REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

Owning your dream home is—literally—a dream shared by many. Unfortunately, the path to your dream home is one paved with financial challenges, especially for people who have their money tied up in investment real estate.

However, some savvy investors use a lesser-known strategy to help them acquire their forever home and enjoy significant financial benefits along the way—a 1031 exchange.

A Brief Overview of a 1031 Exchange

Before we dive into the intricacies of 1031 exchanging into your dream home, let's first look at the basics of a 1031 exchange.

A 1031 exchange, named after Section 1031 of the Internal Revenue Code, is a powerful tax-deferral strategy for real estate investors. A property sale is normally taxable, but a 1031 exchange allows investors to defer the tax on the transaction by selling property held for business or investment use and then buying another property for business and investment.

Due to the tax deferral on the sale, Section 1031 has been a game-changer for investors by enabling them to reinvest the proceeds from the sale of one property into another, often upgrading to more valuable or desirable properties. And all of it while deferring the taxes due!

The Important Parts of a 1031 Exchange

In a 1031 exchange, these are the most crucial terms to know:

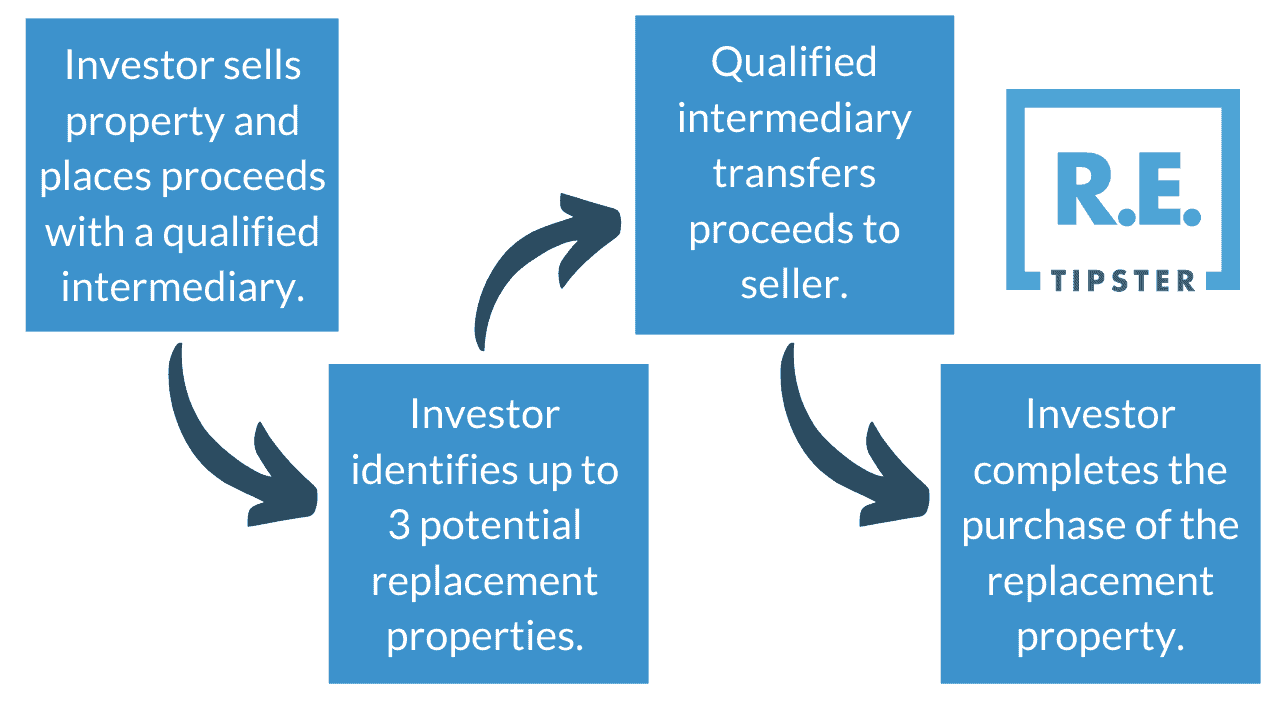

- Qualified Intermediary (QI): A qualified intermediary (QI) is a neutral third party that facilitates the exchange. They are responsible for holding the proceeds from the sale of the relinquished property and ensuring the exchange complies with IRS regulations.

