What Is Amortization?

REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

Shortcuts

- Amortization is spreading the cost of an asset or loan over time.

- A common example is an amortized loan, which comprises many types of loans, such as mortgages and student loans.

- Regularly scheduled payments on amortized loans go toward both principal and interest, but typically interest first.

- Loan amortization schedules show an inverse relationship between principal and interest over time.

- Negative amortization occurs when payments aren’t enough to cover the interest, increasing the loan’s principal.

Amortization Explained

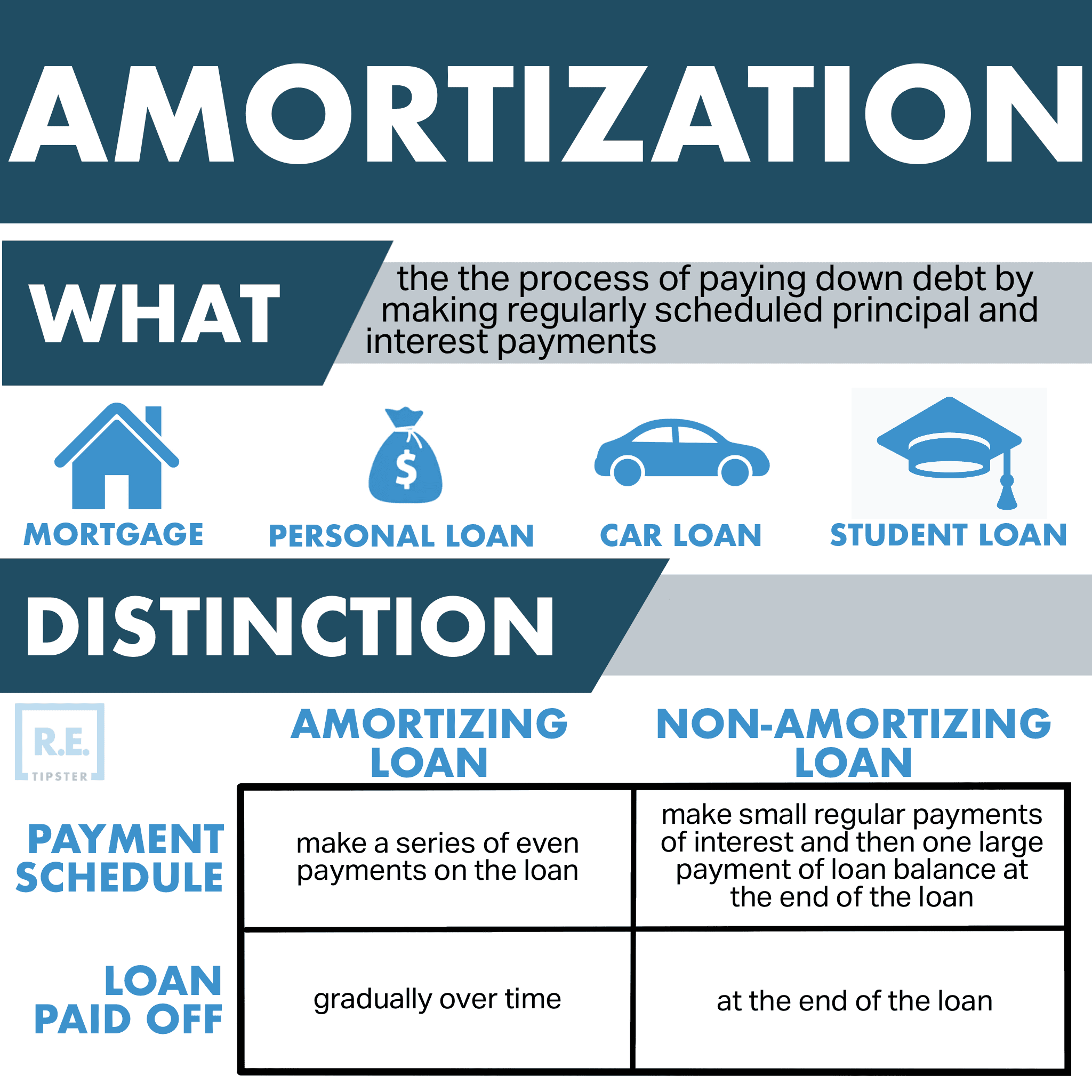

Amortization is an accounting technique that lowers or expenses out the value of an asset over time.

One example is loan amortization, which is the process of paying down debt by making regularly scheduled principal and interest payments. Most business and consumer loans—mortgages, car loans, student loans, and personal loans—follow an amortization schedule.

Amortization is also used, along with depreciation, to spread out the cost of a capital expense for accounting and tax purposes.

