What Is Tenant Screening?

REtipster features products and services we find useful. If you buy something through the links below, we may receive a referral fee, which helps support our work. Learn more.

How Tenant Screening Works

A tenant screening process generates a document called a screening report. This document contains revealing insights into the past actions of prospective renters.

In general, it helps residential landlords and property managers identify prospective tenants most likely to cause problems[1].

A tenant screening report may include the following:

- Rental history.

- Eviction records[2].

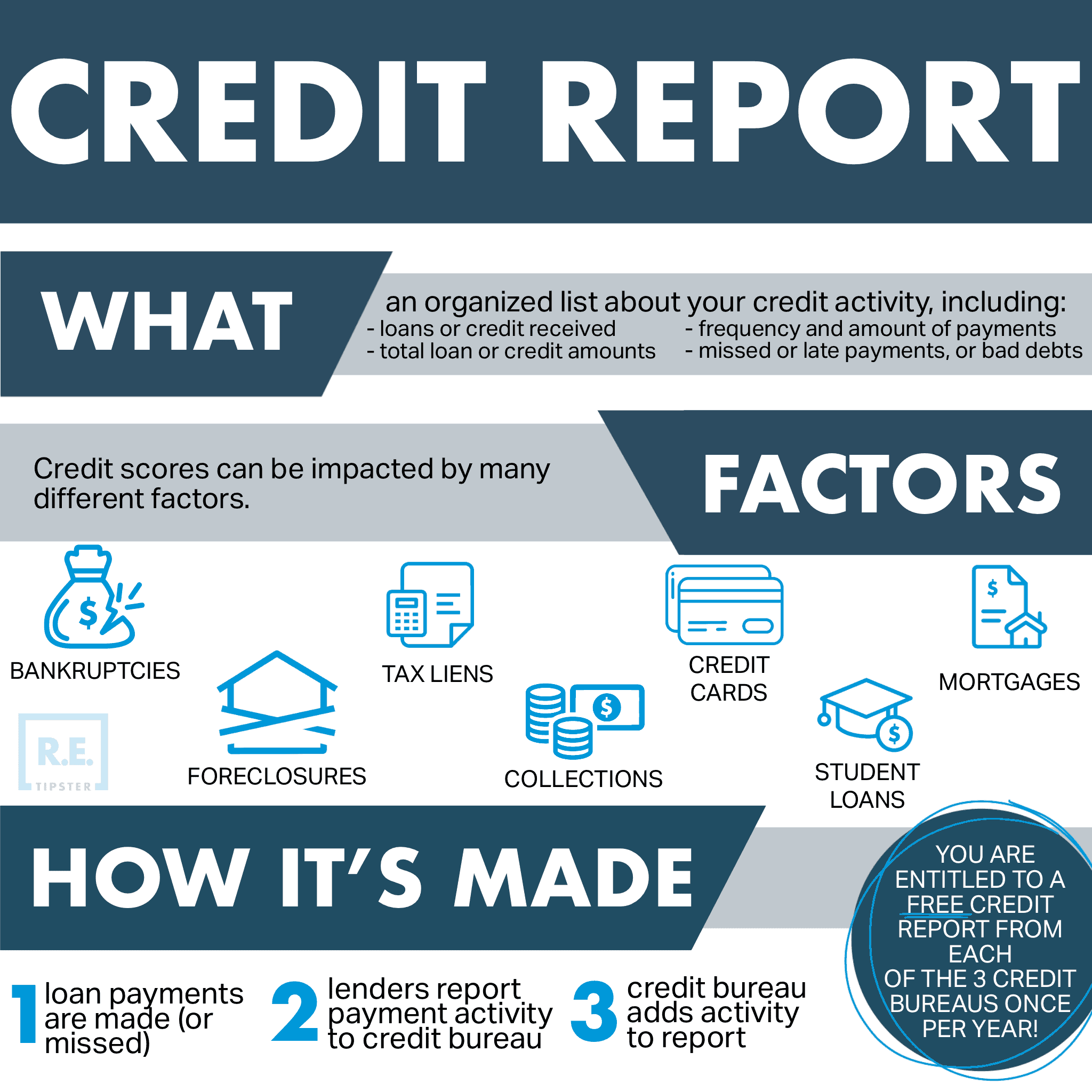

- Credit reports.