- Identification Period: After selling your relinquished property, you have 45 days to identify potential replacement properties. This identification process must be thorough and precise, as the IRS enforces strict rules regarding the identification of replacement properties.

- Exchange Period: Once you've identified your replacement property, you have a total of 180 days from the sale of your relinquished property to close the deal on the new property. This timeframe requires careful planning and execution to meet the IRS deadlines.

- Like-Kind Property: To qualify for a 1031 exchange, the replacement property must be of “like-kind” to the relinquished property, a definition that offers flexibility in choosing properties.

Turning Dreams into Reality: 1031 Exchanging into Your Dream Home

Now, let's explore how you can use the power of a 1031 exchange to turn your dream home into a reality while enjoying substantial financial benefits. Let's take it step-by-step:

Step 1: List Your Investment Properties for Sale

The process begins by listing your investment properties for sale. Simultaneously, you can initiate your search for your dream home. This is an exciting but sometimes challenging process, as it involves balancing the sale of your existing properties with the need to find and purchase a suitable replacement that will eventually be your own dream home.

Step 2: Engage a Qualified Intermediary (QI)

To start the 1031 exchange, you'll need to find a reputable qualified intermediary. A QI is pivotal in facilitating the exchange by keeping the entire exchange compliant with all applicable IRS guidelines. They can point you in the right direction and advise you on how to best obtain the home of your dreams.

The importance of finding a trustworthy QI who will provide transparency throughout the process cannot be understated. You can’t officially set up your 1031 exchange until you’re under contract, but it never hurts to discuss the process with your QI beforehand.

Step 3: Under Contract, Identifying Replacement Properties

Once your investment property is under contract (or even earlier if you’re more comfortable), it’s time to start looking for your dream home. In this phase, you'll work closely with your QI to meet all IRS deadlines.

After you close the sale of your relinquished property, the clock starts, and you have 45 days to officially identify the new property you intend to purchase.

Take note: For the 1031 exchange to be valid, the IRS requires the exchange to real property only, not other asset classes (such as stocks or partnership interests).

Step 4: Acquiring Your Dream Home

With your identified property in sight, closing the deal is next. You have 180 days from the sale of your relinquished property to finalize the purchase of your dream home. This is where the pressure mounts, but the prospect of making your dream a reality will keep you motivated throughout the process.

Finally, the day arrives when you close the sale of your investment property and acquire your dream home. It's a momentous occasion that signifies your successful navigation of the 1031 exchange process, meeting all requirements while fulfilling your long-held dream.

Here's how the exchange works in a nutshell:

Requirements Before Moving Into Your Dream Home

Before moving into your dream home acquired through a 1031 exchange, you need to meet several requirements as prescribed in Revenue Procedure 2008-16:

Renting for a Minimum of 14 Days: In the first two years after acquiring a property through a 1031 exchange, you must rent it out to an unrelated party for at least 14 days each year. This requirement ensures that the property maintains its status as a legitimate investment property.

Limiting Personal Use: In the same two-year period, you must limit your personal use of the property to either 14 days a year or 10% of the time you rent it out, whichever is greater. Adhering to this rule ensures that you fulfill the IRS requirements and continue to enjoy the tax benefits of the 1031 exchange.

Financial Advantages and Benefits for Heirs

It's also essential to consider the potential benefits for your heirs. When they inherit the property acquired through the exchange, they receive a step-up in cost basis. This means that the property's value is determined at the time of inheritance, potentially reducing or even eliminating federal taxes when they decide to sell. This aspect is particularly valuable when you're doing estate planning and considering the legacy you leave behind.

Does this all sound too good to be true? That's the response I generally get. “You're telling me that I can 1031 exchange from my rentals into my dream home, defer all my federal taxes, pass it on to my heirs, and I just need to stay out of it and get minimal rents for the first 24 months I own it?”

YES!!! Even better, you can pass over $12 million in assets to your heirs at the federal level—tax-free.

With careful planning and guidance from your QI and CPA, you can successfully navigate the exchange process and transform your dreams into reality. Don't let the complexities deter you from achieving your goals; instead, use them as stepping stones to land the home of your dreams.