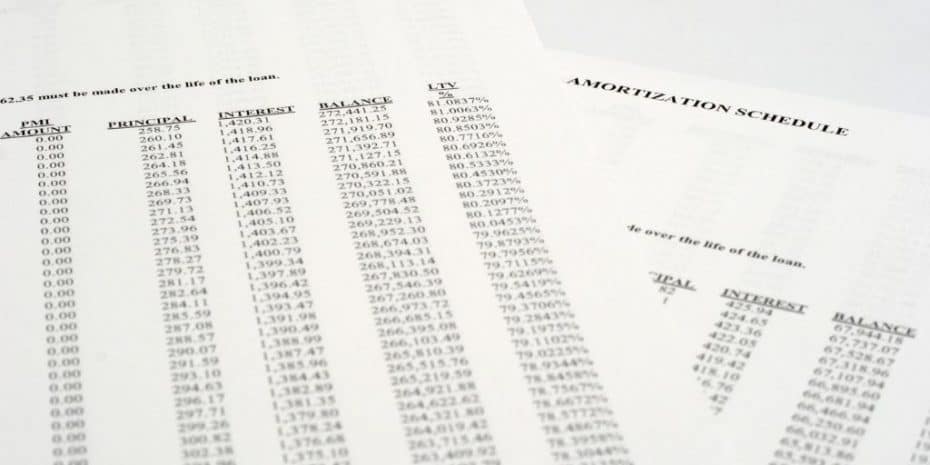

With an amortized loan, payments are applied first to interest and then to the principal balance. Interest is based on the most recent loan balance; as the term progresses, a higher percentage of the payment is allocated to the principal. There is an inverse relationship between principal and interest over the length of the amortization schedule.

Loan amortization involves a series of calculations. The interest due for the period is calculated by applying the interest rate to the current loan balance. This amount is subtracted from the payment to determine the amount to be applied to the principal.

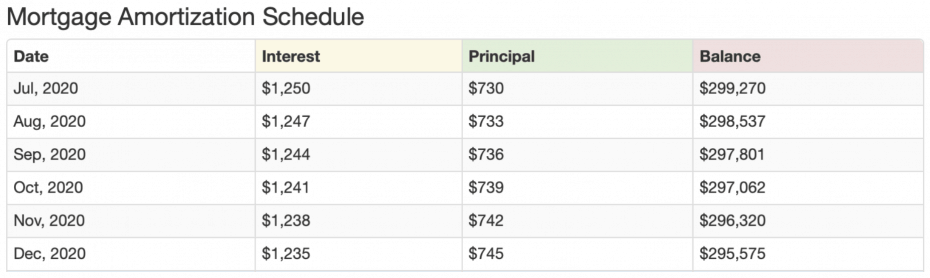

The tables below show the first six months and the last six months of the amortization schedule for a $300,000, 20-year fixed mortgage. The inverse principal and interest relationship is clearly demonstrated.

Table courtesy Amortization-Calc

Table courtesy Amortization-Calc

Amortization and Balloon Payments

It’s important to note that the loan term and amortization schedule may not always be aligned. In a conventional 15-year mortgage, the borrower pays a series of equal, amortized payments over the full 15-year term.

It is not uncommon in real estate to see loans structured with balloon payments. For example, a loan might follow a 25-year amortization schedule but have a 10-year term. In other words, the borrower makes lower monthly payments for 10 years (as if it were to be paid off with equal monthly installments at the end of 25 years). However, since the loan comes due at the 10-year mark, the borrower then owes a “balloon payment” for the entire remaining balance of the loan. This is one of the most frequently used structures in commercial real estate.

It is also common in properties sold with seller financing (also known as owner financing). The owner may base payments on a 30-year amortization schedule but structure the loan with a balloon due after five years.

Amortization of Assets

Business assets can be expensed out in one of two ways: Amortization or depreciation. Depreciation is used for tangible assets that have a defined useful life—for real estate investors, these are things such as buildings, land, appliances, and improvements.

Amortization, on the other hand, is used to expense out intangible assets. Real estate investors may have intangible assets such as internet domain names, mailing lists, computer software, joint venture agreements, franchises, copyrights, blueprints, and permits.

RELATED: Depreciation Calculator

Amortization differs from depreciation in that amortized assets are expensed on a straight-line basis, meaning the same amount is written off each year over the asset’s lifespan. Depreciation can be accelerated, meaning a larger share of the value is expensed in the first few years.

The Internal Revenue Service (IRS) dictates both the depreciation and amortization schedules for business assets.

What is Negative Amortization?

Negative amortization occurs when a scheduled payment isn’t enough to cover the interest due for that period. When this happens, the unpaid interest is added to the principal. As a result, the borrower ends up paying interest on unpaid interest.

Negative amortization is actually a feature in some loan products. Payment-option adjustable-rate mortgages (ARMs) and graduated payment mortgages (GPMs) are both examples of negative amortization loans.

In a payment-option ARM, the borrower chooses what portion of their payment is applied to interest; the unpaid portion is tacked onto the loan balance. With a GPM, the amortization schedule is structured so that payments are lower at the beginning of the term and increase over time. This results in unpaid interest which is added to the principal.

Negative amortization provides payment flexibility for borrowers but it usually results in significantly higher interest charges over the life of the loan. In most of these loans, payments are usually recalculated at scheduled intervals during the loan to realign it with the amortization schedule.

Alternatively, the lender will set a negative amortization limit. When the principal balance hits the limit, payments are recalibrated so the loan amortizes on schedule.

Loan Amortization Calculator

Are you ready to generate your own amortization schedule?

With this calculator, you can solve for the term, interest rate, principal, or payment.

Solve for X by entering three (3) of the four known fields, then press the button next to the empty field to calculate!

Once calculated, click “View Amortization Schedule” to see the results!