REtipster features products and services we find useful. If you buy something through the links below, we may receive a referral fee, which helps support our work. Learn more.

If you’re like most landlords, you're always interested in finding ways to increase the cash flow from your rental properties.

If you’re like most landlords, you're always interested in finding ways to increase the cash flow from your rental properties.

One way to do this is to simply take a fresh look at your business model and think about how you operate your rentals.

You probably know how to be a generalist (as most of us do) by renting to the Craigslist crowd, but consider how your income would increase if you become a specialist who dominates a niche market.

Traditional landlords get a lot of press and admittedly, it’s a fine way to learn the ropes. However, if you’re ready to expand, then you need to focus.

Yes, FOCUS! You can wring out more cash flow by adapting your rentals to your local market.

The Five Positions

Let's take a look at five examples of how you can position a single-family home:

1. Typical Rental Housing

In this scenario, you rent an unfurnished dwelling to a tenant and charge more rent than your expenses. In most cases, annual or monthly leases are in place and the goal is to receive market rents.

For illustration purposes, let’s use Seth as a fictitious example. Seth rents out his 3-bedroom 2 bath house for the going market rate of $1,000 per month. His total monthly costs are $900, so he nets $100 each month. Not bad!

Most landlords are happy to clear $100 per month, per unit. They aspire to follow the well-worn path to wealth and buy more and more properties with this kind of cash flow goal in mind. It’s a solid strategy. You can always increase your profitability by increasing your rents or reducing your expenses.

2. Dormitory Housing

With this type of housing, you can take the same type of property and rent furnished rooms to tenants who are affiliated in some way. Monthly leases are in effect and the objective is to rent each room at a rate equivalent to an unfurnished one-bedroom apartment without utility expenses.

With dormitory housing, Seth can rent nicely furnished rooms on a referral basis to single mothers with one child – with one mother and child to each bedroom. Here, Seth is able to get $600 per room for a total of $1,800 each month. Housekeeping is not included, so Seth’s expenses are $1,380; he now clears $420 each month.

This mode of operating could also work for three guys taking a year-long marine mechanical course at a trade school. It could also work for medical students.

The magic behind the idea that makes co-housing work is that the occupants benefit from living with their peers. This method is $3,840 more profitable per year than operating as a traditional landlord.

3. Rooming House

Another way to utilize a rental property is to take the same house and rent the fully furnished rooms to several unrelated tenants who are willing to share the bedrooms, bathrooms, kitchen and other amenities.

In this scenario, Seth can rent his 3-bedroom, 2 bath house to five tenants for $100 per week. His onsite manager is the sixth person, but the manager exchanges his services for rent. Seth is able to gross $2,000 per month, but his expenses are more as well.

Seth’s rooming house includes bi-weekly housekeeping, internet, utilities, and internet his expenses are $1,410 so he nets $590 per month. This method of operating is more complicated, but it also translates into an additional $5,280 per year when compared to the traditional landlord model.

4. Bed and Breakfast Host

A landlord can also rent guest rooms in their dwelling to travelers as a hotel alternative. Your goal is to create a unique experience and charge a premium when possible.

In this scenario, Seth could live in the smaller bedroom in his 3-bedroom, 2-bath house and leave the best bedrooms for his guests.

Acting as an innkeeper, he offers his luxurious two rooms via Airbnb, HomeAway, and other websites. He prepares a continental breakfast for guests on his way to his 9 to 5 job and everyone is happy.

As a result, Seth is able to charge hotel rates for his rooms. Based on what he learned from AirDnA (a website that does analytics on Airbnb), he can competitively price his master bedroom at $125 per night and the other bedroom at $100. AirDnA statistics suggest that Seth will be able to keep every room rented nine days per month and so he grosses $2,250 per month.

His expenses are more because he will have to pay $1,605 for normal expenses, housekeeping, utilities, internet, and cable, so all in all, as an innkeeper Seth pockets $645 each month. This is $6,540 more profitable than being a traditional landlord!

5. Corporate Housing

Landlords can also rent a furnished dwelling to a business and charge a premium rate for the furnishings. Typical terms are annual and monthly leases. The goal with this approach is to capture rents slightly less than a comparable hotel.

Now, Seth gets really smart and realizes that the crew at Arch Construction has a two-year contract working on the local roads. This group is from out of town and stay in motels during the week.

Seth knows the crew was paying $80 a night per room for the 2-man crew’s motel rooms, which comes out to $800 per work week, Monday through Friday, and he figures he can beat the $3,200 monthly rate they were paying.

So entrepreneurial Seth makes a proposal to the company and they accept his all-inclusive offer to house the crew for $2,800 per month with weekly housekeeping. It’s a 12% savings for the company, and the crew loved the laundry service Seth included because they no longer needed to spend their weekends doing laundry.

The housekeeping, laundry, upgraded cable TV, plus regular expenses cost Seth $1,965 per month, so he is able to net $835 each month. That’s $8,820 more per year than a traditional landlord would make!

What Does It All Mean?

This is far from an all-inclusive list of how you could operate a 3 bedroom 2 bath house. The beauty is that you can mix and match models; they are flexible! But are you flexible? Or is the traditional model so ingrained in your mind that you're missing the serious profit potential of these alternative approaches?

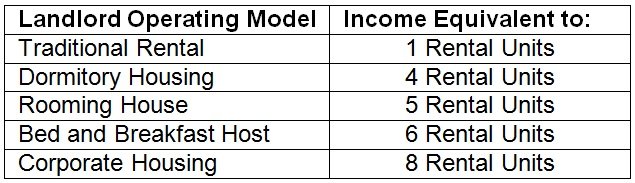

One school of thought instructs you to buy rentals that produce $100 per month in net income. With this in mind, the following table presents the benefit of moving from a generalist to a niche housing specialist:

These advanced modes of operations might be more time-consuming, but they can lead to exponentially greater profits. And that’s good news if you’re a busy person.

By serving a niche, you can make one rental yield the equivalent of eight rentals.

Now I’ve got time for that – don’t you?

Reposition Your Rental

Have things changed in the neighborhood surrounding your rentals? Have new businesses come to town? Is the area losing its luster?

Whatever the case, new opportunities, and technologies are unfolding that can allow you to dramatically increase your income. The only catch is that you have to reposition your mindset.

If your sole focus is to simply buy more rentals, it may not be very helpful in achieving your real estate goals.

More properties will guarantee more expenses, but getting more income out of what you already own is a low risk way to advance.

Consider alternating between buying and repositioning rentals to reach your goals faster. The two tactics work together like pedals on a bicycle. It’s a smart process, especially for part-time investors who need to work efficiently.