REtipster features products and services we've used, tested, and think you'll find useful. If you buy something featured here, we may earn an affiliate commission. Learn more.

This real estate crowdfunding platform invests in farmland throughout the United States and gives accredited investors the opportunity to diversify their money into assets outside of the stock market.

Even in the real estate world, farmland is a very different type of real estate asset. It doesn't follow the same trends as the rest of the real estate market (e.g., single-family houses, apartments, and other commercial buildings). In many ways, farmland operates in a world of its own, and values rise and fall based on the global supply and demand of farmland and food commodities (with a limited amount of farmland available and a growing number of mouths to feed worldwide).

Investing in farmland is a way to diversify, not just into real estate, but into a real estate class that isn't controlled by the same type of volatility that affects most of the conventional real estate investments people think of.

How AcreTrader Works

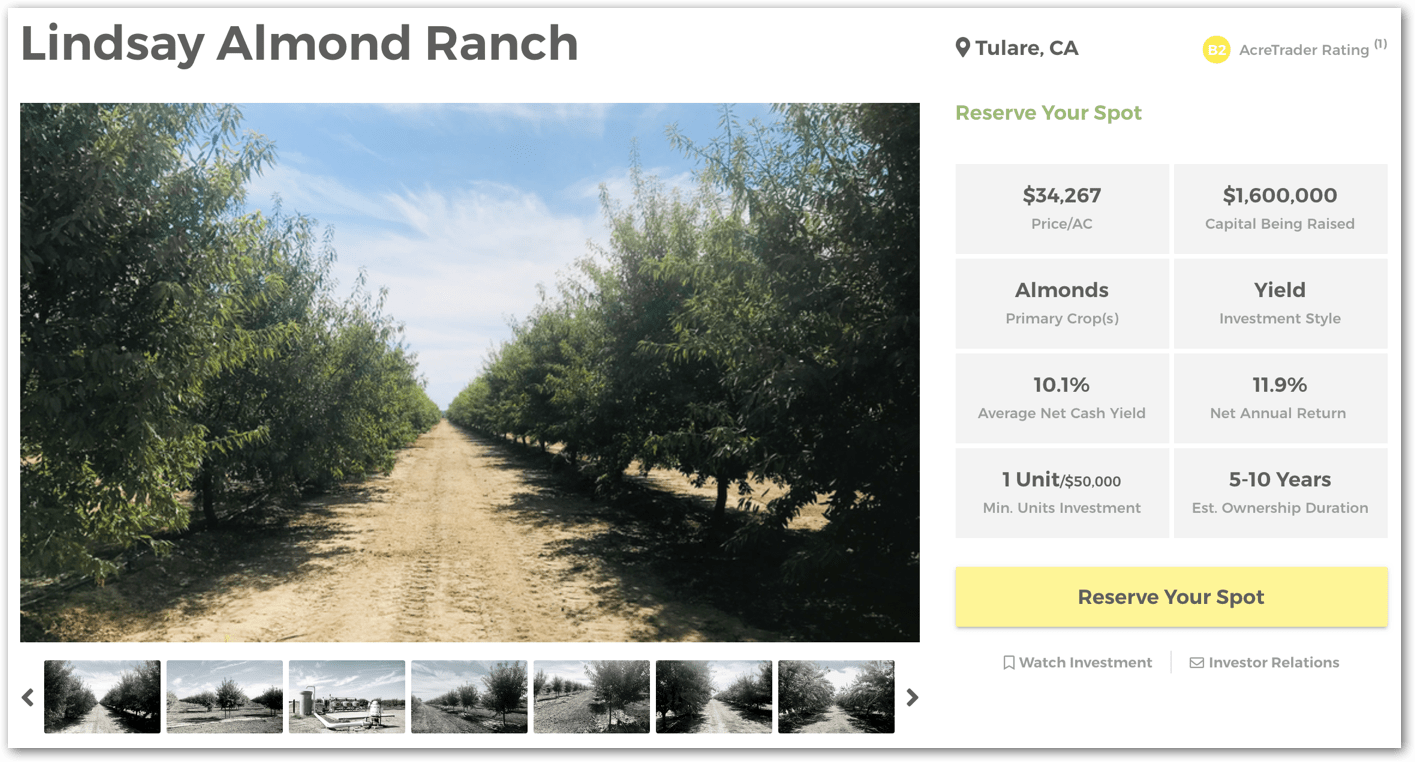

Similar to most crowdfunding platforms, AcreTrader offers a way for an individual accredited investor to invest in smaller chunks of a much larger property.

If you've ever wanted to own farmland but you don't have the capital, industry knowledge, and risk tolerance to buy an ENTIRE 40+ acre parcel of farmland on your own, AcreTrader allows you to be one of several different investors that participates in the ownership of a property, with as little as $5,000.

REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

As the video explains, each farmland parcel is placed in its own legal entity and divided into shares sold through AcreTrader's secure investor portal. Investors can buy shares and let AcreTrader handle the rest.

Each shareholder should receive annual cash payments from the farmers renting the land (ideally, the land price will grow over time as the value of farmland increases).

The Competitive Advantage of AcreTrader

As someone who spent many months trying to evaluate farmland as a legitimate investment option to pivot to, I can tell you that farmland investments come with a lot of challenges.

