What Is an Umbrella Policy?

REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

Shortcuts

- An umbrella policy is extra liability insurance that kicks in when your regular insurance maxes out.

- Umbrella coverage extends over multiple types of insurance like auto, home, and watercraft.

- Typical coverage starts in increments of $1 million and helps protect valuable assets.

- Some umbrella policies offer “drop down” coverage for unique scenarios like the primary insurer’s insolvency.

- Umbrella policies have exclusions and limitations, so they don’t replace your regular insurance.

- These policies are especially beneficial for homeowners, landlords, business owners, and people with higher-risk hobbies.

How Does an Umbrella Policy Work?

An umbrella policy is a type of broad personal liability insurance that protects you from expensive legal fees exceeding the limits of your other main liability policies. They don’t replace existing auto, home, or watercraft coverage[1] but act as an additional layer of liability protection.

The name “umbrella” policy shows what it does: it covers more areas than just one.

Individuals, families, and business owners buy umbrella policies to add to their main insurance policies, such as homeowner’s or auto insurance, to provide extra liability coverage. When someone makes a claim that is too big for the main coverage, these policies add extra layers of protection.

Umbrella coverage may also be considered supplementary coverage for risks like slander or libel[2] that may not be included under a standard homeowner’s policy.

How Much Does an Umbrella Policy Cover?

An umbrella policy provides a higher limit of liability coverage, typically in increments of $1 million[3], to protect assets above and beyond the insured’s underlying liability limits. For example, if someone has a $300,000 homeowner’s policy limit but is sued for $1 million due to a serious accident on their property, their umbrella policy would cover the remaining $700,000 once the homeowner’s policy reaches its limit.

Some umbrella policies may offer “drop down” coverage[4] that defends and pays claims within the underlying policy limits if the primary insurance fails to respond due to insolvency or other specific conditions.

Deductibles on umbrella policies[5] are typically called self-insured retention; the amount can vary widely. Premiums average $150 to $300 per year for $1 million in additional liability limits, but this depends on the coverage amount and the insured’s risk factors.

When Is an Umbrella Policy Needed?

Many homeowner’s and renter’s insurance policies provide liability coverage limits that may range up to $100,000 or even $300,000. While these amounts may seem sufficient for minor lawsuits, any serious claims or multiple claims joined together could easily exceed such limits. An umbrella policy may help cover the excess.

Some common situations where umbrella coverage is beneficial include:

- Auto accidents resulting in severe injuries where medical bills and legal awards push claims over the driver’s auto policy limits.

- Slip-and-fall accidents or other personal injury lawsuits on your property where damages sought are high.

