What Is Preforeclosure?

REtipster does not provide legal advice. The information in this article can be impacted by many unique variables. Always consult with a qualified legal professional before taking action.

Shortcuts

- Preforeclosure is a stage in the foreclosure process in which the lender has started the foreclosure proceedings, but the foreclosure sale has yet to occur.

- In preforeclosure, the borrower may take certain steps to avoid foreclosure, such as forbearance, loan modification, or a short sale.

- It takes about 18 months for a lender to foreclose a house, although this might take longer in borrower-friendly or judicial foreclosure states.

- Preforeclosure per se does not appear on credit reports, but the missed payments that lead up to it do.

How Preforeclosure Happens

Foreclosure is a multi-stage process that usually begins with a borrower defaulting on payments. Once the lender declares the debt in default, they initiate foreclosure proceedings, which start with the preforeclosure stage.

At this point, the lender has not yet foreclosed on the property (and has not sold it), so the borrower still owns the property and can take certain actions to avoid foreclosure and keep it.

During the preforeclosure stage, the borrower and real estate lender may negotiate several outcomes:

- A workout agreement, such as forbearance, repayment, or loan modification[1].

- A foreclosure sale.

- A short sale[2].

- A deed in lieu of foreclosure[3].

- Bankruptcy[4].

- Foreclosure.

By understanding the preforeclosure process, borrowers can take steps to prevent foreclosure and protect their property.

RELATED: Foreclosure.com Review: How Can It Help Real Estate Investors?

How Long Does Foreclosure Take?

Under normal circumstances, it takes a mortgage lender about 18 months[5] to foreclose on a house. However, in borrower-friendly states, the process can take several years.

Foreclosure typically goes through four stages:

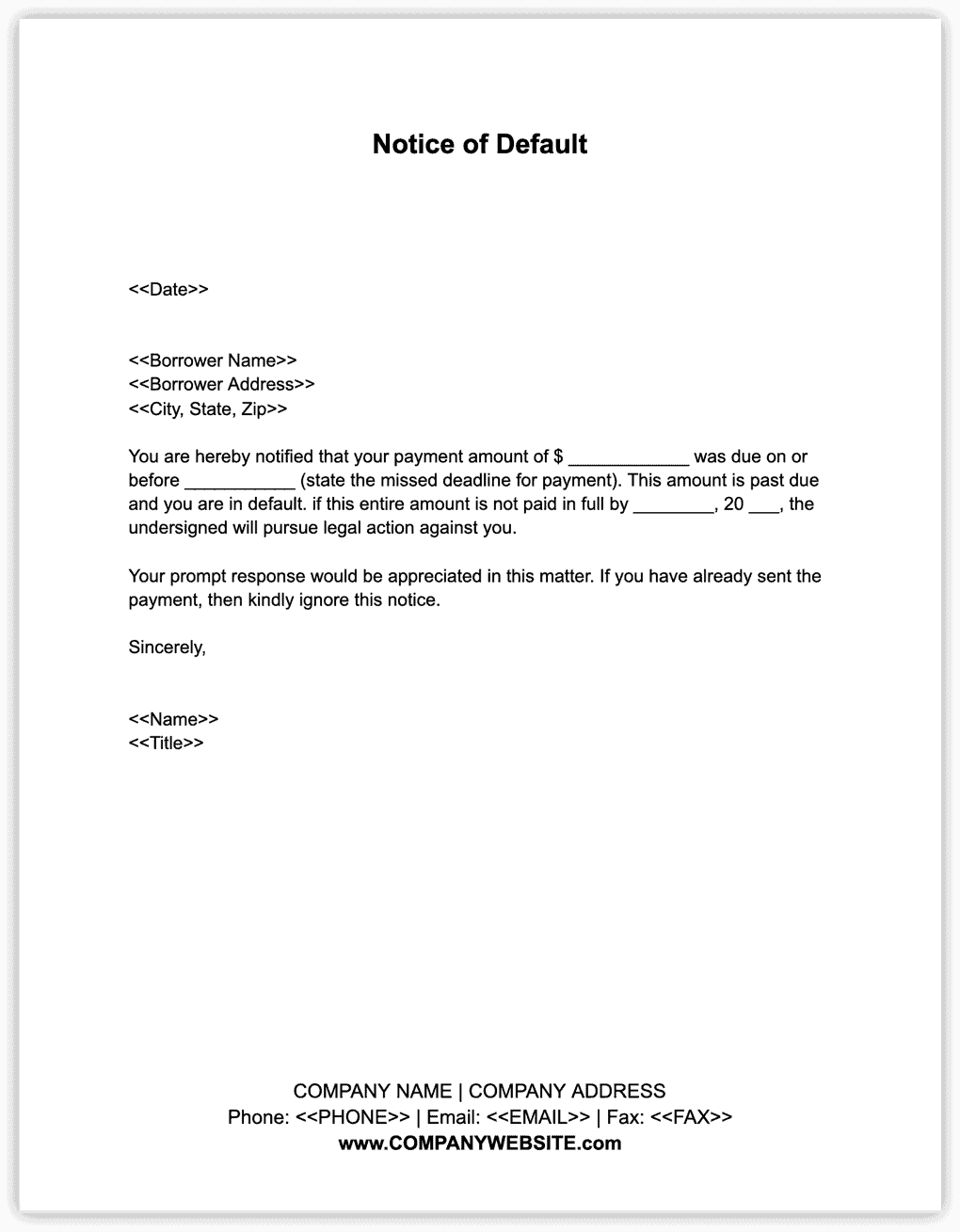

1. Notice of Default

The process begins when the borrower becomes at least 90 days past due, and the lender issues a notice of default.

