In the travel industry, Airbnb has revolutionized couch-surfing. The business of providing strangers a temporary place to stay has created a community of guests and hosts. Airbnb has changed consumer behavior and created a market for short-term rentals for all sorts of travelers. Most of these STR providers use a master-lease for several properties, similar to WeWork’s model where they use a master lease to procure many properties at a time.

Today, short-term rentals have suffered a big blow due to the pandemic. So many are asking, will short-term rentals survive?

With the ongoing pandemic, the future of the STR market still remains unclear. Health concerns and travel restrictions have caused Airbnb bookings to drop by as much as 96% in some cities in March this year. Occupancy rates for Airbnbs in the United States are predicted to drop to an all-time low of 20.5% occupancy in November, compared to 39.6% occupancy in November 2019. This is bad news for many new real estate investors who joined Airbnb for alternative or primary income, especially for those who built their business on starter debt. One such example is Airbnb host Cherly Dopp who told the Wall Street Journal that she is now facing impending mortgages, maintenance, insurance, taxes, and restrictions.

To help hosts get by, Airbnb raised a $250 million relief fund, but it does not fully cover the loss of thousands of hosts. In fact, many are still struggling to keep up with their losses. Over 30,000 people have also signed a petition in April 2020 to file a class-action lawsuit against Airbnb.

Several local housing commissions are reacting through stricter enforcement of vacation rentals. Recently the Malibu Planning Commission unanimously approved a short-term rental ordinance and voted to place $1,000 per fay fines on violations for nuisance complaints.

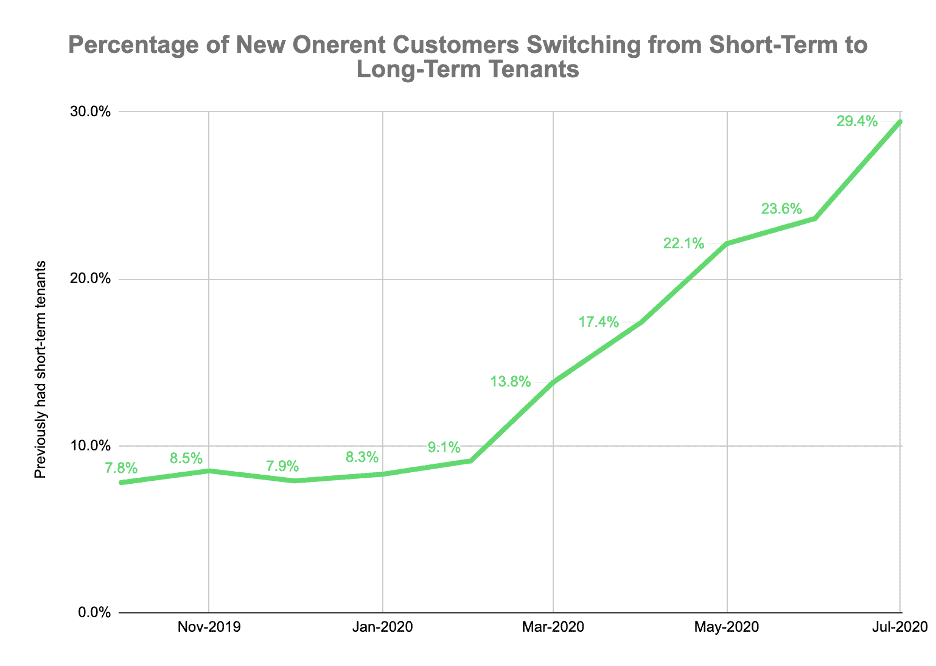

Aside from that, short-term rental (STR) companies who use the master-lease model are in for a big hit. Sonder, Lyric, Domio, and Zeus Living are some companies using master-leases who are now bound to pay rent to their landlords, even when they have little to no guests. Meanwhile, we’ve has seen a 205% increase in new landlords who seek to convert their STRs to long-term rentals.

To recover from their losses, many Airbnb hosts are now switching to long-term rentals. Those who have started to switch realized there is also another large market they have been missing out on—tenants who are looking for semi-permanent residences.

The pandemic has become a learning curve for real estate investors who placed a lot of trust in the short-term rental market. Unfortunately, they ended up risking the very investment they thought would help increase their personal wealth.

Let’s go over how the pandemic has impacted the market, and see how the future of short-term rentals look like.

Unprecedented Booking Cancellations

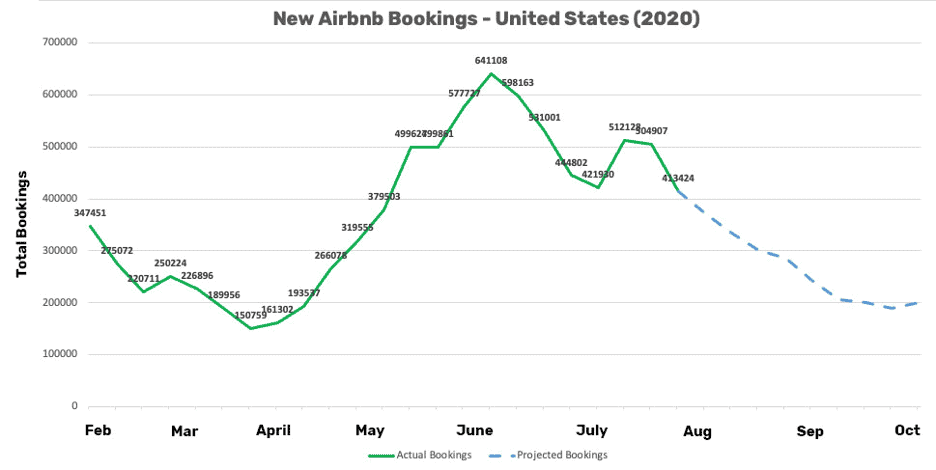

Short-term rentals have been greatly impacted by social distancing and travel restrictions. Urban hotels, for one, have seen an occupancy of 42.2% at the end of June 2020, showing a 31.3% drop compared to the same time last year. AirDNA also shows STR platforms like Airbnb and VRBO suffering an 85% drop in bookings. Other travel companies like Expedia, Hilton, and Booking.com’s market capitalizations plummeted to 58%, 44%, and 37% respectively.