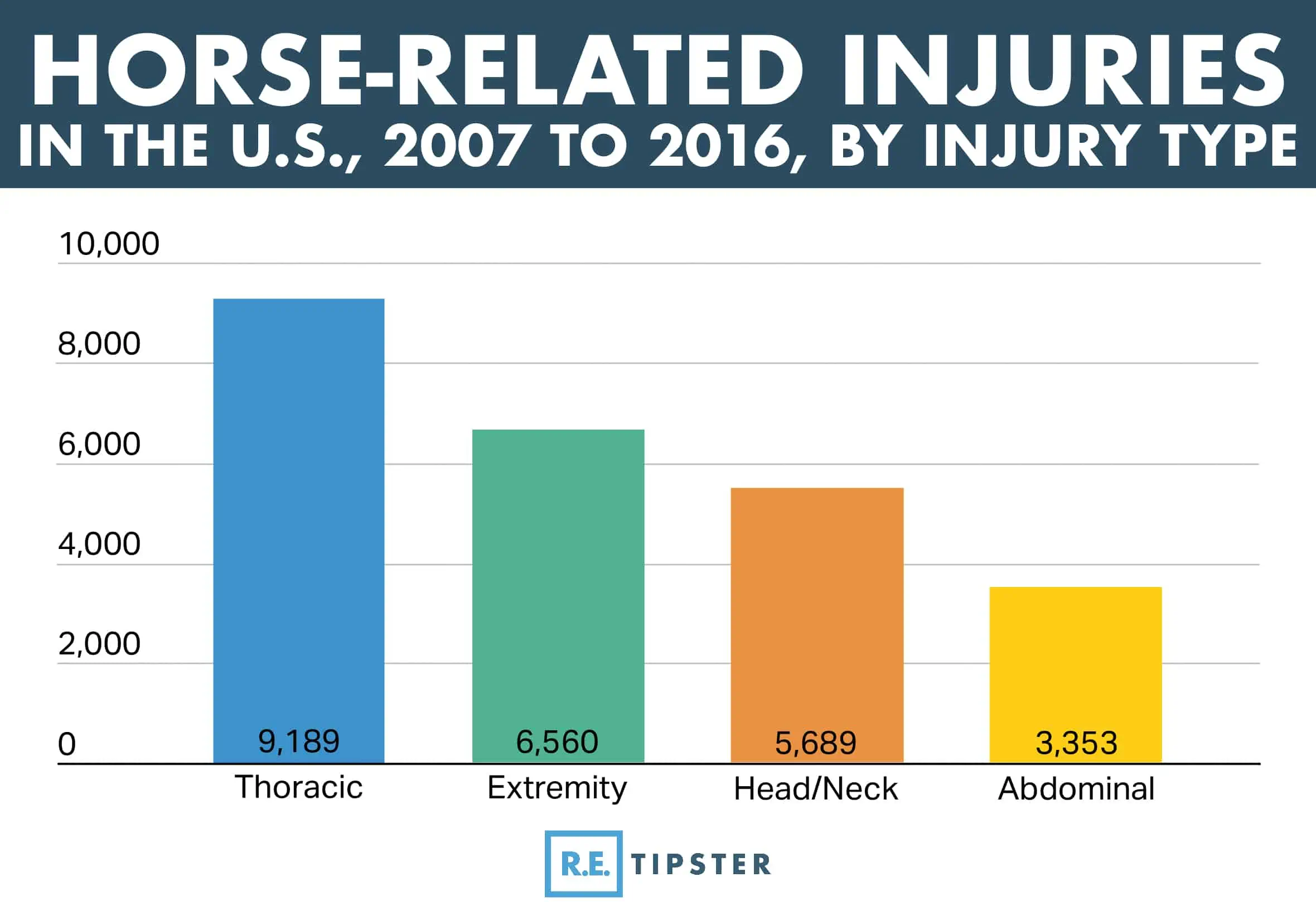

- Recreational activities like boating, skiing, or horseback riding[6] that carry higher inherent risk of injury (and thus lawsuits).

Source: “Hearing hoofbeats? Think head and neck trauma: a 10-year NTDB analysis of equestrian-related trauma in the USA,” University of Texas Rio Grande

Who Needs an Umbrella Policy?

- Homeowners: If you own a home, especially if it’s a big one with a pool, trampoline, or even a playground, you’re at higher risk for lawsuits. People can get injured on your property, and you could be held responsible. This is especially true if you’re a parent and your child accidentally injures someone or damages property.

- Landlords: If you’re renting out property, you’re also at risk. If a tenant or their guest is hurt on your property, you could be liable for their medical bills and more[7].

- Business owners: Businesses have their own set of risks, from customer injuries to problems with products. An umbrella policy is also useful for business owners facing the risk of expensive lawsuits from customers, clients, or employees.

- Investors and high net worth individuals: If you’re an investor or someone with substantial assets, an umbrella policy can protect you from the financial risks that come with owning and managing properties.

- Car owners: Driving is risky, even for the best drivers. One accident can lead to huge costs, especially if someone gets seriously injured. Around 40% to 50% of car accidents go to claims court[8], and without an insurance policy that covers it, settling these can come out of your pocket.

- Hobbyists: Do you love boating, skiing, or horseback riding? These activities can be risky, and if an accident occurs, you could be liable. An umbrella policy can offer specialized coverage for these types of activities.

Types of Umbrella Policies

Some insurers offer more specialized types of umbrella policies.

A commercial umbrella may make sense for businesses and commercial property owners with higher liability exposures, while a personal umbrella may benefit individuals and families with homeowners, auto, watercraft, and personal excess liability policies.

Additionally, a commercial umbrella policy are either “stand-alone” or “following-form[9].”

A stand-alone umbrella policy is the typical commercial umbrella policy, which can be purchased discretely from the primary liability policy. These policies offer limited coverage without an underlying primary policy like auto or homeowner’s insurance and at a higher premium.

The other type is a following-form, which is purchased as part of the primary policy and has the same general terms and conditions as the underlying policies it complements.

Optional add-on coverages on some umbrella policies may include worldwide liability protection, limited medical payments coverage, and identity theft reimbursement.

Things to Consider Before Buying an Umbrella Policy

Before purchasing umbrella insurance, consumers should evaluate their specific needs and risks to find the right level of protection. Some factors to consider include:

- Your existing insurance limits and deductibles on primary auto, home, and watercraft policies.

- The value of your total assets like property, investments, and future earnings potential.

- If you engage in riskier recreational activities, run a business or side hustle, own rental properties, etc.

- Your overall net worth and ability to afford large claims or judgments not fully covered.

- Coverage amounts offered (typical increments are $1M, $2M, $5M or more of protection).

- Umbrella policy premium cost compared to increased protection provided.

- Insurer financial strength ratings and customer service or claims reputation.

Limitations and Exclusions of an Umbrella Policy

When choosing an umbrella policy, it’s important to be aware of what it can and cannot do under certain circumstances.

