What I'm thinking about: The most ‘feel-good’ land deal we’ve been a part of since we entered this industry (and a bonus of being quite profitable).

The 8-Month Title Nightmare That Nearly Broke Us

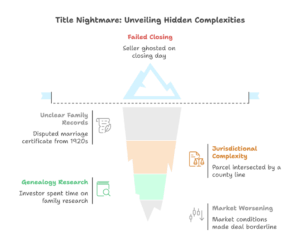

In late 2024, we began working on an East Texas deal that seemed straightforward… and quickly evolved into becoming the messiest title situation I've ever seen.

“Straightforward” is probably a reach. The parcel was intersected by a county line, adding jurisdictional complexity, and it was an estate deal, but the seller appeared to be the sole title holder with organized family docs. Two local title companies couldn't get their underwriters over the finish line, citing unclear family records (e.g., disputed last name on a marriage certificate from the 1920’s (!!))

Btw, this was after we had already spent $3,500 on a survey, under the assumption the title would clear, a decision we regretted.

With a $110K purchase price, the capital risk was too significant for us to consider underwriting title on our own, so as a Hail Mary, we reached out to the most specialized messy title company in TX, and it STILL took them months to figure it out.

There were times during this process where I was prepared to write off our hard costs and move on. Our land investor partner deserves massive credit here—he spent disgusting amounts of time working hand-in-hand with the seller on genealogy research to find the docs that title needed.

Finally, after 8 months of back and forth, all that was left was for the seller to sign the closing docs. And on the day of closing, the seller called our land investor partner and tearfully said he needed to reschedule with the title company, and then ghosted us.

It was a stunning turn since the seller had been cooperative and eager to close for months, helping to corral countless family members to sign various affidavits of heirship.

We had roughly $5k in hard costs at that point, plus the market had worsened since we started working on this deal, making it borderline at best. So we had to carefully weigh whether we were going to walk or potentially invest further into legal remedies if needed.

I cover how we handled this situation in more detail here. Suffice to say, the seller came back to the closing table, and we officially closed earlier this week.

All-in costs: ~$118K. Plan was to list just under $260K, below market, and probably not sell for less than $200K worst case.

The 7-Day Turnaround: From Ghost to $230K Cash

A few days after we took title, our land investor partner heard from a family member of the seller indicating he was interested in purchasing it from us.

I called the family member, and he stated:

“I really can't believe this property was sold. It's got deep family history. If I would have known, I would have reached out to my cousin to work something out.”

If it wasn’t clear from above: Even if he HAD known, there's a near-zero chance he could have closed this deal, given the extremely complex title work, and the fact that two local title companies had given up on clearing title.

Although I had no prior awareness of the seller’s family background, it became clear they are African-American and that the property has been in their family since slavery times. They were originally part of a plantation that their family took over after emancipation. We're talking nearly 200 years of family history.

(Note: I debated including the above, given how hot-button anything related to race is in the U.S. Ultimately, I think the seller's family history is critical to note since it's a reminder of how deep and complex attachment can be to certain properties).

I'm just sitting there silent, letting him tell his story, trying to figure out what room there is to work with.

He offers $200K cash to keep it off the market.

That's way lower than I'm willing to consider. We haven't even tested the market yet, and I'm confident we're priced below comps at $260K. But I can tell this guy has serious emotional attachment—and cash buyers who can close in 30 days are worth listening to.

After discussing with our land investor partner and waiting a couple of hours to see if the potential buyer would come back and anchor himself higher, I sent him this exact text (and sent to his email too for increased visibility):

“Hi Mr. [Last Name], it's Chris, we spoke about the [Address] property.

Discussing with my partners, we are understanding of the meaning/history the property has for you and your family and would love for you to come away with it.

If you're able to meet us in the middle at $230K cash, 30 day close, we're willing to sign a contract before it hits the market.

We can give you until noon CST tomorrow so you can sleep on it and make any calls you may want to.

After that, we will begin marketing it aggressively, given how long it took for us to purchase the parcel.

No worries if it doesn't work for you, just wanted to give you the option, and feel free to ring me.”

Emotional acknowledgment, specific number, hard deadline (but not crazy pressure).

The next morning at 8:30 AM, he calls me, appreciating the offer, then tries to counter at $225K.

I held firm, knowing $230K was the lowest we’d consider before hitting the market, and told him if he got to $230K, I’d sign a contract today.

Then I went silent. Our BATNA was excellent and we thought it was going to perform well on the market. (Plus, was $5K really going to be a deal breaker?)

Buyer: “$230K, okay Chris, let’s sign.”

Before calling our broker, I already had the buyer locked up verbally. Then I renegotiated our listing commission from 6% to 3% since we'd brought our own buyer, and we acknowledged all of the work she had put into the deal over the previous months. She readily agreed—all of us get paid quickly. Super hard acquisition, easy dispo. I’ll take it.

Anticipated result: $100K net profit split with our land investor partner. Eight months of work, but only ~30 days of full capital deployment.

And here's the ‘feel good’ part—this property stays with the family that's stewarded it for generations (with a clear title), and we get a solid return rewarding our exhaustive persistence. I won’t be forgetting this story any time soon.

5 Lessons That Created $100K in One Week

- Solve problems others won't touch. It's no wonder why several land investors have pivoted their businesses to incorporate messy title deals (and we want to fund more!). The market is tougher. It's harder to come by low-hanging fruit. And creativity and persistence lead to survival.

- Avoid hard costs until title is clear (when possible). As mentioned above, we regretted committing to an expensive survey on the assumption that title was going to clear. Sometimes it's a balance though because surveys and other fieldwork can have extensive timelines, and you have to weigh that against the urgency that the seller is expressing to close.

- Acknowledge the emotions behind people’s desires. There was a clear and obvious emotional attachment that the buyer had to this property. Look at how I respectfully worded the text message. No forceful language, and we both came back to the negotiation table on our own accord. Is it any wonder why we were able to work out a mutually beneficial outcome?

- Spread the rewards. As above, we didn't try to hardball/squeeze out our broker, even though we locked down a buyer on our own within a few days of purchasing the property. Plus, she quickly prepped a contract and took over title co. logistics, which adds a sense of professionalism and trust that most buyers appreciate in our experience.

- Never count your chickens before they hatch. DUH! While we would love to take buyers at their word (especially buyers with deep attachments to the property, like the above), we don't shortcut any contractual requirements. We required an EMD and proof of funds to be submitted to the title company within a few days of going under contract (this buyer sent in both).

=====

Looking for reliable funding on ‘messy title’ deals? Serious Land Capital’s growing expertise in solving messy problems creates competitive advantages in a difficult market, and we have patient capital reserves to strike when the iron’s hot.

Originally published on https://seriousland.capital/newsletter/ on