- Employment verification.

- Criminal records.

- Sex offender registries[3].

- Terrorist watchlists.

Recommendation or risk score based on the criteria selected by the landlord or property manager.

Landlords and property managers rely on tenant screening reports to determine which aspiring tenants are good candidates. Many landlords set the amount of renter’s security deposit based on these reports.

Naturally, any incorrect or outdated information in the tenant screening report can undermine a tenant’s ability to find and obtain housing[4].

If a property owner or manager rejects a prospective tenant, federal law obligates them to inform the candidate if their tenant screening reports were used in the decision-making process. Moreover, landlords must also share the company’s contact information where the report came from.

Also, rejected tenants should be made aware of their right to dispute the errors in the report and to request a free copy of it within 60 days from the date they were denied housing.

Red Flags in a Tenant Screening Report

Red flags in tenant screening reports include bad credit, unverifiable sources of income, a history of evictions, or criminal convictions. Active arrest warrants or pending criminal charges may also put an aspiring tenant at a disadvantage.

In addition, lying about income, using family members as references, being overly defensive about background check results, and offering an advance payment are warning signs that can make landlords suspicious of aspiring tenants.

Red flags do not necessarily disqualify a prospective tenant from getting housing. However, since it is likely other candidates have better credentials, the landlord will usually pick one who seems the least problematic.

BY THE NUMBERS: 34% of American consumers find errors in their credit reports, casting doubt on the Consumer Data Industry Association’s claim of a 98% accuracy rate.

Source: CNBC

What Does a Landlord Look For in a Tenant?

Generally, landlords and property managers look for tenants that never miss a payment, respect the rental unit, and do not cause trouble.

To see whether candidates fit these criteria, they want to see good creditworthiness, spotless rental histories, adequate income, and no record of criminal activity.

Creditworthiness

Creditworthiness is generally the sum of many good decisions made over a long period. It involves paying bills in-full and on time to demonstrate financial reliability and using as little debt as possible to avoid the appearance of being cash-strapped[5].

A rental applicant can improve their credit score by maintaining a lengthy credit history, using a healthy mix of credit types, and not actively seeking new credit from other lenders.

Rental History

Historical rent payments may also appear in the credit report[6].

Unless the previous landlords voluntarily signed up for a rent reporting service, there might be no available data to see one’s history as a renter. That is why many landlords and property managers have to make do with eviction lawsuit records that may exist.

Income

There is no universal standard when it comes to income. However, landlords and property managers will almost always prefer higher earners.

Two primary schools of thought determine whether one’s income is enough to pay rent regularly[7]. Some believe half of one’s monthly income should be dedicated to cover the necessities, including housing. Others only want to accept tenants who do not have to spend more than 30% of their gross monthly income on rent.

Criminal Background Check

Landlords run a criminal background check to assess how much of a risk prospective tenants are to other renters, the property, or the neighborhood.

Tenant Screening FAQs

Tenant screening involves a lot of questions, mostly from tenant candidates who are unsure how their data is sourced and handled.

Here are some frequently asked questions about tenant screening.

What Is a Good Credit Score to Rent a House?

670 is usually the magic number, but 600 to 650 is acceptable, especially in a less competitive rental market.

A lower credit score does not automatically result in denial, but it may prompt landlords to look closely at one’s credit information.

Without stellar credit, aspiring tenants may still snag rental units by agreeing to a higher security deposit or paying rent a few months in advance. Either can help offset any risk associated with poor credit[8]

Online tools like Avail, TenantCloud, and SmartMove can all be used to pull credit and background checks.

