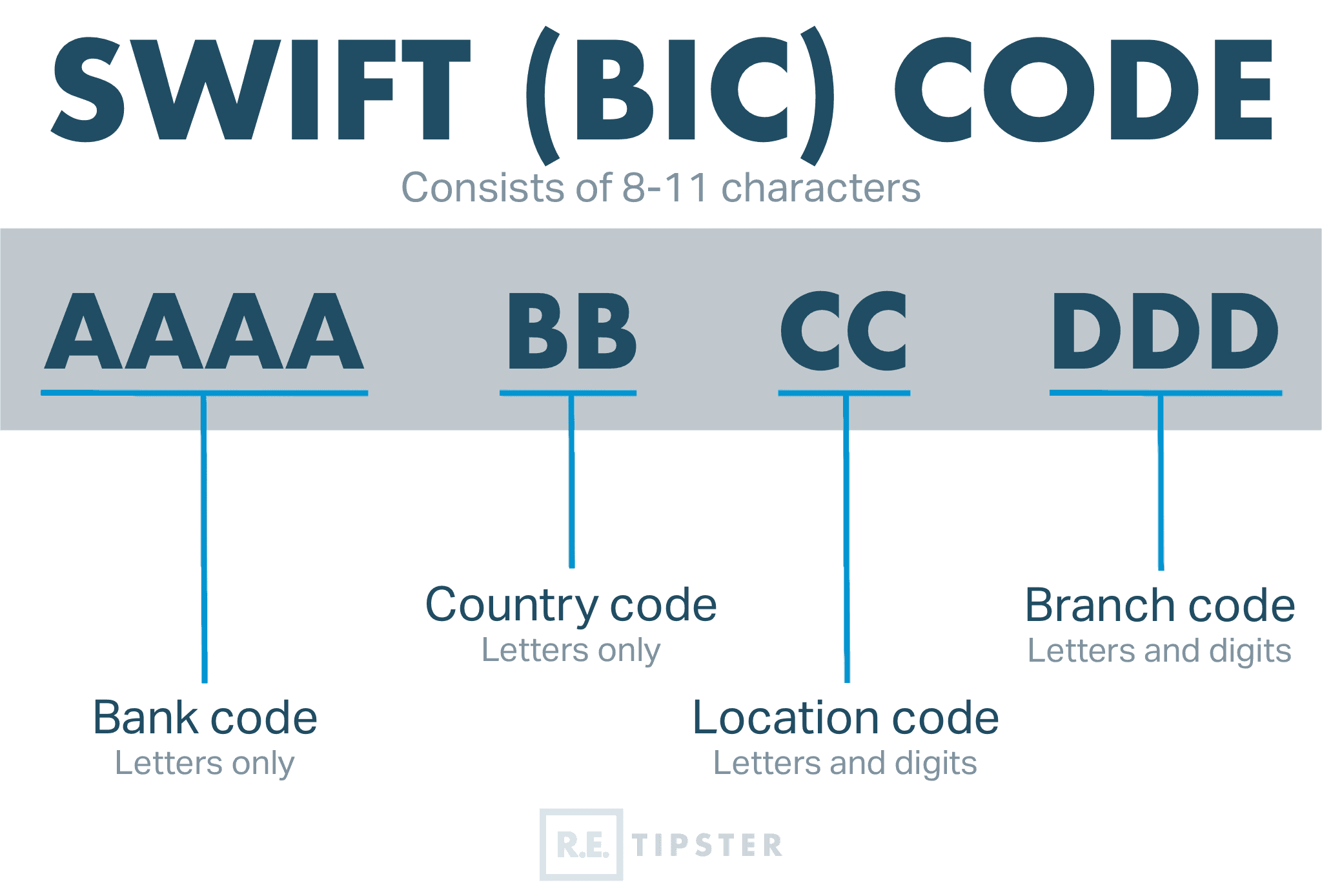

The SWIFT network utilizes a standard code system. Upon joining SWIFTNet Link, each financial institution is assigned a unique 8- or 11-character code. This SWIFT code is also known as the bank identification code (BIC), SWIFT ID, or ISO 9362 code[5].

SWIFT codes make it easier and quicker for a financial institution to find their correct counterpart when facilitating a transaction, no matter where they are in the world.

The characters in the code are structured in a specific format:

For example, the SWIFT code for a Bank of America branch office in Miami is BOFAUS3MXXX. In this code:

- The first four characters, BOFA, describe the code for Bank of America.

- The next two characters, US, describe the code for the United States where the bank is located.

- The next two characters, 3M, describe the code for Miami.

- The last three characters, XXX, will depend on the individual branch code or the branch where the payment transfer occurs. If left XXX, this denotes the bank’s main office.

What Happens in a SWIFT Transaction?