Months after the crisis started, travel remains slow. Considering that the fall months are approaching, Airbnb’s most popular markets have dropped in bookings, increased in June, but is now declining again due to the second wave of Coronavirus cases. Consequently. The number of active properties has declined since the beginning of the year at 1.09 million short-term units in February to 850,000 in August 2020.

Though large companies may get by, smaller STRs will find it more difficult to deal with extended vacancies and will struggle to recoup lost income. Recently, Airbnb has even started to introduce mid and long-term stays to penetrate other areas in the real estate market.

Operating Cash Problems for Master-Leasers

Companies who signed with master-leases depend on “stays” to pay their rent. When you book a stay, STRs require you to make an upfront payment that acts as a deposit for your future accommodation. What we don’t usually know is that the pre-payments we make for short-term stays are not protected by the law. Most, if not all, STR companies use your pre-payment before you even use your accommodation. They use your pre-payment to help their company grow–borrowing money from bookings and using that debt to procure more master-leases.

Short-term rental companies start to lose their capital when bookings are slow. This is most common in companies that use master-leases, like residential WeWork, for example. The more vacancies these companies get, the more pressure they feel to regain what they lost. Master-lease models legally require companies to pay rent even during a crisis, not to mention paying for city registration fees, taxes, and property maintenance.

Though Airbnb set up $1 billion for booking loss subsidy, smaller STRs who use master leases are predicted to have greater costs.

Changes in Consumer Behavior

As we enter a “new normal,” consumer behavior has evolved rapidly. With new protocols and standards such as physical distancing, more and more guests are now hesitant to travel and stay in a stranger’s house.

Mass gatherings and large-scale events like conferences, concerts, and business trips are most likely out of the picture for most people. Professionals have started to work from home, which means spending more time in just one area.

Saturday Night Live had their own take with this situation as well:

Ooli’s the dream Airbnb guest. Oh, sorry, did we say dream? We meant nightmare. #SNLAtHome pic.twitter.com/BNeud79em3

— Saturday Night Live – SNL (@nbcsnl) April 26, 2020

One thing’s for sure: people will travel again. But there are so many questions we still need to wrap our heads around. Will people still consider staying in a stranger’s home? Will hosts still want to rent out a spare space in their house for BnB? Will Superhosts adapt to long-term rentals? Will “co-living” thrive in this new normal? These are some of the many questions Airbnb patrons should think about.

As commercial real estate reels from the work-from-home paradigm shift, the Airbnb market is also taking a step back to re-assess the impacts of changes in consumer behavior.

Downside Risks of Short-Term Rentals

The way consumers behave and how the market reacts today are factors that investors need to evaluate to ascertain the risks short-term rentals now face.

In 2019, WeWork’s near-collapse made people in tech, finance, and commercial real estate sectors remodel their tolerance for the master-lease, community-adjusted EBITDA model. Today, Airbnb faces the same challenges as WeWork. People have started to realize that growth is not your company’s only priority. Your business should also bring profit.

Fast forward to the future of short-term rentals, especially those with master-leases. We could see how venture capitalists, property owners, and operators might all reconsider their risk tolerance.

At first glance, STRs are attractive to real estate investors because of the promise of high returns and the risk of occupancy rates. But the actual numbers show that an Airbnb host only gets around 48% occupancy rates on average even before the COVID-19 situation, while long-term rentals have a 93% average nationally. Plus, with unforeseen circumstances such as economic downturns, natural calamities, and health crises, short-term rentals get riskier.

The Future of Short-Term Rentals

The prospect for short-term rentals still looks grim. If the crisis persists, Airbnb hosts will certainly face a downstream effect due to lost income. Most hosts might also convert to long-term rentals. The financial impact may also be experienced by lenders, property managers, and maintenance workers. Local governments are imposing more restrictions and retracting the affordable housing supply.

RELATED: Buy and Hold Real Estate Explained

While converting STRs for long-term rentals are uncomfortable for Airbnb hosts, local residents, NIMBYers, and economists are looking forward to lower housing prices when STRs start to convert. However, not everyone agrees. Others say there might be a short inventory on Airbnb units that if the shift happens, its impact would not be felt on overall home prices. Airbnb properties only account for less than 2% of the total housing inventory. But it may just be part of the larger recession snowball.

In Airhostsforum.com, users are seeking answers about STR conversions, changes in regulation, and cancellations.

User Lynick442 expressed this concern:

“I’m personally afraid of this. I have a strict 28 days stay so that they don’t get classified as tenants but they just added a new rule [in] my state about no evictions and I can’t get a straight answer if this applies to Airbnb…I might shut down completely.”

The future may be unclear for now, but some things are for sure:

- Short-term rental owners and operators would soon shift to long-term rentals to recoup finances.

- As bookings are slow, STRs following the master-lease model would feel immense pressure.

- Consumer behavior will change after COVID and this will impact demand.

- The short-term rental business would have to adjust and re-evaluate their risk tolerance.

- Home values will experience a negative impact in areas with a significant number of STRs.

Even when the pandemic is over, the short-term rental market will still experience the after-effects of COVID-19. Today, it is hard to imagine how STRs will survive. Will “shelter in place” now translate to “no more shelter at my place”?