What Is a Wraparound Mortgage?

REtipster does not provide legal advice. The information in this article can be impacted by many unique variables. Always consult with a qualified legal professional before taking action.

REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

How Do Wraparound Mortgages Work?

Usually used as a form of seller financing, wraparound mortgages allow a property owner to keep their original mortgage loan in place even when they agree to sell their property to another buyer with seller financing. It works much like a “subject to” purchase with a few key differences[1].

Suppose a buyer makes an offer to buy a property but fails to qualify for a bank loan. They approach the seller to ask about seller financing and the seller agrees to finance 80% of the purchase price at an 8% interest rate.

But on the seller’s side, they decide to leave their existing loan open and only finance the difference between their mortgage balance and the total seller financing loan amount. That way, they can simply finance a portion of their proceeds to the buyer, and collect the down payment in cash.

The buyer gets their financing at negotiable terms that are potentially lower than hard money loan pricing. The seller collects ongoing income and spreads out their taxable gains, all while earning interest that usually includes a spread over what they are actually paying the original bank.

To fully understand what a wraparound mortgage is, it often helps to see an example fully laid out.

Wraparound Mortgage Example

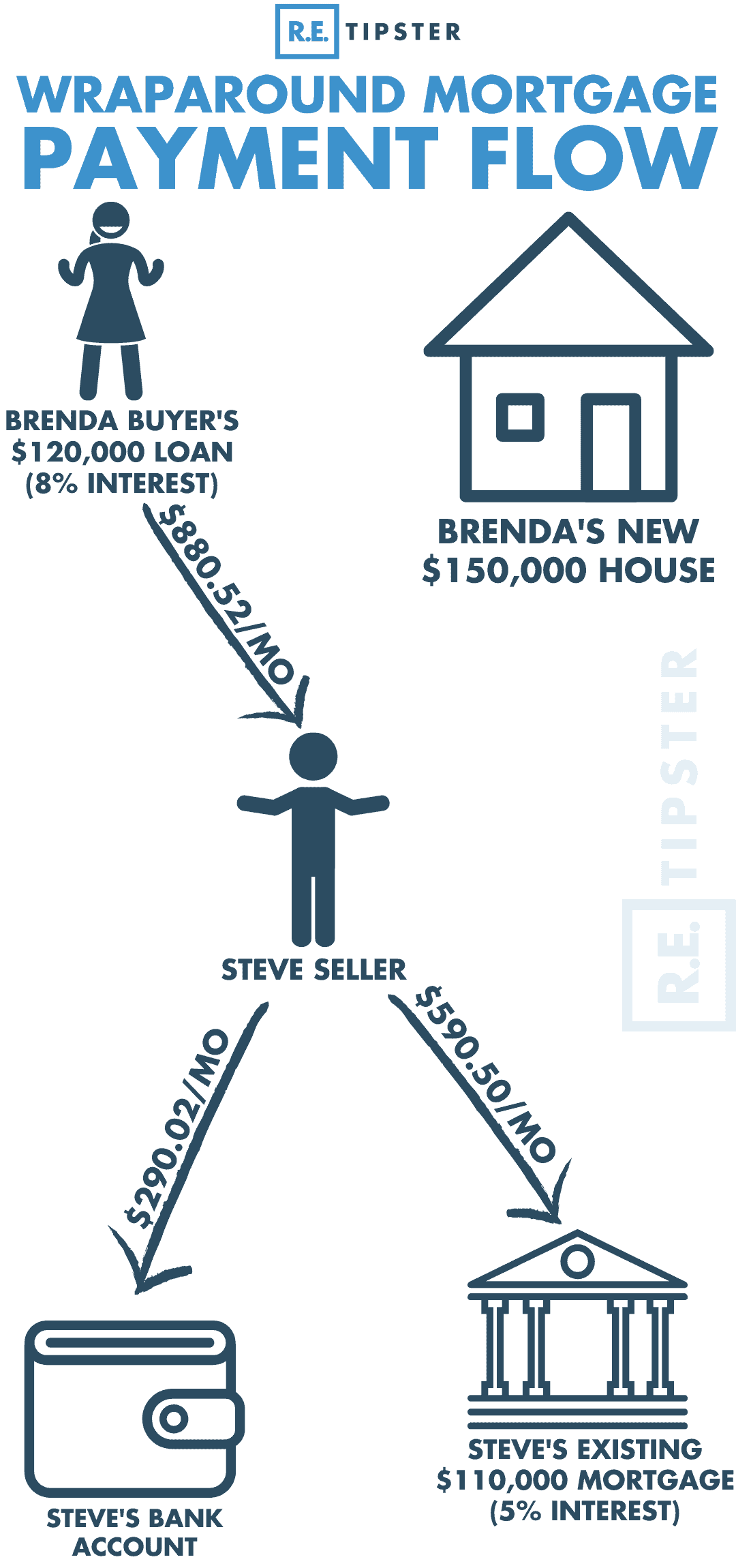

Continuing the example above, Brenda Buyer negotiates 80% seller financing with Steve Seller, at a purchase price of $150,000. Brenda comes up with a $30,000 down payment in cash and receives the remaining $120,000 in installments as a seller-financed mortgage loan at 8% interest. That puts her monthly principal and interest payment at $880.52.