Suppose a Bank of America customer in downtown Miami wants to send money to their friend in London, who banks with Standard Chartered. The sender in Miami can walk into their Bank of America branch to send the funds. They will need their friend’s account number and the unique SWIFT code assigned to Standard Chartered in London (in this case, SCBLGB2LXXX).

Bank of America will initiate the transaction by sending a payment transfer SWIFT message to the Standard Chartered branch in London using SWIFTNet Link. This message will contain all the relevant information regarding the transaction, including the sender’s details, amount, fees charged, receiver’s details, and more.

When Standard Chartered receives the SWIFT message and the information checks out, it will clear the payment and release the funds into the recipient’s account.

What Information Is Needed For a SWIFT Transfer?

To send money abroad using SWIFT, the sender must provide the following information:

- Recipient’s name and address.

- Name and address of the financial institution receiving the money.

- The institution’s SWIFT code.

- The receiver’s IBAN (International Bank Account Number) and related bank details.

It is important to understand the distinction between SWIFT code and IBAN. The SWIFT code identifies a specific institution down to the city where it is located., while IBAN is that of a specific bank account through which the funds sent are processed and validated.

How Long Do SWIFT Transfers Take?

In transfers where the sending and receiving banks are in a nostro and vostro relationship[7], the SWIFT transfer happens quickly, usually less than a day.

On the other hand, if the SWIFT message goes through various intermediary banks until it gets to one that can process the information and relay it to the receiving bank, this may delay the process. In these cases, SWIFT transfers can take one to four business days[6].

How Secure are SWIFT Transactions?

SWIFT employs several security measures, including data encryption, intrusion detection safeguards, and audit tracking to secure transactions on the network. Messages sent and received through the SWIFT system have a 99.999% guaranteed delivery rate[8].

Another important consideration is that SWIFT does not actually handle the funds being transferred. The network is simply used to communicate between the sending and receiving banks. The banks themselves handle the money and are responsible for the security of the transaction.

How SWIFT Makes Money

As a member-owned cooperative, SWIFT makes money through fees paid by its members. Financial institutions that want to be members of SWIFT pay a one-time initial fee upon joining, and then annual fees thereafter, based on their membership level.

In turn, SWIFT members charge end-users (i.e., customers) for the privilege of using its network to facilitate cross-border payments. These charges vary depending on a few factors, including the institution’s usage volume, commercial policy, and the number of intermediaries involved in the transaction. Each intermediary bank likely tacks on its own commission, which explains why different users pay different fee amounts for international payments.

SWIFT members also make money through currency exchange rates. Banks typically charge 3% to 5% higher than the prevailing rate when processing currency conversions[9]. This usually represents the largest cost involved in SWIFT cross-border transfers.

SWIFT members may also charge additional discretionary costs, such as bank overheads and processing fees. End-users usually bear these charges.

Takeaways

- The Society for Worldwide Interbank Financial Telecommunications (SWIFT) is a global messaging standard used by banks to communicate and process cross-border transactions.

- It is a member-owned cooperative comprising more than 11,000 financial institutions across over 200 countries. SWIFT replaced the obsolete Telex method.

- The system works by assigning a unique ID code to each member, used to identify the institution, country, city, and branch. This makes the entire process more secure and enormously expedites the transfer of funds from one bank to another.

- SWIFT transactions can take anywhere from instantaneous (in the case of a nostro/vostro dual ledger system) up to four business days to complete.

Sources

- Kagan, J. (2022). Telegraphic Transfer (TT). Investopedia. Retrieved from https://www.investopedia.com/terms/t/telegraphic-transfer.asp

- The Society for Worldwide Interbank Financial Telecommunication. (n.d.) SWIFT history. Retrieved from https://www.swift.com/about-us/history

- Financial Crimes Enforcement Network. (n.d.) Appendix D – Fundamentals of the Funds Transfer Process. U.S. Department of the Treasury. Retrieved from https://www.fincen.gov/sites/default/files/shared/Appendix_D.pdf

- The Society for Worldwide Interbank Financial Telecommunication. (n.d.) SWIFTNet Link. Retrieved from https://www.swift.com/our-solutions/interfaces-and-integration/swiftnet-link

- ISO 9362. (n.d.) Business Identifier Code. Retrieved from https://www.iso9362.org/isobic/overview.html

- The Society for Worldwide Interbank Financial Telecommunication. (n.d.) How long do wire transfers take? Retrieved from https://www.swift.com/your-needs/banking/how-long-do-wire-transfers-take

- Borga, L. (2022). Nostro Account vs. Vostro Account. FundsNet. Retrieved from https://fundsnetservices.com/nostro-account-vs-vostro-account

- Fineksus. (n.d.) 5 Things to Know About Secure Financial Messaging Services. Retrieved from https://fineksus.com/5-things-to-know-about-secure-financial-messaging-services/

- CurrencyTransfer. (n.d.) What are SWIFT transfers and how long do they take? Retrieved from https://www.currencytransfer.com/faq/what-is-swift-transfer