RELATED: Finding the Best Farmland Markets in the U.S.

I found that it's significantly more difficult to find great deals on farmland compared to vacant residential lots. Most farmland owners are farming it themselves and/or making a decent income, so they have no real motivation to sell their property for a “dirt cheap” price.

A LOT of due diligence is required when buying a parcel of farmland. Everything from crop yield to flood zones to soil types to weather patterns (just to name a few things), there are all kinds of things that need to align to make a piece of farmland “good” for farming and sufficient to charge enough annual rent.

All this to say, finding good deals and managing relationships with farms is much easier with an outfit like AcreTrader handling all of these tasks for you. Not to mention, you can spread out smaller investment amounts among several different farm projects, so you don't have to put all of your eggs in one basket.

What Kind of Returns to Expect?

The return on any investment comes with no guarantees.

Anything you put your money into should only be done with the understanding that some element of risk and uncertainty is involved.

That being said, AcreTrader offers plenty of data on their properties that you can take a closer look at before you decide to invest.

Some of the more notable things are:

- Detailed Executive Summary, including plenty of maps, background information on the management team,

- Comprehensive historical and project financials, including the past plantings and performance of the subject property.

- Subscription Agreement: What you'll agree to as a shareholder in this investment.

- Well Test and Water Right Information

- LLC Operating Agreement and Articles of Organization

If you're an accountant or banker by trade (as I used to be), I think you'll find more than enough reading material here to help you assess your level of comfort with each investment opportunity and whether it's a “go” or “no-go” for you.

RELATED: The Beginner's Guide to Farmland Due Diligence

Why Invest With AcreTrader?

Most investors who park their money with AcreTrader, do it for two key reasons.

- Cashflow: Getting annual payments from the farmer's cash rent.

- Appreciation: The increase in property value when the property is sold, 3 – 10 years after the original investment.

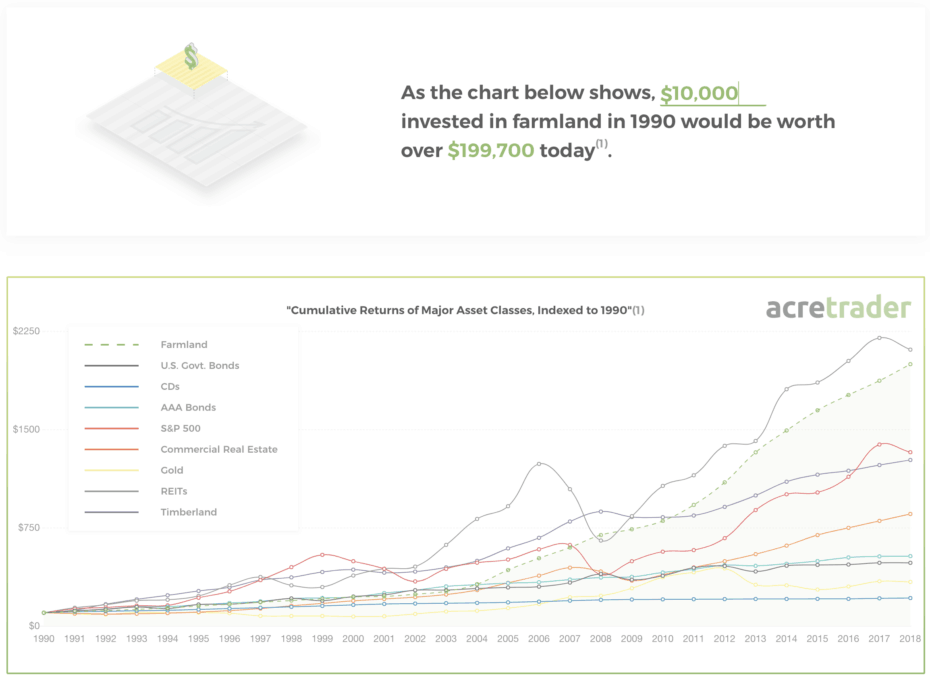

Comparatively speaking, farmland has lower volatility than most major asset classes.

While nobody has a crystal ball to predict the future, it would be hard to fault an astute investor for parking at least some of their cash in this real estate asset.

Compared to Gold, the S&P 500, commercial real estate, and AAA bonds, farmland has outperformed over the last 15 – 20 years.

And of course, because farmland is a tangible, “real” asset (you can see and touch it) and is legitimately useful, some investors find an added sense of comfort with these attributes as well.

Is AcreTrader Right For You?

The goal of this article isn't to convince you that AcreTrader is where you should put your money.

The purpose of this review is to simply make you aware of this investment option in the market.

Farmland brings a lot of unique value to the table, and if you've ever been interested in farmland investing but perhaps (like me), you just didn't have all the resources at your disposal to handle things like:

- Finding the deals

- Doing all the due diligence

- Negotiating with the seller

- Managing relationships with local farmers

- Finding the right exit strategy

- And everything in between

AcreTrader could be your ticket to a new world of opportunity in the real estate business.

Have you had experience with AcreTrader or any other real estate crowdfunding websites? Let us know about it in the forum!

Disclosure: This is a sponsored promotion for the AcreTrader platform. REtipster may have investments in companies represented on the AcreTrader platform. This informational blog post is by no means a promotion, solicitation, or recommendation of any specific investment.