What Is Takeout Financing?

REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

Shortcuts

- Takeout financing is a long-term loan that “takes out” or replaces a short-term loan.

- It is typically used in the construction industry to pay off a short-term loan that financed construction or development of commercial real estate.

- Takeout financing is useful because it has lower interest rates, which allows the developer to save money by paying down the high-interest construction loan.

- A bridge loan may also be used as an initial takeout loan before a permanent takeout loan is approved.

What Is Takeout Financing For?

Takeout financing is when a long-term loan is used to pay off a short-term loan[1]. It is so-called because it replaces, or “takes out,” the initial loan.

This financing is common in the construction industry, where a developer takes out a short-term construction loan, and, when the project is done (or when certain milestones in the construction have been met), takes out another loan with longer terms and lower interest rates to pay off the original interim financing.

Takeout financing not only pays off the principal of the original loan but also its accumulated interest.

The takeout lender and the borrower enter into a long-term arrangement in takeout financing. The takeout loan in this funding setup is usually for real estate property projects[2], usually amortized over 25 years[3].

The difference between a takeout loan and other loans is that takeout lenders not only impose interest but may also demand a share of any capital gains on the collateral when it is subsequently sold.

Takeout Commitment

Takeout lenders also issue a takeout commitment to the borrower. This is a written guaranty that the borrower will get sufficient funding to pay off the initial financing or construction loan[4].

It is common for short-term lenders, such as banks, to require that developers have this commitment from a takeout lender before they provide a construction loan. These lenders rely on takeout commitments to mitigate the risk on the money they lend to construction firms or developers.

How Construction Funding Works

Compared with other real estate projects, commercial real estate development can be more capital-intensive. For example, much more capital is needed upfront to develop a large-scale office building than a smaller multifamily unit[6]. This is why many commercial real estate projects need additional or long-term funding, such as takeout financing.

Therefore, developers usually need to secure two types of financing: a short-term loan and a long-term one.

A construction loan is an example of a short-term loan. This loan finances the construction phase and lease-up period of a project. New developers, in particular, need this initial financing as they still lack a solid credit history that would enable them to get long-term funding for a project.

Takeout financing is an example of a long-term loan for construction projects. This loan provides the borrower with capital to pay off the initial loan. Meanwhile, the borrower can repay the longer-term loan with lower interest rates over an extended period.

A financial institution sometimes combines short- and long-term financing into one package. The combination is called construction-to-perm loans or construction/mini-perm loans[5].

BY THE NUMBERS: The annual expenditure of the U.S. construction industry averages about $1.231 trillion.

Source: Policy Advice

Takeout Financing Requirements

Takeout lenders are typically large financial conglomerates, such as insurance or investment companies.

They screen borrower applications for takeout financing by verifying the following:

- Construction receipts. The loan officer examines the details of the borrower’s construction loan—the original plans, the loan draw schedule, and invoices to check if the work was completed to specifications.

- Certificate of occupancy. This certificate assesses that the borrower’s project is ready to move to the operational stage from the construction phase.

- A lien check. The loan officer looks at payment settlements. The lender confirms that no construction liens are hanging over the project before approving takeout financing.

- Other standard documentation. Other requirements include the borrower’s corporate tax returns during the last three years, corporate bank statements, and lease agreements on the subject property. The lenders usually perform this same procedure on the personal guarantors of the takeout loan, if any.

