The best deals in real estate are always found off-market, with motivated sellers in some kind of distress.

But distressed properties come in many forms, each requiring its own unique approach. As you narrow down your own niche investing strategy, consider the following types of distressed properties.

1. Short Sales

The classic type of distressed property is foreclosures. But the foreclosure process includes several phases, each requiring a different strategy.

When borrowers first default, they can sometimes negotiate a short sale with their mortgage lender. The lender agrees to take a lower payoff than the total amount owed, and they do this because the borrower has negative equity, owing more than the property is worth.

Typically the homeowner lists the property for sale on the MLS, and the property sells for market value, perhaps with a slight discount for speed or because it needs updating. But as you research how to find distressed properties, you probably want to go further than “buy short sales listed on the MLS.”

2. Preforeclosures

Few defaulting homeowners actually sell their properties as a short sale. Most either bring their loans current or bury their heads in the sand while the foreclosure process rolls along.

Four months after a borrower first defaults, mortgage lenders can hire an attorney to file in court for foreclosure. It takes several more months to schedule an auction date and advertise it publicly.

In that window between when the foreclosure filing becomes public record and the auction date, real estate investors have an opportunity to reach out to homeowners and negotiate a sale.

I myself got my start in real estate investing by buying preforeclosures for a well-funded investor. The approach was simple enough, offering homeowners a choice: we can either buy the property outright or buy it and lease it back to them, with a repurchase option. Nearly all homeowners opted for the latter as they wanted to stay in their homes.

Of all types of distressed property sales, you can often score the best deals with this strategy.

As for how to find distressed properties in preforeclosure, you can, of course, check public records, but that’s tedious. Save yourself the headaches by using a platform like Foreclosure.com or Propstream. They’re not free, but they’re extremely effective in displaying many types of distressed properties, not just foreclosures.

3. Foreclosure Auctions

Not many properties actually sell at a foreclosure auction. But no review of how to find distressed properties would be complete without including this step in the foreclosure process.

You don’t need any special software to hear about upcoming auctions. By law, lenders must advertise them a certain number of times, at set intervals before the public auction. Look up your local legal bulletin publication to find out where foreclosures are advertised in your county.

Lenders typically set the starting bid for the auction at the total amount owed by the borrower. That includes not just the principal balance and interest but also late fees and legal fees from the attorney’s office, which add up quickly.

These auctions generally occur on the courthouse steps, not at the property itself. Because the homeowner still owns the property at this point, bidders do not have access to the inside of the property. So you don’t know the interior condition, and even if you do—for instance, if you had met with the owner there to negotiate a sale but never closed it—the homeowner could damage the property between the auction date and when you’d actually take possession. I’ve seen plenty of vindictive damage in my day, from ruining the floors to punching through every cabinet door to pouring concrete down the plumbing.

All of which means you’re unlikely ever to buy a property at a foreclosure auction. In most cases, no one bids, and the lender ends up “winning” the auction by default.

4. Bank-Owned REOs

When no one bids, the lender must buy back the property after the auction. That process, in itself, requires some bureaucracy and takes at least a month or two.

Even once the lender takes legal ownership of the property, they must then go through the eviction process if the former homeowner has refused to vacate. Add on several more months for that.

Eventually, the lender takes physical possession of the property and can assess its condition and market value. Most lenders have go-to real estate agents in each market for this, and the Realtor typically provides a recommendation on whether to repair the property or sell it as-is. In my experience, most lenders sell the property as-is, needing various amounts of TLC.

The real estate agent then lists the property on the MLS, where you’ll have to compete with every other buyer. Unless, that is, you’ve built a relationship with the REO manager at that particular bank and arrange a first look at REO properties before they get assigned to a Realtor.

The acronym REO stands for “real estate owned” by the lender. While most corporate lenders such as Wells Fargo and Bank of America have rigid rules governing REOs, some local and regional banks simply have an employee oversee these properties. If you can build a relationship with them, sometimes they’ll send you updated lists of properties to avoid the costs and headaches of hiring a Realtor. Read more about how to buy REO properties if this strategy appeals to you.

5. Government-Owned REOs

The federal government backs certain types of loans, such as FHA loans, VA loans, and USDA loans. And when borrowers default on those loans, the government sometimes gets stuck with the properties.

Expect even more bureaucracy buying government-owned REOs than bank-owned properties, though. If you don’t mind navigating some red tape, you can sometimes find decent deals. Check out HUD’s list of foreclosed properties to see what’s available.