Does Tenant Screening Affect Credit Scores?

Tenant screening may affect credit scores, especially if a landlord does a hard inquiry[9], reducing a candidate’s score by up to five points.

It is a small deduction, but it can affect the creditworthiness of an individual with a short credit history. A hard credit inquiry can show up on a credit report for up to two years.

Fortunately, multiple hard inquiries may only count once when done within a short period because credit scoring models consider this activity as rate shopping. For example, FICO and VantageScore ignore several hard pulls made within 30 and 14 days, respectively[10].

There are ways to avoid the credit impact of a hard pull. For example, if the applicant provides the credit report the landlord uses for screening, there will be no point deduction because it is considered a soft credit inquiry.

How Long Does the Screening Process Take for an Apartment?

Typically, it takes one to three days.

It may take longer when the landlord or property manager finds it unusually difficult to verify everything that needs checking.

The usual issues that prolong the tenant screening process are not being as thorough as possible when filling out the application form, having incomplete papers, and failing to anticipate needing a co-signer or a guarantor.

How Much Does It Cost to Screen Tenants?

The fees tenant screening companies charge vary by location and level of service. In general, they range from $14 to $75 per applicant.

It is common for tenant screening service providers to pull credit reports from one of the three major credit bureaus. However, only some give landlords and property managers the option to choose.

Some tenant screening companies can provide supplemental documents and check references as well.

Takeaways

- Tenant screening is a background check that helps residential landlords and property managers identify good tenants and weed out less desirable ones.

- Landlords and property managers use tenant screening to find the ideal tenant: one who pays in full and on time, takes care of the rental unit, and does not pose any risk to other tenants, the property, and the neighborhood. Conversely, tenant screening also helps them avoid the opposite.

- Landlords generally look for credit reports, rental history, income, and criminal activity (if any) to fit these criteria.

Sources

- Eberlin, E. (2019.) Renting From a Landlord vs Property Manager. The Balance. Retrieved from https://www.thebalancemoney.com/renting-from-landlord-vs-property-manager-4174463

- Consumer Financial Protection Bureau. (2021.) How long can information, like eviction actions and lawsuits, stay on my tenant screening record? Retrieved from https://www.consumerfinance.gov/ask-cfpb/how-long-can-information-like-eviction-actions-and-lawsuits-stay-on-my-tenant-screening-record-en-2104/

- Myers, C. (2022.) Can a Landlord Evict a Sexual Predator Upon Finding Out? The Nest. Retrieved from https://budgeting.thenest.com/can-landlord-evict-sexual-predator-upon-finding-out-24343.html

- Shetty, N. (2022.) The problem with tenant screening reports. The Real Deal. Retrieved from https://therealdeal.com/2022/09/12/the-problem-with-tenant-screening-reports/

- DeNicola, L. (2022.) What factors affect your credit scores? Credit Karma. Retrieved from https://www.creditkarma.com/advice/i/what-affects-your-credit-scores

- Merritt, J. (2022.) How Can You Get Credit for Paying Rent? U.S. News. Retrieved from https://money.usnews.com/credit-cards/articles/how-can-you-get-credit-for-paying-rent

- Luthi, B. (2020.) How Much of My Income Should Go Toward Rent. Experian. Retrieved from https://www.experian.com/blogs/ask-experian/how-much-should-i-spend-on-rent/

- Irby, L. (2020.) What Do Landlords Look for in a Credit Check? myFICO. Retrieved from https://www.myfico.com/credit-education/blog/credit-score-to-rent-apartment

- TransUnion. (2015.) The Difference Between Hard and Soft Credit Inquiries. Retrieved from https://www.transunion.com/blog/credit-advice/the-difference-between-hard-and-soft-credit-inquiries

- Allcot, D. (2019.) Do apartment credit checks hurt your credit score? Bankrate. Retrieved from https://www.bankrate.com/finance/credit-cards/does-rental-application-hurt-credit-score/