Meanwhile, Steve Seller still has an existing mortgage balance of $100,000. He originally took out the loan for $110,000 at 5% interest, so his monthly payment is $590.50. At the settlement table, he pockets Brenda’s $30,000 down payment and lends her the remaining $20,000 of his would-be proceeds as part of the seller financing.

Steve collects $880.52 from Brenda each month, and in turn, continues paying his original mortgage at $590.50. He keeps the difference of roughly $290.

Note that because Steve earns a spread on the interest for the original loan balance, he earns a much higher effective interest rate. To make this seller financing arrangement work, he only had to delay the receipt of $20,000 of the sale proceeds, but he’s also collecting $290 per month for it. This means his effective return on this $20,000 is over 17%.

Transferring Title and the “Due on Sale” Clause

Most real estate investors ask a crucial question: What about the “due on sale” clause in the seller’s original mortgage note? This is the same question that arises with subject-to deals.

As a refresher, most mortgage loans include a clause stating that the mortgage must be paid in full upon sale or transfer of the property. Technically, Steve Seller in the wraparound loan example above will be violating this clause, if it exists in the original mortgage documents. If the original mortgage lender discovers this, they could call the loan if they discover this change in the ownership.

Seller-financiers can approach this hiccup in three ways.

Option 1: They could just proceed and hope their lender does not find out and call the loan. As long as the monthly payments keep coming in, most mortgage lenders pay little attention to the loan or property[2]. Still, the seller-financier must be prepared to pay off the loan if the lender calls the loan.

Option 2: Sellers can do an installment sale, in which the legal title does not transfer immediately (see: land contract or contract for deed). The buyer takes control of the property but does not legally own it until they meet a certain requirement. That could include getting their own separate financing to pay off the seller in full, or it could be paying the loan balance below a certain amount, or something else entirely. But the new deed does not get recorded right away, so the seller still retains legal ownership.

Option 3: The buyer could assume the original mortgage. But in doing so, they become the legal borrower and start making payments directly to the lender. The seller typically cannot earn a spread on the interest at that point, and would usually structure the seller financing as a second mortgage rather than a wraparound mortgage. It’s also worth noting that most mortgage loans are not assumable.

Advantages of Wraparound Mortgages for Investors

Wraparound mortgages come with several advantages for sellers.

First, they do not have to come up with money out of pocket to pay off their old mortgage when they sell a property with seller financing.

Second, they can potentially earn a spread on the interest for that existing loan balance[3].

Sellers can also insist on retaining legal ownership of the property, which means they don’t have to go through the expensive and lengthy foreclosure process if the buyer defaults. Plus, they won’t violate the “due on sale” clause of their old mortgage if the title doesn’t transfer to a new owner.

For buyers, it adds another option for financing new properties. Buyers can negotiate the interest rate, the down payment and LTV, the loan amortization, and every other component of the loan.

Takeaways

For all their benefits for both buyers and sellers, wraparound mortgages do come with risks. Sellers run the risk of their original lender calling the loan if they transfer ownership without paying it off, and they also run the risk of being left with a hefty mortgage payment if the buyer defaults.

Buyers will also have to live with the risk that the seller may default on their original mortgage since it’s the seller’s responsibility to continue paying their original loan payment. This could potentially lead to a foreclosure that the new buyer may never receive notice about.

As with everything else in real estate investing, it’s important to balance the risk with the return when dealing with a wraparound loan.

Sources

- Weintraub, E. (2020.) Buying Subject-To an Existing Loan. The Balance Small Business. Retrieved from https://www.thebalance.com/buying-subject-to-an-existing-loan-1798423

- Merrill, T. (n.d.) Navigating Due On Sale Clauses For Subject-To Deals. FortuneBuilders, Inc. Retrieved from https://www.fortunebuilders.com/navigating-due-sale-clauses-subjectto-deals/

- Mortgage101.com. (n.d.) Wraparound Mortgage: Buyer and Seller Advantages. Retrieved from https://www.mortgage101.com/article/wraparound-mortgage-buyer-seller-advantages/