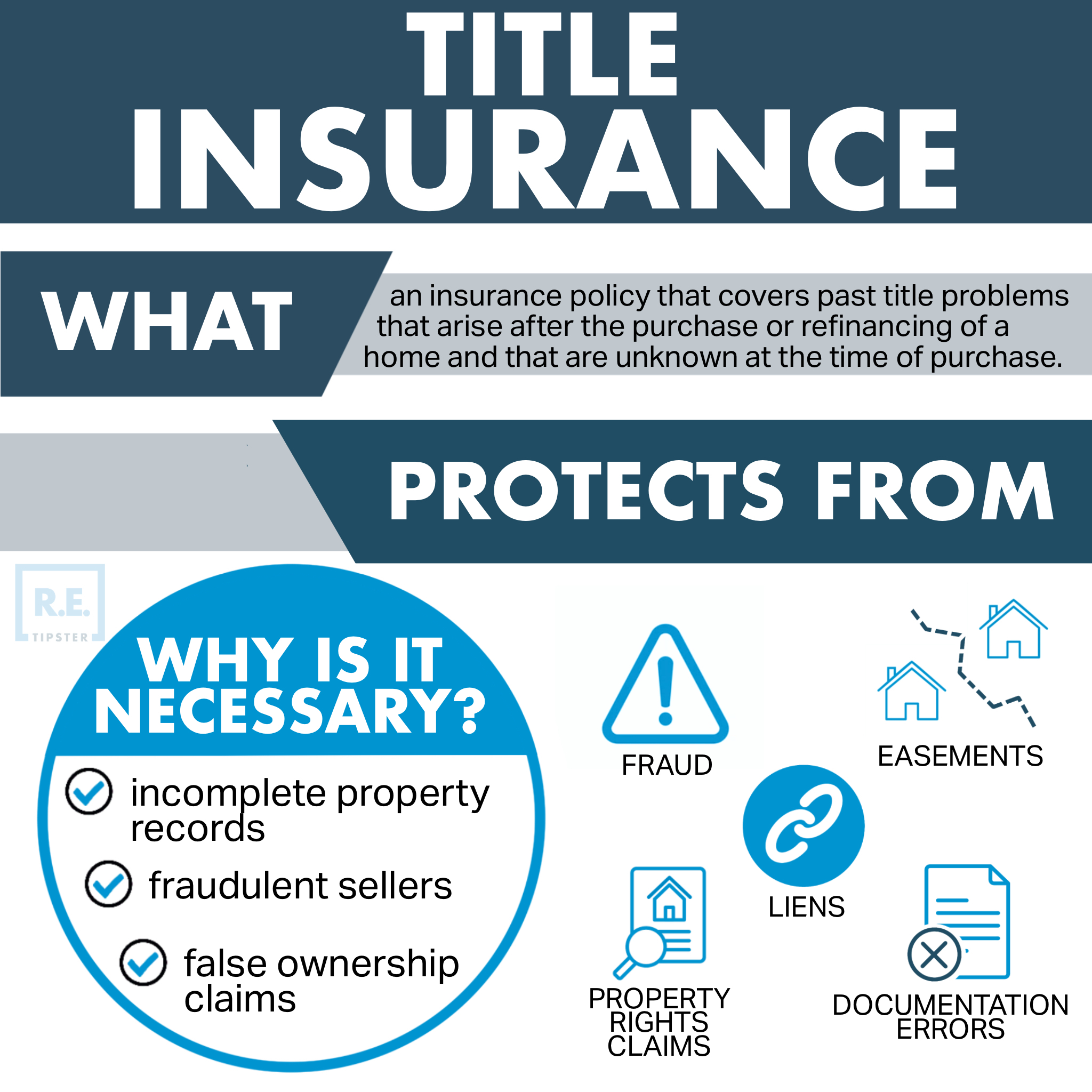

What Is Title Insurance?

REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

Why Does a Property Owner Need Title Insurance?

A property owner needs title insurance to protect them from title problems, such as fraud on paperwork, unpaid taxes on the property, or third-party claims (e.g., a spouse or an heir of the previous owner) on ownership.

Title problems may arise anytime, even after owning the property problem-free for years.

As a form of indemnity insurance, title insurance covers any issue that may not be visible in a title search.

A lender usually orders a title search from a title insurance company before the home loan closes. This title search attempts to reveal any possible cloud on the title[3]. If the title search finds no defect, the title is free and clear; otherwise, the buyer must address any defect first.

Buyers may fix minor title defects or document errors by presenting supporting papers with accurate information. However, some issues, such as conflicting wills[4] and missing heirs[5], are more challenging and may take time to resolve.

When a title problem surfaces after the title insurance is issued, the title company instead shoulders the financial burden to protect the insured’s interest.

Title Insurance vs. Homeowners Insurance

Title insurance protects the insured from encumbrances[1] in the past, while homeowners insurance shields the insured from those that may yet happen[2], typically for physical damage or liabilities that may occur in the property premises.

The liability coverage of homeowners insurance triggers when someone gets hurt on the insured party’s property. The policy covers the insured party from sudden medical expenses, among other compensation, that the aggrieved party may demand.

Another deviation from title insurance is that a homeowners policy does not always fully reimburse the amount spent to fix the damage[6]. Homeowners insurance also pays for replacing damaged personal property or living expenses during renovation or repair.

A title insurance policy can offer as much protection to mortgage lenders as it does to the homeowner. The type of title insurance, as explained below, dictates who receives the coverage as well as who may incur the title insurance costs.

Types of Title Insurance

There are two types of title insurance: by party or by coverage.

By Party

This type of title insurance comes in two forms: lender’s policy and owner’s policy.