First off, an umbrella policy is not meant to replace your standard insurance policies. You’ll need to have regular home, auto, or other types of insurance before you can add an umbrella policy.

Second, deductibles still apply. You’ll still have to pay your regular insurance deductible before the umbrella policy kicks in. So if your home insurance has a $1,000 deductible, you’ll pay that first, and then the umbrella policy covers additional costs.

Finally, an umbrella policy won’t cover damages to your personal belongings[10]. For example, if your basement floods and ruins your furniture, the umbrella policy won’t cover that; homeowner’s insurance does.

Frequently Asked Questions: Umbrella Policy

How do I decide the amount of umbrella coverage I need?

The amount of coverage you’ll need depends on your personal risk factors and the assets you’re trying to protect.

A good rule of thumb is to choose a coverage limit that’s at least as high as your net worth[11]. Some financial advisors even recommend getting coverage that’s twice your net worth to be on the safer side.

What does an umbrella policy not cover?

Some exclusions that may apply include property damage to real estate owned by the policyholder, bodily injury or property damage expected or intended from the standpoint of the insured[12], commercial vehicles like trucks or livery vehicles used for business, and professional liabilities arising from certain business activities or negligence.

However, most personal umbrella policies are otherwise very broad in covering liability risks not already addressed under the primary insurance.

Is an umbrella policy worthwhile?

For homeowners with substantial assets like a paid-off home or retirement accounts, the relatively low cost of an umbrella policy is usually worthwhile for the significant liability protection it provides above standard insurance limits. Even homeowners with average net worth can benefit from umbrella coverage depending on the risks of a swimming pool, boat ownership, or side business activities that increase exposure to high injury claims.

An umbrella policy for business owners is also worth the price. If you own or operate a business (such as flipping properties), you’ll want to look into a commercial umbrella policy since a typical umbrella policy usually won’t cover business-related liabilities[13]. This policy offers additional coverage tailored for business risks, like employee injuries or product liabilities.

Sources

- Does umbrella insurance replace my other policies? (2023, June 15.) Peninsula Underwriters Insurance Agency. Retrieved from https://www.penagency.com/blog/does-umbrella-insurance-replace-my-other-policies/

- Does an umbrella policy cover libel or slander? (2018, April.) AllState. Retrieved from https://www.allstate.com/resources/personal-umbrella-policy/libel-slander-liability

- Schlichter, S. (2023, January 30.) What Is Umbrella Insurance, and How Does It Work? NerdWallet. Retrieved from https://www.nerdwallet.com/article/insurance/umbrella-insurance

- Benge, V. (n.d.) What Is Drop Down Coverage on an Umbrella Insurance Policy? Chron Small Business. Retrieved from https://smallbusiness.chron.com/drop-down-coverage-umbrella-insurance-policy-41128.html

- Fontinelle, A. (2023, April 21.) How an Umbrella Insurance Policy Works. Investopedia. Retrieved from https://www.investopedia.com/articles/personal-finance/040115/how-umbrella-insurance-works.asp

- Christey, G., Nelson, D., Rivara, F., Smith, S., Condie, C. (1994, August.) Horseback riding injuries among children and young adults. The Journal of family practice, 39(2), 148–152. Retrieved from https://pubmed.ncbi.nlm.nih.gov/8057065/

- Licensed vs. Unlicensed Contractors. (n.d.) KW Lang Mechanical. Retrieved from https://kwlang.com/licensed-vs-unlicensed-contractors/

- How Many Car Accident Claims Go to Court in the US? (2022.) Hughes Law. Retrieved from https://www.ryanhugheslaw.com/articles/car-accident-claims-statistics

- Stanovich, C. (n.d.) Commercial Umbrella – Stand Alone Or Follow Form? Austin & Stanovich Risk Managers. Retrieved from https://austinstanovich.com/pdf/Articles/Commercial-Umbrella-Stand-Alone-of-Follow-Form.pdf

- Kilroy, A. (2023, October 10.) How An Umbrella Insurance Policy Works And What It Covers. Forbes Advisor. Retrieved from https://www.forbes.com/advisor/car-insurance/umbrella-insurance/

- How Much Umbrella Insurance Do I Need? (2023, October 24.) Ramsey Solutions. Retrieved from https://www.ramseysolutions.com/insurance/how-much-umbrella-insurance-do-I-need

- Warshauer, I. C., & Plunkett, C. (1994, 06). The truth about products liability insurance coverage. Risk Management, 41, 51. Retrieved from https://www.proquest.com/docview/227008693?parentSessionId=cR9KlbCe7GUnvWC26KARWHkvWies612hvX9IsWDZyKs%3D

- Lindsey, R. (2022, May 4.) Why Umbrella Insurance Isn’t Enough Anymore. XInsurance. Retrieved from https://www.xinsurance.com/blog/why-umbrella-insurance-isnt-enough/