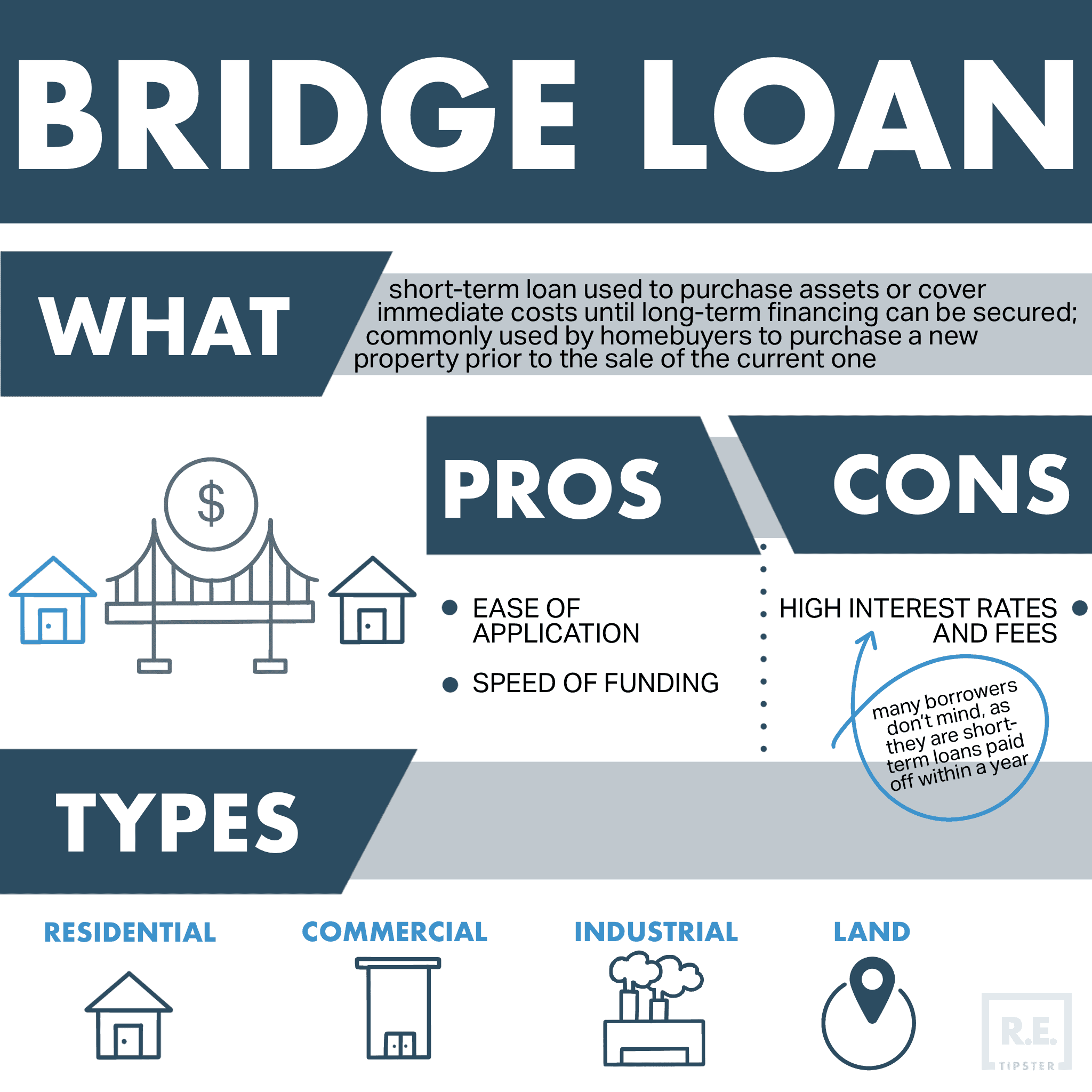

Bridge Loans as Initial Takeout Financing

Takeout financing may sometimes take the form of a commercial bridge loan[7]. Borrowers can use this funding between acquiring commercial property and obtaining a permanent loan. They can use the bridge loan when their commercial property is yet to be fully optimized or when its lease-up is taking longer than expected.

Commercial bridge loans can be funded quickly[8], with terms and features including the following:

- Maturity of between three months and three years.

- Relatively higher interest rates and fees.

- Requires collateral, typically real estate.

Takeout loans, in comparison, have more favorable terms. Subject to negotiation, takeout financing can feature a 30-year mortgage with fixed amortization and the building as collateral[9]. The borrower can get a lower interest rate and use the funding from the mortgage to pay off the short-term loan that financed the construction.

Pros and Cons of Takeout Financing

There are several advantages and disadvantages to a takeout loan.

Pros

- Lower cost. The takeout loan pays down a higher-interest construction loan, which allows the developer to lower their costs.

- Less risk. Takeout financing injects long-term certainty into a property development that may otherwise face delays and other unforeseen issues.

Cons

- Share of future income. The lender may demand a percentage of the future income from the property as one of the conditions for approval.

- Capital gains. Some takeout lenders may also demand a cut on capital gains from the property if it is sold later.

Sources

- Hayes, M. (2021.) Takeout. Investopedia. Retrieved from https://www.investopedia.com/terms/t/takeout

- Tracy, P. (2020.) What is a Take-Out Loan? Investing Answers. Retrieved from https://investinganswers.com/dictionary/t/take-out-loan

- C-Loans. (n.d.) Commercial and Apartment Construction Loans “Takeout Loans.” Retrieved from https://www.c-loans.com/takeout-loans

- Kagan, J. (2019.) Take-Out Commitment. Investopedia. Retrieved from https://www.investopedia.com/terms/t/take-out-commitment.asp

- Cauble, T. (2020.) Here Are The 5 Primary Types of Commercial Real Estate. The Cauble Group. Retrieved from https://www.tylercauble.com/blog/types-of-commercial-real-estate

- Links Financial. (2016.) Real Estate Land Development Financing. Retrieved from https://www.links-financial.com/real-estate-development-financing/

- (2021.) Hoory, L. (2021.) Commercial Bridge Loans: Uses, Terms and Lenders. Retrieved from https://leverage.com/financing/commercial-bridge-loan/

- Feldman Equities. (n.d.) Are Bridge Loans a Good Form of Financing for Commercial Real Estate? Retrieved from https://www.feldmanequities.com/education/are-bridge-loans-a-good-form-of-financing-for-commercial-real-estate/

- Westwood Net Release Advisors. (2014.) Should You Get a Takeout Loan? Retrieved from https://westwoodnetlease.com/should-you-get-a-takeout-loan/