A template for a notice of default.

This letter expresses the lender’s intention to pursue foreclosure proceedings within 30 days, creating a sense of urgency for the borrower to settle all unpaid monthly mortgage bills.

2. Preforeclosure

If the borrower takes no action after receiving the notice of default, the lender’s attorney or foreclosure trustee will schedule the property’s sale through auction. The lender may have to advertise the upcoming sale weeks before the auction’s date.

Until the bidding war for the property, the borrower can still ask for a payment arrangement or pay off the outstanding balance to stop the foreclosure process and keep the property. If a preforeclosure sale occurs, the lender may or may not obtain a deficiency judgment to close out the outstanding balance (if any) on the sale proceeds.

3. Foreclosure Sale

If the borrower takes no action during preforeclosure, the foreclosure auction commences. The property is sold to the highest bidder during the auction, and the purchaser is entitled to immediate possession of the house.

If there are no takers for the property, the lender assumes ownership and tries to sell it through a broker or real estate-owned asset manager.

4. Post-Foreclosure and Eviction

Regardless of how the public auction turns out, the borrower receives an eviction notice. The occupants usually need a few days to pack their bags and vacate the premises. A law enforcement officer or local sheriff then enforces the eviction notice by visiting the premises and, if necessary, removing the occupants and impounding their belongings.

Judicial and Non-Judicial Foreclosure

Not all states allow lenders to foreclose on a property directly; some require a court order. States that permit direct foreclosure are called non-judicial foreclosure states, while those that require a court order are called judicial foreclosure states. Judicial foreclosure can be more challenging for lenders because of the court’s involvement, potentially prolonging the process.

Here is a map showing which states are non-judicial and which are judicial foreclosure states:

Longest Foreclosure Timeline: Nevada

Nevada has the longest foreclosure timeline, with a staggering 2,683 days required to foreclose on a house[6]. Nevada’s borrower-friendly foreclosure laws require lenders and loan servicers to exhaust all options to help distressed borrowers avoid losing their homes. Federal law also prohibits lenders or loan servicers from initiating the foreclosure process until the borrower is more than 120 days past due.

Rounding out the top five states with the longest foreclosure timelines are Hawaii, New Jersey, Louisiana, and New York. Nevada is an outlier on this top-five list because it is both a non-judicial and judicial foreclosure state (the former being more common).

Preforeclosure and Credit Reports

Preforeclosure does not typically show up on a borrower’s credit report because there is no specific credit report item indicating when a mortgage enters preforeclosure.

However, preforeclosure can still negatively impact a person’s creditworthiness. Negative events that trigger preforeclosure (and those that occur during) can lower a person’s credit scores.

Before preforeclosure begins, a borrower must be at least 90 days past due or miss three consecutive monthly mortgage payments, which constitutes a default. These negative actions can lower a person’s credit scores for three main reasons:

- Payment history: This is the most significant factor in determining FICO credit scores[7]. Falling behind on a home loan can damage a borrower’s credibility as a borrower.

- Debt size: If a borrower misses any number of mortgage payments, the principal balance remains the same. As a result, the borrower is as indebted as before, if not more, due to possible fees the lender may apply for non-payment. Note that VantageScore emphasizes credit usage more and payment history less[8].

- Negative reports: Reported missed and late payments can tarnish a borrower’s name as a debtor for up to seven years[9]. Negative items may appear on a credit report beyond the regular seven-year limit if a borrower applies for a job with an annual salary of over $75,000 or seeks more than $150,000 worth of life insurance or credit.

BY THE NUMBERS: A mortgage borrower with excellent credit could see up to credit-score deduction of up to 110 points after a single late payment.

Source: LendingTree

Sources

- Caginalp, R. (2022, August 8.) Mortgage relief: What to know about mortgage forbearance. Bankrate. Retrieved from https://www.bankrate.com/mortgages/everything-you-should-know-about-mortgage-forbearance/

- Hamblin, C. & Nelson, T. (2021, March 16.) Short Sale Rules: What You Need to Know. HGTV. Retrieved from https://www.hgtv.com/lifestyle/real-estate/new-short-sale-rules-what-you-need-to-know

- Mrozinski, J. (2018, March 4.) Pros and Cons of Getting a Deed in Lieu of Foreclosure. Yahoo. Retrieved from https://sports.yahoo.com/pros-cons-getting-deed-lieu-100053596.html

- Filing for Bankruptcy to Prevent Foreclosure. (2022, October 18.) Justia. Retrieved from https://www.justia.com/foreclosure/alternatives-to-foreclosure/filing-for-bankruptcy-to-avoid-foreclosure/

- Moore, C. (2020, July 2.) How long does foreclosure take? FOXBusiness. Retrieved from https://www.foxbusiness.com/real-estate/how-long-home-foreclosure-take

- Loftsgordon, A. (2022, August 15.) States With Long Foreclosure Timelines. Nolo. Retrieved from https://www.nolo.com/legal-encyclopedia/states-with-long-foreclosure-timelines.html

- The 5 Factors that Make Up Your Credit Score. (2021, August 31.) My Home by Freddie Mac. Retrieved from https://myhome.freddiemac.com/blog/notable/20210831-factors-credit-score

- Gravier, E. (2021, August 6.) Here’s everything you need to know about your VantageScore credit score, plus how to check it. CNBC. Retrieved from https://www.cnbc.com/select/what-is-vantagescore/

- How Long Does Information Stay on My Equifax Credit Report? (2018.) Equifax. Retrieved from https://www.equifax.com/personal/education/credit/report/how-long-does-information-stay-on-credit-report/