A lender’s title insurance policy (also known as loan policy) insures the mortgage lender’s financial stake in the house, which serves as collateral for the loan.

By contrast, an owner’s policy looks after the interest of the homeowner and their heirs.

The payout of either title insurance policy can cover the fees associated with claims. More importantly, each includes a comprehensive title search to uncover the property ownership risks involved in the transaction.

By Coverage

Title insurance by coverage includes standard and extended policies. The former covers only the basics, whereas the latter offers protection against more risks.

A standard policy covers only common title risks, such as clerical mistakes in legal documents, public records, or deeds (e.g., fraud or forgery). Standard title insurance is commonly secured as the owner’s policy.

An extended policy (also known as an American Land Title Association policy) may be more beneficial for undocumented liens, survey and boundary issues, easement disputes, and building regulation violations. This is the most dependable option to protect the lender’s security interest.

Title Insurance: Frequently Asked Questions

Below are common questions related to title insurance.

What Does Title Insurance Not Cover?

Title insurance does not cover existing issues discovered during a title search[7] or eminent domain[8].

Furthermore, title insurance does cover title defects that arise due to the owner’s carelessness or malice. For instance, failing to pay a contractor or having unpaid property taxes can lead to future title claims, no matter the status of the owner’s title insurance policy.

A real estate buyer should not confuse title insurance with mortgage insurance or private mortgage insurance (PMI)[9]. A PMI covers the greater risk a mortgage lender assumes when the borrower makes a down payment of less than 20% of the property’s value[10].

A home buyer may need title insurance and PMI to take out a mortgage. Note that these are separate purchases.

Who Pays for Title Insurance?

The mortgage borrower usually pays for title insurance, specifically a lender’s policy.

An owner’s policy is a discretionary expense, but some states may force the seller to cover title insurance premiums for the buyer’s benefit.

On average (across the 50 states), an owner’s title insurance policy may cost $1,000[11]. The final amount—a one-time fee payable at closing—depends on the state, the house’s sales price, and the insurer.

The borrower has the final say on where they choose to buy title insurance, even though the lender, seller, or real estate agent may recommend their own.

How Long Does Title Insurance Last?

Title insurance lasts for as long as the insured has a stake in the house.

Therefore, the lender’s policy is good until the home loan matures or ends another way.

For example, if the borrower refinances, the lender’s title insurance policy will expire because the new home loan will replace the existing one. As a result, the borrower has to purchase a new lender’s policy.

Meanwhile, the owner’s policy does not lose its utility even after the mortgage is paid. It protects the insured and their heirs as long as they have a stake in it.

Is Title Insurance Worth It?

An owner’s title insurance policy can be a considerable expense. Some buyers may reason that they do not need title searches to learn about a house’s history.

However, not having title insurance can be incredibly risky, especially when buying property owned by a financially distressed homeowner. In addition, once the house changes hands and there is no policy in place, the new owner is responsible for any title defect, existing or otherwise.

BY THE NUMBERS: Using a third party to do a title search costs $75 to $100.

Source: Legal Beagle

Takeaways

- Title insurance protects the lender or homeowner against loss due to an issue that may infringe on property ownership rights.

- Title insurance policies protect either the lender or the homeowner.

- The lender’s policy expires only when the home loan ends, whereas the owner’s policy is good for as long as the homeowner has a stake in the house.

- Title insurance does not come cheap, but it can be risky to proceed without one.

Sources

- Giusti, A. (2020, September 24.) Don’t let common property title issues derail your home closing. Bankrate. Retrieved from https://www.bankrate.com/mortgages/common-property-title-issues/

- What Happens When Wills and Deeds Conflict? (2020, November 27.) Deeds.com. Retrieved from https://www.deeds.com/articles/what-happens-when-wills-and-deeds-conflict/

- Kilroy, A. (2022, October 16.) Encumbrances: What They Are And How They Work. Quicken Loans. Retrieved from https://www.quickenloans.com/learn/encumbrance

- Araujo, M. (2022, June 15) What Is a Covered Peril? The Balance. Retrieved from https://www.thebalancemoney.com/homeowners-insurance-peril-2645726

- What if an Heir Cannot Be Located? (2016, October 14.) Probate.com. Retrieved from https://www.probate.com/Latest-News/2016/October/What-if-an-Heir-Cannot-Be-Located-.aspx

- Curtis, K. (2022, April 8) Actual Value vs. Replacement Cost. U.S. News. Retrieved from https://www.usnews.com/insurance/homeowners-insurance/actual-cash-value-vs-replacement-cost

- Lander, S. (2018, November 20.) What Is the Difference Between Standard & Extended Title Insurance? SF Gate. Retrieved from https://homeguides.sfgate.com/difference-between-standard-extended-title-insurance-58582.html

- Rafter, D. (2022, October 18.) 6 Eminent Domain Examples And The History Behind Them. Rocket Mortgage. Retrieved from https://www.rocketmortgage.com/learn/eminent-domain

- Tarpley, L. (2022, November 3.) There are 4 types of private mortgage insurance, and the type you choose determines how and when you pay. Insider. Retrieved from https://www.businessinsider.com/personal-finance/private-mortgage-insurance

- Backman, M. (2021, July 19) 3 Problems With Making Less Than a 20% Down Payment on a Home. The Motley Fool. Retrieved from https://www.fool.com/the-ascent/mortgages/articles/3-problems-with-making-less-than-a-20-down-payment-on-a-home/

- Ference, A. (2022, August 8.) What Is Title Insurance, and How Much Does Title Insurance Cost? Realtor.com. Retrieved from https://www.realtor.com/advice/buy/how-much-does-title-insurance-cost/