Fannie Mae and Freddie Mac also sometimes get stuck holding foreclosed homes. Each offers loan programs to facilitate buying these REOs; check out Fannie Mae’s HomePath and Freddie Mac’s HomeSteps programs for property listings and loan details. As you can imagine, these agencies prefer to work with owner-occupant homebuyers, so they work particularly well for house hacking. You can always move out after occupying the home for a year and keep it as a rental.

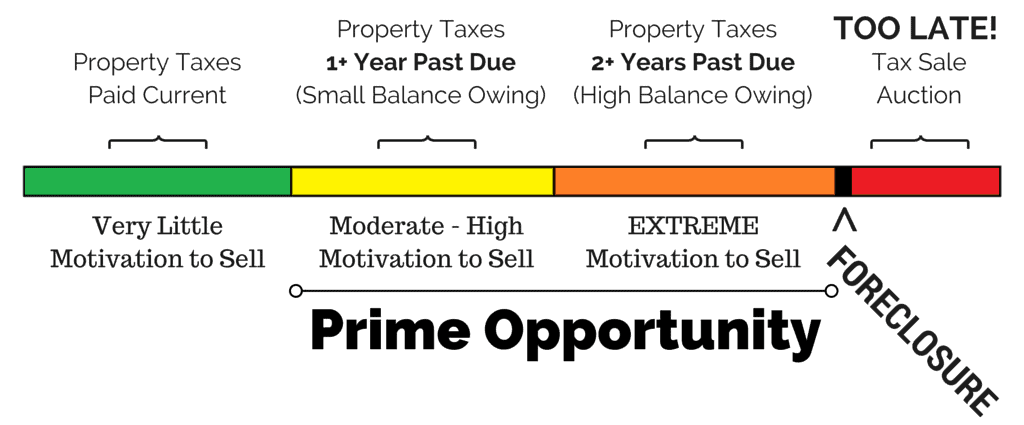

6. Tax Sales

When people fail to pay their property taxes, local governments either sell the properties directly at tax sale auctions or sell the tax liens. The rules vary by state.

Local governments typically auction these off once or twice a year. Read up on how to buy properties at tax deed auction if you’re interested. While you’re at it, listen to our interview with Brenda Flatter about the risks of tax deeds and how to overcome them.

Just bear in mind that, like foreclosure auctions, tax deed auctions don’t take place at the property. Buyers have no way of verifying the interior state of the property.

7. Tax Liens

In some states, local governments can’t sell ownership of the property; they can only sell the tax liens. Buyers then have to foreclose on the lien to take ownership of the property.

Seth actually has deep experience with tax liens and tax deed sales. Start with his crash course on tax liens to learn more about how to find distressed properties this way—without losing your shirt.

8. Divorces

Not all distressed sellers are in the midst of losing their homes to foreclosure or tax sale. Some find themselves in marital distress and simply want to sell their homes quickly to be done with the process and move on.

Divorce filings are a matter of public record, but (again) you can use online services to find these things easier. Platforms like Propstream display local divorce filings, allowing real estate investors to reach out to them to make offers.

You won’t win any points for sensitivity, but some divorcing couples just want to dump their property and never look back. Offer a quick settlement, perhaps with a mobile notary who can visit each owner separately.

9. Abandoned or Neglected Properties

When owners lose interest in a property, it sometimes becomes visibly obvious. Deferred maintenance starts to stack up, and you can tell from the street.

Sure, some of these owners stop paying their mortgages or property taxes, ending up in foreclosure or tax sale. But not all do, and some may not have a mortgage at all.

Besides, you ideally want to find these owners before anyone else realizes they’re in distress. You’ll have their captive attention without noise from competing investors.

So yes, driving for dollars might sound labor-intensive and low-tech. But it remains one of the most effective ways to find distressed properties that no other investors have moved in on yet.

You can also bring a modern twist to this classic approach through tools like DealMachine. This phone app pulls up the property address when you snap a photo of a house, along with the owner’s contact information, ownership history, and property liens. For an extra fee, you can click a button to send the owner a postcard.

Owners could include tired landlords, disinterested heirs, or financially troubled homeowners. In all cases, you want to get ahold of them before their property goes into foreclosure or tax sale.

Final Thoughts

Distressed owners make motivated sellers, often willing to accept a low purchase price in exchange for a fast sale. They’re many real estate investors’ bread and butter.

Which, of course, means you’ll have competition. Experiment with different approaches, different methods of contact, different wording, different types of offers. See what resonates with distressed sellers and what doesn’t.

It costs you time and money to reach out to these owners, so the better your response rate, the higher your profit margins. Constantly aim to refine your approach to stay ahead of your competitors and stay profitable.